Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China's CSI Ssh Gold Equity Index Extends Losses To 7.5%, Biggest Single-Day Drop Since April 2025

[Ethereum Drops Below $2700, Down Over 9.2% In 24 Hours] January 30Th, According To Htx Market Data, Ethereum Dropped Below $2,700, With A 24-Hour Decline Of Over 9.2%

[Bitcoin Dips Below $83,000, 24-Hour Loss Extends To 6.7%] January 30Th, According To Htx Market Data, Bitcoin Fell Below $83,000, With A 24-Hour Decline Expanding To 6.7%

The White House: More Announcements Will Be Made Regarding The Easing Of Sanctions On Venezuela

The White House Stated That The Easing Of Sanctions Against Venezuela Applies Only To Downstream, Not Upstream, Oil Production

China Central Bank Injects 477.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

EUR/USD rises near 1.1980 as US Dollar weakness persists amid Trump’s Fed uncertainty, while market eyes Eurozone consumer data and US jobless claims. Traders brace for volatility ahead of economic releases and policy signals.

1.19603

Entry Price

1.22000

TP

1.19000

SL

0.0

Pips

Flat

1.19000

SL

Exit Price

1.19603

Entry Price

1.22000

TP

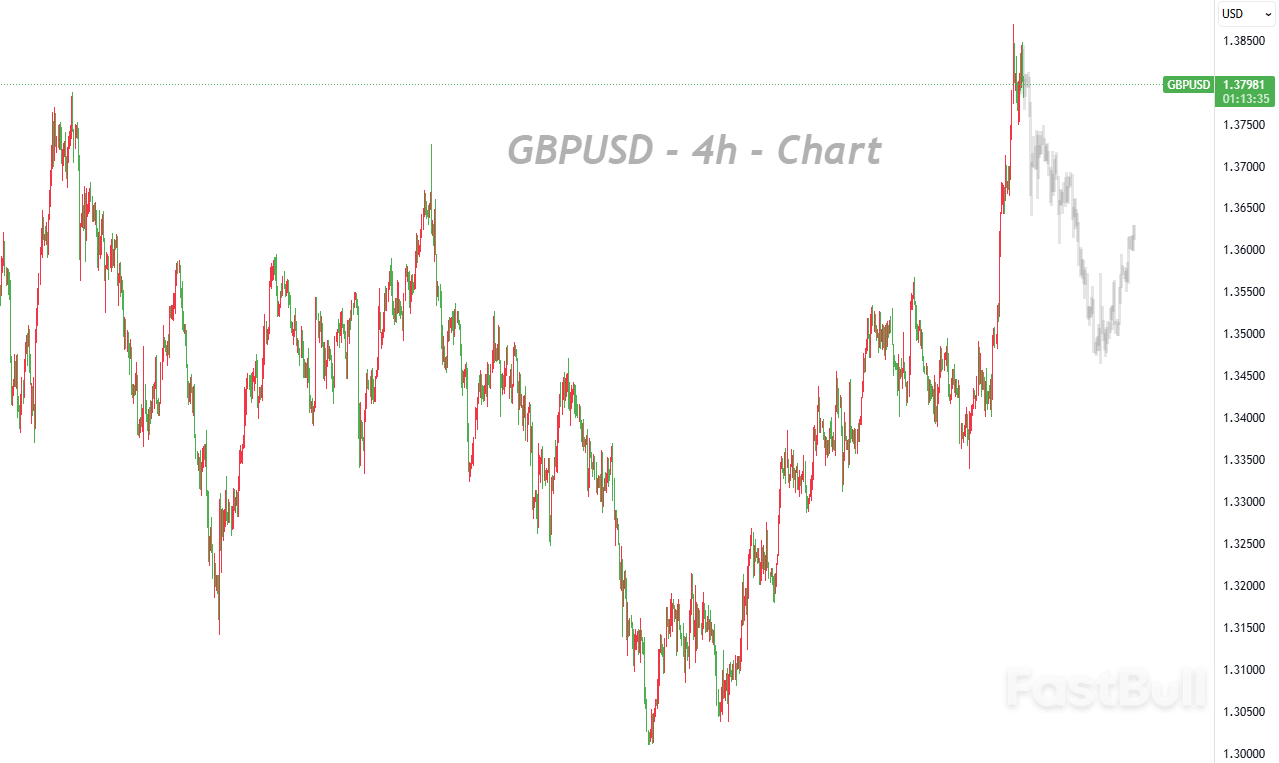

GBPUSD is consolidating near multi-year highs, while the US dollar remains under pressure amid “sell-America” trade sentiment, the Fed’s policy outlook, and elevated political uncertainty. On the technical front, a failed short-term inverse head-and-shoulders pattern signals rising pullback risk at elevated levels.

1.38081

Entry Price

1.35000

TP

1.39990

SL

0.0

Pips

Flat

1.35000

TP

Exit Price

1.38081

Entry Price

1.39990

SL

AUD/USD rises near 0.7050 after strong Australian inflation data boosts expectations of an RBA rate hike, though a steadier US Dollar limits the pair’s upside.

0.70600

Entry Price

0.72000

TP

0.70150

SL

45.0

Pips

Loss

0.70150

SL

0.70148

Exit Price

0.70600

Entry Price

0.72000

TP

Gold prices extended their record rally as geopolitical tensions, US dollar weakness, and continued expectations of Federal Reserve rate cuts drove strong safe-haven inflows, with structural demand from central banks and investors reinforcing bullion’s advance.

5540.00

Entry Price

5700.00

TP

5470.00

SL

700.0

Pips

Loss

5470.00

SL

5469.95

Exit Price

5540.00

Entry Price

5700.00

TP

Recently, gold has experienced sustained upward momentum driven by multiple factors, briefly challenging the 5600 resistance level. However, the short-term rally has been excessive, increasing the risk of a corrective pullback.

5580.00

Entry Price

5335.00

TP

5650.00

SL

--

Pips

PENDING

5335.00

TP

Exit Price

5580.00

Entry Price

5650.00

SL

Due to escalating geopolitical tensions and sustained Chinese crude oil demand, crude oil prices reached a four-month high. Additionally, an unexpected decline in U.S. crude oil inventories alleviated concerns over oversupply and supported elevated oil prices. This, in turn, buoyed the Canadian dollar, which is correlated with commodity prices, while the weakening U.S. dollar continued to exert downside pressure on USD/CAD, reaffirming the recent bearish outlook for the currency pair.

1.35241

Entry Price

1.38000

TP

1.33000

SL

0.0

Pips

Flat

1.33000

SL

Exit Price

1.35241

Entry Price

1.38000

TP

Trading Recommendations

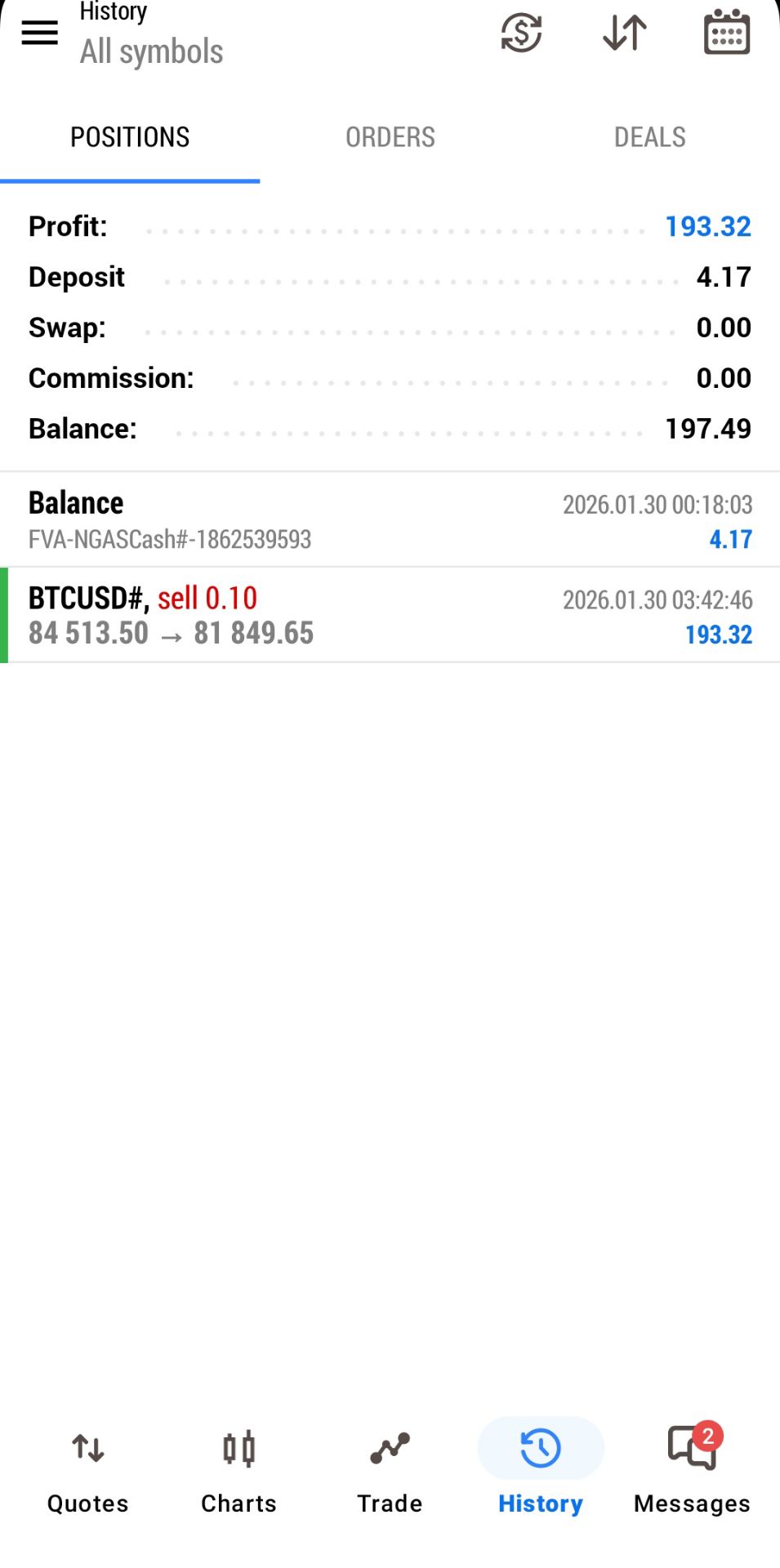

Trading RecommendationsMacroeconomic concerns and geopolitical tensions may further impact Bitcoin prices. Current market dynamics closely align with historical volatility patterns.

93500.0

Entry Price

70870.0

TP

99900.0

SL

--

Pips

PENDING

70870.0

TP

Exit Price

93500.0

Entry Price

99900.0

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up