Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)A:--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)A:--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)A:--

F: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)A:--

F: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)A:--

F: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)A:--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime RateA:--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)A:--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)A:--

F: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)A:--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)A:--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Mexico Trade Balance (Nov)

Mexico Trade Balance (Nov)--

F: --

P: --

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)--

F: --

P: --

U.S. PCE Price Index Prelim QoQ (SA) (Q3)

U.S. PCE Price Index Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q3)

U.S. GDP Deflator Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)--

F: --

P: --

U.S. Industrial Output YoY (Nov)

U.S. Industrial Output YoY (Nov)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

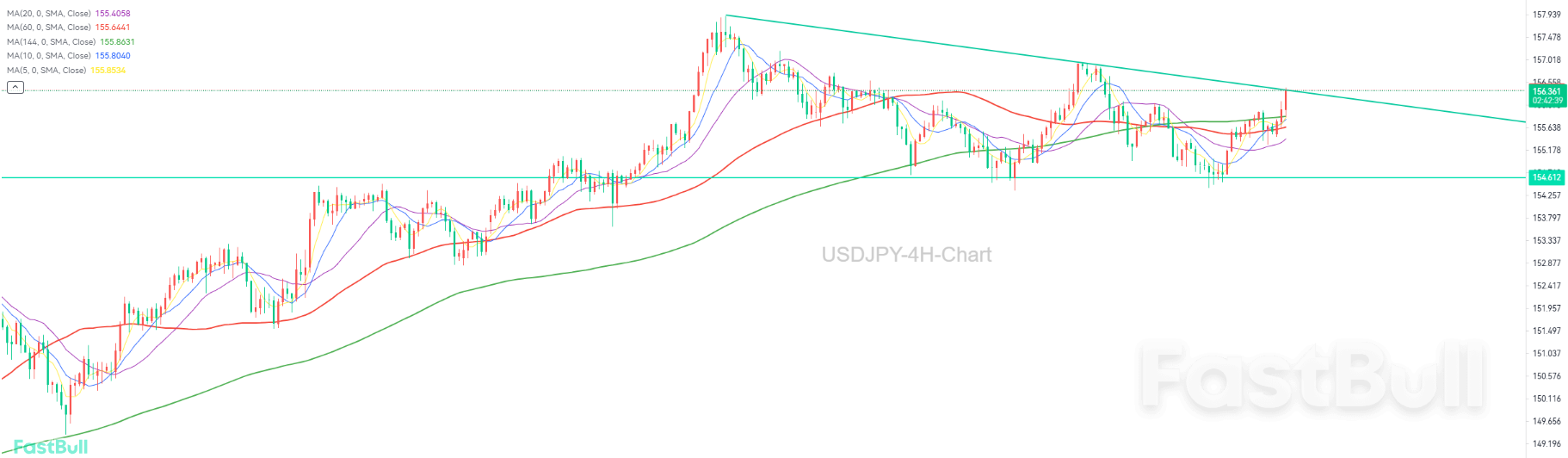

Although the Bank of Japan (BoJ) raised interest rates today, market expectations for further BoJ tightening moderated, and USD/JPY may continue to strengthen.

156.631

Entry Price

160.100

TP

154.300

SL

0.0

Pips

Flat

154.300

SL

Exit Price

156.631

Entry Price

160.100

TP

Given the strength of the prevailing primary uptrend, the current bearish move is viewed as a technical retracement rather than a trend reversal.

0.93050

Entry Price

0.93500

TP

0.92800

SL

--

Pips

PENDING

0.92800

SL

Exit Price

0.93050

Entry Price

0.93500

TP

The 200-period MA is particularly noteworthy; it has recently functioned as a critical dynamic support, acting as a springboard for price action.

1.17229

Entry Price

1.18200

TP

1.16800

SL

0.0

Pips

Flat

1.16800

SL

Exit Price

1.17229

Entry Price

1.18200

TP

A further deceleration in U.S. inflation could propel gold to fresh record highs.

4373.30

Entry Price

4065.00

TP

4415.00

SL

215.4

Pips

Profit

4065.00

TP

4351.76

Exit Price

4373.30

Entry Price

4415.00

SL

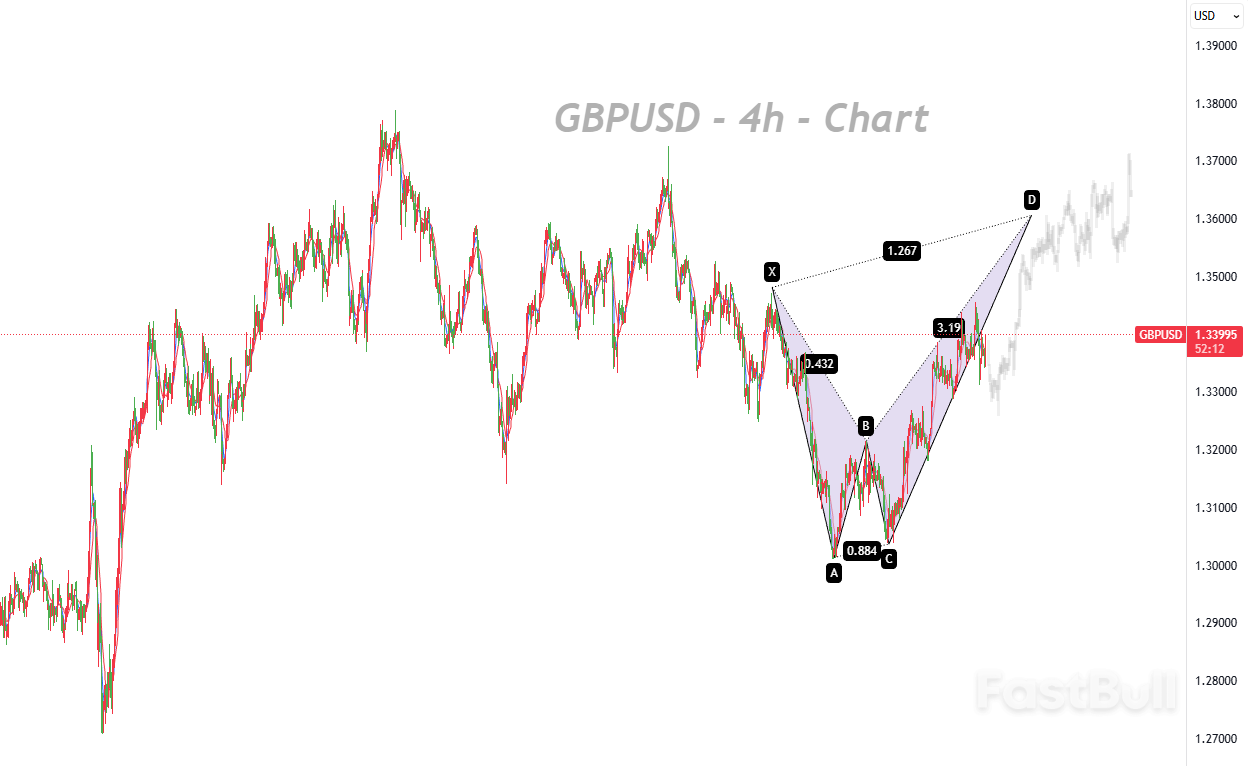

If the Bank of England (BoE) delivers the expected 25 bp rate cut but signals greater caution on further easing than the market anticipates, sterling is likely to rally. Such a hawkish surprise would probably manifest as an exceptionally tight vote on any prospective reduction.

1.33967

Entry Price

1.36150

TP

1.32400

SL

0.0

Pips

Flat

1.32400

SL

Exit Price

1.33967

Entry Price

1.36150

TP

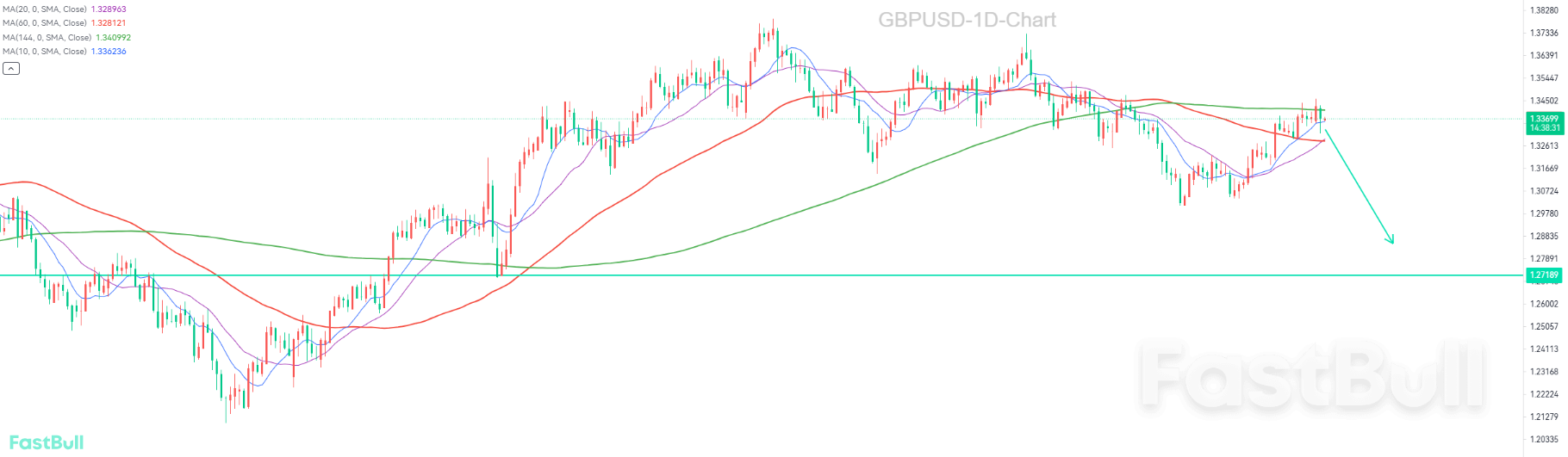

Today, the Bank of England (BOE) is scheduled to release its latest monetary policy decision, with prevailing market expectations indicating a potential interest rate cut, which may exert downward pressure on the British pound.

1.33678

Entry Price

1.30200

TP

1.34600

SL

0.0

Pips

Flat

1.30200

TP

Exit Price

1.33678

Entry Price

1.34600

SL

The U.S. dollar strengthened as markets adopted a cautious stance ahead of the upcoming U.S. Consumer Price Index (CPI) report, which is expected to provide further insights into the evolution of price pressures.

1.37795

Entry Price

1.42000

TP

1.35700

SL

9.5

Pips

Profit

1.35700

SL

1.37890

Exit Price

1.37795

Entry Price

1.42000

TP

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up