Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

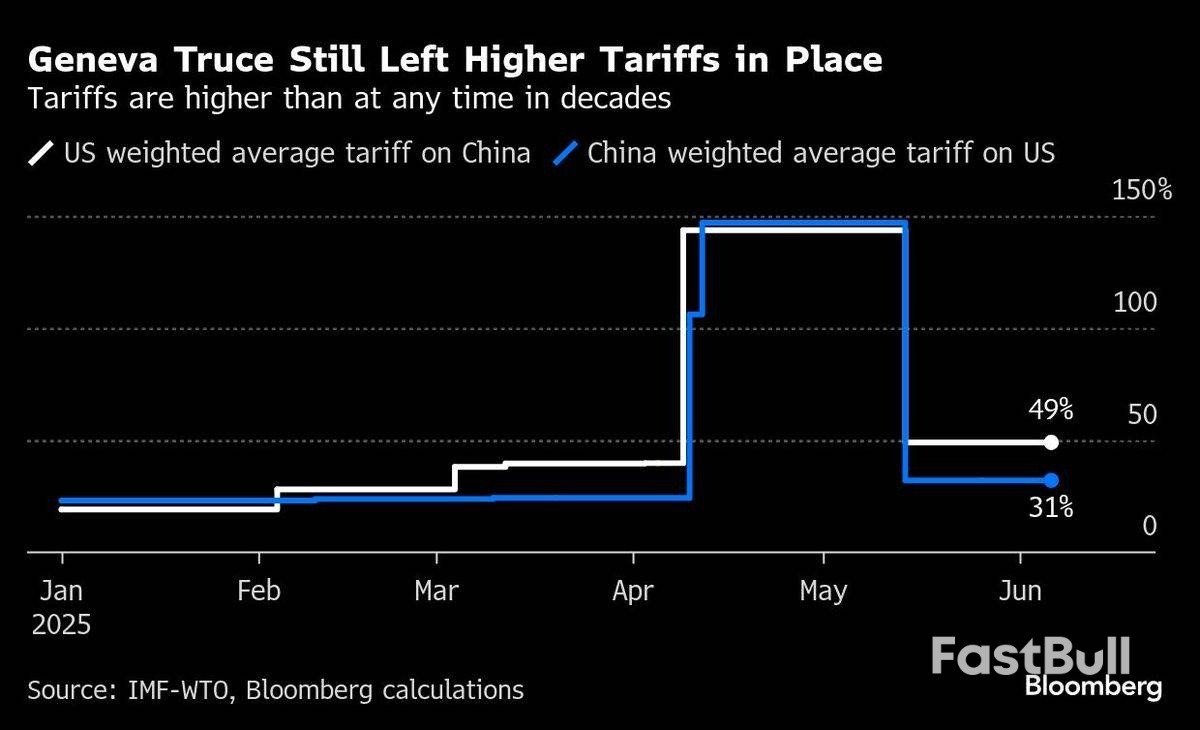

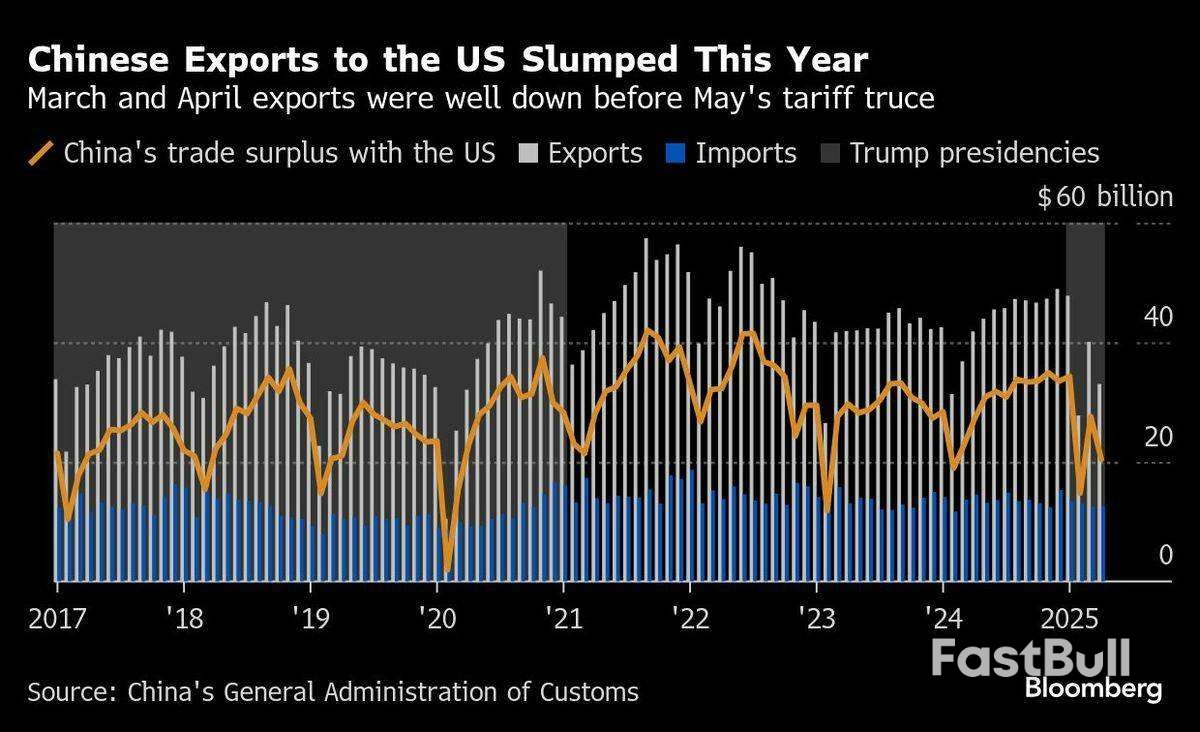

In the early hours of Wednesday, Donald Trump declared that Xi Jinping was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Some 36 hours later, the US leader said he got what he wanted: A commitment to restore the flow of rare earth magnets.

In the early hours of Wednesday, Donald Trump declared that Xi Jinping was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Some 36 hours later, the US leader said he got what he wanted: A commitment to restore the flow of rare earth magnets.

It’s less clear what Xi got in return, apart from putting a lid on further punitive US measures. One of the few clear takeaways appeared to be an assurance for the US to welcome Chinese students, a major issue in China but also not one that would explain why Xi got on the phone after making Trump wait for months.

By taking the call now, Xi appears to be betting that a reset in ties will lead to tangible wins in the weeks and months ahead, including tariff reductions, an easing of export controls and a generally more civil tone. The biggest sign of that was another round of talks that will now include US Commerce Secretary Howard Lutnick, who is in charge of curbs on the sale of advanced technology to China.

Whether Xi will get any of that, however, now hinges on a famously erratic Trump administration in which views toward China differ drastically.

“This call provides tactical de-escalation for US-China relations,” said Sun Chenghao, a fellow at the Center for International Security and Strategy at Tsinghua University in Beijing.

“However, China’s core demands — equal sanction relief, reciprocal enforcement mechanisms, and an end to tech containment — remain critical for sustainable agreements,” he added. “Without substantive US adjustments in follow-up talks and policies, the consensus may not translate into long-term stability.”

Investors were sceptical that relations between the world’s biggest economies were finally on track, with China’s CSI 300 Index little changed on Friday. While the two leaders spoke just days before Trump’s inauguration, Xi had kept his US counterpart waiting for a phone call ever since as tensions rapidly escalated, with tariffs climbing well beyond 100% before the two sides agreed to lower them in Geneva last month.

In recent days, Trump had looked like the more desperate of the two, seen by his repeated requests for a call capped off by his social media post at 2.17am on Wednesday. The call next day finally ended the longest post-inauguration silence between American and Chinese leaders in more than 20 years.

“We’re in very good shape with China and the trade deal,” Trump told reporters on Thursday after the 90-minute conversation. “I would say we have a deal, and we’re going to just make sure that everybody understands what the deal is,” he added.

The big immediate problem for the US was a lack of rare earth magnets essential for American electric vehicles and defence systems. After the Geneva meeting, the US side believed it had secured the flow of these materials, only to be disappointed when China kept its export licensing system in place, saying that exporters to the US still needed to apply just like everyone else.

China, in turn, felt betrayed by a fresh wave of US restrictions on AI chips from Huawei Technologies Co, software for designing chips, plane engines and visas for upwards of 280,000 Chinese students.

“Both sides felt that the agreement in Geneva was being violated,” said Gerard DiPippo, associate director at the RAND China Research Center. From the White House’s perspective, he said, “China committed to send the magnets.”

Although Xi flexed his muscles with the rare earths restrictions, he also has reasons to come to the table. China’s economy is expected to slow sharply in the second quarter and come under pressure into the second half of the year, according to Morgan Stanley economists led by Robin Xing.

“Now the China pendulum is swinging back from ‘political principle’ of standing firm against the US to ‘pragmatism’ in support of a still fragile economy,” said Han Lin, China country director at The Asia Group. “In other words, Beijing wants to de-escalate, and as long as there is a face-saving path for Xi to do so, now is better than never.”

Xi can point to several things that indicate more is coming. The addition of Lutnick in upcoming trade talks, led in Geneva by Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, signals Trump may be willing to consider reversing some of the technology curbs that threaten to hobble China’s long-term growth ambitions.

Xi’s statement after the call also made clear he expects the US to “remove the negative measures taken against China”, which could include warnings against the use of Huawei's Ascend chips and restriction on the sale of chip design software to China.

The two leaders also exchanged invitations to visit each other’s country, events that will build momentum toward stabilising the relationship with agreements on thorny issues spanning trade, export controls and people-to-people exchanges. Trump said their wives would also come along, adding to the positive optics.

It’s significant that Trump agreed to visit China first, according to Bert Hofman, professor at the East Asian Institute at the National University Singapore and former World Bank country director for China.

“Xi probably realised that a call would be in the Chinese interest given the eagerness of Mr Trump to have one,” he said. “This will accelerate talks and hopefully extend the truce beyond August,” he added, as the tariff reductions agreed in Geneva will expire in early September.

But some analysts advised against being overly optimistic, pointing out the lack of details on key trade matters.

“There doesn’t seem to be a deeper agreement that would prevent either side from taking additional negative actions, even as talks proceed,” said Kurt Tong, a former US consul general in Hong Kong and a partner at The Asia Group.

That fragility is compounded by Trump’s transactional approach to foreign policy and ties with China in particular. In January 2020, when Trump signed a Phase-One trade deal with Beijing, he said the relationship between the countries was “the best it’s ever been” before it quickly unraveled following the spread of Covid-19 around the globe.

“It would be unwise to bet that Trump has a vision for further negotiations that he won’t abandon suddenly later on,” said Graham Webster, who leads the DigiChina project at Stanford University.

Another area where Xi could see an early win is on the issue of fentanyl. Any deal to cooperate in blocking the flow of the drug to the US could immediately bring down American tariffs on Chinese imports by 20 percentage points.

While the call helped to stem the negative trajectory of the relationship, the next two weeks will be crucial to confirm whether the truce will last, according to Wu Xinbo, a professor at Fudan University in Shanghai. He said China expects to see more progress on tariffs and US tech curbs.

“The call in itself is not a reward,” Wu said. “What’s important is what will come out of the call.”

According to a report from Statistics Canada, Canada’s labor market showed unexpected resilience in May, adding 8,800 jobs compared to consensus expectations for a decline of 11,900. The unemployment rate, meanwhile, edged up to 7.0%, in line with projections, as labor force participation remained steady.

The employment rate held at 60.8%, reflecting stable engagement in the labor market despite weak job creation in recent months. While May’s headline gain was marginal, it marked an upside surprise following a nearly flat April and comes amid growing concern over labor market slack.

Core-aged women drove the gains, adding 42,000 jobs and lifting their employment rate to 80.1%, partially rebounding from a significant drop in April. However, employment among core-aged men fell 31,000 in the month, pushing their employment rate to its lowest level in nearly seven years, excluding pandemic disruptions.

Sectoral gains were led by wholesale and retail trade (+43,000) and information, culture and recreation (+19,000), while losses in public administration (-32,000) and accommodation and food services (-16,000) capped broader expansion. Private sector hiring rose 61,000, its first monthly gain since January, while self-employment dropped by 30,000, signaling possible shifts in worker preferences or employer demand.

On a regional basis, British Columbia, Nova Scotia, and New Brunswick (NYSE:BC) posted job gains, while Quebec and Manitoba contracted. Ontario remained flat on the month, with some of the country’s highest unemployment rates concentrated in industrial centers like Windsor (10.8%) and Oshawa (9.1%).

Wage growth remained firm, with average hourly earnings rising 3.4% year-over-year to $36.14, mirroring April’s pace. Total hours worked were unchanged month-over-month, though up 0.9% compared to May 2024, pointing to moderate improvements in labor productivity.

While the unemployment rate has now risen for three straight months, May’s increase was modest and anticipated. With 1.6 million Canadians unemployed and rising job search durations, the labor market continues to show signs of loosening, even as headline numbers defy short-term expectations.

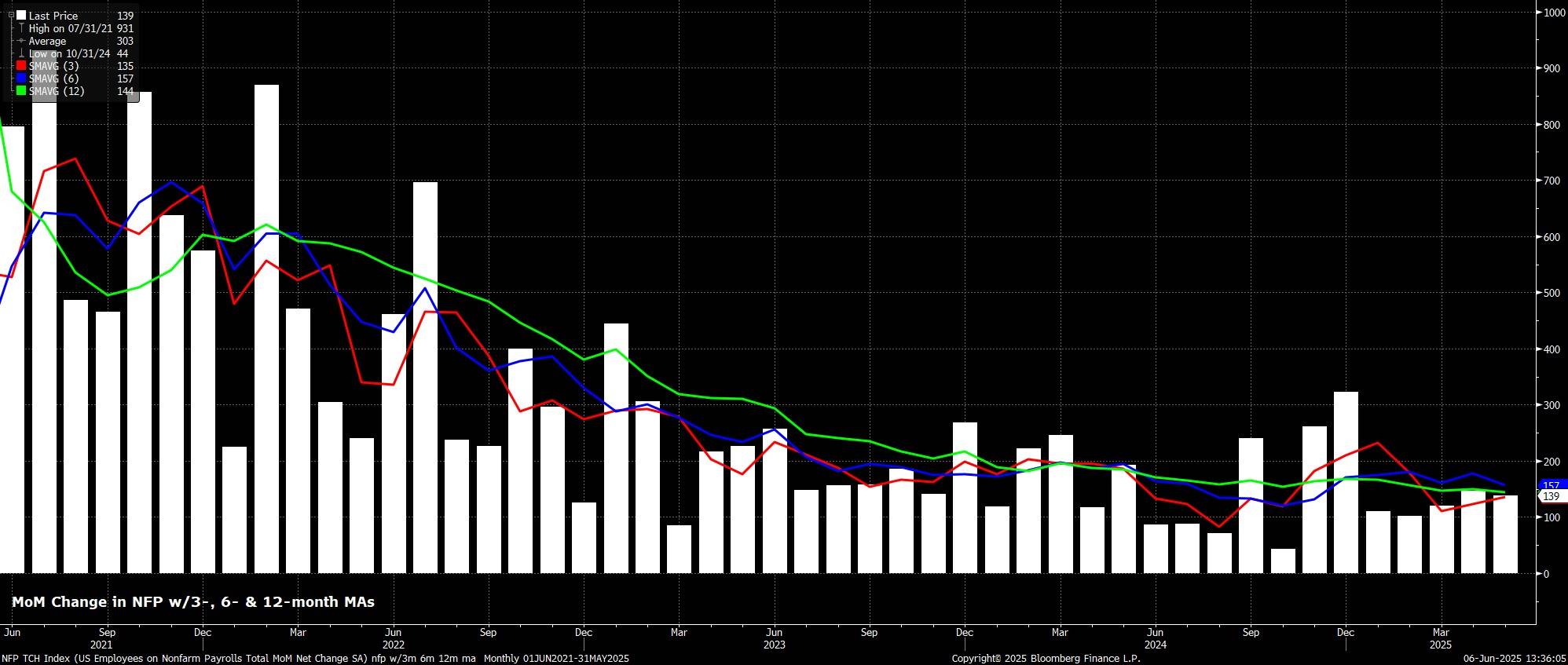

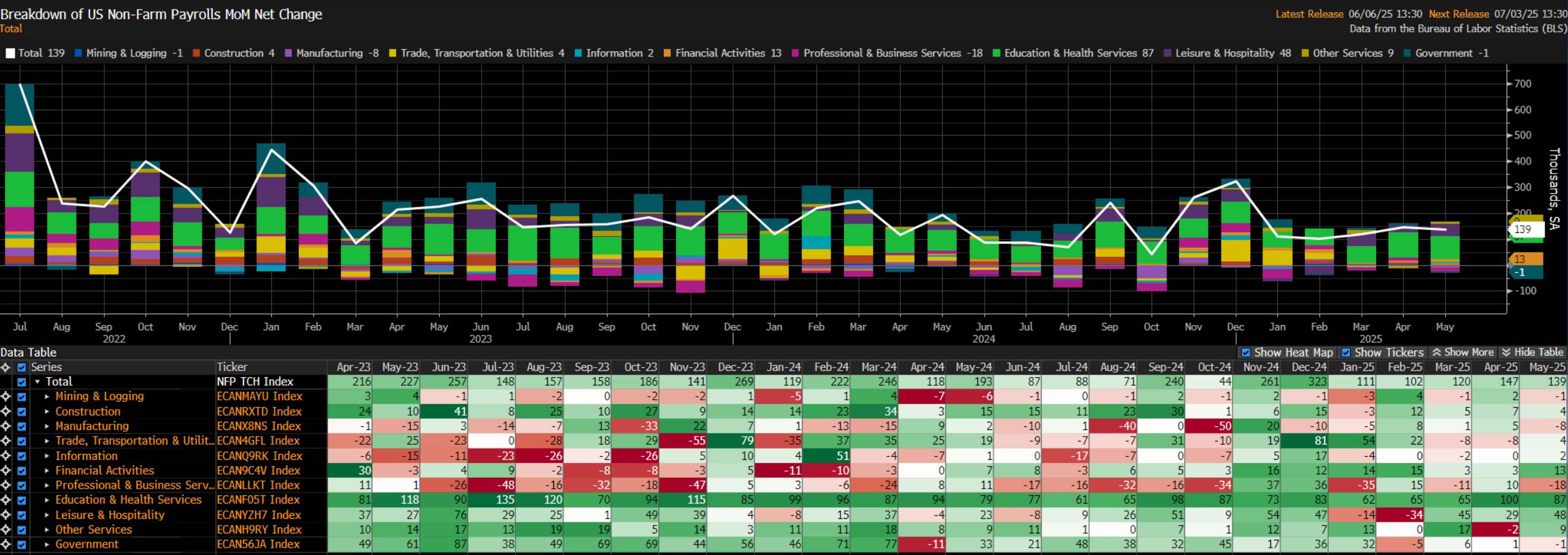

Headline nonfarm payrolls rose by +139k last month, modestly aboveh consensus estimates for a +125k increase, but well within the tighter than usual forecast range of +75k to 190k. Simultaneously, the prior two payrolls prints were revised by a sizeable net -95k, in turn taking the 3-month average of job gains to +135k, still considerably above the breakeven pace

Digging a little deeper into the payrolls print, job gains were relatively broad-based, though for the second month running Education led the way, closely followed by Leisure & Hospitality, while on the flip side Professional & Business Services, Manufacturing, and Mining & Logging were the only sectors seeing MoM declines in employment.

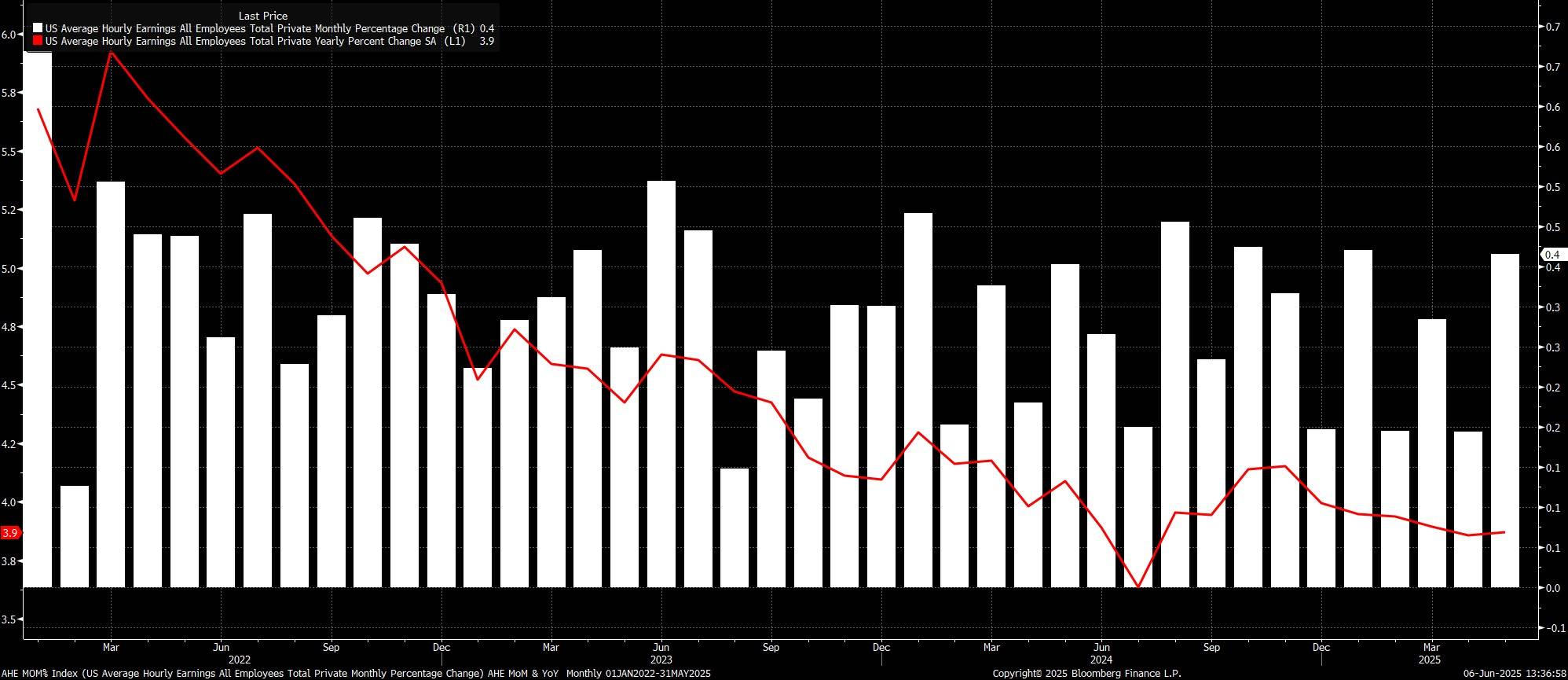

Sticking with the establishment survey, the jobs report once again pointed to earnings pressures remaining contained. Average hourly earnings rose 0.4% MoM, a touch hotter than expected, which in turn saw the annual rate also tick higher, to 3.9% YoY.

Data of this ilk continues to reinforce the FOMC's now-familiar view that the labour market is not a source of significant upside inflation risks at the current juncture. Those risks, though, are obviously still present, stemming primarily from President Trump's tariff policies, even if said price pressures are likely to prove temporary in nature.

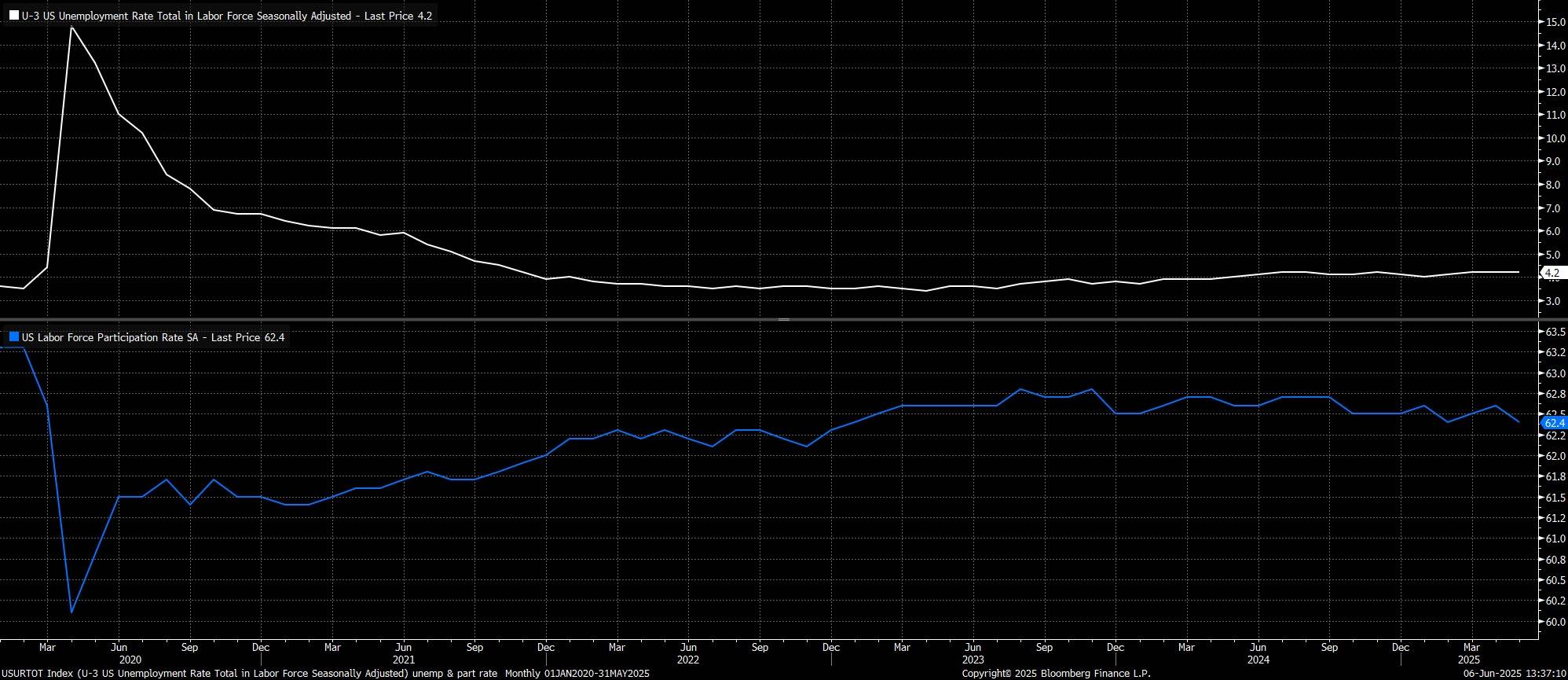

Turning to the household survey, unemployment held steady at 4.2%, in line with expectations, though labour force participation surprisingly dipped to 62.4%, below the bottom of the forecast range.

As has been the case for some time, however, some degree of caution is required in interpreting this data, which has been unusually volatile this cycle, as the BLS continue to grapple with falling survey response rates, and the rapidly changing composition of the labour force.

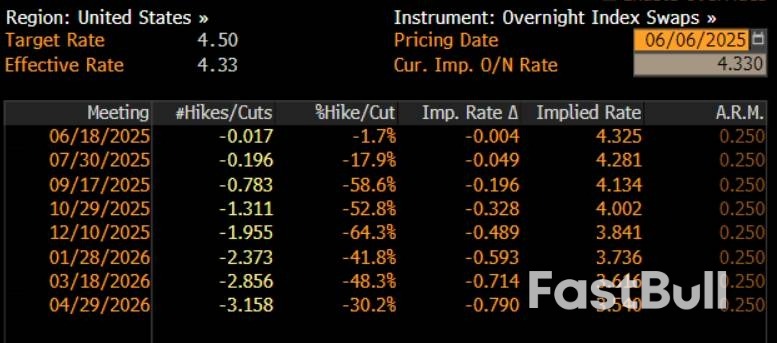

As the jobs report was digested, money markets, per the USD OIS curve, underwent a very marginal dovish repricing, continuing to fully discount the next 25bp cut for October, but now pricing around 48bp of easing by year-end, compared to 53bp pre-release.

Zooming out, it's difficult to imagine the May jobs report significantly shifting the outlook from a monetary policy perspective. For the time being, the FOMC remain firmly in ‘wait and see' mode, buying time to assess the impact of tariffs, plus the associated policy uncertainty, and how this shifts the balance of risks to either side of the dual mandate. Furthermore, policymakers are also seeking to ensure that inflation expectations remain well-anchored, in spite of any transitory tariff-related price pressures.

Consequently, Powell & Co, who enter the pre-meeting ‘blackout' period at close of play today, are likely to remain on the sidelines for the time being. Though the direction of travel for rates clearly is still lower, the prospect of a rate cut before Q4 remains a long shot.

The economic data expected to be released in the US has finally been shared:

According to LSEG data, employment growth expectations ranged from 75,000 to 190,000.

In a Reuters poll, the market expectation was 130,000, a significant drop from the 177,000 figure released in April. The unemployment rate was expected to remain stable at 4.2%.

Bank of America (BofA) had expected a 150,000-plus increase, above expectations, anticipating resilience in the labor market. The bank says this could prompt the Fed to keep interest rates steady for an extended period. BofA analysts say markets are more focused on the “recession side of stagflation.”

On the other hand, UBS Chief Economist Paul Donovan said that many forecasts were below market expectations. “Companies may have slowed hiring due to uncertainty about trade policies. However, this is unlikely to lead to an increase in layoffs. This means that rate cuts will have limited impact at the moment. However, if consumer demand weakens, rate cuts will become more critical,” Donovan said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up