Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. Treasury Secretary Scott Bessent emphasized that easing trade tensions depends on China's actions, despite recent partial tariff rollbacks, as businesses brace for supply shortages and economic strain from escalating U.S.-China tariffs...

The U.S. Dollar, the world's reserve currencyand the ultimate safe-haven asset, is now the world's worst-performing majorcurrency in 2025. Octa Broker explains why.

The historical role of the U.S. dollar as theworld's leading safe-haven currency is under threat. Despite risingmacroeconomic uncertainty, investors are fleeing the U.S. dollar, defyingconventional safe-haven flows. Greenback's rapid depreciation over the pastweeks has fuelled speculation over the loss of confidence in its safe-havenstatus. With USDCHF trading news multi-year low, Octa Broker analyzes if we arein the midst of dramatic regime change in markets and explains why the U.S.dollar is struggling amid global trade turmoil

The U.S. dollar (USD), the buck or the greenback,as it is often informally referred to, has long occupied a rather exclusiveposition in global finance. Ever since the end of World War II and theestablishment of the Bretton Woods monetary system, the greenback has played acrucial role in facilitating cross-border transactions and smoothinginternational trade flows, in addition to serving as a primary reserve currencyfor central banks around the world. Being the official currency of the world'slargest economy, the United States, has certainly helped the dollar maintainits dominant position. Indeed, the sheer size of the U.S. economy, its deep andliquid financial markets, strong private property rights and the rule of lawenshrined in the U.S. Constitution, and last but not least, the unrivalledpower of the U.S. military, made the dollar the most trusted global currency.

As a result, the greenback became what market participants call ‘a safe-havencurrency’, a refuge for investors during times of macroeconomic uncertainty ormarket turmoil. Most recently, however, the instability in global financialmarkets triggered by rising trade tariffs and exacerbated by fears of a globalrecession seems to have upended this narrative, undermining the dollar's establishedrole.

The U.S.dollar has been depreciating almost relentlessly since mid-January. In justthree and a half months, the Dollar Index (DXY), which measures the value ofthe greenback relative to a basket of six major foreign currencies, includingthe euro, Japanese yen, British pound, Canadian dollar, Swedish krona, andSwiss franc, lost more than 10% in value (from 13 January high to 21 Aprillow). On 11 April, it breached the critical 100.00 level, and although it hassince increased slightly, it remains by far the worst-performing currency amongother major currencies this year so far. This decline has raised an importantquestion: Is the U.S. dollar losing its safe-haven status, or is it merely atemporary setback?

Thecatalyst for the dollar's slide is rooted in the escalating trade tensions,particularly the aggressive tariff policies enacted by U.S. President DonaldTrump. In recent weeks, the U.S. imposed a 10% baseline tariff on all imports,with much steeper duties imposed on key trading partners like China, which, inturn, retaliated with its own 125% levies on U.S. goods. These moves havestoked fears of a global recession, as international supply chains may getdisrupted with potentially devastating consequences for the world economy.Historically, such uncertainty would bolster the dollar, as investors seek thesafety of U.S. assets. However, this time around, the greenback is faltering,while alternative safe-haven currencies like the Swiss franc (CHF) and Japaneseyen (JPY) are gaining ground.

Kar YongAng, a financial market analyst at Octa Broker, says that the U.S. dollar'srecent weakness is driven by a diversification shift among investors intoalternative safe-haven currencies, motivated by risk-hedging and fears over thegrowth prospects of the U.S. economy.

'Weare witnessing a major reallocation of capital. Market participants realisethat in a trade war, there are no winners. In the short term, the U.S. economywill face the consequences, and they will not be pretty. Big players with largeinvestments in the U.S. realised they needed to hedge their currency risk, sothey moved into the Swiss franc and the Japanese yen. Also, higher tariffs arefuelling recession fears, so traders have increased their bets on additionalrate cuts by the Fed [Federal Reserve].That too had a bearish effect on the greenback'.

Indeed, onApril 21, USDCHF dropped below the 0.80500 mark, the level unseen in almost 14years, while USDJPY was hovering near the critical 140.00 area, a drop belowwhich will open the way towards new multi-year lows. Significant shifts incapital flow allocations have prompted some analysts to conclude that the U.S.dollar is facing a crisis of confidence. However, Octa analysts have adifferent view and believe that the current situation doesn't reflect a broaderosion of investors' long-term trust in the U.S. dollar.

Kar Yong Ang said: 'The issue isn't so much a fundamental lossof faith in the U.S. dollar's long-term prospects. What we are witnessing rightnow is a dramatic, yet logical response to the probable economic implicationsof Donald Trump's trade policies. You have an administration, which iseffectively re-structuring the global trade order, that does not conceal itsdissatisfaction with the Fed and apparently believes in a weak dollar. Ifyou're a foreign investor in the U.S., you simply cannot afford to be unhedgedthese days. But also, let's not forget that the greenback has been falling fromrelatively high levels, so a healthy downward correction was long overdue'.

In other words, the recent slide in the U.S. dollar is not an unusualphenomenon or an anomaly; it is quite natural and probably a short-termoccurrence. In fact, even after an 11% drop in 2025, the greenback is stillsome 38% above its historical low set in 2008. Furthermore, it is clear thatonce key global actors adopt more conciliatory diplomatic rhetoric and engagein active trade negotiations, the situation will normalise immediately.

As for thedollar's long-term prospects, its dominant status will likely continue to bechallenged, but no single currency can take its crown for now. According to the Bank of InternationalSettlements (BIS), the U.S. dollar still accounts for nearly 88% ofinternational transactions, and its dominance in Forex markets remainsunmatched, with daily trading volumes dwarfing those of the yen or franc.According to the International Monetary Fund (IMF), more than half (57.8%) ofthe $12.4 trillion in global foreign exchange reserves were in U.S. dollars.Therefore, while the greenback may not be the automatic refuge it once was, itsrole as a Forex cornerstone endures for now.

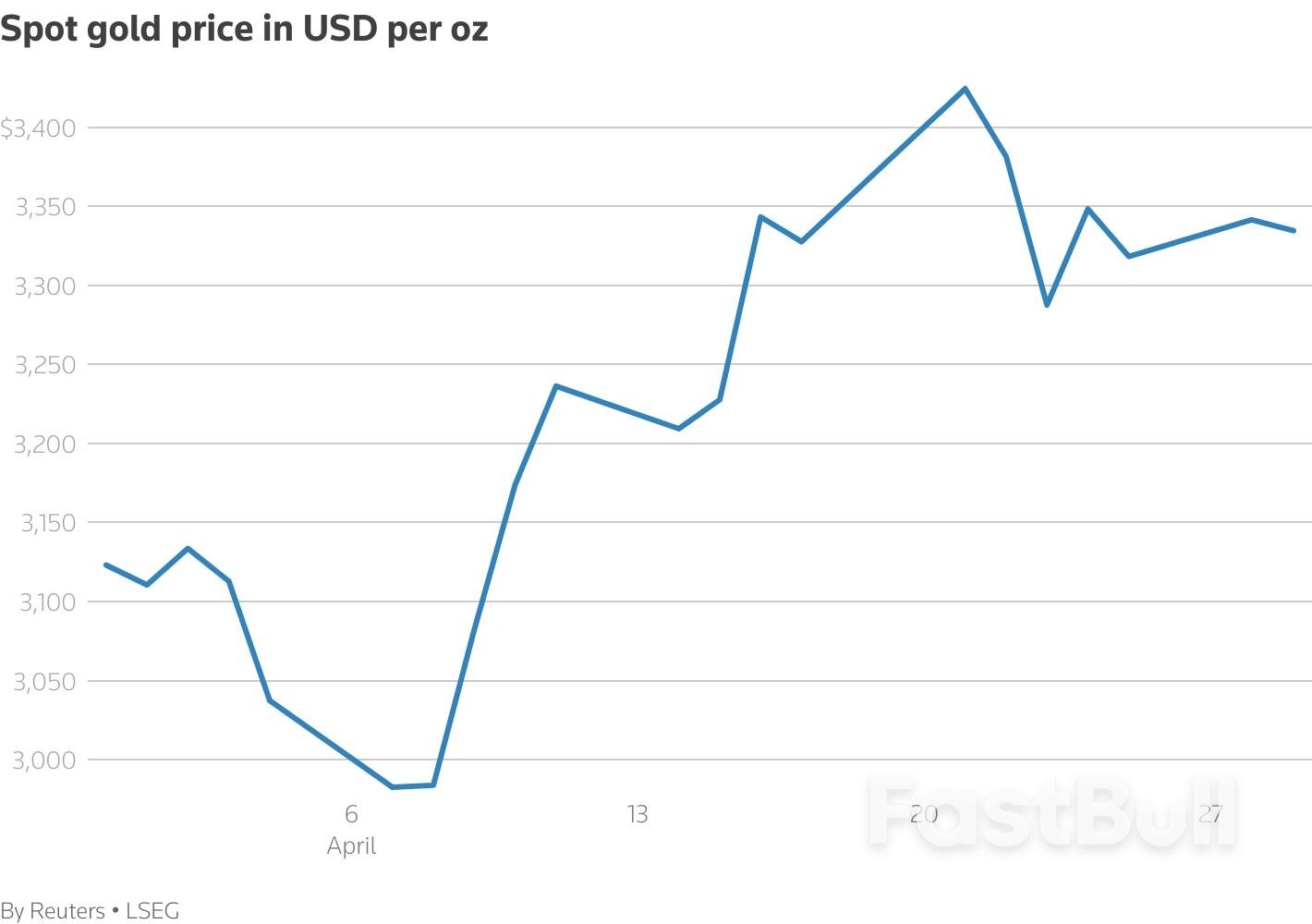

Gold prices dropped on Tuesday as softening trade tensions between the U.S. and its trading partners dulled the metal's safe-haven appeal, while investors awaited U.S. economic data to assess the Federal Reserve's policy path.

Spot gold was down 0.8% at $3,314.65 an ounce, as of 0619 GMT. U.S. gold futures lost 0.7% to $3,324.20.

"The risk environment has clearly improved recently, with market participants buoyed by optimism that the worst of the trade tensions may be behind us amid encouraging rhetoric around trade deals," said IG market strategist Yeap Jun Rong.

U.S. Treasury Secretary Scott Bessent said on Monday several top trading partners had made "very good" proposals to avoid U.S. tariffs, with India likely to be among the first to finalize a deal.

China's recent moves to exempt certain U.S. goods from its retaliatory tariffs showed a willingness to de-escalate trade tensions, Bessent added.

U.S. President Donald Trump's administration will also move to reduce the impact of his automotive tariffs by alleviating some duties imposed on foreign parts in domestically-manufactured cars.

But risks are high that the global economy will slip into recession this year, according to a majority of economists in a Reuters poll, with many saying Trump's tariffs have damaged business sentiment.

Bullion, traditionally seen as a hedge against political and financial instability, rose to an all-time high of $3,500.05/oz last week due to elevated uncertainties.

Investors will monitor economic data this week, including the U.S. job openings report later in the day, Personal Consumption Expenditures on Wednesday, and the non-farm payrolls report on Friday.

"Longer-term structural tailwinds for gold prices are likely to keep the broader upward trend intact, supported by room for ongoing reserve diversification among emerging market central banks," Rong said.

Spot silver was down 0.6% at $32.98 an ounce, platinum fell 0.2% to $984.65 and palladium lost 0.5% to $944.34.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up