Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump’s proposed tax bill could boost defense and domestic producers through tax breaks and spending, while hurting renewable energy, health insurers, and real estate due to funding cuts and higher interest rates.

The European Union has changed its team locked in trade talks with the Trump administration, bringing in a close aide to European Commission President Ursula von der Leyen to deal more swiftly with political questions arising from the technical negotiations, three sources familiar with the talks said.

The move follows frequent outbursts of frustration by U.S. President Donald Trump at what the White House perceives as slow progress in talks with the EU. Late in May he recommended a 50% tariff on most European goods from June, before backtracking.

The move to bring more political decision-making to the EU team reflects challenges confronting the bloc as it negotiates a trading relationship with a U.S. president who has said repeatedly the EU was established to screw the United States.

It also reflects the difficulties negotiating trade terms in isolation when Trump has sought to fold non-tariff barriers such as digital services taxes and food standards into the talks.

"If you are a trade negotiator you need to be sure you have full political backing, so if the top level is there you feel stronger," one of the sources said.

The expanded team, which apart from the von der Leyen aide now also includes a cabinet member of Trade Commissioner Maros Sefcovic, was dispatched to Washington this week after a call between Trump and von der Leyen in which they agreed to fast-track negotiations.

Following that call Trump agreed to allow more time for talks between Washington and the 27-nation bloc to produce a deal by July 9.

"It was a merger of Commission layers to reinforce and act fast," a second of the sources said of the team's expansion, adding the team's shape could change again as talks continue.

U.S. Trade Representative Jamieson Greer said a meeting with Sefcovic in Paris on Wednesday had been constructive and that he was pleased negotiations were advancing quickly. He noted "a willingness by the EU to work with us to find a concrete way forward to achieve reciprocal trade".

Sefcovic told reporters that both sides had concluded talks were "advancing in the right direction, at pace," and that high-level contacts would follow shortly. He and Greer had agreed how to "restructure" the focus of negotiations with the United States, he added.

Washington was focused on four areas in its negotiations with other countries: tariffs, non-tariff barriers, purchases and economic security, one of the sources said.

Trump has already hit Europe with a 50% tariff on steel and aluminium as well as a heightened levy on car imports. The EU is racing to secure a deal before July 9 when "reciprocal" tariffs on most other goods could surge from 10% to as high as 50%.

Unlike Britain, the first major economy to reach a narrow trade agreement with the Trump administration, the EU is pushing for a comprehensive deal, with a baseline tariff rate below the 10% now in force.

Two of the three sources said additional technical expertise had also been added to the negotiating team, but there had been no changes to the team's leadership.

"I think it suits everyone to have the political cover," the first source said.

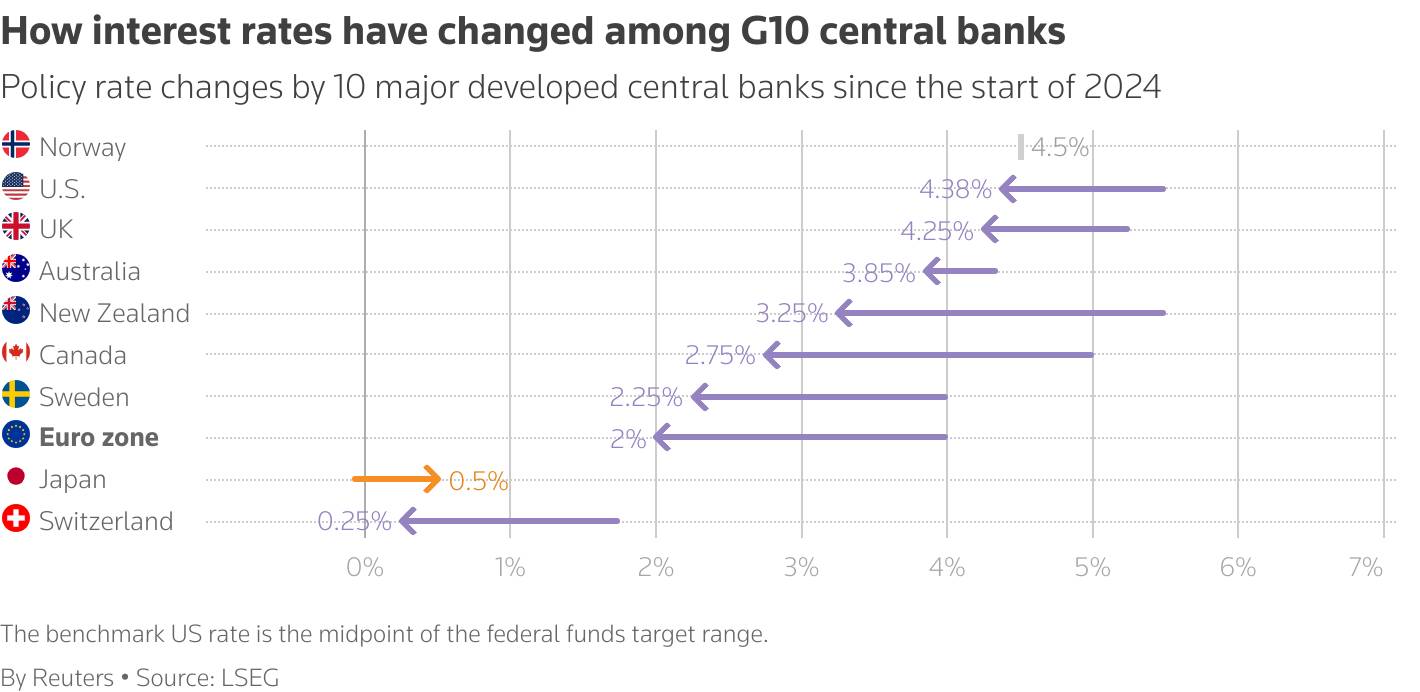

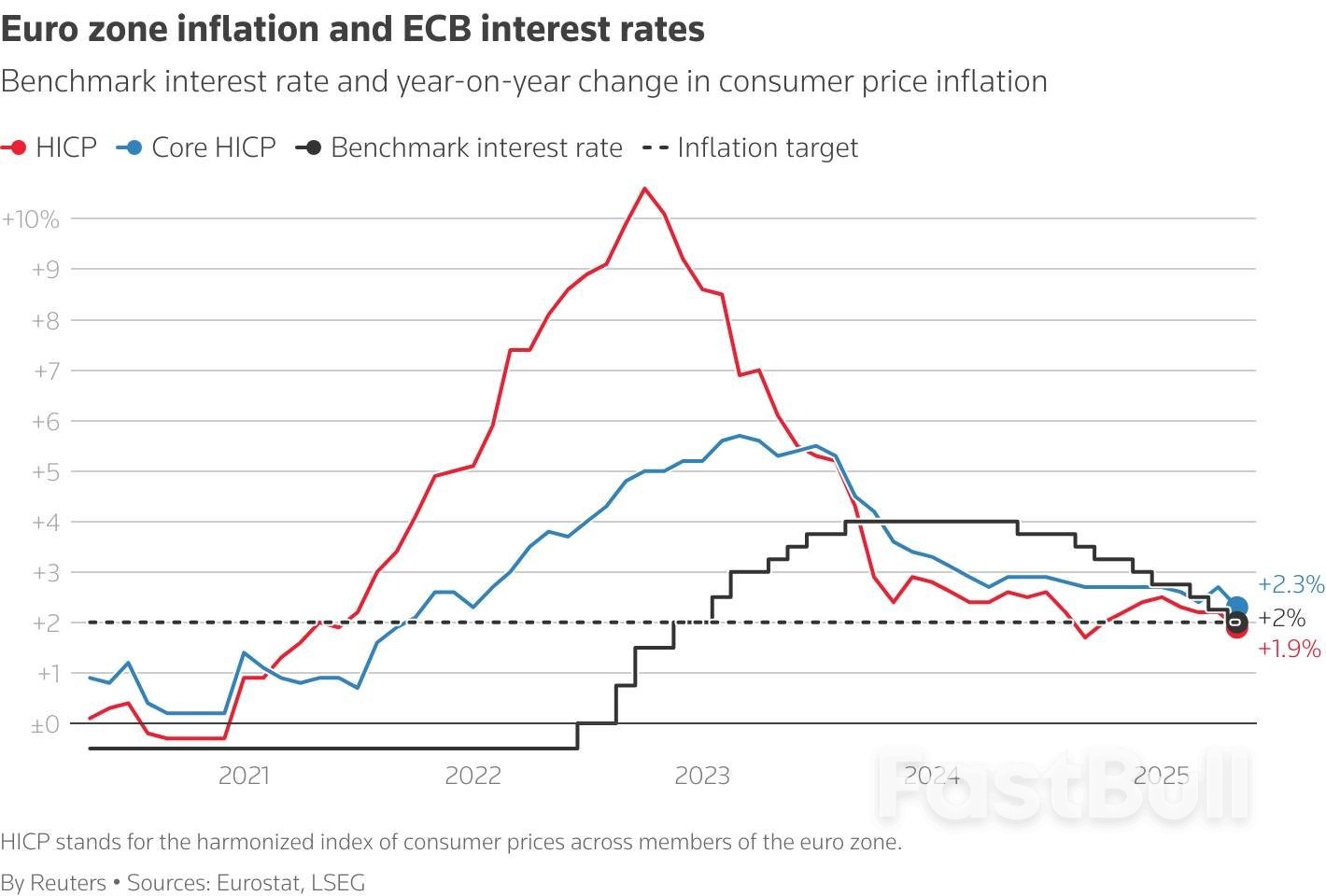

The European Central Bank cut interest rates as expected on Thursday but hinted at a pause in its year-long easing cycle after inflation finally returned to its 2% target.

The ECB has lowered borrowing costs eight times, or by 2 percentage points, since last June, seeking to prop up a euro zone economy that was struggling even before erratic U.S. economic and trade policies dealt it further blows.

With inflation now just below 2%, ECB President Christine Lagarde said the central bank for the 20 countries that share the euro was in a "good position", which investors took as signalling a break in cuts, if not an end to policy easing.

"We are well-positioned after that 25 basis point rate cut and with the rate path as it is," Lagarde told a press conference. "With today's cut, at the current level of interest rates, we believe we are in a good position."

The interest rate path implied by markets sees a pause in July and anticipates just one more cut in the deposit rate toward the end of the year, possibly in December.

"I think we are getting to the end of a monetary policy cycle that was responding to compounded shocks, including COVID, including the war in Ukraine, the illegitimate war in Ukraine, and the energy crisis," Lagarde said.

Economists also saw her words as a clear indication of a pause and some even bet that the ECB's most aggressive easing cycle since the global financial crisis of 2008-2009 might be at a close.

"We think the ECB is done cutting rates now, but this view is contingent on no major negative surprises surfacing and economic outlook to gradually become more robust in line with the ECB's forecasts," Nordea said in a note to clients.

Lagarde said the decision on Thursday was virtually unanimous, with only one policymaker objecting to a cut.

"Our central view is that today's cut is likely the last for some time," HSBC said in a note.

Lagarde also said the euro zone appeared to be attracting more foreign investment, a sign of growing investor confidence and part of the reason why the euro has firmed so much since the U.S. administration embarked on its global trade war.

But there is exceptional uncertainty in the outlook.

European Central Bank (ECB) President Christine Lagarde speaks to the media following the Governing Council's monthly monetary policy meeting in Frankfurt, Germany, March 6, 2025. REUTERS/Jana Rodenbusch/File Photo Purchase Licensing Rights, opens new tab

Falling energy prices and a stronger euro could put further downward pressure on inflation, said Lagarde, adding that effect could be reinforced if higher tariffs led to lower demand for euro exports and re-routing of overcapacity to Europe.

Depending on the outcome of the trade war with the United States, inflation and growth could significantly differ from projections, the ECB said, as it took the unusual step of releasing alternative scenarios to its forecasts.

The case for a pause rests on the premise that the short- and medium-term prospects for the currency bloc differ greatly and may require different policy responses.

Inflation is set to dip in the short term and undershoot the ECB's target next year, but increased government spending and higher trade barriers will add to price pressures later.

The added complication is that monetary policy impacts the economy with a 12-to-18 month lag, so support approved now could be giving help to a bloc that no longer needs it.

"In our baseline, we expect the ECB to pause at the July meeting and deliver a final rate cut in September," PIMCO portfolio manager Konstantin Veit said. "A more recessionary configuration will likely be needed for the ECB to go faster and further in this cutting cycle."

A line chart comparing inflation metrics over the past five years.

Acknowledging near-term weakness, the ECB cut its inflation projection for next year.

U.S. President Donald Trump's tariffs are already damaging activity and will have a lasting impact even if an amicable resolution is found, given the hit to confidence and investment.

Most economists think inflation could fall below the ECB's 2% target next year, triggering memories of the pre-pandemic decade when price growth persistently undershot 2%, even if projections show it back at target in 2027.

Further ahead, the outlook changes significantly.

The European Union is likely to retaliate against any permanent U.S. tariffs, raising the cost of trade. Firms could relocate some activity to avoid trade barriers but changes to corporate value chains are also likely to raise costs.

Higher European defence spending, particularly by Germany, and the cost of the green transition could add to inflation while a shrinking workforce due to an ageing population will keep wage pressures elevated.

European Central Bank officials envisage a pause in their interest rate-cutting campaign when they next set policy in July, according to people familiar with the matter.

Given the uncertainty surrounding US President Donald Trump’s tariffs, a timeout following eight reductions in borrowing costs is currently seen as the most likely scenario, the people said, declining to be identified discussing confidential talks.

Some officials see reductions in borrowing costs as maybe already finished, while others still back another move — probably in September, according to the people.

They stressed policymakers’ thinking could yet shift, with the July 9 deadline for US-European trade negotiations looming. The next rate meeting is scheduled for July 23-24.

An ECB spokesperson declined to comment.

The ECB lowered its deposit rate to 2% on Thursday, saying inflation — which dipped to 1.9% in May — is “currently at around” its target. Addressing reporters later, President Christine Lagarde said ECB policy is “in a good position to navigate the uncertain conditions” that are likely to come from global trade and a jump in spending in Europe.

“We are getting to the end of a monetary-policy cycle that was responding to compounded shocks — including Covid, the illegitimate war in Ukraine and the energy crisis,” she told reporters in Frankfurt.

Traders trimmed wagers on additional cuts, with another quarter-point move this year no longer seen as a certainty.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up