Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Vietnam has officially been placed among six countries prioritized by the U.S. for bilateral tariff negotiations. Prime Minister Pham Minh Chinh announced the move at the National Assembly’s 9th session, noting that the first round of talks is set for May 7...

Investors in Hollywood's top studios and streaming services were spooked Monday after President Donald Trump proposed implementing a 100% tariff on movies made overseas.

Shares of Netflix, Disney, Paramount and Warner Bros. Discovery fell ahead of the opening bell, with Comcast-owned Universal also trading slightly down. Here's how those share moves shook out:

Trump called tax incentives offered by foreign countries "a national security threat" in a post on Truth Social Sunday night. He said he was authorizing the Department of Commerce to impose a levy on all films produced abroad that are sent to the United States.

How Trump intends to implement these duties is unclear, as is exactly who is being targeted and who would foot that potential tariff bill.

Hollywood studios have long filmed movies overseas, either for tax benefits or to capture the natural setting of international locations. Some films are shot in multiple countries, with many studios having satellite production hubs around the globe.

When Trump first instituted a 25% tariff on imports from Canada, a popular filming location for Hollywood movies and television shows, industry experts told CNBC that it wouldn't have a major impact on production. After all, the majority of projects are shot digitally, and transporting the final product can be done online or with a data storage device. There isn't a physical good that exchanges hands in the same way as, say, toys or clothing that's made in another country.

Questions are already swirling. What part of the production process would be hit with this duty? Would it apply only to movie projects or will TV shows filmed internationally also incur this levy? Are already completed projects exempt?

Additionally, as with the first round of tariff announcements earlier this year, industry experts worry about how these duties will impact relationships with other countries. Hollywood relies on international box office sales to recoup lofty film budgets. China has already closed its doors to Hollywood product. Other regions could retaliate and do the same.

U.S. President Donald Trump walks with his nominee for the chairman of the Federal Reserve Jerome Powell on their way to a 2017 press event at the White House. (Photo by Drew Angerer/Getty Images) · Drew Angerer via Getty Images

President Trump appeared to put to rest any lingering concerns that he might fire Federal Reserve Chairman Jerome Powell, ruling that possibility out in an interview that aired Sunday.

"Why would I do that?" he said in the conversation on NBC’s Meet the Press with Kristen Welker. "I get to replace the person in another short period of time."

Powell’s term as chair is up in May 2026, and Powell has already made it clear he intends to serve in his post until that end point.

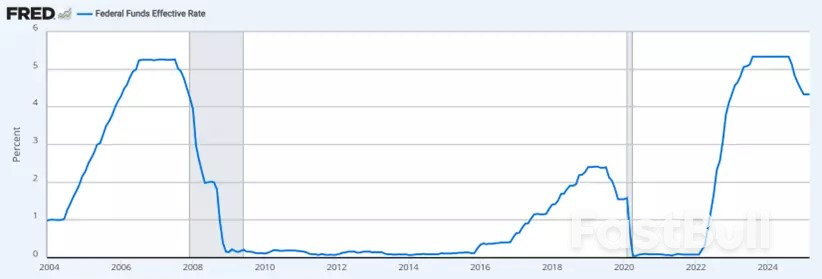

But the president also made it clear that he doesn’t intend to stop calling for the Fed to lower rates. The central bank is not expected to take any action at its meeting Tuesday and Wednesday as it waits for greater clarity about how Trump’s tariffs will affect inflation and the US economy.

Trump told NBC Powell doesn’t want to lower rates "because he’s not a fan of mine. You know, he just doesn’t like me because I think he’s a total stiff."

Trump started the speculation about a possible Powell firing when he said last month on social media that "Powell's termination cannot come fast enough." Less than a week later he told reporters that he had “no intention” of firing Powell.

It apparently was a step that was considered. White House economic adviser Kevin Hassett told reporters last month that Trump and his team were, in fact, studying whether the Fed chair could be removed.

Trump's attacks on Powell ramped up after Powell said in a speech earlier this month that the president's aggressive slate of tariffs would lead to higher inflation and lower growth and that the Fed would likely hold rates steady for now.

Seemingly acknowledging that slower economic growth could be on the horizon, Trump in an April 21 social media post called for "pre-emptive rate cuts" and referred to Powell as a "major loser."

"There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW."

Many other Fed officials beyond Powell have also urged patience and caution before making any rate moves, given the many uncertainties ahead.

'If you don't like to be criticized, don't take the job'

The race to succeed Powell as Federal Reserve chair is starting to play out in the open.

Two men considered by Fed watchers as possible candidates to eventually assume Powell's seat have offered some pointed public views about the central bank, its mission, and its independence in the days and weeks after Trump ramped up his criticisms in mid-April.

The most critical comments came from former Fed governor Kevin Warsh, considered by many to be a frontrunner for the job when Powell's term is up in May 2026.

Futures tied to Canada's main stock index fell on Monday, mirroring Wall Street's losses after U.S. President Donald Trump reignited new tariff concerns, while investors awaited the Federal Reserve's monetary policy decision this week.

June futures on the S&P/TSX index (.SXFcv1), opens new tab were down 0.4% at 6:20 a.m. ET (1020 GMT).

Trump announced on Sunday a 100% tariff on movies produced outside the U.S., saying the American film industry was dying a "very fast death" due to the incentives offered by other countries to lure filmmakers.

Shares of U.S. film and television production firms were down before the bell.

While the U.S. and China's talks provided a brief respite on Friday, after Beijing said it was considering Washington's offer to discuss Trump's 145% tariffs, the uncertainty around the outcome continues to loom over the markets.

Separately, Prime Minister Mark Carney said on Friday he will be in Washington on Tuesday for what he expects to be "difficult but constructive" talks with Trump.

Investors will also focus on the Fed's meeting, where the rates are expected to be kept steady.

Among commodities, gold prices rose more than 1% on Monday, helped by a weaker dollar.

Oil prices dropped more than 2% after OPEC+ decided over the weekend to further speed up oil output hikes, raising concerns about excess supply amid uncertain demand outlook.

The Toronto Stock Exchange on Friday rose to a one-month high, led by gains in industrial shares, as stronger-than-expected U.S. jobs data eased investor concerns about a recession.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up