Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

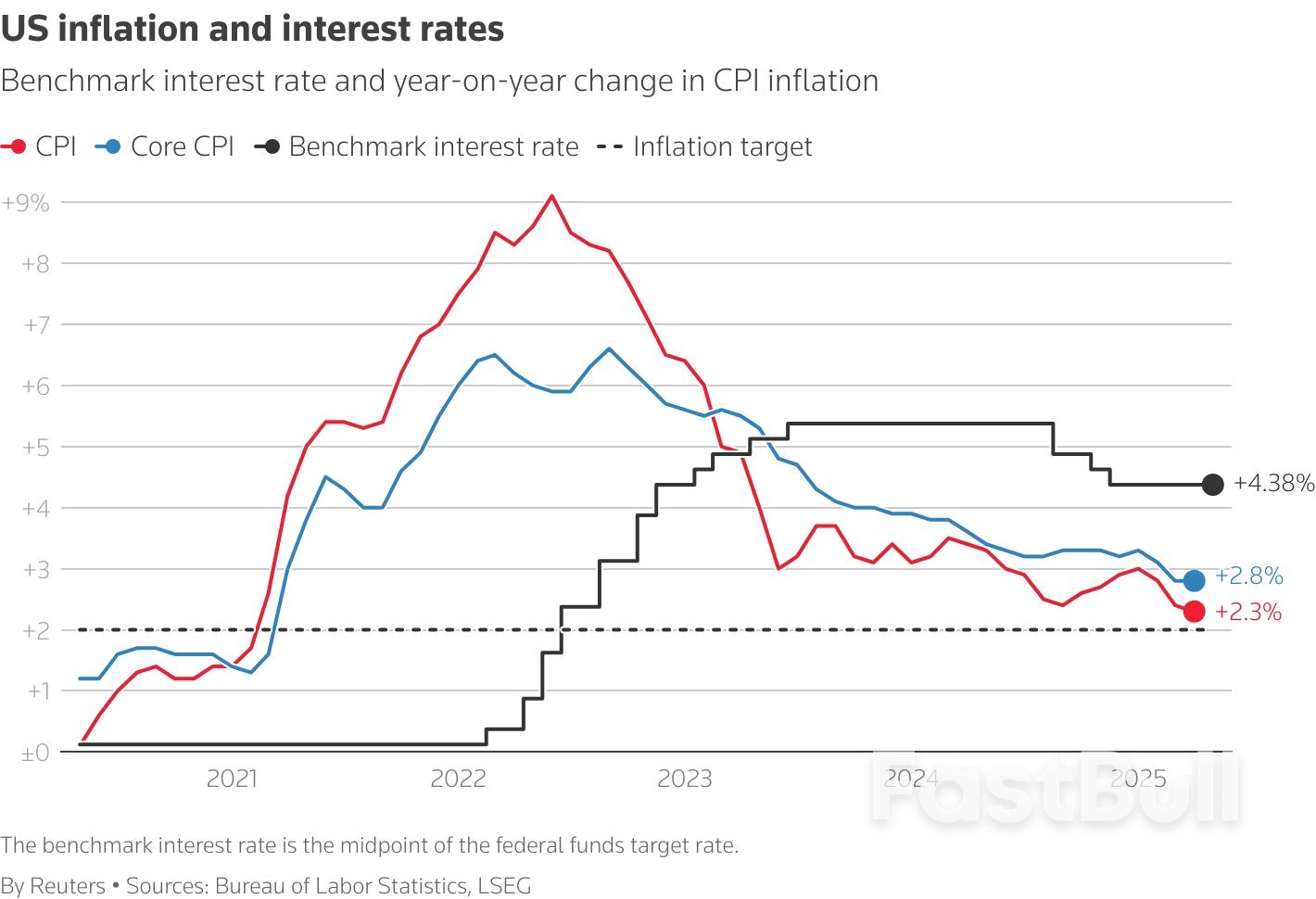

The U.S. trade deficit narrowed sharply in April, with imports decreasing by the most on record as the front-running of goods ahead of tariffs ebbed, which could provide a lift to economic growth this quarter.

The U.S. trade deficit narrowed sharply in April, with imports decreasing by the most on record as the front-running of goods ahead of tariffs ebbed, which could provide a lift to economic growth this quarter.

The trade gap contracted by a record 55.5% to $61.6 billion, the lowest level since September 2023, the Commerce Department's Bureau of Economic Analysis said on Thursday. Data for March was revised to show the trade deficit having widened to an all-time high of $138.3 billion rather than the previously reported $140.5 billion.

Economists polled by Reuters forecast the deficit narrowing to $70.0 billion. The goods trade deficit eased by a record 46.2% to $87.4 billion, the lowest level since October 2023.

A rush to beat import duties helped to widen the trade deficit in the first quarter, which accounted for a large part of the 0.2% annualized rate of decline in gross domestic product last quarter. The contraction in the deficit, at face value, suggests that trade could significantly add to GDP this quarter, but much would depend on the state of inventories.

Imports decreased by a record 16.3% to $351.0 billion in April. Goods imports slumped by a record 19.9% to $277.9 billion. They were held down by a $33.0 billion decline in imports of consumer goods, mostly pharmaceutical preparations from Ireland. Imports of cellphones and other household goods fell $3.5 billion.

Imports of industrial supplies and materials declined $23.3 billion, reflecting decreases in finished metal shapes and other precious metals.

Motor vehicle, parts and engines imports fell $8.3 billion with passenger cars accounting for much of the decline. The front-loading of imports is probably not over. Higher duties for most countries have been postponed until July, while those for Chinese goods have been delayed until mid-August.

President Donald Trump's administration had given U.S. trade partners until Wednesday to make their "best offers" to avoid other punishing import levies from taking effect in early July.

Imports from Canada were the lowest since May 2021, while those from China were the lowest since March 2020. But imports from Vietnam and Taiwan were the highest on record.

Exports rose 3.0% to $289.4 billion, an all-time high. Goods exports increased 3.4% to a record $190.5 billion. They were boosted by a $10.4 billion jump in industrial supplies and materials, mostly finished metal shapes, nonmonetary gold and crude oil.

Capital goods exports advanced $1.0 billion, lifted by computers. But exports of motor vehicles, parts and engines fell $3.3 billion, held down by passenger cars as well as trucks, buses and special purpose vehicles.

Donald Trump picked up the phone and called Xi Jinping on Thursday, and the Chinese president finally answered.

The conversation, reported by Xinhua and confirmed by Beijing’s foreign ministry, was initiated by Trump, who had been pushing for direct talks after weeks of rising trade tension between the US and China.

But details of the chat were not shared.

This was only their second call of the year, the first being on January 17, before Trump returned to the White House. In recent days, Washington has accused Beijing of dragging its feet on following through with trade promises, especially around critical mineral exports.

Those promises came from talks in Switzerland, where both sides had agreed to temporarily lower tariffs. But that deal started falling apart fast. Trump’s administration wasn’t seeing the deliveries it expected, and China wasn’t happy about the new waves of restrictions coming from Washington.

During the call, Trump raised issues over China’s delay in exporting key minerals that were part of the post-Geneva understanding. He also brought up semiconductors, where his administration had just issued fresh export bans and advised US firms to avoid relying on Chinese chips.

The White House claimed the decision was for national security, but Beijing called it punishment disguised as protection. Adding fuel to the fire, China was already frustrated by a new rule tightening visa access for Chinese students, something it viewed as politically motivated.

Officials in Beijing said the US was “undermining recent progress” by targeting young people and education exchanges. Trump didn’t back down. The administration believes these moves are necessary to protect American strategic interests.

The economic impact of all this was already showing. On the day of the call, US stock futures climbed. The Dow went up 89 points, while S&P 500 and Nasdaq-100 futures both gained 0.2%. Investors reacted quickly to any hint that the two countries were at least talking again, even if the problems weren’t solved.

Meanwhile, new numbers showed the US trade deficit had dropped to $61.6 billion in May, its lowest point since September 2023. That’s a $76.7 billion drop from April, and the fastest monthly decline since 1992.

Exports were up $8.3 billion, while imports had collapsed by $68.4 billion, a 16.3% slide. Companies had rushed to bring goods in ahead of Trump’s April 2 “liberation day” tariffs, knowing costs were about to go up.

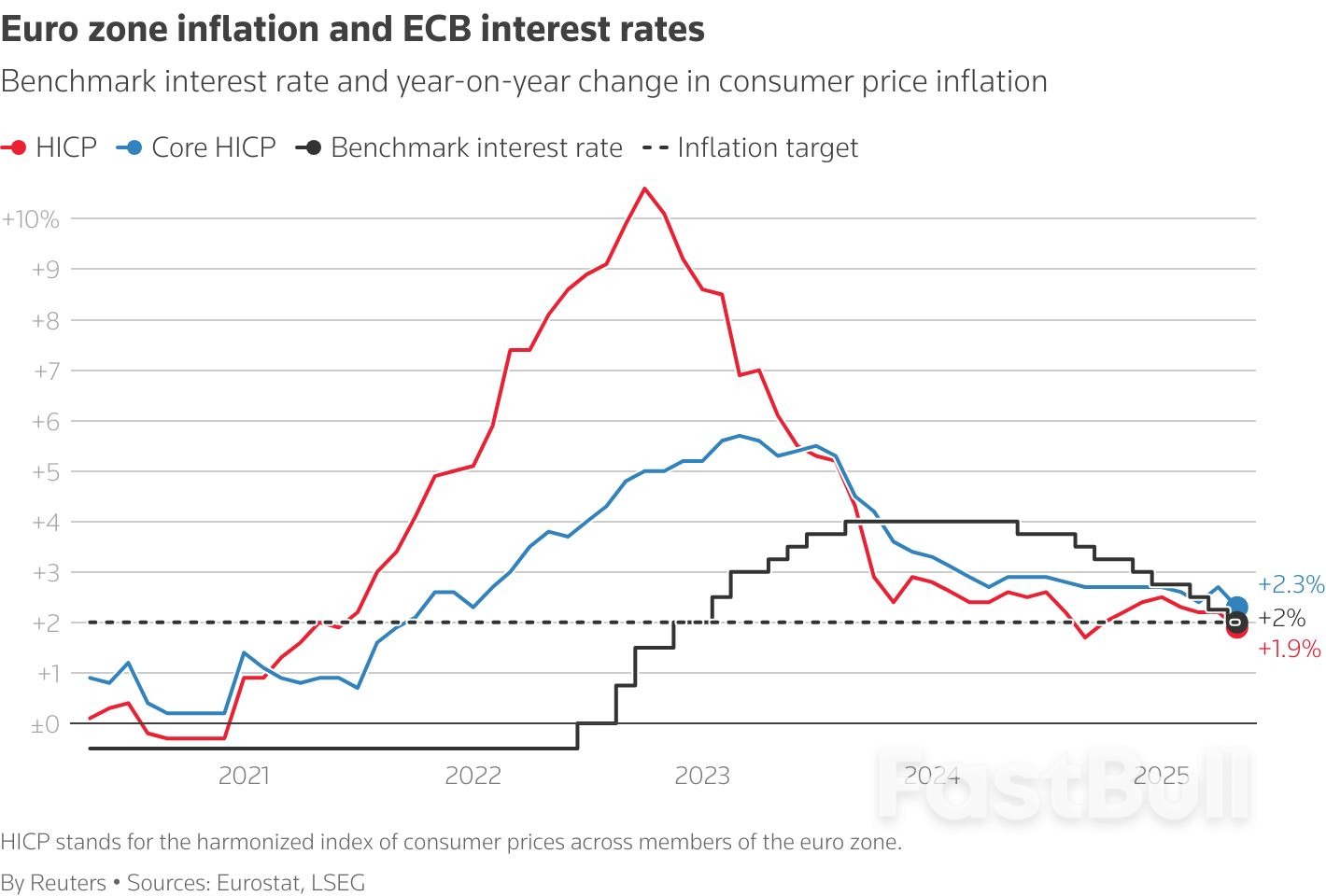

The European Central Bank slashed interest rates at its latest policy meeting on Thursday as expected, bringing its key deposit rate down by 25 basis points to 2.0%, although officials did not provide outright guidance for changes later this year.

In a statement, the ECB said its decision to lower borrowing costs for the eighth time since last June comes as the euro area economy faces waning inflation but persistent uncertainty around the impact of global trade tensions.

Thursday’s cut was widely anticipated by markets, meaning that much of the debate among analysts heading into the announcement swirled around the central bank’s plans for rates over the rest of the year. Particularly with inflation easing back down to the ECB’s 2% target, some investors have bet that policymakers will push pause on the rate-reduction cycle in July and potentially roll out one more drawdown before the end of 2025.

"We forecast one more rate cut in the second half of the year with risks skewed towards deeper cuts," said Jack Allen-Reynolds, Deputy Chief Euro Zone Economist at Capital Economics, in a note following the decision.

Officials did not provide any specific rate guidance in their statement, but ratcheted down their expectations for future price gains. Estimates for headline inflation in 2025 and 2026 were lowered to 2.0% and 1.6%, respectively, a drop of 0.3 percentage points compared to the ECB’s projections in March. Inflation is seen returning to 2.0% in 2027.

Speaking at a press conference, ECB President Christine Lagarde added that the ECB is "not pre-committing to a particular rate path".

Consumer price inflation in the 20 countries using the euro eased to 1.9% in May, thanks to sliding energy prices and declining services costs. In the prior month, the figure came in at 2.2%. So-called "core" inflation, which strips out volatile items like food and fuel, decelerated to 2.3% from 2.7%, data from Eurostat, the European Union’s statistics agency, found.

The ECB also left its growth projections for 2025 unchanged, anticipating average gross domestic product expansion of 0.9%. While the first quarter was stronger than expected, the central bank flagged that the euro zone’s prospects for the remainder of the year are "weaker".

Murkiness is also surrounding the impact of U.S. President Donald Trump’s tariff plans. The White House has especially targeted the European Union -- which includes several euro zone countries -- with elevated so-called "reciprocal" levies. The ECB warned that the uncertainty may weigh on business investment and exports in the short term, although medium-term growth is tipped to be bolstered by increased government spending on defense and infrastructure.

"Inflationary pressures in the euro zone are receding faster than expected. Not only did [...] Trump make the European economy great again -- for one quarter, as frontloading of exports and industrial production boosted economic activity -- he also made inflation almost disappear," said Carsten Brzeski, Global Head of Macro at ING, in a note.

Trump referenced the ECB’s rate-cutting campaign earlier this week in a social media post urging Federal Reserve Chair Jerome Powell to bring borrowing costs down at a faster pace. The Fed drew down rates by one percentage point in 2024, but has left them unchanged since December, noting that the tariff turmoil could place renewed upward pressure on inflation in the U.S.

Canada's trade deficit in April widened to an all-time high of a whopping C$7.1 billion ($5.2 billion), data showed on Thursday, as tariffs imposed by President Donald Trump sucked out demand for Canadian goods from the United States.

Its exports to the rest of the world rose, but could not compensate for the drop in exports to the U.S., data from Statistics Canada showed.Exports to the U.S. shrank by 15.7%, a third consecutive monthly decline, Statscan said, adding that exports south of the border have fallen by over 26% since the peak seen in January.Analysts polled by Reuters had expected the trade deficit to widen to C$1.5 billion for April. Statistics Canada also made a big revision to the trade deficit recorded in March to C$2.3 billion from C$506 million.

Canada shipped 76% of its total exports to the U.S. last year and the trade between the two countries exceeded a trillion Canadian dollars for a third consecutive year in 2024.

But a barrage of tariffs from Trump on Canada and its C$90 billion worth of retaliatory tariffs on U.S. imports have started disrupting trade between the two.

Total exports in April plunged by 10.8% to C$60.4 billion, the lowest level seen in almost two years, Statscan said. This was the third consecutive monthly decline and the strongest percentage decrease in five years, it said.While exports to the U.S. led the drop, lower crude oil prices and a stronger Canadian dollar also contributed.

The Canadian dollar was trading up 0.17% to 1.3651 to the U.S. dollar, or 73.25 U.S. cents. Yields on the two-year government bonds were down 0.4 basis points to 2.613%.

Exports to the rest of the world were up 2.9% and in volume terms total exports registered a big decline of 9.1% in April.

The biggest drop in exports came from motor vehicles and parts which lost 17.4% of trade in April from March and was almost entirely attributable to exports of passenger cars and light trucks, which fell 22.9% in April, Statscan said.

Imports were down 3.5% in April to C$67.58 billion, but were partly offset by imports of unwrought gold.

Due to the sharp decline in exports to the U.S., Canada's merchandise trade surplus with the United States narrowed to C$3.6 billion, the smallest surplus since December 2020, the statistics agency said.

The deficit with rest of the world marginally increased to C$10.7 billion in April from C$9 billion in March.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up