Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Economic data points from the United States often send ripples across global markets, and this week is no different. The latest report on the US PPI, or Producer Price Index, just dropped, and it’s stirring up some discussion about the state of inflation and what it could mean for assets like cryptocurrencies.

Economic data points from the United States often send ripples across global markets, and this week is no different. The latest report on the US PPI, or Producer Price Index, just dropped, and it’s stirring up some discussion about the state of inflation and what it could mean for assets like cryptocurrencies.

The U.S. Department of Labor recently released the figures for the Producer Price Index for May. Here’s a quick breakdown of the key numbers:

This print, particularly the softer month-over-month figure, provides a slightly different perspective on inflationary pressures compared to some recent data releases. It suggests that the prices producers are receiving for their goods and services aren’t accelerating as quickly as some anticipated.

So, what exactly is the Producer Price Index? Think of it as a measure of inflation from the perspective of the sellers or producers in the economy. It tracks the average changes in selling prices received by domestic producers for their output.

Why is this important? Because changes in producer prices often serve as an early indicator of potential changes in consumer prices. If producers are paying more for raw materials or receiving higher prices for their goods, those costs can eventually be passed on to consumers, showing up later in the Consumer Price Index (CPI). The PPI is often seen as a leading or coincident indicator for the CPI, though the relationship isn’t always perfectly direct or immediate.

Tracking the PPI helps economists and policymakers gauge inflationary trends earlier in the supply chain.

The Federal Reserve, the central bank of the United States, has a dual mandate: to maximize employment and maintain stable prices (control inflation). Economic data like the PPI is crucial for the Fed’s decision-making process regarding monetary policy, specifically interest rates.

When inflation data comes in lower than expected, it can provide the Fed with more flexibility. It suggests that the economy might be cooling down, and the urgency to keep interest rates high to combat inflation could lessen. Conversely, hotter-than-expected inflation data puts pressure on the Fed to maintain or even increase rates.

While the Fed pays closer attention to the Personal Consumption Expenditures (PCE) price index as its preferred inflation gauge, the PPI and CPI are also significant inputs into their assessment of the overall inflationary environment. A series of softer inflation prints across different measures could pave the way for potential interest rate cuts in the future.

The May PPI report, showing a slightly weaker month-over-month increase than anticipated, could be interpreted by markets as a sign that inflationary pressures might be easing. This narrative, if sustained by future data, could support the argument for the Federal Reserve potentially cutting interest rates sooner rather than later. While one data point isn’t a trend, it adds to the overall picture the market is building.

While the May PPI data provides a piece of the puzzle, markets are always looking ahead to the next major releases. The Consumer Price Index (CPI) is often considered more impactful for direct market reaction, and the May CPI data is also highly anticipated. The CPI report will give us insight into inflation from the consumer’s perspective, which is a critical component the Fed evaluates.

Beyond inflation data, market participants will also be closely watching employment figures, retail sales, and manufacturing data to get a comprehensive view of the U.S. economy’s health. The collective picture painted by these economic indicators will heavily influence market sentiment and expectations regarding the Federal Reserve’s future actions.

The U.S. May PPI report came in slightly below market expectations on a month-over-month basis, while the year-over-year figure remained stable and in line with forecasts. This data point suggests that inflationary pressures at the producer level might be moderating, which is a piece of potentially good news for those hoping for future interest rate cuts from the Federal Reserve. While not a definitive game-changer on its own, this Inflation Data contributes to the ongoing narrative that could influence the Fed’s path and, consequently, the performance of the Crypto Market and other risk assets. As always, staying informed about key economic releases is vital for understanding the broader market context.

U.S. President Donald Trump said on Thursday an Israeli strike on Iran "could very well happen," and a senior Israeli official told the Wall Street Journal it could occur as soon as Sunday unless Iran agrees to halt production of material for an atomic bomb.

U.S. intelligence has indicated that Israel has been making preparations for a strike against Iran's nuclear facilities, and U.S. officials have said on condition of anonymity that Israel could attack in the coming days.

The Wall Street Journal report was the first suggestion of a potential date for an Israeli strike on its longtime foe Iran as Israel tries to block Tehran from developing a nuclear weapon.

Trump on Thursday reiterated his hopes for a peaceful end to the tensions, and there was counter-speculation that the threat of an Israeli attack was a tactic intended to pressure Iran into concessions on its nuclear program at the negotiating table.

"We remain committed to a Diplomatic Resolution to the Iran Nuclear Issue!" Trump wrote on his Truth Social platform.

"My entire Administration has been directed to negotiate with Iran. They could be a Great Country, but they first must completely give up hopes of obtaining a Nuclear Weapon," he added.

Tensions have been building as Trump's efforts to reach a nuclear deal with Iran appear to be deadlocked.

U.S. and Iranian officials were scheduled to hold a sixth round of talks on Tehran's escalating uranium enrichment programme in Oman on Sunday, according to officials from both countries and their Omani mediators.

Speculation about an Israeli attack has raised fears that such a move could spark a regional war and retaliatory strikes from Iran, which has vowed to destroy Israel.

Axios reported on Thursday that the White House has told Israel the U.S. will not be directly involved in any Israeli strike on Iranian nuclear facilities, quoting two U.S. sources and an Israeli source familiar with the discussions.

Analysts have said Israel is unlikely to act without U.S. support, citing past threats on Iran that fizzled out without Washington's backing.

The Wall Street Journal said the U.S. would not provide "offensive assistance" to Israel for an attack on Iran.

While the U.S. could still aid Israel with intelligence or logistics support as well as help defend Israel if Iran strikes back, it was unclear how the reported U.S. unwillingness to participate directly might influence Israeli decision making.

Axios said a solo Israeli operation would be more limited because its air force does not have bombers that can carry the bunker buster bombs needed to hit Iran's Fordow underground uranium enrichment facility.

The U.N. nuclear watchdog's board of governors on Thursday declared Iran in breach of its non-proliferation obligations, and Tehran announced counter-measures. A senior Iranian official said a "friendly country" had warned it of a potential Israeli attack.

Security concerns have risen since Trump said on Wednesday that U.S. personnel were being moved out of the region because "it could be a dangerous place" and that Tehran would not be allowed to develop a nuclear weapon.

Israeli Prime Minister Benjamin Netanyahu raised the possibility of strikes in a phone conversation with Trump on Monday, the Journal reported, citing two U.S. officials.

"I don't want to say imminent, but it looks like it's something that could very well happen," Trump told reporters at a White House event earlier on Thursday, adding Iran could not be allowed to develop a nuclear weapon.

"I'd love to avoid the conflict," he said. "Iran's going to have to negotiate a little bit tougher, meaning they're going to have to give us something they're not willing to give us right now."

Security in the Middle East has already been destabilised by spillover effects of the Gaza war between Israel and Palestinian militant group Hamas.

Trump has threatened to bomb Iran if the nuclear talks do not yield a deal and said he has become less confident Tehran will agree to stop enriching uranium. The Islamic Republic wants a lifting of U.S. sanctions imposed on it since 2018.

Trump on Thursday also expressed frustration that oil prices had risen amid supply concerns arising from potential conflict in the Middle East.

With Washington offering little explanation for its security concerns, some foreign diplomats suggested that the evacuation of personnel and U.S. officials anonymously raising the spectre of an Israeli attack could be a ploy to ratchet up pressure on Tehran for concessions at the negotiating table.

A senior Iranian official told Reuters on Thursday the latest tensions were intended to "influence Tehran to change its position about its nuclear rights" during the Sunday talks.

Iranian President Masoud Pezeshkian said that even if the country's nuclear facilities were destroyed by bombs they would be rebuilt, state media reported on Thursday.

The International Atomic Energy Agency's Board of Governors declared Iran in breach of its non-proliferation obligations for the first time in almost 20 years, raising the prospect of reporting it to the U.N. Security Council.

The step is the culmination of a series of stand-offs between the IAEA and Iran since Trump pulled the U.S. out of a nuclear deal between Tehran and major powers in 2018 during his first term, after which that accord unravelled.

An IAEA official said Iran had responded to the 35-nation board's declaration by informing the U.N. watchdog that it plans to open a third uranium enrichment plant.

Enrichment can be used to produce uranium for reactor fuel or, at higher levels of refinement, for atomic bombs. Iran says its nuclear energy programme is only for peaceful purposes.

Additional reporting by Yousef Saba and Dubai newsroom, Marc Jones in London, GV De Clercq in Rome, Jeff Mason, Jarrett Renshaw, Humeyra Pamuk, Gram Slattery and Idrees Ali in Washington, Alexander Cornwell in Jerusalem; writing by Timothy Heritage, Michael Georgy, Matt Spetalnick and Deepa Babington; editing by Mark Heinrich, Deepa Babington and Cynthia Osterman

Key Points:

Donald Trump publicly criticized Federal Reserve Chair Jerome Powell on June 12, 2025, calling him a “numbskull” over current interest rates in a public appearance.

Trump's remarks led to a decline in Bitcoin's price, highlighting the impact of political discourse on cryptocurrency volatility.

Trump referred to Powell during a public interview, insisting a rate cut is crucial. His criticism centers around the economic implications of current policies, emphasizing the need for changes in monetary direction.

The immediate aftermath saw Bitcoin prices dip, underscoring the influence of U.S. political rhetoric on market sentiment. Other sectors did not show significant fluctuations.

"We're going to spend $600 billion a year because of one numbskull," Trump said, illustrating his frustration with current economic leadership.

Concerns about U.S. fiscal policies and their macroeconomic effects often ripple through financial markets. Cryptocurrency, particularly Bitcoin, is sensitive to such high-profile comments, affecting investor behavior.

Looking ahead, potential policy shifts or regulatory responses could reshape market dynamics. Historical trends show such events typically provoke a short-term market response, especially among digital assets, raising questions about longer-term implications.

Israel launched airstrikes on Iran, in a major escalation in the standoff over Tehran’s atomic program that risks sparking a new war in the Middle East.

Most Read from Bloomberg

● Shuttered NY College Has Alumni Fighting Over Its Future

● Trump’s Military Parade Has Washington Bracing for Tanks and Weaponry

● NYC Renters Brace for Price Hikes After Broker-Fee Ban

● Do World’s Fairs Still Matter?

● NY Long Island Rail Service Resumes After Grand Central Fire

Explosions were heard in Tehran, according to local media. Iran had previously vowed to respond to any attack.

Israeli Defense Minister Israel Katz said in a statement he’s declaring a special state of emergency due to Israel’s “preemptive strike against Iran.” Israel is anticipating a retaliatory drone and missile attack, Katz said in a statement.

The attack came amid renewed questions about diplomatic efforts to resolve tensions over Iran’s atomic work. US and Iranian negotiators are scheduled to hold a sixth round of talks in Oman on Sunday, but President Donald Trump said this week he’s less confident about the chances of a deal.

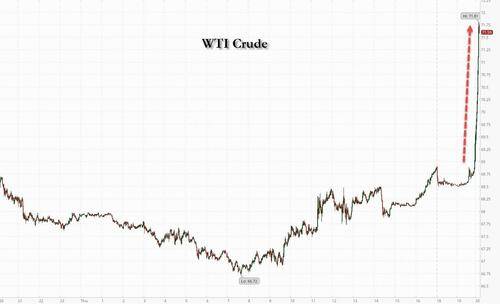

Oil surged following reports of the strike. Brent rose as much as 5.7%, jumping above $73 a barrel, while West Texas Intermediate also rallied.

Israel is already involved in a major military operation in Gaza where it’s been bombarding and blockading the civilian population for the past 20 months as it tries to destroy Hamas following the group’s deadly attack on the Jewish state on Oct. 7, 2023.

Most Read from Bloomberg Businessweek

● American Mid: Hampton Inn’s Good-Enough Formula for World Domination

● New Grads Join Worst Entry-Level Job Market in Years

● The Spying Scandal Rocking the World of HR Software

● US Tariffs Threaten to Derail Vietnam’s Historic Industrial Boom

● As Companies Abandon Climate Pledges, Is There a Silver Lining?

Futures and yields are tumbling, and gold and oil are surging following reports of successive explosions in Iran as a result of what Al Arabiya and Axios report are Israeli airstrikes.

Separately Axios reports that the Israeli Air Force conducted a strike in Iran, citing two unidentified people with knowledge of the operation. It was not immediately clear who Israel is targeting.

In kneejerk response, stock futures are tumbling...

... as are bond yields...

... while Oil (where we recently warned that the record shorts will be badly burned)...

... and gold are soaring.

The Trump administration is developing a plan to use Cold War-era powers to prioritize and fund rare earth projects it deems critical to national security, people familiar with the matter said.

Officials are discussing using the Defense Production Act to tap financing, loans and other means for rare earths element-related projects, including mining, processing and other downstream technologies to bolster the US’s capability to build a domestic supply chain, the people said. A specific course of action or a timeline have yet to be finalized, the people said.

MP Materials Corp., the sole domestic producer of rare earths, would be a prime beneficiary. Deputy Defense Secretary Steve Feinberg is working to line up funding for the company, people familiar with that matter said. The Nevada-based mineral processor has received millions in funding from the Defense Department.

A spokesman for MP Materials declined to comment. Representatives for the White House and the Pentagon didn’t immediately respond to requests for comment.

Defense Secretary Pete Hegseth in a congressional hearing this week said that MP Materials “is a great example of a place where we can partner with industry” and that Feinberg is focused on sourcing rare earths supply.

The US currently lacks the so-called mine-to-magnet capability at scale, and invoking the emergency authority will give the Defense Department and other agencies tools to speed up sourcing that severely lags China’s dominance in the industry. The urgency has only increased since Beijing flexed its rare earths capacity as leverage in trade talks with Washington over the past month.

Beijing’s decision to block exports of rare earths focused Trump administration attention on China’s dominance in processing the materials used in semiconductors, jet engines and other technology, and it’s stoked a surge of interest in rapidly developing US supply chains.

An existing US stockpile is “massively insufficient” Burgum said, adding that billions of dollars could be needed to build a bigger mineral reserve.

The latest discussions come more than two months after President Donald Trump signed an executive order to boost production of critical minerals that encouraged faster permitting for mining and processing projects.

While that order encompassed rare earths, one of the people familiar with the matter said issuing a new directive is essentially a chance for Trump to publicly message that he’s countering Beijing on a US vulnerability that’s inflamed trade tensions between the world’s largest economies.

At the National Energy Dominance Council, David Copley is leading work on the rare-earths issue and has been tasked with coordinating most efforts related to critical minerals, people familiar with the matter said.

Copley, a former executive with the mining company Newmont Corp., has been receiving proposals for how the US can quickly build out its own critical minerals supply chains and lists of potential shovel-ready projects the government can quickly invest in through DPA and other funding avenues.

Copley’s role has taken on new prominence as a result of Elon Musk’s efforts to downsize the federal bureaucracy that have led to a wave of buyouts, resignations and retirements at key federal offices working on supply chain issues.

The Trump administration revived Biden-era efforts to create a domestic supply chain for rare-earth magnets after China in April clamped down on exports of the materials, Bloomberg News reported last week.

As part of the effort, officials solicited proposals to bolster domestic supplies of the magnets within the next six to 12 months.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up