Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. stock futures fell amid renewed trade tensions and mixed earnings. Dow Jones shows bearish signals, while investors await economic data and Fed commentary for further market direction.

The EUR/USD currency pair continues to move within the development of a bearish correction and a bullish channel. The moving averages indicate the presence of a short-term upward trend for the pair. Prices have broken through the area between the signal lines upwards, which indicates pressure from buyers of the European currency and a potential continuation of the growth of the currency pair quotes from the current levels. At the time of publication of the forecast, the Euro to Dollar exchange rate for today is 1.1383. As part of the Forex forecast for April 25, 2025, we should expect an attempt to develop a bearish price correction and a test of the support level, which is located on the EUR/USD pair near the 1.1345 area. Next, an upward price rebound and continued growth of the Euro Dollar currency pair. The potential target of such a movement on FOREX is the area above the 1.1745 level.

An additional signal in favor of the development of a bullish scenario on the EUR/USD currency pair tomorrow will be a rebound from the ascending trend line on the RSI indicator. The second signal in favor of this option will be a rebound from the lower border of the bullish channel. The cancellation of the growth option for the Euro Dollar currency pair tomorrow will be a fall and a breakout of the 1.1145 level. This will indicate a breakout of the support area and a continuation of the fall to the area at the level of 1.1065. Confirmation of the rise in the EUR/USD currency pair should be expected with a breakout of the resistance area at the level of 1.1565.

EUR/USD Forecast Euro Dollar for April 25, 2025 suggests an attempt to develop a bearish correction of the pair and a test of the support area near the level of 1.1345. Where should we consider the upward rebound in the price of the Euro Dollar currency pair and an attempt to continue the growth of the asset on the market to the area above the level of 1.1745. An additional signal in favor of the instrument’s rise on the Forex market will be a test of the support line on the relative strength indicator (RSI). The cancellation of the growth option for the EUR/USD pair will be a drop in quotes and a breakout of the 1.1145 level. This will indicate a breakout of the support area and a continuation of the fall of the currency pair on Forex to the area below the 1.1065 level.

The head of the International Monetary Fund urged countries to move “swiftly’’ to resolve trade disputes that threaten global economic growth.

IMF managing director Kristalina Georgieva said the unpredictability arising from President Donald Trump’s aggressive campaign of taxes on foreign imports is causing companies to delay investments and consumers to hold off on spending.

“Uncertainty is bad for business,’’ she told reporters Thursday in a briefing during the spring meetings of the IMF and its sister agency, the World Bank.

Georgieva’s comments came two days after the IMF downgraded the outlook for world economic growth this year. The 191-country lending organization, which seeks to promote global growth, financial stability and to reduce poverty, also sharply lowered its forecast for the United States. It said the chances that the world’s biggest economy would fall into recession have risen from 25%, to about 40%.

Georgieva warned that the economic fallout from trade conflict would fall most heavily on poor countries, which do not have the money to offset the damage.

Since returning the White House in January, Trump has aggressively imposed tariffs on American trading partners. Among other things, he’s slapped 145% import taxes on China and 10% on almost every country in the world, raising U.S. tariffs to levels not seen in more than a century. But he has repeatedly changed U.S. policy — suddenly suspending or altering the tariffs — and left companies bewildered about what he is trying to accomplish and what his end game might be.

Trump’s tariffs — a sharp reversal of decades of U.S. policy in favor of free trade — and the resulting uncertainty around them have caused a weekslong rout in financial markets. But stocks rallied Wednesday after the Trump administration signaled that it is open to reducing the massive tariffs on China. “There is an opportunity for a big deal here,” U.S. Treasury Secretary Scott Bessent said Wednesday.

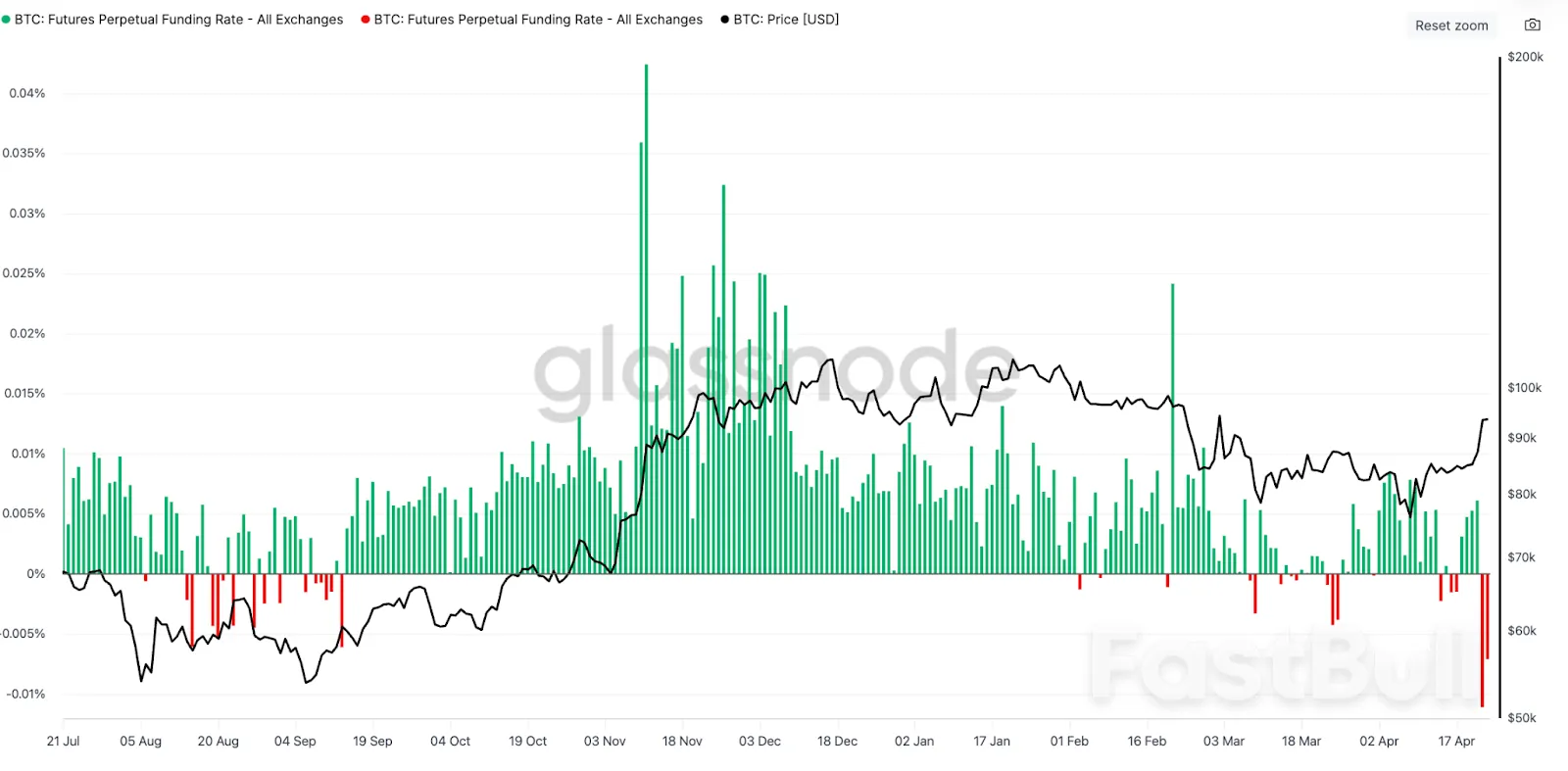

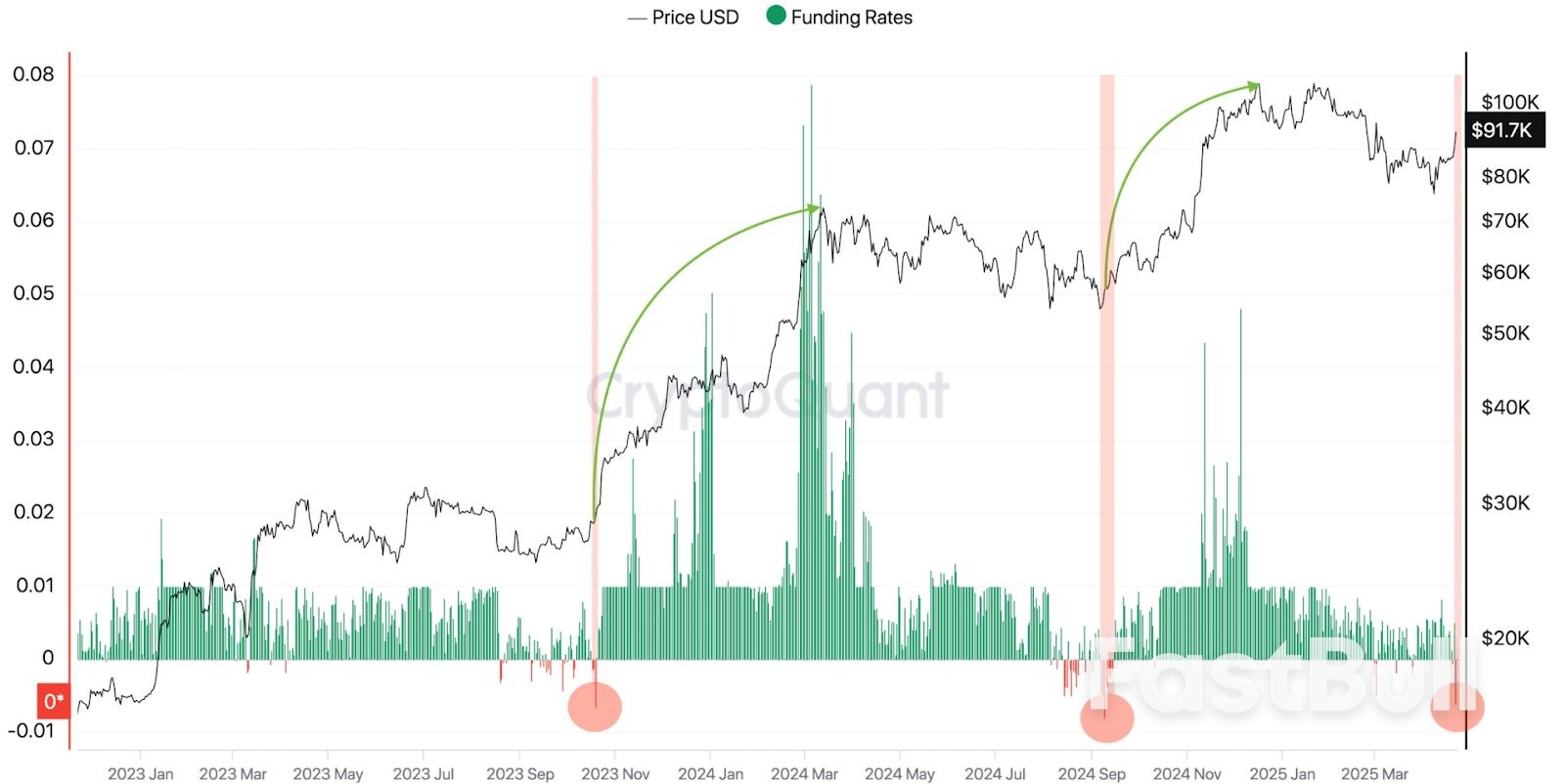

BTC/USD chart. Source: Swissblock

BTC/USD chart. Source: Swissblock Source: AlphBTC

Source: AlphBTC

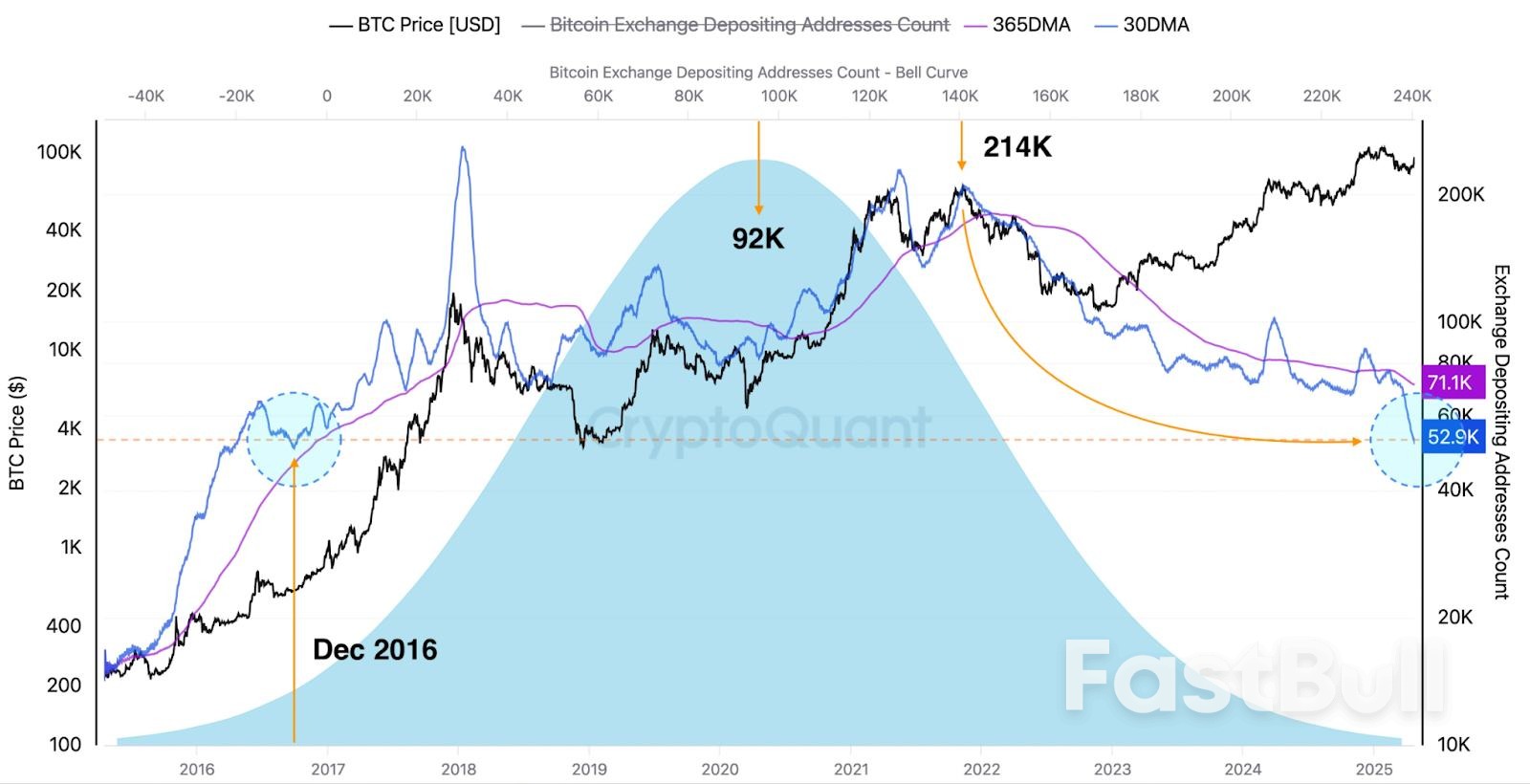

Bitcoin exchange depositing address count. Source: CryptoQuant

Bitcoin exchange depositing address count. Source: CryptoQuant

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up