Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US President Donald Trump formally cut a fentanyl-related tariff on imports from China to 10%, delivering on a key element of the sweeping trade deal struck with Chinese leader Xi Jinping.

US President Donald Trump formally cut a fentanyl-related tariff on imports from China to 10%, delivering on a key element of the sweeping trade deal struck with Chinese leader Xi Jinping.

The move, which lowers the levy from the current 20% rate, will be effective on Nov. 10, according to an executive order issued Tuesday.

"The PRC has committed to take significant measures to end the flow of fentanyl to the United States, including stopping the shipment of certain designated chemicals to North America and strictly controlling exports of certain other chemicals to all destinations in the world," Trump said in the order.

Trump imposed the fentanyl tariff to pressure Beijing to do more to crack down on trafficking of the deadly drug and the precursor chemicals used to make it, but agreed to lower the rate following an October summit with Xi in South Korea, citing progress with China's efforts.

Trump said the State Department and Department of Homeland Security would continue to monitor China's implementation of the agreement.

"Should the PRC fail to implement its commitments as described in section 1 of this order, I may modify this order as necessary," Trump said.

The reduced rate marks a significant concession to China and is part of a broader pact between Trump and Xi that will ease trade restrictions following months of spiraling tariff announcements and export curbs between the world's two largest economies.

That agreement — intended to last for one year — stabilized what was a turbulent relationship between Washington and Beijing that had them escalating threats in a bid for leverage ahead of the summit. The Trump-Xi deal, however, falls short of any enduring pact, setting the stage for further turbulence ahead of renegotiations in a year and potential disagreements over enforcement sooner.

In addition to reducing the fentanyl rate to 10%, the truce is also expected to extend the suspension, for one year, of a separate 24% levy. But the full tariff picture remains murky; several goods are excluded from the baseline levy and other products face preexisting tariffs.

The deal eases what had been a comparative disadvantage for China over some peers. Trump's tariff rate on China — long considered America's biggest trading foe and a major geopolitical rival — is now nearly the same as the levies applied on several Southeast Asian countries.

Trump, speaking to reporters shortly after the Xi meeting, said the Chinese leader pledged that "he was going to work very hard to stop the flow" of fentanyl. Trump has said he would cut all fentanyl-related tariffs if Beijing cracks down, signaling a possible concession in future talks.

Still, Treasury Secretary Scott Bessent has warned that the fentanyl-related tariff reduction may be reviewed sooner than the one-year timeframe of the overall deal.

"We're going to set up a very strict quantitative criteria and we'll revisit it in six or 12 months to see whether they've accomplished it. And my sense is the tariffs could go up or down," Bessent told Fox News Sunday on Nov. 2.

Trump said he expects to visit China in the first half of next year, and to host Xi in the US after that trip. Those meetings will serve as crucial markers for the status of the truce. The deal also rests under a cloud of legal uncertainty with the US Supreme Court weighing the constitutionality of Trump's use of emergency powers to enact country-by-country levies.

U.S. stock futures inched lower on Tuesday evening after Wall Street suffered broad losses, as top bank executives warned of a looming market correction and investors grappled with deepening uncertainty around Federal Reserve policy.

S&P 500 Futures inched 0.2% lower to 6,789.0 points, while Nasdaq 100 Futures fell 0.4% to 25,487.0 points by 19:28 ET (00:28 GMT). Dow Jones Futures edged up 0.1% to 47,252.0 points.

In Tuesday's regular session, the S&P 500 slipped 1.2%, and the NASDAQ Composite dropped over 2%, while the Dow Jones Industrial Average fell 0.5%.

The slide came after Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) chiefs sounded alarm bells over overheated valuations and speculative trading in technology shares.

Morgan Stanley CEO Ted Pick said markets could face a drawdown of 10 %–15 %, adding that such a pullback would be a healthy normalization after months of exuberance driven by artificial-intelligence optimism.

Goldman Sachs CEO David Solomon echoed those concerns, warning that the surge in mega-cap tech stocks had created "bubble-like dynamics" that were unsustainable without stronger earnings support.

Their remarks stoked investor anxiety that Wall Street's rally, powered by the "Magnificent Seven" tech giants, may be approaching a breaking point. Several of those companies have seen market capitalizations soar to record highs this year, fueling fears of excessive concentration risk.

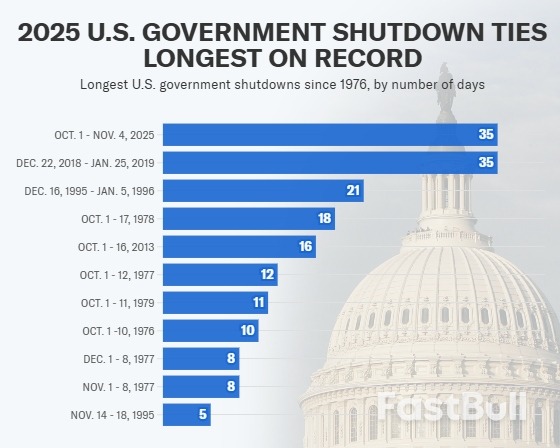

The warnings came as investors also faced growing uncertainty about the Fed's next policy steps. A prolonged government shutdown has left key economic data releases unavailable, depriving policymakers and traders of crucial signals about the state of the economy.

Fed officials on Monday added to the confusion. Some policymakers suggested that the central bank could consider another cut in December if inflation continues to cool, while others argued that strong job growth and resilient demand meant policy should stay restrictive for longer.

In extended trading, several tech names slumped following quarterly results. Advanced Micro Devices (AMD) (NASDAQ:AMD) dropped over 3% despite topping profit estimates, as Amazon said that it dissolved its stake in the chipmaker.

Pinterest (NYSE:PINS) tumbled roughly 20% after its quarterly revenue guidance fell short of expectations, stoking worries about a slowdown in digital advertising.

Super Micro Computer (NASDAQ:SMCI) slid 9% after issuing bleak guidance, with analysts flagging near-term delivery delays in its AI server business.

Oil fell for a second day after an industry report indicated the biggest increase in US inventories in more than three months.

West Texas Intermediate held above $60, while Brent settled at more than $64 on Tuesday. US crude inventories rose 6.5 million barrels last week, according to a document from the American Petroleum Institute seen by Bloomberg. That would be the biggest jump since July 25 if confirmed by official data later Wednesday.

Oil declined Tuesday after a global equities rally hit a speed bump and the greenback climbed to the highest in more than five months, weighing on crude and other dollar-denominated commodities. WTI has fallen 16% this year as increased production from OPEC+ and non-member nations amplified concerns over a forming glut, although prices have rebounded somewhat after the US last month announced sanctions on Rosneft PJSC and Lukoil PJSC, Russia's two biggest producers.

US President Donald Trump said he met with representatives from Switzerland and announced additional trade talks, as the European nation seeks to reduce a tariff rate that ranks higher than any other developed nation.

"It was my Great Honor to just meet with high level Representatives of Switzerland," Trump said Tuesday in a social media post. "We discussed many subjects including, and most importantly, Trade and Trade Imbalance. The meeting was adjourned with the understanding that our Trade Representative, Jamieson Greer, will discuss the subjects further with Switzerland's Leaders."

Trump has imposed a 39% tariff on goods from Switzerland, threatening to drive up costs for chocolatiers including Lindt and watchmakers, including Swatch Group and Rolex SA. Pharmaceuticals accounted for almost half of Swiss exports to the US in 2024, according to data compiled by Bloomberg Economics.

The US earlier this year scrapped plans to impose tariffs on gold bars from Switzerland after the plan shocked global markets and threatened to disrupt supplies.

Switzerland has recently proposed moving some business from Swiss gold refiners to the US as part of a bid to broker a broader trade deal.

The presidential meeting comes as Helene Budliger Artieda, Switzerland's top trade diplomat, has made repeated trips to Washington in recent weeks as Bern attempts to negotiate a lower rate. The White House did not immediately respond to a request for comment on who Trump met with.

Swiss President Karin Keller-Sutter declined to give a timeline for negotiations when asked about the progress late last month.

"In the end the US president decides," she said. "So maybe it just needs some more patience."

Despite the tariff rate, indications are that demand for Swiss goods has, in some cases, withstood the impact of the tariffs. Foreign sales to the US excluding gold, adjusted for seasonal swings, were 43% higher in September than in August, the country's customs office said last month.

Still, Bern has cut its growth forecast for next year based on the expected impact of Trump's tariffs on the economy. Foreign sales of Swiss watches fell in September, driven by a 55% plunge in exports to the US.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up