Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

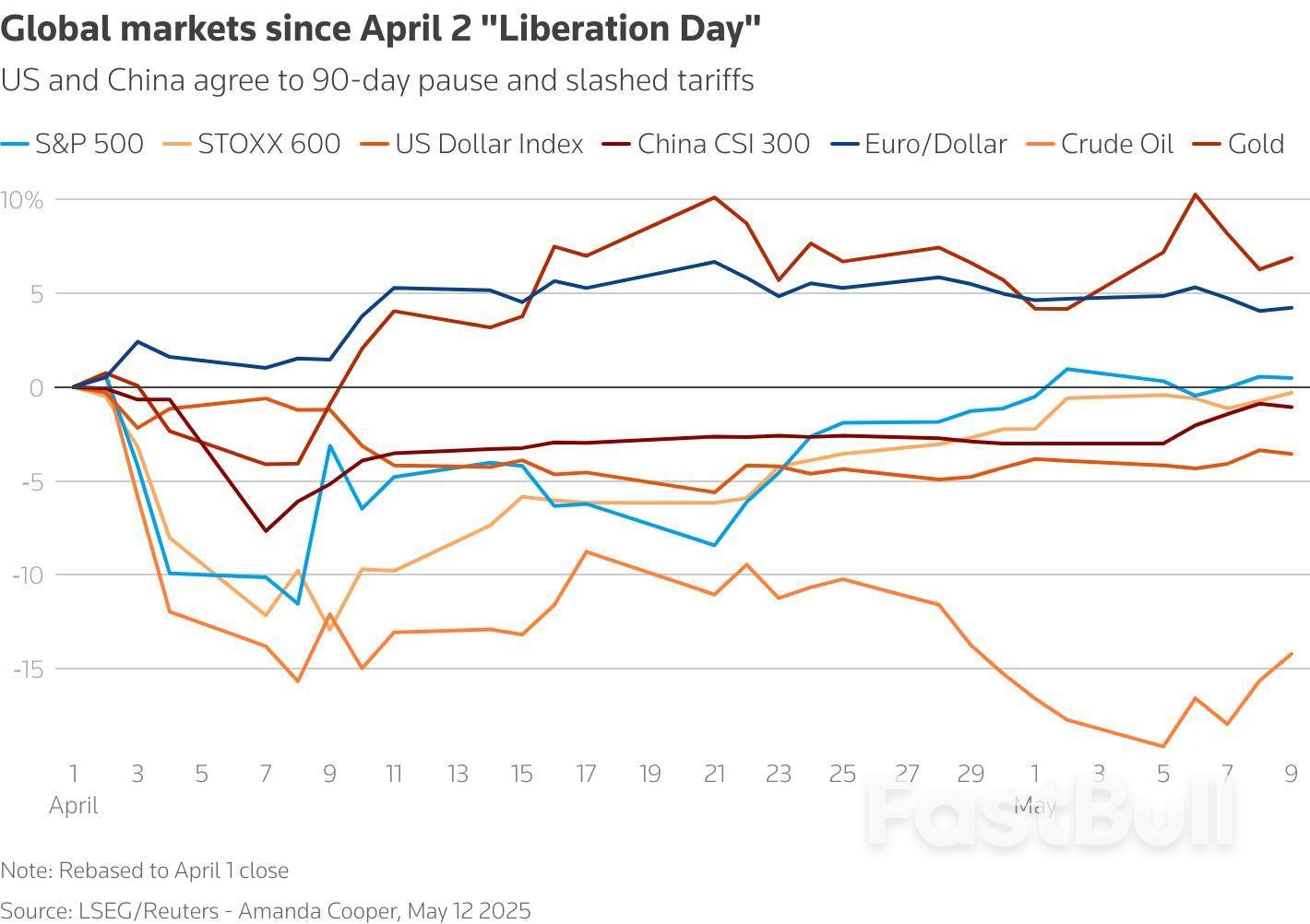

The U.S. dollar rallied after a 90-day U.S.-China tariff truce boosted global sentiment, driving Treasury yields higher and strengthening the dollar index, with markets now eyeing key inflation data.

Daily US Dollar Index (DXY)

Daily US Dollar Index (DXY)A breakthrough in U.S.-China trade talks has propelled world stocks and the dollar higher, but investors fear further negotiations could prove a long slog, tempering optimism, as risks of a global economic slowdown persist.

Speaking after two days of talks with Chinese officials in Geneva, U.S. Treasury Secretary Scott Bessent said on Monday the two sides had agreed a 90-day pause on measures and that tariffs would fall by over 100 percentage points.

That leaves U.S. tariffs on Chinese goods at 30% from May 14 to August 12 and Chinese duties on U.S. imports at 10%, beating investors' best-case scenarios going into the talks.

The dollar jumped by the most in almost a month against a basket of major currencies , as the yen and Swiss franc fell along with other safe-haven assets like gold and government bonds.

S&P 500 stock futures leapt almost 3%, suggesting a hefty rally at the opening bell, while U.S. Treasury prices sagged, sending yields to one-month highs above 4.4% .

But relief that the worst of a global trade war could be avoided was tempered by caution, given a more permanent deal needs to be struck and that higher tariffs overall are still likely to weigh on the global economy.

"It's long-term positive plus 90 days of uncertainty," said Charles Wang, chairman of Shenzhen Dragon Pacific Capital Management Co.

Michael Metcalfe, head of macro strategy at State Street Global Markets in London, estimated that Monday's U.S.-China trade deal implied an average effective tariff rate of around 15%.

"Given where expectations were, it's a net positive," he said. "You basically reverse the reciprocal tariff announcement, and if you reverse the reciprocal tariff announcement you are back to square one."

After taking office in January, U.S. President Donald Trump had imposed tariffs of 145% on imports of Chinese goods, with China in turn raising tariffs on U.S. goods to 125% and limiting exports on some vital rare earth minerals.

Those measures had brought nearly $600 billion in two-way trade to a standstill, disrupting supply chains and sparking fears of an immediate cratering of the global economy.

Trump's April 2 "Liberation Day" announcement of sweeping tariffs on China and others sparked a sharp exit from U.S. assets, including the dollar and Treasuries - the mainstays of the global financial system - before being paused.

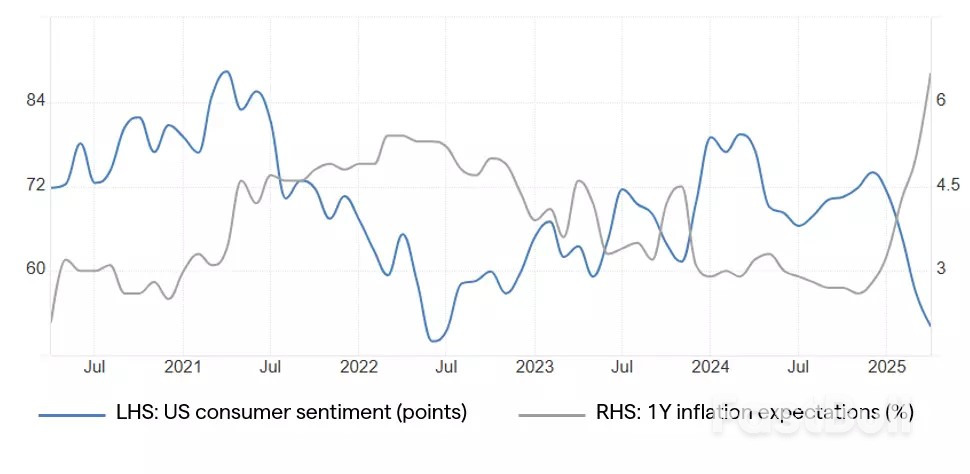

Heightened uncertainty caused by U.S. trade policy has hurt business and consumer confidence. The dollar index, while up over 1% on Monday, remains down some 7% so far this year.

Reassuring for markets are signs that Trump may be rethinking his trade strategy, given the damage caused already, as economic indicators have turned south and central bankers warn of the risk of slowing growth and rising inflation.

A deal last week with Britain, plus positive noises from Japan, Vietnam and South Korea, have helped restore some confidence, along with a cooling in geopolitical tensions.

U.S. stocks are already roughly where they were prior to April 2, while beneficiaries of the "sell America" trade, such as European and Chinese stocks have given up a big chunk of those gains (.STOXX), opens new tab, (.CSI300), opens new tab.

"This is only a three-month temporary reduction of tariffs. So this is the beginning of a long process," Zhiwei Zhang, chief economist at Pinpoint Asset Management in Hong Kong, said.

"The two sides will spend months probably, to come up with a resolution, or reach a final trade deal, but this is a very good starting point."

Rabobank's head of FX strategy Jane Foley said there was more optimism that the tariffs will not have the devastating impact many had feared, but this did not mean a return to the pre-Trump status quo.

"The overall scenario is not as bad as it could have been, but we still have a fair amount of uncertainty about where these tariffs will settle, their impact on world growth and central bank policy," she said.

State Street's Metcalfe said as uncertainty over trade lifts, the focus could also turn to other hot spots - such as Trump's plans for tax cuts and what that means for U.S. debt levels, especially as revenues from tariffs drop.

"It (the U.S./China deal) doesn't mean the policy uncertainty has gone away, it's moved on to a new area," he said.

Reporting by Alun John, Amanda Cooper and Dhara Ranasinghe in London, Samuel Shen in Shanghai and Summer Zhen in Hong Kong; Graphic by Amanda Cooper; Editing by Dhara Ranasinghe and Catherine Evans

as of 9 May 2025. Past performance is not a reliable indicator of future performance.

as of 9 May 2025. Past performance is not a reliable indicator of future performance. as of 9 May 2025. Past performance is not a reliable indicator of future performance.

as of 9 May 2025. Past performance is not a reliable indicator of future performance. as of 9 May 2025

as of 9 May 2025Oil prices soared Monday, adding to last week’s sharp gains, after the U.S. and China announced a trade deal which would ease some of their tariff measures, raising hopes of an end to the trade war between the world’s two largest consumers of crude oil.

At 08:20 ET (12:20 GMT), Brent Oil Futures expiring in June rose 3.7% to $66.28 per barrel, while West Texas Intermediate (WTI) crude futures gained 4% to $63.43 per barrel.

Both contracts rose by more than 4% last week on optimism over a potential de-escalation in Trump’s tariff agenda.

Monday’s surge was driven by the news that the U.S. and China have agreed to a 90-day pause to soaring tariffs placed on each other and will temporarily lower their respective levies.

Washington has agreed to cut U.S. President Donald Trump’s so-called "reciprocal" tariffs on China to 10%, while a 20% tariff related to Beijing’s alleged role in the flow of the illegal drug fentanyl remains in force. Meanwhile, China’s duties on U.S. imports are being cut to 10%, the nations said in a rare joint statement following high-stakes trade talks over the weekend.

More negotiations are planned between the two sides, while both sides may conduct working-level consultations on relevant economic and trade issues, the countries said.

Crude prices have been hit hard over the last month or so on worries that the trade spat may spiral into a crisis that could threaten global economic activity and increase uncertainty for businesses.

As the world’s two largest economies move toward a more stable trade relationship, expectations of stronger industrial activity and consumer demand, especially in China, lifted sentiment around the demand outlook.

Despite the positive outlook, oil price gains were tempered by plans from OPEC+ to increase oil output in May and June.

“These changes to its production schedule ultimately shorten the timeline for the full return of the 2.2 mm b/d tranche of its production cuts to 14 months from the 18 months initially announced in December 2024,” said analysts at BCA Research, in a note dated May 12.

The hike decision comes at a time when there is already plenty of demand uncertainty.

The timing of these production hikes suggests that geopolitical considerations are also at play, BCA added. Specifically, U.S.-Saudi relations.

President Trump has been explicit about his preference for low oil prices, and Saudi Arabia is hoping to secure greater military, defence, and civil nuclear cooperation.

By unwinding some support for oil prices ahead of Trump’s visit this week, Saudi Arabia may be hoping to demonstrate that it is willing to negotiate in good faith.

Elsewhere, U.S.-Iran nuclear talks concluded on Sunday, with further negotiations planned, leaving the potential for increased Iranian oil exports uncertain.

The fourth round of talks occurred in advance of Trump’s trip to the Middle East.

Investors also closely watched increased geopolitical tensions between India and Pakistan, as the nuclear-armed neighbors engaged in their worst fighting in decades.

The two countries reached a ceasefire agreement on Saturday, though reports of violations emerged shortly afterward.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up