Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The United States has ordered the deployment of 10 F-35 fighter jets to a Puerto Rico airfield to conduct operations against drug cartels, sources say, adding more firepower to intensifying U.S. military operations in the Caribbean that are stoking tension with Venezuela.

The United States has ordered the deployment of 10 F-35 fighter jets to a Puerto Rico airfield to conduct operations against drug cartels, sources say, adding more firepower to intensifying U.S. military operations in the Caribbean that are stoking tension with Venezuela.

The new deployment comes on top of an already bristling U.S. military presence in the southern Caribbean as President Donald Trump carries out a campaign pledge to crack down on groups he blames for funneling drugs into the United States.

The disclosure about the F-35s came just hours after the Pentagon accused Venezuela of a "highly provocative" flight on Thursday by fighter jets over a U.S. Navy warship.

It also follows a U.S. military strike on Tuesday that killed 11 people and sank a boat from Venezuela Trump said was transporting illegal drugs.

At every turn, the Trump administration has sought to tie Venezuelan President Nicolas Maduro's government to narco-trafficking, allegations Caracas denies.

More specifically, Trump has accused Maduro of running the Tren de Aragua gang, which his administration designated a terrorist organization in February.

Venezuela's Communications Ministry did not respond to a request for comment about the F-35s or the allegations that Venezuelan fighter jets flew over a U.S. warship.

The sources, speaking on condition of anonymity about the latest U.S. deployment, said the 10 fighter jets are being sent to conduct operations against designated narco-terrorist organizations operating in the southern Caribbean. The planes should arrive in the area by late next week, they said.

F-35s are highly advanced stealth fighters and would be highly effective in combat against Venezuela's air force, which includes F-16 aircraft.

A U.S. official, speaking on condition of anonymity, said two Venezuelan F-16s flew over the USS Jason Dunham on Thursday.

The Dunham is one of at least seven U.S. warships deployed to the Caribbean, carrying more than 4,500 sailors and Marines.

U.S. Marines and sailors from the 22nd Marine Expeditionary Unit have also been carrying out amphibious training and flight operations in southern Puerto Rico.

The buildup has put pressure on Maduro, whom U.S. Defense Secretary Pete Hegseth has called "effectively a kingpin of a drug narco state."

Maduro, at a rare news conference in Caracas on Monday, said the United States is "seeking a regime change through military threat."

Speaking on Thursday, Hegseth defended Tuesday's deadly strike in comments to reporters and vowed that such activities would continue, citing the threat that illegal narcotics pose to public health in the United States.

"The poisoning of the American people is over," Hegseth said.

Rep. Ilhan Omar, a Democrat from Minnesota, condemned what she called Trump's "lawless" actions in the southern Caribbean.

"Congress has not declared war on Venezuela, or Tren de Aragua, and the mere designation of a group as a terrorist organization does not give any President carte blanche to ignore Congress’s clear Constitutional authority on matters of war and peace," Omar said in a statement.

U.S. officials have not clearly explained what legal justification was used for Tuesday's air strike on the boat or what drugs were on board.

Trump said on Tuesday, without providing evidence, that the U.S. military had identified the crew of the vessel as members of Venezuelan gang Tren de Aragua.

Canada’s economy lost 66k jobs (-0.3% m/m) in August, adding to 41k jobs lost in July. The job losses concentrated in part-time positions (-60k), while full-time employment was little changed.

The unemployment rate rose to a new cycle high of 7.1%. The increase would have been worse were it not for 31k fewer workers in the labour force.

Job losses were seen across several industries. The biggest losses were in professional, scientific and technical services (-26k; -1.3%), transportation and warehousing (-23k; -2.1%), and manufacturing (-19k; -1.0%). However, construction employment bounced back (+17k; +1.1%) from July’s decline (-22k; -1.3%).

Wage growth slowed to 3.2% in August, slightly lower than 3.3% in July.

July and August’s job losses have now more than reversed June’s outsized gain, and the Canadian economy has lost 39k jobs since January. The unemployment rate has risen half a percentage point over the same time period. It could be worse though, a slowdown in labour force growth is keeping the unemployment rate from rising too high, despite weak labour demand.

August’s report is consistent with the Bank of Canada’s characterization of “an excess supply of labour” in July’s Monetary Policy Report. However, it hasn’t yet prompted them to lower rates beyond the pre-emptive cuts made early in the year. Markets are now putting odds on the next cut coming in September. We have long expected two more cuts this year, with the inflation report on September 16th likely to help cement the timing of the next cut.

How long does it take for conventional wisdom to make a 180 degree U-turn? In the case of anything Trump related, it's just under 6 months.It was in early April, just after Liberation Day's reciprocal tariffs were announced, that US bond markets suddenly cratered, sparking a collapse in hundreds of billions of basis trades, and triggered fears of a global economic shock. That's when tariffs were widely seen as bad and anyone who dared to say it's never that black or white - such as this website - were blasted as economic illiterates. Well, fast forward to today when quietly conventional wisdom has been turned on its head and the mere possibility of tariffs getting pulled is now seen as one of the biggest threats to the stability of the bond market!

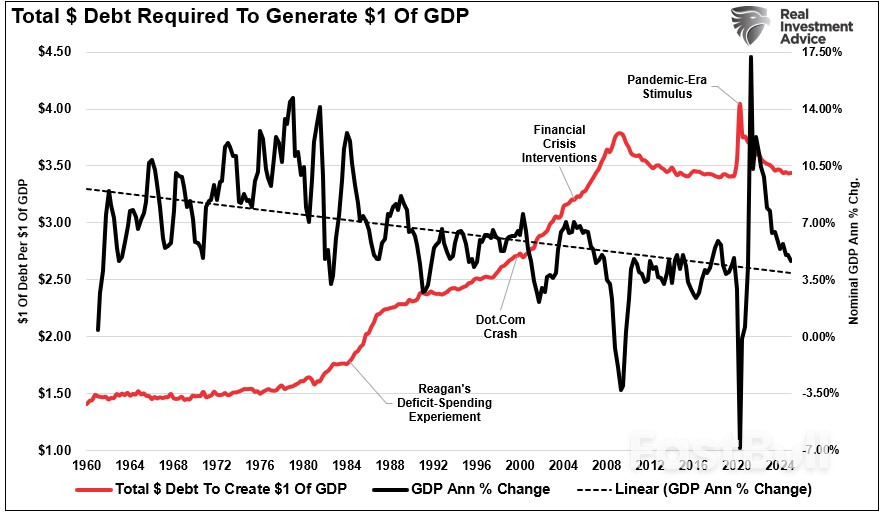

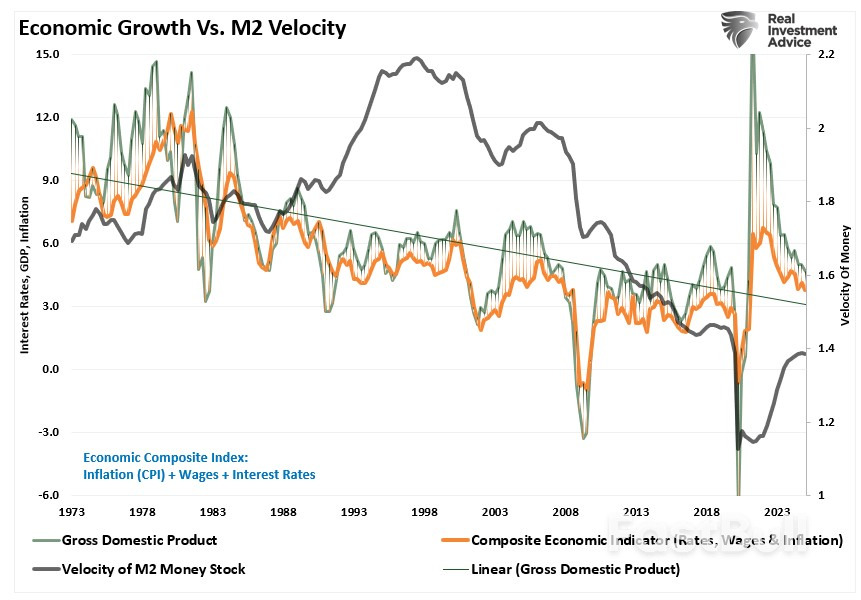

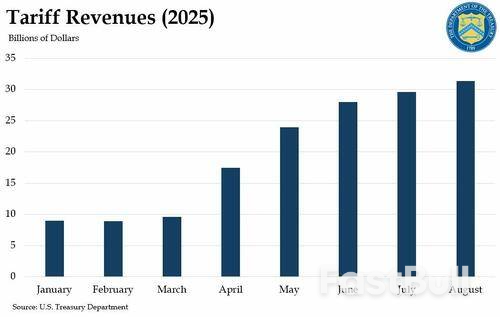

That's right: if the Financial Times is to be believed - and it is, since it loathes Trump with a passion and would never say anything even remotely complementary if it could avoid it - Trump’s tariffs are now a key factor keeping Treasury investors on board (the same tariffs that were widely blamed for the relentless selling back in April). According to the paper, the tariff revenues - which so many of the establishment economists never even considered in April - are now seen as a crucial income stream that offsets the costs of the Big Beautiful Bill, and investors are now counting on hundreds of billions of dollars raised by the remaining tariffs to offset Trump’s tax cuts and keep a lid on US borrowing.

“The only way I can see for the US government to reduce its outstanding debt in the near term is to use the tariff revenue,” said Andy Brenner, head of international fixed income at NatAlliance Securities, citing also revenues from chipmakers’ China sales. “If all of the sudden the tariff revenue will not be there, that is a problem.”Not only that, but as we noted two weeks ago, both S&P and Fitch recently conceded that tariff revenues for the US federal government were one factor that prevented them from downgrading the sovereign.

The Congressional Budget Office last month forecast Trump’s tariffs would boost US government revenues by $4tn over the coming decade. That would help pay for tax cuts in Trump’s One Big Beautiful Bill Act, which is projected to increase borrowing by $4.1tn over the same period.The shift in market sentiment comes after months of turmoil in Trump’s economic strategy, including his trade war with trading partners such as China and his attacks on the US Federal Reserve.

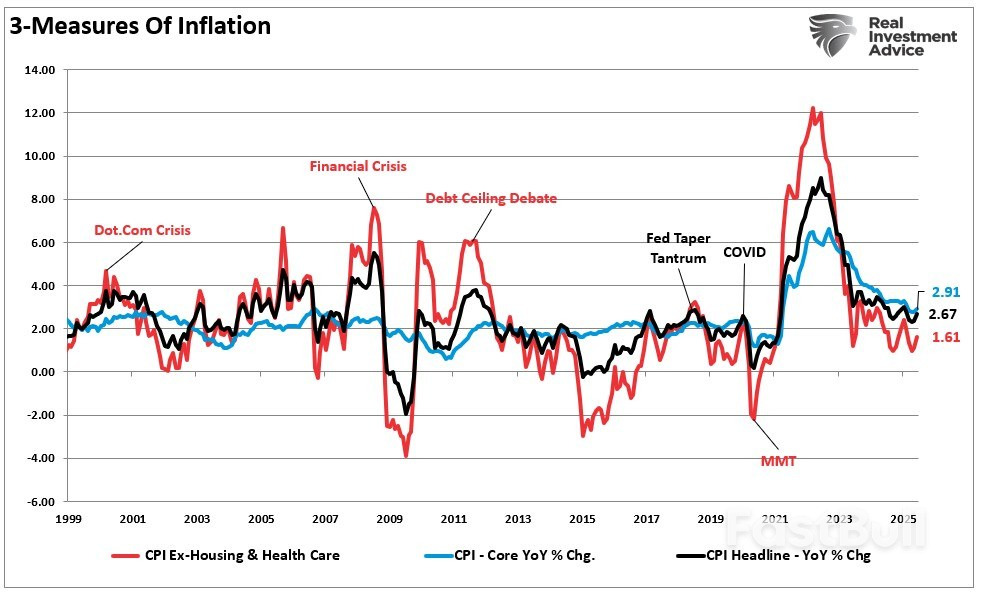

Indeed, the appeals court ruling - which overturns Trump's tariffs - was the catalyst behind the US Treasury bond sell-off on Tuesday and Wednesday, analysts said, as investors worried that reduced tariff revenues would lead to a greater glut of Treasury issuance.Thierry Wizman, a global rates strategist at Macquarie Group, said: “If the bulk of Trump’s tariff programme is nullified by the courts some analysts will cheer, inflation will subside, growth may improve, and the Fed may be more inclined to ease monetary policy. But if the focus is on debt and deficits at that time, the bond market may riot.”

Indeed, the appeals court ruling - which overturns Trump's tariffs - was the catalyst behind the US Treasury bond sell-off on Tuesday and Wednesday, analysts said, as investors worried that reduced tariff revenues would lead to a greater glut of Treasury issuance.Thierry Wizman, a global rates strategist at Macquarie Group, said: “If the bulk of Trump’s tariff programme is nullified by the courts some analysts will cheer, inflation will subside, growth may improve, and the Fed may be more inclined to ease monetary policy. But if the focus is on debt and deficits at that time, the bond market may riot.”

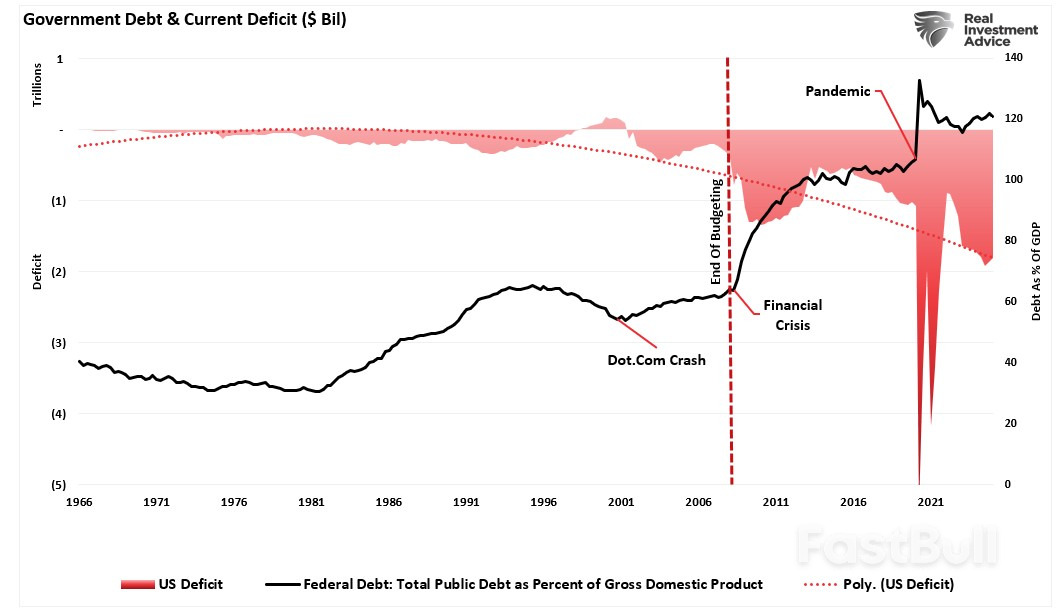

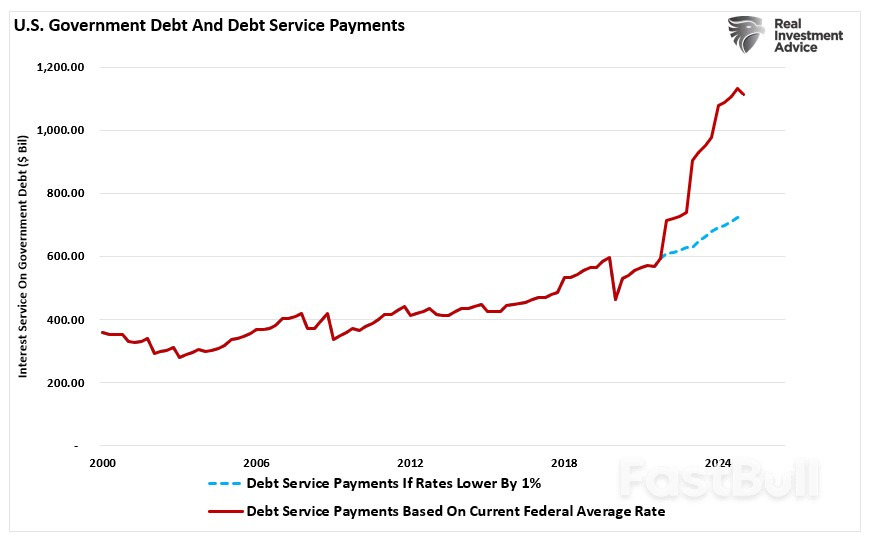

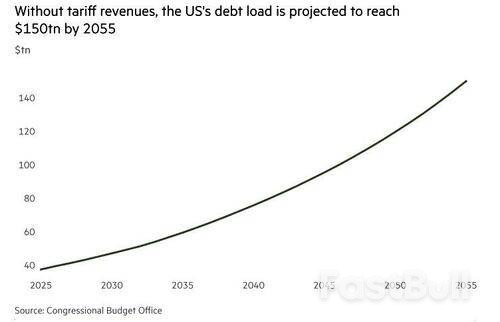

He added: “The risk that tariffs go away but the [One Big Beautiful Bill Act] stays may become the dominant risk for [US Treasuries] over the next few weeks.”Robert Tipp, head of global bonds at PGIM Fixed Income, said there was “a hope that tariff revenue can help control the budget deficit”.To be sure, even with tariff revenues, investors warn about the daunting scale of the US government’s borrowing needs.Des Lawrence, senior investment strategist at State Street Investment Management, said if the tariffs “were put on pause, it deprives Uncle Sam of a revenue source”. But the “bigger negative picture” is the sheer scale of government spending, he said. Without tariff revenue, the CBO expects US debt relative to GDP to surpass its second world war peak by 2029.

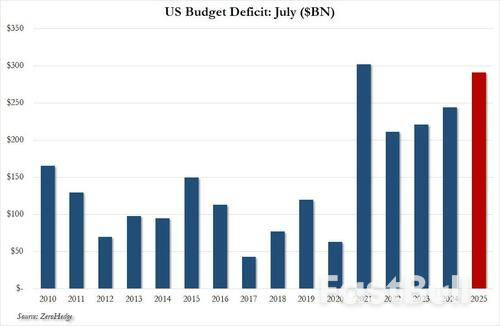

“It’s helpful in plugging a gap, but there’s still a big issue in America spending much more than it’s receiving,” Lawrence said, and he too is right as we showed a few weeks ago when we demonstrated that despite record tariff revenue, the US budget deficit hit a whopping $291bn in July, the second highest deficit for the month on record.

And now the fate of the US bond market is in the hands of a handful of supreme court justices, whose decisions are never taken on the merits of the underlying argument but are purely and unapologetically political. Last week, the Court of Appeals ruled against the Liberation Day tariffs, arguing that the emergency powers law did not give the US president the legal authority to impose these tariffs. And last evening, the Trump administration appealed this decision before the Supreme Court, and the enforcement of the earlier ruling has been delayed until the Supreme Court can review the case. So, pending the Supreme Court decision, tariffs remain in effect.

But if Trump loses this appeal, that key source of revenue would quickly dry out. Undoubtedly the administration will already have alternatives up its sleeve –with sectoral tariffs a key candidate– but it would unleash a new wave of uncertainty that could sap confidence. No wonder Trump has said that if the Supreme Court does not overturn the Appeal court decision, the consequences would be catastrophic for the US: he is, after all, correct.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up