Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US tariffs target specific AI chips, initially sparing South Korea's memory sector, but broader duties linked to US production loom.

The United States has imposed a 25% tariff on certain advanced computing chips, a move that South Korea's trade minister said will have a limited initial impact on the country's semiconductor companies.

The new measures, announced by President Donald Trump, follow a nine-month national security investigation under the Trade Expansion Act of 1962.

According to Trade Minister Yeo Han-koo, the first phase of the tariffs specifically targets high-end artificial intelligence chips from companies like Nvidia and AMD.

"Since the memory chips that South Korean companies mainly export are currently excluded, the immediate impact is expected to be limited," Yeo stated.

However, he cautioned that it was "not yet time to be reassured," highlighting uncertainty over how a potential second phase of tariffs could expand. Yeo confirmed the government will continue to work with the industry to protect the interests of South Korean firms.

The 25% tariff applies to a narrow range of high-performance semiconductors and devices containing them. Among the products explicitly named are Nvidia's H200 AI processor and AMD's MI325X chip.

The White House specified that the tariffs would not apply to chips and related devices imported for:

• U.S. data centers

• Startups

• Non-data center consumer applications

• Non-data center civil industrial applications

• U.S. public sector applications

The action is part of a wider U.S. strategy to incentivize domestic semiconductor manufacturing and reduce reliance on chip producers in regions like Taiwan. According to a White House fact sheet, the United States may impose broader tariffs on semiconductors in the future to further this goal.

The potential for escalating measures was underscored by U.S. Commerce Secretary Howard Lutnick. Speaking at a groundbreaking ceremony for Micron's new plant in New York, Lutnick warned that South Korean and Taiwanese chipmakers not investing in the U.S. could face tariffs as high as 100% unless they commit to increasing production on American soil.

As Thailand heads towards a pivotal election next month, the ruling Bhumjaithai Party is campaigning on a platform to resolve the border conflict with Cambodia and crack down on the country's role as a transit point for human trafficking victims.

The conservative party, which assumed power in September, is positioning itself as the primary defender of Thai sovereignty following clashes with Cambodia that erupted for five days last July and again in December.

Foreign Minister Sihasak Phuangketkeow, the party's second prime ministerial candidate after incumbent leader Anutin Charnvirakul, stated that if re-elected on February 8, Bhumjaithai will maintain its firm stance on protecting Thailand's territorial integrity. Simultaneously, the party aims to restore diplomatic ties to reopen borders and resume trade.

Anutin has leveraged a wartime leader image by aligning closely with the Thai military, a strategy that has doubled his party's popularity since border tensions flared last May. This hardline position resonates strongly with conservative and rural voters, especially in the seven northeastern border provinces, boosting the party's campaign with nationalist sentiment.

"We are determined to protect our sovereignty, our territorial integrity," Sihasak said in an interview. "I'm hoping that we will be able to put the conflict behind us soon, build up confidence and trust and move forward with our relationship."

Sihasak emphasized that any progress is contingent on the December 27 ceasefire holding. Key conditions for normalizing relations include:

• The withdrawal of heavy weapons from border areas.

• Cooperation on landmine removal.

• Joint crackdowns on scam operations.

"This is still a very delicate period where we have to avoid all acts of provocation," he cautioned.

The foreign minister dismissed recent comments from Cambodian minister Keo Remy, who suggested Bhumjaithai's re-election would trigger a third border clash and advised Thais to vote for other parties. Sihasak labeled the remarks "verbal provocation" and interference in domestic affairs.

Bhumjaithai's rise came after the previous Pheu Thai government, led by Paetongtarn Shinawatra, was ousted. A leaked phone call involving a former Cambodian leader led to her court-ordered dismissal for ethical violations. While Pheu Thai claims it can also resolve the conflict, public trust has weakened due to the Shinawatra family's close personal ties with Cambodia's ruling Hun dynasty before the border dispute.

Meanwhile, the progressive People's Party, which has never held power, advocates for a peaceful solution but remains untested in handling territorial conflicts. Its anti-establishment stance contrasts sharply with a period of high public adoration for the armed forces.

Thailand has framed the deadly conflict not just as a territorial dispute but also as a war on the transnational criminal operations that have taken root in Cambodia. The Thai air force has targeted several sites in the neighboring country, identifying them as abandoned casinos repurposed for military or drone activities.

Internally, Sihasak acknowledged that Thailand must address its role as a regional transit hub for victims lured into working for scam centers.

"If we are going to try to lead the regional and international efforts to combat scams, we have to look at ourselves and put our house in order," he stated. "You have to crack down on those involved, otherwise it's not going to be possible."

The conflict has also drawn international economic pressure. In July, US President Donald Trump threatened to freeze trade deals with both Thailand and Cambodia if the fighting did not stop. After a ceasefire was reached, the US imposed a 19% tariff on goods from both nations.

Sihasak said a re-elected Bhumjaithai government would seek to lower these export tariffs in upcoming negotiations with US officials. He also plans to task Thai ambassadors worldwide with finding new export markets and attracting foreign direct investment to counter growing protectionism.

"We're facing more protectionism, more unilateralism, especially what we see coming from the US," he said.

Furthermore, the party aims to rebuild investor confidence. Thailand's stock market has experienced net outflows of foreign funds for three consecutive years since 2023, a period marked by political turmoil and two regime changes.

"If we have a stable government, we have consistent policies, I think we could reverse the trend," Sihasak concluded. "Thailand is still an attractive place to invest."

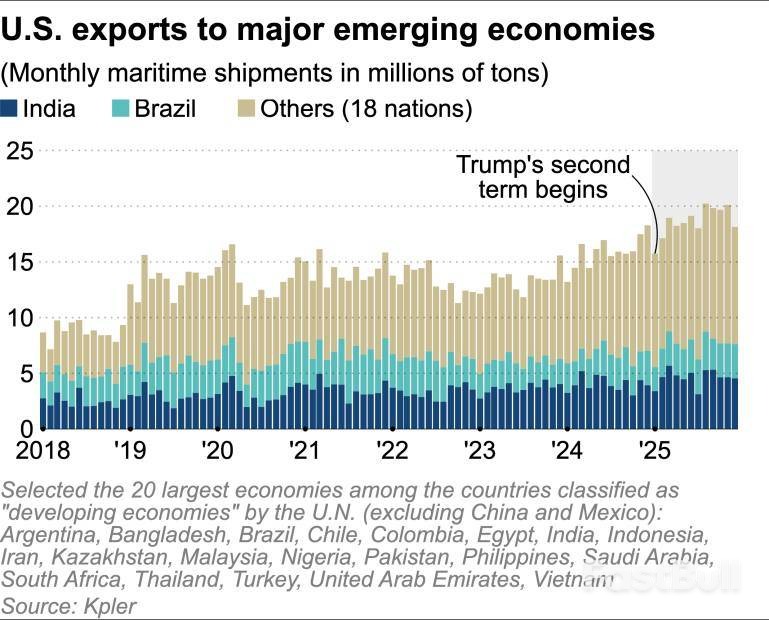

U.S. maritime exports to key emerging markets, excluding China, jumped 17% last year, highlighting how President Donald Trump's trade policies are actively reshaping global supply chains.

An analysis of Kpler trade data reveals that U.S. shipments to 20 major emerging economies, including India, Brazil, and Vietnam, grew from 190 million metric tons in 2024 to 223 million tons in 2025. This surge, particularly in agricultural goods, has helped offset a steep decline in exports to China.

"We can see a significant increase in imports following trade talks with the U.S." in some countries, noted Ishan Bhanu, lead agricultural commodities analyst at Kpler.

Several Asian nations recorded sudden and dramatic increases in U.S. commodity imports after securing more favorable trade terms with Washington.

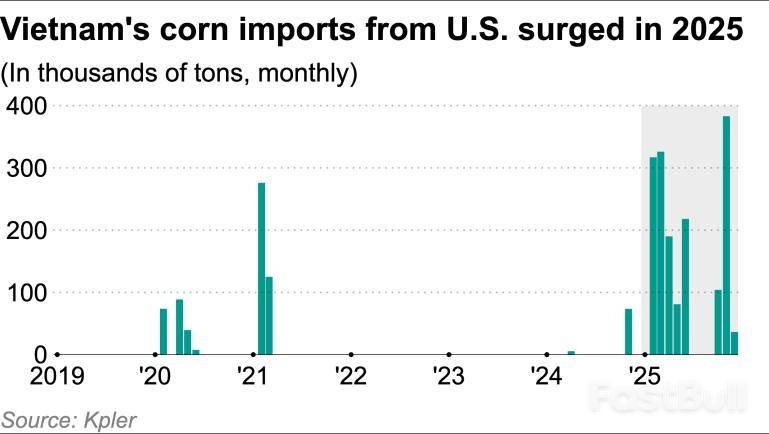

Vietnam's Corn Market Transformed

Vietnam provides a stark example of this trend. In 2025, the country's corn imports from the U.S. skyrocketed 21 times compared to the previous year, reaching approximately 1.7 million tons. This shift followed a trade negotiation last June where the U.S. agreed to lower its tariff rates from 46% to 20% in exchange for Vietnam purchasing $2 billion in American farm products.

By November, Vietnam's monthly corn imports from the U.S. hit a record 383,000 tons. "A very interesting phenomenon," Bhanu told Nikkei Asia. "Vietnam has always taken a lot of South American corn, and [in 2025] it has taken a lot of U.S. corn."

Pakistan and Bangladesh Follow Suit

Similar dynamics played out in other textile-exporting nations. U.S. soybean shipments to Pakistan surged from just 60,000 tons in 2024 to 1.23 million tons in 2025. The boom followed a July trade agreement where the U.S. cut import tariffs on Pakistan's textile sector from roughly 29% to 19%, boosting its competitiveness against rivals like India.

Bangladesh also shifted its procurement strategy. Historically a major buyer of Russian, Canadian, and Ukrainian wheat, Bangladesh began purchasing large volumes from the U.S. after securing reduced American tariffs on its own exports. "Now they're buying a lot from the U.S., even at higher prices than other countries," Bhanu explained.

Across the globe, Nigeria also became a major buyer of U.S. grains, with wheat imports climbing from 0.53 million tons in 2024 to 1.48 million tons in 2025. Driven by these new agreements and other factors like a delayed Russian harvest, total U.S. wheat exports to the 20 emerging nations rose 16% to 21.57 million tons.

The trade deals prompted many nations to purchase U.S. commodities even when they were more expensive on the open market. In early January, U.S. soybeans were priced at $418 per ton, higher than Brazilian soybeans at $407 per ton.

"Emerging markets continued buying U.S. products, mindful of trade negotiation terms and relations with Washington," said Bhanu.

While Brazilian soybeans were cheaper due to a bumper crop, the political calculus favored U.S. suppliers. In the corn market, a smaller price gap between U.S. and other sources gave American exporters a competitive edge. "Tariff negotiations prompted emerging markets to change their sourcing strategies," confirmed Hideki Hattori of Nippn, a major Japanese flour milling company.

The export boom wasn't limited to agriculture. U.S. natural resource shipments also expanded, with crude oil exports to the 20 emerging economies climbing 58% in 2025 to 36 million tons, or about 760,000 barrels per day.

India became a key buyer as it sought to improve relations with Washington. The country faced a 50% U.S. tariff on its exports as a penalty for purchasing Russian oil, which President Trump claimed was "fueling a war machine." In response, Indian refiner Reliance Industries announced it would halt Russian crude imports at its Jamnagar complex.

Kpler data shows India's crude imports from Russia fell 29% year-on-year in December, while its imports from the U.S. soared 4.9 times to 330,000 barrels per day.

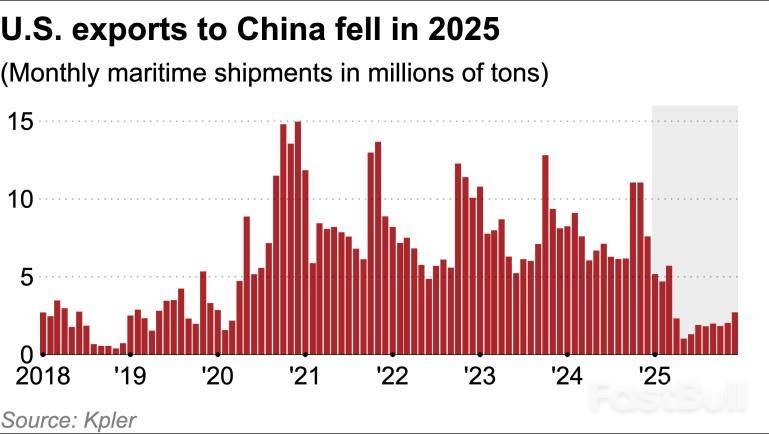

While U.S. exports to these new markets grew, they failed to compensate for a massive drop in trade with China. U.S. exports to China plummeted 65% in 2025, falling from 93 million tons to 32 million tons. The 33-million-ton increase in shipments to the 20 other nations did not fully offset this decline.

The collapse in the China trade was driven largely by a near-complete halt in soybean transactions, which previously accounted for 30% of U.S. exports to the country, after May 2025.

The "America First" trade policy may also create economic headwinds. A study by the Auckland University of Technology projected that the Trump tariffs would reduce the U.S. economic growth rate by 0.36 percentage points in 2025. The growth rates of Thailand and Brazil were also expected to decline by 0.44 and 0.19 points, respectively.

As the second Trump administration enters its second year, emerging economies are navigating a new geopolitical landscape. "Southeast Asian countries cannot afford to be too confrontational toward the U.S.," said Tricia Yeoh, an associate professor at the University of Nottingham Malaysia. "They are particularly adept at creating good impressions."

However, she added that Washington's aggressive tariff policies and hardline stances are creating "a growing impression among Southeast Asia and other emerging countries that the U.S. is no longer adhering to the rules-based international order."

U.S. President Donald Trump on Friday suggested he might impose tariffs on countries that do not support U.S. control over Greenland, escalating his administration's rhetoric even as a bipartisan congressional delegation was in Copenhagen working to ease tensions with Denmark.

For months, Trump has publicly insisted that the U.S. should acquire Greenland, a semi-autonomous territory of NATO ally Denmark. Earlier in the week, he declared that anything less than the Arctic island falling under U.S. control would be "unacceptable."

During a White House event on rural health care, Trump revealed a new potential strategy, recounting how he had previously threatened European allies with tariffs on pharmaceuticals.

"I may do that for Greenland too," Trump stated. "I may put a tariff on countries if they don't go along with Greenland, because we need Greenland for national security. So I may do that."

This was the first time the president mentioned using tariffs to force the issue. The White House has consistently justified its pursuit of Greenland by claiming China and Russia have designs on the territory, which holds vast untapped reserves of critical minerals. The administration has also not ruled out the possibility of taking the territory by force.

The tariff threat follows a recent meeting in Washington where the foreign ministers of Denmark and Greenland met with U.S. Vice President JD Vance and Secretary of State Marco Rubio. While the talks resulted in an agreement to form a working group, they failed to resolve fundamental disagreements, with Denmark and the White House later offering conflicting views on the group's purpose.

In sharp contrast to the White House's confrontational tone, a delegation of U.S. senators and House members met with Danish and Greenlandic lawmakers in Copenhagen, including Danish Prime Minister Mette Frederiksen.

The delegation's leader, Senator Chris Coons, a Delaware Democrat, thanked their hosts for "225 years of being a good and trusted ally and partner," adding that they had a "strong and robust dialogue about how we extend that into the future."

Senator Lisa Murkowski, an Alaska Republican, stressed that the visit was meant to nurture a decades-long relationship. "Greenland needs to be viewed as our ally, not as an asset, and I think that's what you're hearing with this delegation," she told reporters.

European leaders maintain that any decision regarding Greenland's status is a matter for Denmark and Greenland alone. In response to the growing pressure, Denmark announced this week it was increasing its military presence in Greenland in cooperation with its allies.

Greenlandic and Danish officials have been direct in their criticism of the U.S. administration's stance.

"We have heard so many lies, to be honest and so much exaggeration on the threats towards Greenland," said Aaja Chemnitz, a Greenlandic politician and member of the Danish parliament who participated in the meetings. "And mostly, I would say the threats that we're seeing right now [are] from the U.S. side."

Greenland's prime minister, Jens-Frederik Nielsen, made his government's position clear on Tuesday. "If we have to choose between the United States and Denmark here and now, we choose Denmark. We choose NATO. We choose the Kingdom of Denmark. We choose the EU."

Back in the U.S., some lawmakers are working to counter the president's agenda. Senator Murkowski, alongside New Hampshire Democrat Senator Jeanne Shaheen, has introduced bipartisan legislation to prohibit the use of Defense or State Department funds to annex or take control of Greenland or any other NATO member's sovereign territory without consent.

Murkowski also noted the lack of public support for the idea. "When you ask the American people whether or not they think it is a good idea for the United States to acquire Greenland, the vast majority, some 75%, will say, we do not think that that is a good idea," she said.

The dispute is also raising deep concerns among the region's Indigenous population. Sara Olsvig, chair of the Inuit Circumpolar Council, which represents 180,000 Inuit across Alaska, Canada, Greenland, and Russia, said the White House's persistent statements offer "a clear picture of how the U.S. administration views the people of Greenland, how the U.S. administration views Indigenous peoples, and peoples that are few in numbers."

Speaking from Nuuk, Greenland, Olsvig told The Associated Press that the core issue is "how one of the biggest powers in the world views other peoples that are less powerful than them. And that really is concerning." She added that the Indigenous Inuit of Greenland do not want to be colonized again.

Japanese Prime Minister Sanae Takaichi is reportedly considering a temporary suspension of the sales tax on food as a key pledge for her upcoming election campaign. This potential policy shift comes as Takaichi is expected to dissolve the lower house of parliament next week.

According to a report from the Mainichi newspaper, citing people familiar with the matter, the government and Takaichi's ruling Liberal Democratic Party are set to decide on the tax suspension after carefully assessing its potential impact on financial markets.

While Takaichi endorsed the idea of a food sales tax cut before taking office in October of last year, she has since given little indication of her plans to implement it. The move would represent a significant fiscal measure, projected to reduce government revenue by about 5 trillion yen ($31.6 billion) annually.

The prime minister has pledged to pursue an "aggressive but responsible" fiscal policy, and markets have already begun reacting to speculation about her economic agenda.

News that Takaichi intends to call an election, likely for February, has triggered notable shifts in financial assets:

• The Japanese yen has weakened against the U.S. dollar.

• Bond yields have risen.

• Stocks have climbed to a record high on market expectations of expanded fiscal spending.

The Trump administration will pursue individual tariff agreements on semiconductors with different countries, a U.S. official confirmed Friday. This strategy rejects a one-size-fits-all approach, signaling that the recent U.S.-Taiwan deal on chip levies will not serve as a universal template for other nations.

The clarification came after the U.S. Commerce Department released details of a trade and investment pact with Taiwan that specifically addressed semiconductor tariffs. The country-specific approach has immediate implications for other major chip-producing nations, including South Korea, which will now likely face their own distinct negotiations with Washington.

The deal with Taiwan offers a clear framework for tariff relief tied to investment in American manufacturing capacity. According to a fact sheet from the Commerce Department, the agreement includes two key provisions:

• During Construction: Taiwanese companies building new semiconductor facilities in the U.S. can import up to 2.5 times their planned capacity without paying sectoral duties for the duration of the approved construction period.

• After Completion: Once a new U.S. production project is complete, these companies can continue to import 1.5 times their new domestic production capacity duty-free.

This model directly links tariff exemptions to the onshoring of chip production, a central goal of the administration's industrial policy.

The focus on semiconductors extends beyond bilateral deals. On Wednesday, President Trump signed a proclamation establishing a 25% tariff on certain semiconductors used for artificial intelligence (AI). This tariff applies specifically to chips imported into the U.S. that are then re-exported to other countries.

Furthermore, the White House has indicated that Trump may impose even "broader" tariffs on both semiconductors and their derivative products in the future.

These trade actions are being implemented under the authority of Section 232 of the Trade Expansion Act of 1962. This law grants the president the power to adjust imports if they are determined to be a threat to U.S. national security, providing a legal basis for the administration's industry-wide tariff strategy.

The precious metals market has packed a year's worth of action into the first two weeks of the year, with both gold and silver posting record-breaking gains before showing signs of a slowdown. The explosive momentum, particularly for silver, now appears to be meeting resistance.

Gold prices have climbed $256 this month, a 6% increase that is already nearing last year's 7% January rally. Silver has been even more dramatic, surging nearly $17.50, or more than 24%. This marks silver's strongest start to a year since 1983.

However, the blistering pace is cooling. Gold ended the week below $4,600, and silver slipped back under $90 an ounce, reminding traders that the market's upward trajectory isn't guaranteed.

Silver’s pullback is not entirely unexpected. The metal’s powerful rally through the second half of 2025 was largely fueled by a supply-crunch narrative, which has now been temporarily resolved.

Late Wednesday, President Donald Trump announced that his administration would not impose tariffs on critical metals following a Section 232 review. The decision, for now, removes a key source of market anxiety. With the U.S. having stockpiled silver for nearly a year over tariff fears, the physical market may begin to normalize as those pressures ease.

Gold, on the other hand, is facing headwinds from a different source: economic reality. Recent data suggests the Federal Reserve is under no immediate pressure to cut interest rates. While rate cuts are still anticipated this year, the market consensus is shifting, with the first move not expected until June at the earliest.

This delay gives support to higher bond yields and a stronger U.S. dollar, which typically weigh on gold prices. However, the long-standing inverse relationship between gold and interest rates has been unreliable for some time. Furthermore, ongoing geopolitical uncertainty continues to generate solid safe-haven demand for the metal.

While some short-term selling and consolidation seem likely for both metals, a complete return to "normal" market conditions is improbable. Traders are operating in an environment defined by tight supply, persistent demand, and evolving macroeconomic stories. Even if silver's liquidity improves, fundamental supply constraints remain.

For investors looking ahead, some analysts believe gold may have an advantage. Silver's staggering 150% rally over the past 12 months has driven the gold-to-silver ratio to its lowest level since 2012. Just as the ratio struggled to stay above 100 last year, many experts now view its current low level as unsustainable, potentially signaling a relative outperformance for gold.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up