Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Pakistan Cricket Team To Boycott T20 World Cup Match Against India, Pakistan Government Says In Post On X

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Envious of Trump, who can freely control gold prices.

Envious of Trump, who can freely control gold prices.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Despite China’s export ban on critical minerals to the United States, American firms continue to receive antimony, gallium, and germanium through third countries such as Thailand and Mexico...

Over 630 days of war later and much of Hamas' top command has been wiped out, and large swathes of the Gaza Strip obliterated. It's been no secret that the Netanyahu government is pursuing the complete annihilation of Hamas, ensuring that it can never again return to rule, but the reality is that the Israeli army is still taking on mass casualties.

This shows that the Hamas insurgency, using the Strip's hundreds of miles of tunnels, is still fierce and ongoing. "Five Israeli soldiers were killed in combat in the Gaza Strip, the Israeli army admitted on Tuesday, in one of the deadliest days for Israeli forces in the devastated Palestinian territory this year," regional media reports.

The five soldiers "fell during combat in the northern Gaza Strip," the IDF announced. In total 14 others were wounded. Included were two that were severely wounded and "evacuated to a hospital to receive medical treatment."

The five soldiers "fell during combat in the northern Gaza Strip," the IDF announced. In total 14 others were wounded. Included were two that were severely wounded and "evacuated to a hospital to receive medical treatment."They came under attack near Beit Hanoun in the north of Gaza,when improvised explosive devices were detonated, after which Israeli soldiers who sought to rescue the wounded came under fire again. Thus it's clear that either Hamas or Islamic Jihad militants set a trap and ambush for the soldiers.

The IDF and Israeli media have described that the infantry troops were operating on foot when the blast happened. One detail which highlights the ongoing extreme difficulty of uprooting the Palestinian insurgency is that the area where the attack occurred was subject of Israeli aerial raids just prior:

The military said the area where the attack took place was targeted from the air ahead of the troops’ operations.

The Netzah Yehuda soldiers were operating under the Gaza Division’s Northern Brigade as part of a fresh offensive with the 646th Reserve Paratroopers Brigade in Beit Hanoun, which began on Saturday, aimed at clearing the area of terror operatives who remain holed up there.

Israeli opposition leader Yair Lapid wrote on X in the wake of the large-scale casualties, "For the sake of the fighters, for the sake of their families, for the sake of the hostages, for the sake of the State of Israel: this war must be ended."

Israeli society has remained fiercely divided over Netanyahu policy, with hostage victims' family members outraged that efforts to negotiate a deal to release the remaining captives have completely stalled.

Meanwhile, there is some activity on this front, with Qatar’s foreign ministry on Tuesday saying that renewed indirect negotiations will "need time". The White House has been supportive of peace efforts, but has sided with Israeli actions in Gaza time and again in its public rhetoric.

"What is happening right now is that both delegations are in Doha. We are speaking with them separately on a framework for the talks. So talks have not begun, as of yet, but we are talking to both sides over that framework," he tells a Doha news conference.

Gold held a decline after President Donald Trump said the new August deadline for the start of so-called “reciprocal” tariffs won’t be delayed, with nations expected to use the extended window to continue negotiating with the US.

Bullion traded near $3,300 an ounce, after a 1% loss in the previous session. Trump’s move to postpone the imposition of all “Liberation Day” duties — which were first announced in April and then delayed to July 9 — to next month is partly an effort to clinch more agreements from nations still willing to deal with the US, denting haven demand for the precious metal.

While the delay has eased some concerns about the potential negative impact that Trump’s tariff agenda could have on the global economy, the president also indicated he could announce substantial new rates on imports of copper and pharmaceuticals. If those materialize, that could see renewed demand for havens.

Gold was also impacted on Tuesday as US Treasuries fell. Yields have been rising as investors pare bets on Federal Reserve interest-rate cuts by year-end, following a report last week that showed a surprisingly resilient US labor market. Higher borrowing costs tend to pose a headwind for non-yielding bullion.

The precious metal has rallied by more than a quarter this year, setting a record in April, as Trump’s efforts to overhaul trade policies stoked uncertainty, driving investors to seek safety in gold. The advance has been supported by central-bank accumulation, with China announcing an eighth straight month of purchases earlier this week.

Spot gold was little changed at $3,300.23 an ounce as of 7:40 a.m. in Singapore. The Bloomberg Dollar Spot Index was little changed. Silver, palladium and platinum edged lower.

U.S. President Donald Trump on Tuesday met for a second time in two days with Israeli Prime Minister Benjamin Netanyahu to discuss Gaza as Trump's Middle East envoy said Israel and Hamas were closing their differences on a ceasefire deal.

The Israeli leader departed the White House on Tuesday evening after just over an hour's meeting with Trump in the Oval Office, with no press access. The two men also met for several hours during a dinner at the White House on Monday during Netanyahu's third U.S. visit since the president began his second term on January 20.

Netanyahu met with Vice President JD Vance and then visited the U.S. Capitol on Tuesday, and is due back in Congress on Wednesday to meet with U.S. Senate leaders.

He told reporters after a meeting with the Republican House of Representatives Speaker Mike Johnson that while he did not think Israel's campaign in the Palestinian enclave was done, negotiators are "certainly working" on a ceasefire.

"We have still to finish the job in Gaza, release all our hostages, eliminate and destroy Hamas' military and government capabilities," Netanyahu said.

Shortly after Netanyahu spoke, Trump's special envoy to the Middle East, Steve Witkoff, said the issues keeping Israel and Hamas from agreeing had dropped to one from four and he hoped to reach a temporary ceasefire agreement this week.

"We are hopeful that by the end of this week, we'll have an agreement that will bring us into a 60-day ceasefire. Ten live hostages will be released. Nine deceased will be released," Witkoff told reporters at a meeting of Trump's Cabinet.

A delegation from Qatar, which has been hosting indirect talks between Israeli negotiators and the Hamas Palestinian militant group, met with senior White House officials for several hours before Netanyahu's arrival on Tuesday, Axios reported, citing a source familiar with the details.

The White House had no immediate comment on the report.

The Gaza war erupted when Hamas attacked southern Israel in October 2023, killing around 1,200 people and taking 251 hostages, according to Israeli figures. Some 50 hostages remain in Gaza, with 20 believed to be alive.

Israel's retaliatory war in Gaza has killed over 57,000 Palestinians, according to the enclave's health ministry. Most of Gaza's population has been displaced by the war and nearly half a million people are facing famine within months, according to United Nations estimates.

Trump had strongly supported Netanyahu, even wading into domestic Israeli politics by criticizing prosecutors over a corruption trial against the Israeli leader on bribery, fraud and breach-of-trust charges that Netanyahu denies.

In his remarks to reporters at the U.S. Congress, Netanyahu praised Trump, saying there has never been closer coordination between the U.S. and Israel in his country's history.

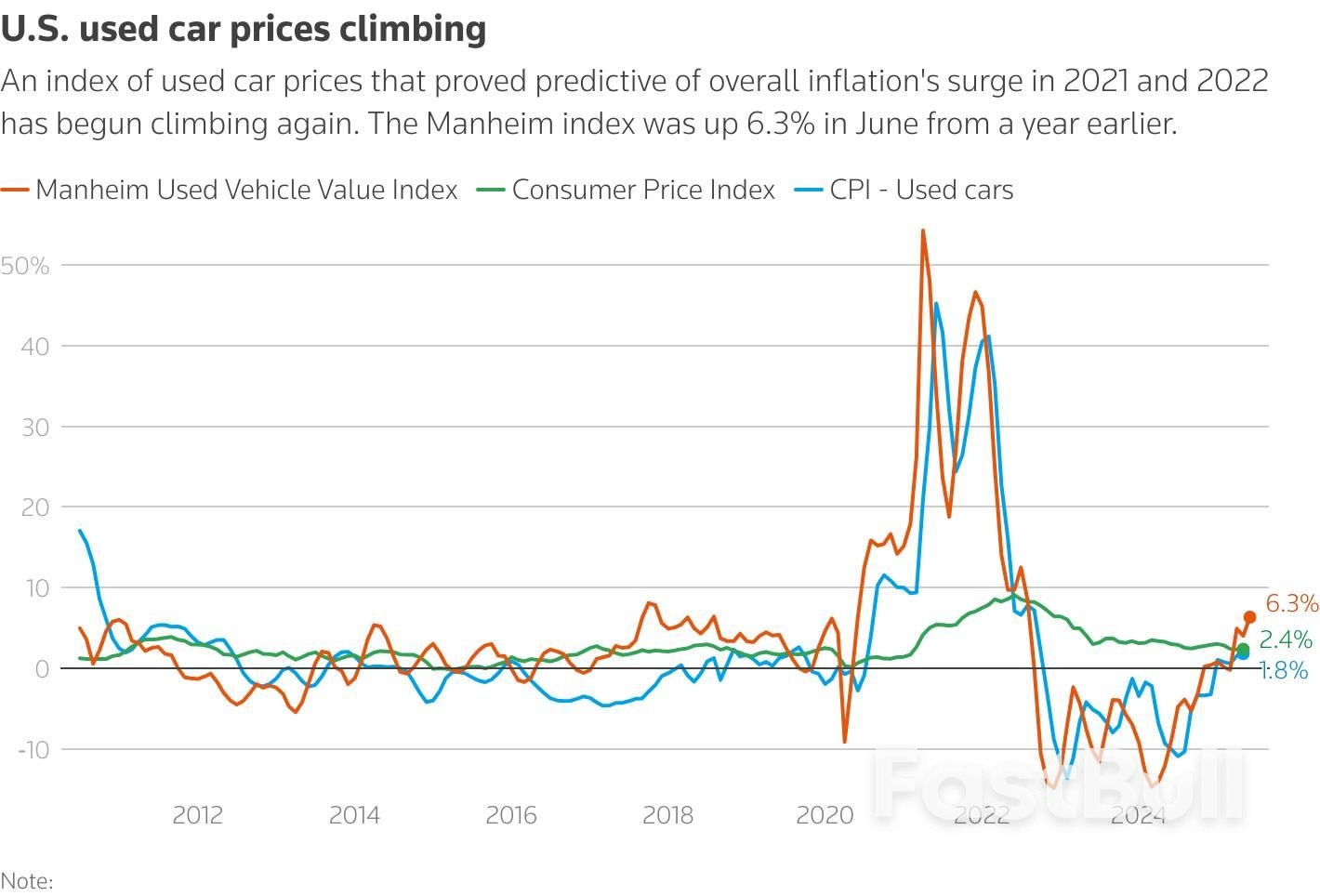

A gauge of U.S. used vehicle prices sold at wholesale auctions that proved predictive ahead of the inflation surge following the COVID pandemic is climbing again, last month notching its largest annual increase in nearly three years.

The rise comes amid ongoing vehicle price and sales volatility connected to auto tariffs imposed by President Donald Trump.

The Manheim Used Vehicle Value Index rose 1.6% in June from May on a seasonally adjusted basis and surged 6.3% from a year earlier, the largest year-over-year increase since August 2022, according to data released on Tuesday. At 208.5, the index has been trending upward for a year and is now at its highest since October 2023.

“Wholesale appreciation trends have been more volatile over Q2 as tariffs really impacted new sales and supply, which impacted the used marketplace as well,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive, which provides the index.

Price pressures typically ease in the second half of the year, but Robb said retail vehicle sales remain "a bit hotter than prior years" and the supply of vehicles coming off lease into the used-car market has been trending downward, "two factors which should be fairly supportive of higher values as we move onward.”

Trump's 25% tariff on imported autos prompted a surge in new vehicle-buying during the early spring as consumers sought to front-run anticipated price increases from the levies. Sales fell off substantially in May and dropped again in June.

Overall inflation has so far defied the predictions of most economists, but many Federal Reserve officials remain convinced some sort of price surge will follow and are hesitant to cut interest rates until satisfied that risk has passed.

Manheim's index in recent years has caught the eye of private economists and some Fed officials who saw it as among the early indicators auguring for a more substantial, and long-lasting, bout of inflation as the economy emerged from the pandemic in 2021 and 2022.

The index began a sharp climb in late 2020 that persisted for more than a year. By mid-2022, overall U.S. inflation as measured by the Consumer Price Index had topped 9% and was the highest since the 1980s.

Fed Governor Christopher Waller in the fall of 2021 warned against "selectively ignoring data series - be it used car prices, food and energy prices or household surveys of inflation expectations. All of these series convey important information about the evolution of inflation, and one should exhibit caution in dismissing data as outliers."

At the time, Waller was building the case for interest rate hikes to combat still-building inflation that some of his colleagues considered "transitory."

Now, though, Waller, who is viewed to be among those Trump is considering as a successor to Fed Chair Jerome Powell, appears more concerned the tariff increases will hurt demand rather than stoke another lasting bout of inflation. Waller said recently he was open to cutting rates as early as the Fed's meeting later in July.

Handing President Donald Trump another victory, the U.S. Supreme Court gave the go-ahead on Tuesday for his administration to pursue mass federal job cuts potentially numbering in the hundreds of thousands and the restructuring of numerous agencies.

Workforce reductions are being planned by the administration at the U.S. Departments of Agriculture, Commerce, Health and Human Services, State, Treasury, Veterans Affairs and more than a dozen other agencies.

The Supreme Court lifted San Francisco-based U.S. District Judge Susan Illston's May 22 order that blocked large-scale federal layoffs called "reductions in force" while litigation in the case proceeds.

White House spokesperson Harrison Fields welcomed the court's action, calling it "another definitive victory for the president and his administration" that reinforced Trump's authority to implement "efficiency across the federal government."

The Supreme Court in recent months has sided with Trump in several cases that were acted upon on an emergency basis since he returned to office in January including clearing the way for implementation of some of his hardline immigration policies. In addition, Trump last week also claimed the biggest legislative win of his second presidential term with congressional passage of a massive package of tax and spending cuts.

The court, in a brief unsigned order on Tuesday, said Trump's administration was "likely to succeed on its argument that the executive order" and a memorandum implementing his order were lawful. The court said it was not assessing the legality of any specific plans for layoffs at federal agencies.

Liberal Justice Ketanji Brown Jackson was the sole member of the nine-person court to publicly dissent from the decision. Jackson wrote that Illston's "temporary, practical, harm-reducing preservation of the status quo was no match for this court's demonstrated enthusiasm for greenlighting this president's legally dubious actions in an emergency posture."

Trump in February announced "a critical transformation of the federal bureaucracy" in an executive order directing agencies to prepare for a government overhaul aimed at significantly reducing the federal workforce and gutting offices and programs opposed by his administration.

A group of unions, non-profits and local governments that sued to block the administration's mass layoffs said Tuesday's Supreme Court ruling "dealt a serious blow to our democracy and puts services that the American people rely on in grave jeopardy."

"This decision does not change the simple and clear fact that reorganizing government functions and laying off federal workers en masse haphazardly without any congressional approval is not allowed by our Constitution," the plaintiffs said in a statement, adding that they would "continue to fight on behalf of the communities we represent."

Illston had ruled that Trump exceeded his authority in ordering the government downsizing.

"As history demonstrates, the president may broadly restructure federal agencies only when authorized by Congress," Illston wrote.

The judge's ruling was the broadest of its kind against the government overhaul being pursued by Trump and the Department of Government Efficiency, a key player in the Republican president's drive to slash the federal workforce.

Formerly spearheaded by billionaire Elon Musk, DOGE has sought to eliminate federal jobs, shrink and reshape the U.S. government and root out what they see as wasteful spending. Musk formally ended his government work on May 30 and subsequently had a public falling out with Trump.

The judge blocked the agencies from carrying out mass layoffs and limited their ability to cut or overhaul federal programs. Illston also ordered the reinstatement of workers who had lost their jobs, though she delayed implementing this portion of her ruling while the appeals process plays out.

Don Moynihan, a public policy professor at the University of Michigan, said the Supreme Court's decision allows Trump to move forward with mass firings of federal workers, without adjudicating the legality of those layoffs.

"These are not minor reductions in force," Moynihan said. "Trump has made clear he wants a major downsizing of the federal government. The court is willing to let him move forward and do severe and irreparable damage to public services."

Americans narrowly favor on Trump's campaign to downsize the federal government, with about 56% saying they supported the effort and 40% opposed, according to April Reuters/Ipsos polling. Their views broke down along party lines with 89% of Republicans, but just 26% of Democrats, supportive.

The San Francisco-based 9th U.S. Circuit Court of Appeals in a 2-1 ruling on May 30 denied the administration's request to halt the judge's ruling. That prompted the Justice Department's June 2 emergency request to the Supreme Court to halt Illston's order.

"The Constitution does not erect a presumption against presidential control of agency staffing, and the president does not need special permission from Congress to exercise core Article II powers," the Justice Department told the court, referring to the constitution's section delineating presidential authority.

Allowing the Trump administration to move forward with its "breakneck reorganization," the plaintiffs told the court, would mean that "programs, offices and functions across the federal government will be abolished, agencies will be radically downsized from what Congress authorized, critical government services will be lost and hundreds of thousands of federal employees will lose their jobs."

The Supreme Court in recent months has let Trump's administration resume deporting migrants to countries other than their own without offering them a chance to show the harms they could face and end temporary legal status previously granted on humanitarian grounds to hundreds of thousands of migrants.

In addition, it has allowed Trump to implement his ban on transgender people in the U.S. military, blocked a judge's order for the administration to rehire thousands of fired employees, twice sided with DOGE and curbed the power of federal judges to impose nationwide rulings impeding presidential policies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up