Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Sides look to get Geneva trade pact back on track; Inclusion of US official Lutnick signals importance of rare earths; Geneva deal had fostered a global relief rally in stocks.

Top U.S. and Chinese officials were due to meet in London on Monday for talks aimed at defusing the high-stakes trade dispute that has widened in recent weeks beyond tit-for-tat tariffs to export controls over goods critical to global supply chains.

Officials from the two superpowers were due to meet at the ornate Lancaster House to try to get back on track with a preliminary agreement struck last month in Geneva that had briefly lowered the temperature between Washington and Beijing.

The talks, which were due to start around 1130 GMT on Monday, come at a crucial time for both economies, with investors looking for some relief from U.S. President Donald Trump's cascade of tariff orders since his return to the White House in January.

"The next round of trade talks between the U.S. and China will be held in the UK on Monday," a UK government spokesperson said on Sunday. "We are a nation that champions free trade and have always been clear that a trade war is in nobody’s interests, so we welcome these talks."

Gathering there will be a U.S. delegation led by Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer, and a Chinese contingent helmed by Vice Premier He Lifeng.

In Geneva the two sides agreed to reduce steep import taxes on each other's goods that had had the effect of erecting a trade embargo between the world's No. 1 and 2 economies, but U.S. officials in recent weeks accused China of slow-walking on its commitments, particularly around rare earths shipments.

The inclusion of Lutnick, whose agency oversees export controls for the U.S., is one indication of how central rare earths has become. He did not attend the Geneva talks, at which the countries struck a 90-day deal to roll back some of the triple-digit tariffs they had placed on each other.

The second round of meetings comes four days after Trump and Chinese leader Xi Jinping spoke by phone, their first direct interaction since Trump's January 20 inauguration.

During the more than one-hour-long call, Xi told Trump to back down from trade measures that roiled the global economy and warned him against threatening steps on Taiwan, according to a Chinese government summary.

But Trump said on social media the talks focused primarily on trade led to "a very positive conclusion," setting the stage for Monday's meeting in London.

The next day, Trump said Xi had agreed to resume shipments to the U.S. of rare earths minerals and magnets. China's decision in April to suspend exports of a wide range of critical minerals and magnets upended the supply chains central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.

"We want China and the United States to continue moving forward with the agreement that was struck in Geneva," White House spokeswoman Karoline Leavitt told the Fox News program "Sunday Morning Futures" on Sunday. "The administration has been monitoring China's compliance with the deal, and we hope that this will move forward to have more comprehensive trade talks."

The preliminary deal in Geneva sparked a global relief rally in stock markets, and U.S. indexes that had been in or near bear market levels have recouped the lion's share of their losses.

The S&P 500 Index, which at its lowest point in early April was down nearly 18% after Trump unveiled his sweeping "Liberation Day" tariffs on goods from across the globe, is now only about 2% below its record high from mid-February. The final third of that rally followed the U.S.-China truce struck in Geneva.

Still, that temporary deal did not address broader concerns that strain the bilateral relationship, from the illicit fentanyl trade to the status of democratically governed Taiwan and U.S. complaints about China's state-dominated, export-driven economic model.

While the UK government will provide a venue for Monday's discussions, it will not be party to them but will have separate talks later in the week with the Chinese delegation.

The dollar slipped against all major currencies on Monday as investors waited for news, while oil prices were little changed.

One argument made for President Donald Trump’s tariffs is that they give him leverage over other countries. But what happens when signs emerge that his leverage is a diminishing asset?

It’s a very real and immediate question. As US and Chinese negotiators gather in London on Monday it’s hard to make the case the US has the strengthening hand. Or that Trump’s bargaining position is about to improve.

Ever since April 2 and the Rose Garden rollout of his “Liberation Day” tariffs, Trump’s been engaged in tactical retreats.

You can argue those have all been in support of the ultimate strategic aim — erecting a tariff wall around the US. But they’ve also come at a cost to Trump’s credibility in negotiations.

That was before a US court ruled those tariffs were illegal, raising the very real prospect the new import taxes at the center of his strategy will eventually be defunct. Even if Trump manages to piece together some more duties using other available authorities, that will take time. And as time passes, leverage evaporates.

In financial markets the president’s weakening position is manifested in the now infamous TACO — ‘Trump always chickens out’ — trade. If equities markets are up, it holds, it’s not because of Trump’s policies. It’s because he always backs down from the most extreme version of them. Which implies less revolution, or economic damage, and therefore higher valuations.

There’s a good chance investors underestimate the damage remaining tariffs will do, or the weakness in the US and global economies in which uncertainty is causing companies to hit the brakes on investment and hiring.

It’s still early. But as Jason Miller, a Michigan State University supply chains expert, pointed out last week, US trade data is already signaling alarming things. The US in April exported a fifth as many cars from Michigan to Canada as it did in a normal month in 2024, by his calculations. Which is not a good omen for Michigan autoworkers.

A weaker economy provides less leverage for Trump in negotiations with other countries, especially if his own policies cause the slowdown. Which may be one reason he is applying so much pressure on Jerome Powell and the Federal Reserve to cut rates. And why Republicans are so eager to pass a tax bill that is prompting growing fiscal concerns in the markets and turning routine bond auctions into meaningful tests.

But the biggest sign of Trump’s diminishing power lies in those negotiations with China.

The talks that kick off Monday in London continue a conversation begun in Geneva last month that led to a de-escalation of tariffs sitting at blockade levels.

They are proceeding after a period of growing alarm in the US, Asia and Europe about Chinese export controls over rare earths used in magnets. China’s slow approval of export licenses led to meaningful production slowdowns. More importantly, it served as a reminder of Chinese leverage. And led to a call between Trump and China’s Xi Jinping that Chinese readouts pointed out came at Trump’s request and led to this week’s encounter.

For both sides the incentive is to keep talking. But whether the talks will lead somewhere meaningful is unlikely to be clear for weeks or even months.

All this is also coming as the clock ticks on Trump’s negotiations with other countries, which face a self-imposed July 9 deadline.

Trump’s tariffs, the White House likes to say, have forced the world to come visit America’s negotiating table. But so far, as Bloomberg’s Josh Wingrove wrote Friday, the evidence is scant that meaningful deals are really coming.

The location of these latest talks between the US and China is a reminder of that. A much-touted agreement with the UK, which until now is the closest Trump has come to landing a new pact, turned out really to be a sketch of what talks might lead to.

In the coming days US tanks are due to parade through the streets of Washington in a showcase of American military might. After which Trump will head to a summit of G-7 leaders in Canada, where he will be eager to project more strength and will undoubtedly command the most attention. It’s just not clear Trump will enter those meetings with fellow G-7 leaders with as much leverage as he had even a few weeks ago.

Citi analysts said they raised their year-end 2025 S&P 500 target to 6300, driven by "a marginally more constructive fundamental view and an expectation for persistency of the current valuation backdrop."

Looking further ahead, the bank’s mid-2026 target of 6500 implies a high-single-digit percentage upside over the next twelve months, underscoring their "structural bullishness on U.S. large cap."

Citi maintains a preference for growth stocks, as the artificial intelligence (AI) theme continues to gain momentum.

The first half of 2025 saw a "whipsaw" market, according to Citi. Their initial expectation for a flat first half followed by a stronger second half was challenged in April, when tariff risks led to a target downgrade.

However, a subsequent rally, fueled by Q1 results and renewed confidence in the AI trade, demonstrated "broader confidence in corporate adaptability and, with it, fundamental stability."

Citi’s revised S&P 500 base case of 6300 for year-end 2025 and 6500 for mid-2026 effectively brings them back to their initial directional outlook for the year.

They have also increased their full-year index earnings estimate to $261 from a previous $255. While this remains below the initial $270 projection and the current $264 consensus, Citi notes that "as worst-case tariff impacts are negated, a modestly higher terminal multiple is applied."

Regarding valuation, Citi acknowledges that the S&P 500 is trading "toward the higher end of its historic valuation range," but they "presume the index can hold 21x forward."

Citi also highlights an "ongoing structural shift in earnings contribution away from Cyclicals and toward Growth," which provides context for historical valuation comparisons.

Citi notes that while concerns persist regarding consumption trends and policy implications on rates/currency, the “AI trade seems to be gaining renewed momentum.”

Bitcoin could be on the verge of a massive breakout, according to popular crypto analyst Doctor Profit, who predicts a potential price surge of up to 170% in the coming months. With a Golden Cross formation, key support near $100K, and a pivotal CPI inflation report just days away, the market may be heading for explosive gains.

At the start of June, Bitcoin was trading at $104,588.85, but briefly dipped 4.10% between June 3–5. However, it bounced back sharply from $100,400 on June 6, rising 2.74% in a single day. Since then, BTC has gained another 5.07%, currently sitting around $106,663.68.

Doctor Profit shared on X (formerly Twitter) that Bitcoin is attempting to break a diagonal resistance line—a move he believes could launch BTC into a new all-time high soon.

“A confirmed Golden Cross and strong $100K support signal a bullish breakout. BTC could rise 70–170% if macro factors align,” he wrote.

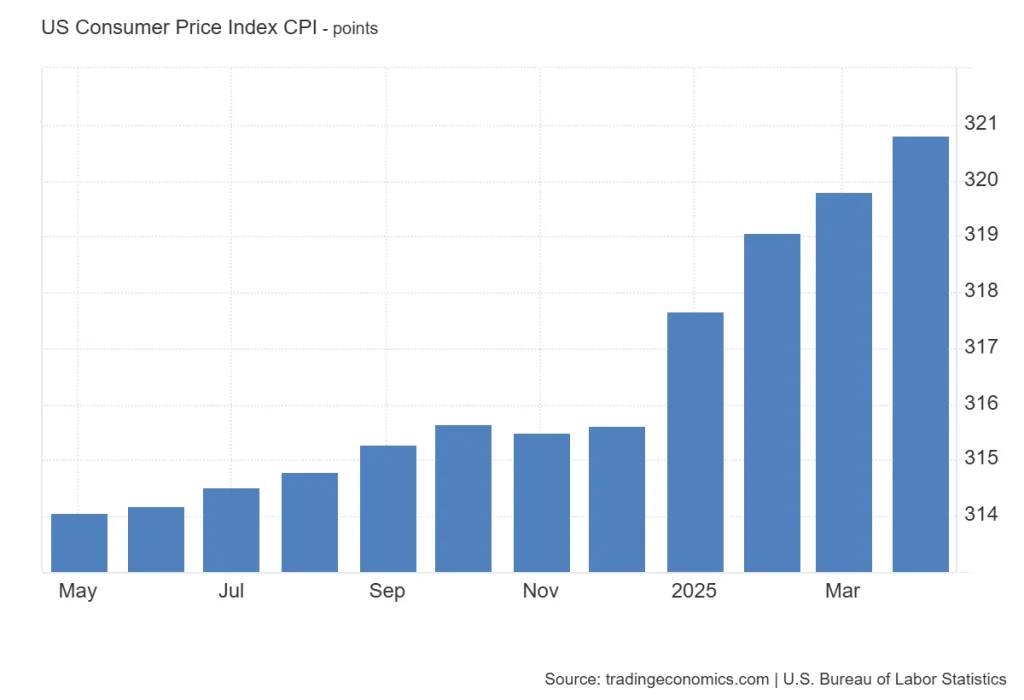

All eyes are on the U.S. Consumer Price Index (CPI) data release scheduled for June 11, 2025. In April, CPI rose from 319.799 to 320.795 points. This month, it's projected to reach 321.9, according to TEForecast.

More importantly, the U.S. inflation rate, which dropped to 2.3% in April, is expected by Wall Street to rise slightly to 2.5%. However, Doctor Profit believes the number could surprise to the downside—possibly between 2.1% and 2.3%. A lower-than-expected CPI could spark optimism, increasing chances of a Fed rate cut—a bullish catalyst for Bitcoin.

Doctor Profit also notes a liquidity cluster between $108K and $110K, which may be BTC's next short-term target before a bigger breakout. If Bitcoin pushes through that zone, it could open the path for a sustained rally.

The European Central Bank is likely to continue cutting interest rates in the second half of 2025, according to analysts at Barclays.

Despite President Christine Lagarde’s signal that the current monetary easing cycle may be nearing its end, Barclays expects two additional 25-basis-point reductions at the ECB’s September and December meetings. This would bring the deposit facility rate down to 1.5% by year-end.

At its June meeting, the ECB lowered policy rates by 25 basis points, citing lower inflation projections.

However, Lagarde struck a more hawkish tone than expected, stating, “We are getting to the end of the monetary policy cycle,” and dismissed inflation undershoots in 2026 as largely driven by energy prices and currency effects.

Barclays analysts believe that, despite the rhetoric, a majority on the Governing Council will support further easing based on current economic and inflation data.

Headline inflation dropped to 1.9% year-on-year in May, below the ECB’s 2% medium-term target. Core inflation also eased, falling to 2.3% from 2.7% the previous month.

Services inflation saw a notable decline, partly reversing holiday-related price spikes. Barclays’ inflation tracker projects headline inflation will stay below target through 2026, bottoming at 1.4% in early 2026 and settling at 1.7% later that year. This path is broadly consistent with updated ECB staff forecasts.

On the growth front, euro area GDP expanded 0.6% quarter-on-quarter in the first quarter, but this figure was inflated by a 9.7% surge in Irish GDP, which reflects multinational activity rather than domestic demand.

Excluding Ireland, the euro area grew 0.3%. Barclays noted that the boost from U.S. firms’ front-loading purchases ahead of tariffs, which temporarily lifted exports, is already fading.

Recent data suggest a slowdown in activity. April industrial production declined across Germany, France and Spain, while factory orders in Germany rose only on the back of strength in two volatile sectors.

Services and retail data were more stable, and the unemployment rate fell slightly in April. Still, Barclays sees overall momentum as weak.

Barclays also questioned the ECB’s baseline growth assumptions, which remain unchanged for 2025 at 0.9% and were revised only slightly downward for 2026.

Analysts said these appear optimistic in light of persistent economic headwinds and delays in fiscal stimulus, especially in Germany, where tax reforms and infrastructure spending are expected to have more impact after 2027.

While the ECB maintains a meeting-by-meeting approach, Barclays sees sufficient evidence for continued policy easing.

Analysts argue that the projected inflation undershoot, combined with fragile growth, supports further rate cuts even if the central bank refrains from signaling them in advance.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up