Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The latest report on the ADP Nonfarm Employment Change was released today, revealing a significant shortfall in the number of jobs...

The latest report on the ADP Nonfarm Employment Change was released today, revealing a significant shortfall in the number of jobs created in the non-farm private sector. The actual figure came in at 62,000, a number considerably lower than the predicted 114,000.

This unexpected drop in job creation is a stark contrast to the forecasted figure. Economists had projected an increase of 114,000, indicating a healthy growth in the private sector. However, the actual data fell short by 52,000 jobs, painting a less rosy picture of the U.S. employment landscape.

Comparatively, this month’s data also shows a notable dip when compared to the previous month. The previous ADP Nonfarm Employment Change report had recorded a healthier 147,000 job additions. This means that compared to the previous month, the number of jobs created in the non-farm private sector has decreased by 85,000.

The ADP National Employment Report is a significant indicator of the health of the U.S. economy, providing an early snapshot of the country’s employment situation two days ahead of government data. Based on the payroll data of approximately 400,000 U.S. business clients, it measures the monthly change in non-farm, private employment.

The lower than expected reading is likely to be interpreted as bearish for the U.S. Dollar (USD), as it indicates a slowdown in job creation in the non-farm private sector. This could potentially influence the Federal Reserve’s decision-making regarding interest rates and monetary policy.

While it’s important to note that this indicator can be very volatile, the significant shortfall in job creation is a potential cause for concern. It underscores the challenges facing the U.S. economy in its efforts to recover and grow, and it may signal the need for more robust measures to stimulate job growth.

Ukraine is ready to sign a natural resources deal with the US, a person familiar with the matter said, in a move that could bolster Washington’s support for Kyiv by strengthening their economic partnership.

The draft agreement, which envisages creating a joint fund to manage Ukraine’s investment projects, has been finalised and may be signed as soon as Wednesday, the person said, speaking on condition of anonymity because the talks are private. Ukrainian Economy Minister Yulia Svyrydenko is on her way to Washington for the signing, they said.

As part of the agreement, the US and Ukraine will seek to create the conditions to “increase investment in mining, energy, and related technology in Ukraine,” according to the draft of the document seen by Bloomberg News. Washington also acknowledges Kyiv’s intentions for the deal to avoid any conflict with its plans to join the European Union — long seen as a red line for Ukraine in the talks.

In another breakthrough, the US has agreed that only future military assistance it may provide to Ukraine following the signing of the deal would count toward its contribution to the fund, according to the document. Ukrainian Prime Minister Denys Shmyhal said Sunday that Washington had dropped its insistence on the inclusion in the deal of the tens of billions of dollars in aid delivered since the start of Russia’s invasion.

The signing could come as President Donald Trump grows increasingly frustrated over delays in clinching a ceasefire in the war, currently in its fourth year. He has questioned whether Russian President Vladimir Putin is willing to make progress toward a peace plan that Trump sought to deliver within the first 100 days of his new administration. Trump is “confident” a deal on critical minerals will be signed with Ukraine, the White House said on Tuesday.

The agreement “strengthens the strategic partnership between the parties for the long-term reconstruction and modernisation of Ukraine, in response to the large-scale destruction caused by Russia’s full-scale invasion”, according to the document.

Two other technical accords that will determine how the joint fund is going to operate have yet to be finalised, the person said.

The US Treasury Department spokesperson didn’t immediately respond to a request for a comment.

US and Ukrainian officials signed a memorandum of intent earlier in April and continued to hash out the technical details of the deal, which would grant the US first claim on profits transferred into a special reconstruction investment fund that would be controlled by Washington.

A previous attempt to clinch the agreement fell through earlier this year after Ukrainian President Volodymyr Zelenskiy clashed with Trump and Vice President JD Vance in the Oval Office. Zelenskiy met one-on-one with the US president at the Vatican on Saturday before the funeral of Pope Francis.

Russia intensified its attacks across Ukraine’s frontline and several cities overnight, as the Kremlin takes a maximalist line in peace negotiations brokered by the US. While Trump envoy Steve Witkoff sought to persuade Putin that Russia should agree to a ceasefire that halts fighting along the current frontlines, the Russian leader insisted Moscow must take full control of four regions of Ukraine which it claims but doesn’t fully occupy, Bloomberg News reported.

White House Press Secretary Karoline Leavitt reiterated on Tuesday that Trump was getting frustrated with the difficulty of getting both Ukraine and Russia to agree to a peace deal, but that “he remains optimistic that we can get this done”.

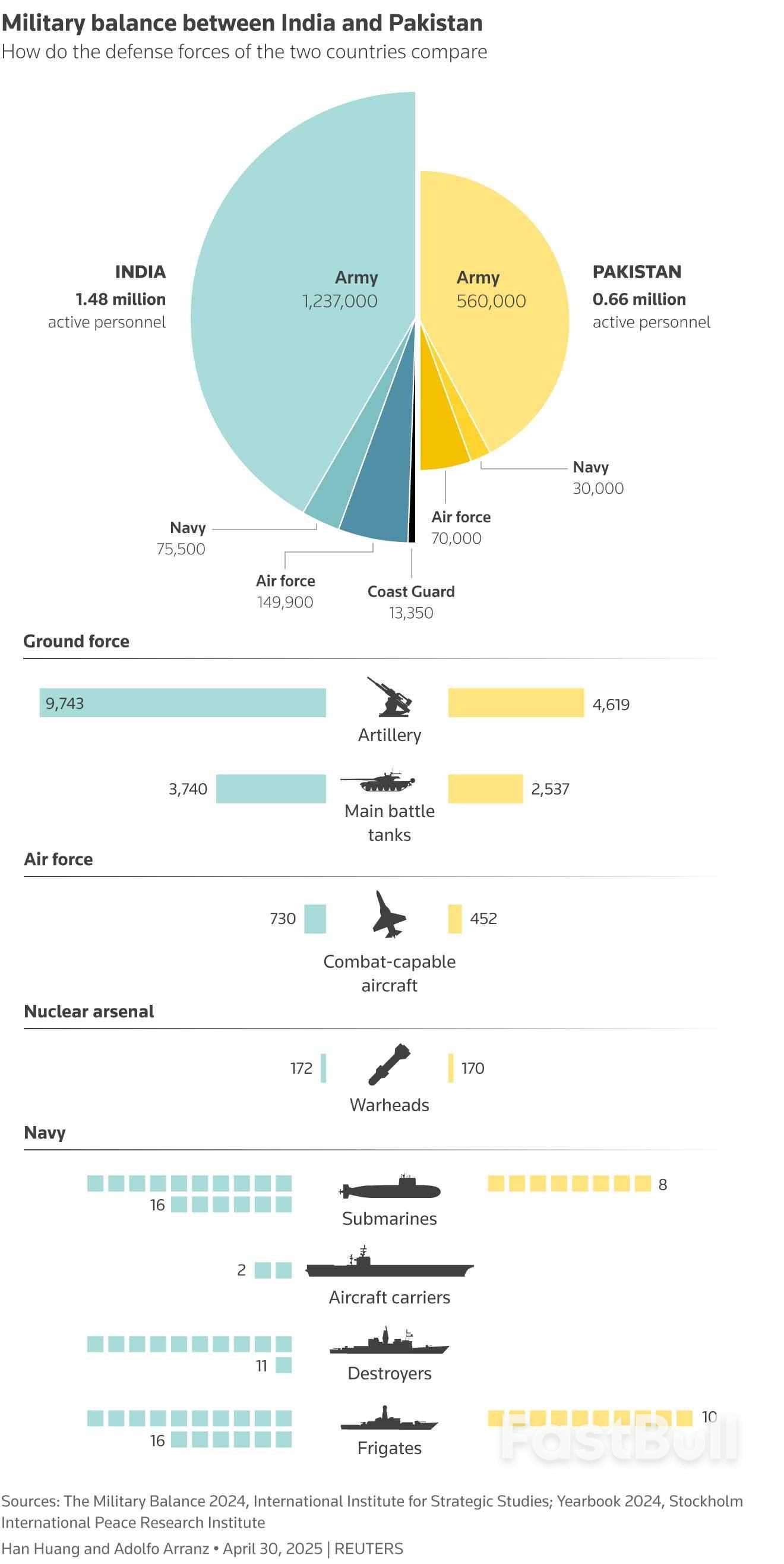

An attack targeting Hindu tourists in Indian Kashmir that killed 26 men has triggered new tensions between India and Pakistan and sparked fears of a conflict, with Pakistan saying it has intelligence suggesting India intends to launch military action.

Here is a look at the defence forces and arsenals of the nuclear-armed South Asian neighbours, according to data from the London-based International Institute for Strategic Studies.

PERSONNEL

India has 1.4 million active personnel in its defence forces - 1,237,000 in the army, 75,500 in the navy, 149,900 in the air force, and 13,350 in the coast guard.

Pakistan's strength is thinner, with under 700,000 personnel, of whom 560,000 are in the army, 70,000 in the air force, and 30,000 in the navy.

GROUND FORCE

India's arsenal includes 9,743 pieces of artillery against Pakistan's 4,619 pieces, and 3,740 main battle tanks compared to Pakistan's 2,537.

AIR FORCE

While India has 730 combat-capable aircraft, Pakistan's fleet is much smaller at 452 aircraft.

NAVY

India's navy has 16 submarines, 11 destroyers, 16 frigates, and two aircraft carriers, while Pakistan's navy has eight submarines and 10 frigates.

NUCLEAR ARSENAL

India has 172 warheads and Pakistan boasts of almost an equal number, with 170.

President Vladimir Putin is open to peace in Ukraine and intense work is going on with the United States, but the conflict is so complicated that the rapid progress that Washington wants is difficult to achieve, the Kremlin said on Wednesday.

U.S. President Donald Trump, who says he wants to be remembered as a peacemaker, has repeatedly said he wants to end the "bloodbath" of the more than three-year war in Ukraine.

But Washington has been signalling that it is frustrated by the failure of Moscow and Kyiv to reach terms to end the deadliest land war in Europe since World War Two.

"The (Russian) president remains open to political and diplomatic methods of resolving this conflict," Kremlin spokesperson Dmitry Peskov told reporters.

He noted that Putin had expressed a willingness for direct talks with Ukraine, but that there had been no answer yet from Kyiv.

Russia's aims had to be achieved either way, he added, saying Moscow's preference was to achieve those aims peacefully.

"We understand that Washington is willing to achieve a quick success in this process," Peskov said in English. But news agency TASS quoted Peskov as saying that the root causes of the Ukraine war were too complex to be resolved in one day.

Putin's decision to send tens of thousands of troops into Ukraine in 2022 triggered the worst confrontation between Moscow and the West since the 1962 Cuban Missile Crisis.

Former U.S. President Joe Biden, Western European leaders and Ukraine cast the invasion as an imperial-style land grab and repeatedly vowed to defeat Russian forces.

Putin casts the war as a watershed moment in Moscow's relations with the West, which he says humiliated Russia after the Soviet Union fell in 1991 by enlarging NATO and encroaching on what he considers Moscow's sphere of influence, including Ukraine.

Putin in March said that Russia supported a U.S. proposal for a ceasefire in Ukraine in principle, but that fighting could not be paused until a number of crucial conditions were worked out or clarified.

On Monday, Putin declared a three-day ceasefire in May to coincide with the 80th anniversary of the victory of the Soviet Union over the Nazis in World War Two.

Ukrainian President Volodymyr Zelenskiy has said that progress in resolving the war depended on Russia taking the first step of agreeing to an unconditional ceasefire.

Trump said on Tuesday he thought that Putin wants to stop the war in Ukraine, adding that if it was not for Trump Russia would try to take the whole of Ukraine.

"If it weren't for me, I think he'd want to take over the whole country," Trump said.

U.S. Secretary of State Marco Rubio said on Tuesday that now was the time for concrete proposals from Moscow and Kyiv to end the war and warned that the U.S. will step back as a mediator if there is no progress.

Trump refused to answer a question about whether the United States would halt military aid to Ukraine if Washington walked away from talks.

Reporting by Reuters; Writing by Guy Faulconbridge and Maxim Rodionov; editing by Andrew Osborn and Sharon Singleton

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up