Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Starlink systems used by Ukrainian military units were down for two and a half hours overnight, a senior commander said, part of a global issue that disrupted the satellite internet provider.

Starlink systems used by Ukrainian military units were down for two and a half hours overnight, a senior commander said, part of a global issue that disrupted the satellite internet provider.

Ukraine's forces are heavily reliant on thousands of SpaceX's Starlink terminals for battlefield communications and some drone operations, as they have proved resistant to espionage and signal jamming throughout the three and a half years of fighting Russia's invasion.

Starlink experienced one of its biggest international outages on Thursday when an internal software failure knocked tens of thousands of users offline."Starlink is down across the entire front," Robert Brovdi, the commander of Ukraine's drone forces, wrote on Telegram at 10:41 p.m. (1941 GMT) on Thursday.

He updated his post later to say that by about 1:05 a.m. on Friday the issue had been resolved. He said the incident had highlighted the risk of reliance on the systems, and called for communication and connectivity methods to be diversified."Combat missions were performed without a (video) feed, battlefield reconnaissance was done with strike (drones)," Brovdi wrote.

Oleksandr Dmitriev, the founder of OCHI, a Ukrainian system that centralises feeds from thousands of drone crews across the frontline, told Reuters the outage showed that relying on cloud services to command units and relay battlefield drone reconnaissance was a "huge risk"."If connection to the internet is lost ... the ability to conduct combat operations is practically gone," he said, calling for a move towards local communication systems that are not reliant on the internet.

Although Starlink does not operate in Russia, Ukrainian officials have said that Moscow's troops are also widely using the systems on the frontlines in Ukraine.

Key points:

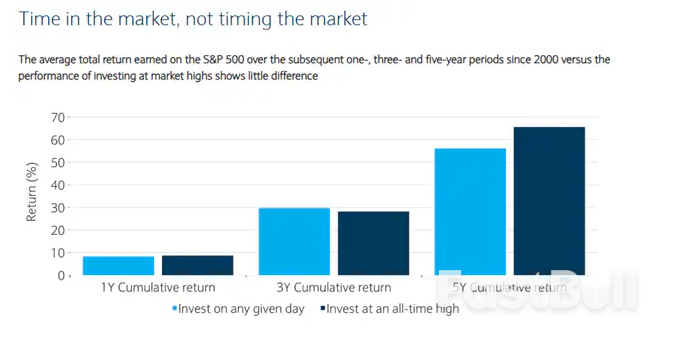

The myth of waiting for the perfect entryIn theory, “buy low, sell high” sounds perfect. In practice, most investors struggle to do either.In fact, if you only invested on days when the S&P 500 hit an all-time high, your long-term returns would often be higher than if you invested on any random day.

That’s because record highs typically happen during bull markets, and bull markets tend to last longer than expected.The real challenge isn’t timing the market. It’s having a strategy that works when prices feel high, and sticking to it.

What to do instead: smart moves at market highs

Even when the overall market is rising, individual stocks and sectors often face short-term dips. Those can be opportunities.

What you can do:

While technology and AI stocks have led the charge, many parts of the market have lagged, and may offer better value and catch-up potential if the rally broadens out.

What to consider:

Market leadership today is shaped less by geography or sector, and more by macro forces like interest rates, trade policies, and geopolitical risk. Traditional diversification alone may not be enough. It’s time to think about how different parts of your portfolio respond to shifting policy and economic drivers.

How to position:

Even if some of these areas have gained attention recently, their relevance over the long term means they may still be underrepresented in many portfolios.

Waiting for the “perfect moment” to invest often leads to missed opportunities. Even when markets dip, fear and uncertainty can prevent action, leaving cash on the sidelines and long-term goals unmet.

What works better:

Buying at market highs can feel uncomfortable, but history shows that long-term investors are often rewarded for staying the course.If you diversify smartly, lean into underappreciated areas, and stay consistent with your investing plan, you won’t need to worry about whether you’re “too late.”Because long-term wealth isn’t built by picking the perfect moment.It’s built by showing up, again and again.

German business sentiment is still riding the wave of optimism. Even though we still see a large portion of wishful thinking, the seventh consecutive increase in Germany’s most prominent leading indicator remains remarkable. In July, the Ifo index came in at 88.6, slightly up from 88.4 in June, and stands now at its highest level since last summer. While expectations remained unchanged, the current assessment component finally improved, suggesting that growth in the third quarter could pick up again.

A wave of optimism seems to have caught the German economy, but it remains unclear whether it is really based on stronger fundamentals or just wishful thinking. It's probably a combination of both. And to be more precise, the wave of optimism has caught corporate life, not households. While the Ifo index looks almost unstoppable, consumer confidence has fallen for two months in a row and remains weak.

Returning to German businesses, there are several reasons for increasing optimism; after two years of inventory build-up and dropping orders, the inventory cycle started to turn for the better at the start of this year. Energy prices have come down from highly elevated levels, and the prospect of fiscal stimulus has played a role, too. In fact, German businesses seem to be focusing on the bright side of what could happen under the new German government, rather than fearing the downsides from ongoing uncertainty and trade tensions. And at least the optics of the new government are good. German businesses had grown disillusioned with the last government’s ongoing internal controversies. Now, the sheer fact that the new government has avoided big blunders like open controversies or erratic policy announcements and has begun to really implement the announced fiscal stimulus has boosted its popularity.

The latest episode in the government’s confidence-building was this week’s summit between the government and business leaders. An initiative of large German corporates, self-named ‘Made for Germany’, promised to invest €631bn over the next three years. While the headline figure looks impressive, only €100bn of that sum will actually be ‘new’ investments. The rest is previously planned investments. €100bn over three years equals some 0.7% GDP per year. Whether these investments will really reach the economy and how much crowding out of other investments will emerge remains to be seen, as does the question of whether these investments will materially boost innovation or new technologies.

In any case, just take a step back and remember where the German economy stood at the start of the year: completely in the doldrums with two years of recession, a huge investment gap and an economic business model that was up for a complete overhaul. Seven months later, there is a €500bn infrastructure fiscal stimulus, a ‘whatever it takes’ spending promise for defence, small tax incentives for private investments and a commitment by large corporates to step up investments. What a change!

Admittedly, there are still few signs of an overhaul of the country’s economic model, either in the government’s coalition agreement or in this week’s announcements by the ‘Made for Germany’ initiative. This increases the risk that all investments will lead to higher productivity. However, Germany had the deep fiscal pockets to avoid the policies it prescribed to many other eurozone countries during the euro crisis: structural reforms and austerity. Still, even with the deep pockets, Germany will have to address the weakness of its economic business model quickly. Investments can only be a first step and not the only step.

To be clear, the near-term outlook for the German economy will still be highly affected by the ongoing trade tensions, possible US tariffs and the stronger euro. It remains remarkable that German businesses seem to almost completely ignore these risks. This return of optimism could also get a cold shower next week when the first estimate of second-quarter GDP growth is released. Nevertheless, the longer-term outlook continues to improve. The jury is still out on whether money will be able to buy growth, but today's Ifo index once again shows that it can at least buy optimism.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up