Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Oct)

U.S. Average Hourly Wage MoM (SA) (Oct)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Oct)

U.S. Average Hourly Wage YoY (Oct)A:--

F: --

P: --

U.S. Retail Sales (Oct)

U.S. Retail Sales (Oct)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Oct)

U.S. Core Retail Sales MoM (Oct)A:--

F: --

U.S. Core Retail Sales (Oct)

U.S. Core Retail Sales (Oct)A:--

F: --

P: --

U.S. Retail Sales MoM (Oct)

U.S. Retail Sales MoM (Oct)A:--

F: --

U.S. Private Nonfarm Payrolls (SA) (Oct)

U.S. Private Nonfarm Payrolls (SA) (Oct)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Oct)

U.S. Average Weekly Working Hours (SA) (Oct)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Nov)

U.S. Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Retail Sales YoY (Oct)

U.S. Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Oct)

U.S. Manufacturing Employment (SA) (Oct)A:--

F: --

U.S. Government Employment (Nov)

U.S. Government Employment (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Dec)

U.S. IHS Markit Services PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Sept)

U.S. Commercial Inventory MoM (Sept)A:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Argentina GDP YoY (Constant Prices) (Q3)

Argentina GDP YoY (Constant Prices) (Q3)A:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Australia Westpac Leading Index MoM (Nov)

Australia Westpac Leading Index MoM (Nov)A:--

F: --

Japan Trade Balance (Not SA) (Nov)

Japan Trade Balance (Not SA) (Nov)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Nov)

Japan Goods Trade Balance (SA) (Nov)A:--

F: --

P: --

Japan Imports YoY (Nov)

Japan Imports YoY (Nov)A:--

F: --

P: --

Japan Exports YoY (Nov)

Japan Exports YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders YoY (Oct)

Japan Core Machinery Orders YoY (Oct)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Oct)

Japan Core Machinery Orders MoM (Oct)A:--

F: --

P: --

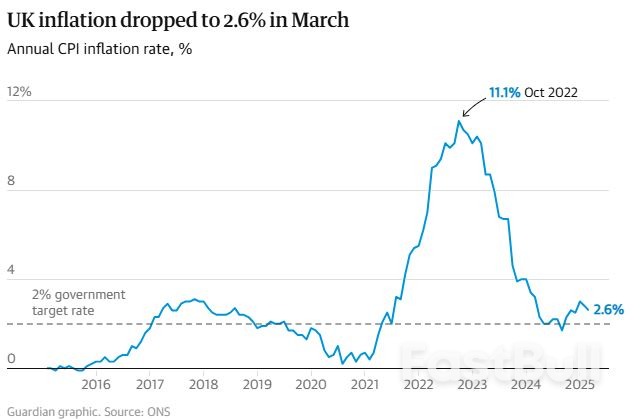

U.K. Core CPI MoM (Nov)

U.K. Core CPI MoM (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.K. Core Retail Prices Index YoY (Nov)

U.K. Core Retail Prices Index YoY (Nov)--

F: --

P: --

U.K. Core CPI YoY (Nov)

U.K. Core CPI YoY (Nov)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Nov)

U.K. Output PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Nov)

U.K. Output PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Nov)

U.K. Input PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. CPI YoY (Nov)

U.K. CPI YoY (Nov)--

F: --

P: --

U.K. Retail Prices Index MoM (Nov)

U.K. Retail Prices Index MoM (Nov)--

F: --

P: --

U.K. CPI MoM (Nov)

U.K. CPI MoM (Nov)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Nov)

U.K. Input PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Retail Prices Index YoY (Nov)

U.K. Retail Prices Index YoY (Nov)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)--

F: --

P: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US President Donald Trump has launched an investigation into critical minerals, signalling further tariffs in the natural resources sector.

Iran's right to enrich uranium is not negotiable, Foreign Minister Abbas Araqchi said on Wednesday, ahead of a second round of talks in Oman this weekend with the United States about Tehran's disputed nuclear programme.

Araqchi was responding to a comment made on Tuesday by the U.S. top negotiator Steve Witkoff, who said Tehran must "stop and eliminate its nuclear enrichment" to reach a deal with Washington.

"We have heard contradictory statements from Witkoff, but real positions will be made clear at the negotiating table," Araqchi said.

"We are ready to build trust regarding possible concerns over Iran's enrichment (of uranium), but the principle of enrichment is not negotiable."

Iran and the U.S. are due to hold a second round of talks in Oman on Saturday over Tehran's escalating nuclear programme, withPresident Donald Trumpthreatening military action if there is no deal.

Before the talks, Araqchi will deliver a message from Iran's Supreme Leader Ali Khamenei to Russian President Vladimir Putin on a trip to Russia, Iranian state media reported on Wednesday.

The Kremlin on Tuesday declined to comment when asked if Russia was ready to take control of Iran's stocks of enriched uranium as part of a possible future nuclear deal between Iran and the United States.

The Guardian reported that Tehran was expected to reject a U.S. proposal to transfer its stockpile of enriched uranium to a third country such as Russia as part of an agreement that Washington is seeking to scale back Iran's nuclear programme.

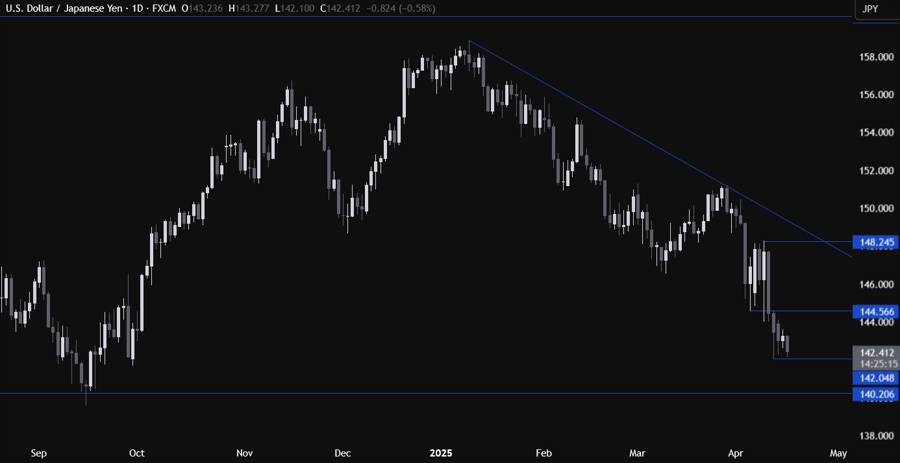

The USD remains underpressure against most major currencies although the fundamental backdropremains unclear. The most popular narrative is that everyone is selling USassets, and the greenback is losing its reserve status as a consequence of theaggressive trade war.

Such big claims aregenerally made at near term tops or bottoms, so it calls for caution. Anyway, that’s thetrend for now and we will need some catalyst to reverse it. Maybe positive newson trade negotiations front could see the market scale back the rate cutexpectations for the Fed and provide a relief rally for the greenback.

For now, we got just a couple of disappointing headlines with the US banning the sale of Nvidia chips to China and European officials suggesting that the tariffs could stay as negotiations stall. We will see how things will evolve in the next days and weeks.

On the JPY side, thecurrency has been driven mainly by global events rather than domesticfundamentals. It’s been supported more by the risk-off flows rather thaninterest rates expectations as the market doesn’t see the BoJ hiking ratesanymore this year. In fact, BoJGovernor Ueda today sounded like more tightening now is out of question andthe central bank might even resort to some easing in case things deterioratefurther.

On the daily chart, we cansee that USDJPY continues its downward trajectory towards the 140.00 handle. Ifthe price gets there, we can expect the buyers to step in with a defined riskbelow the level to position for a rally back into the major trendline. The sellers, on the other hand,will want to see the price breaking lower to increase the bearish bets into newlows.

On the 4 hour chart, we cansee that the price rolled back to the 142.05 low as the selling pressure returned.From a risk management perspective, the sellers will have a better risk toreward setup around the 144.56 level to position for further downside. Thebuyers, on the other hand, will want to see the price breaking above the 144.56level to start targeting a bigger pullback into the 148.25 level next.

On the 1 hour chart, we cansee that the recent low around the 142.00 handle has been holding up prettywell. This is where we can expect the buyers to step in with a defined riskbelow the level to position for a pullback into the 144.56 level. The sellers,on the other hand, will look for a break lower to increase the bearish betsinto the 140.00 handle next. The red lines define the average daily range for today.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up