Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Trump and his allies have intensified their criticism of Federal Reserve Chair Jerome Powell, focusing on a $2.5 billion renovation of the Fed’s headquarters as potential grounds for dismissal...

Japan's central bank may face political pressure to keep interest rates low for longer than it wants, as opposition parties favouring tax cuts and loose monetary policy are expected to gain influence after a July 20 election.

Opinion surveys suggest Prime Minister Shigeru Ishiba's coalition may lose its majority in the upper house of parliament, forcing it to court an array of smaller parties pushing for easier fiscal and monetary policy.

The governing bloc led by Ishiba's Liberal Democratic Party is already a minority in the more powerful lower house, so a stalemate in both chambers could give opposition parties outsized influence in policy decisions.

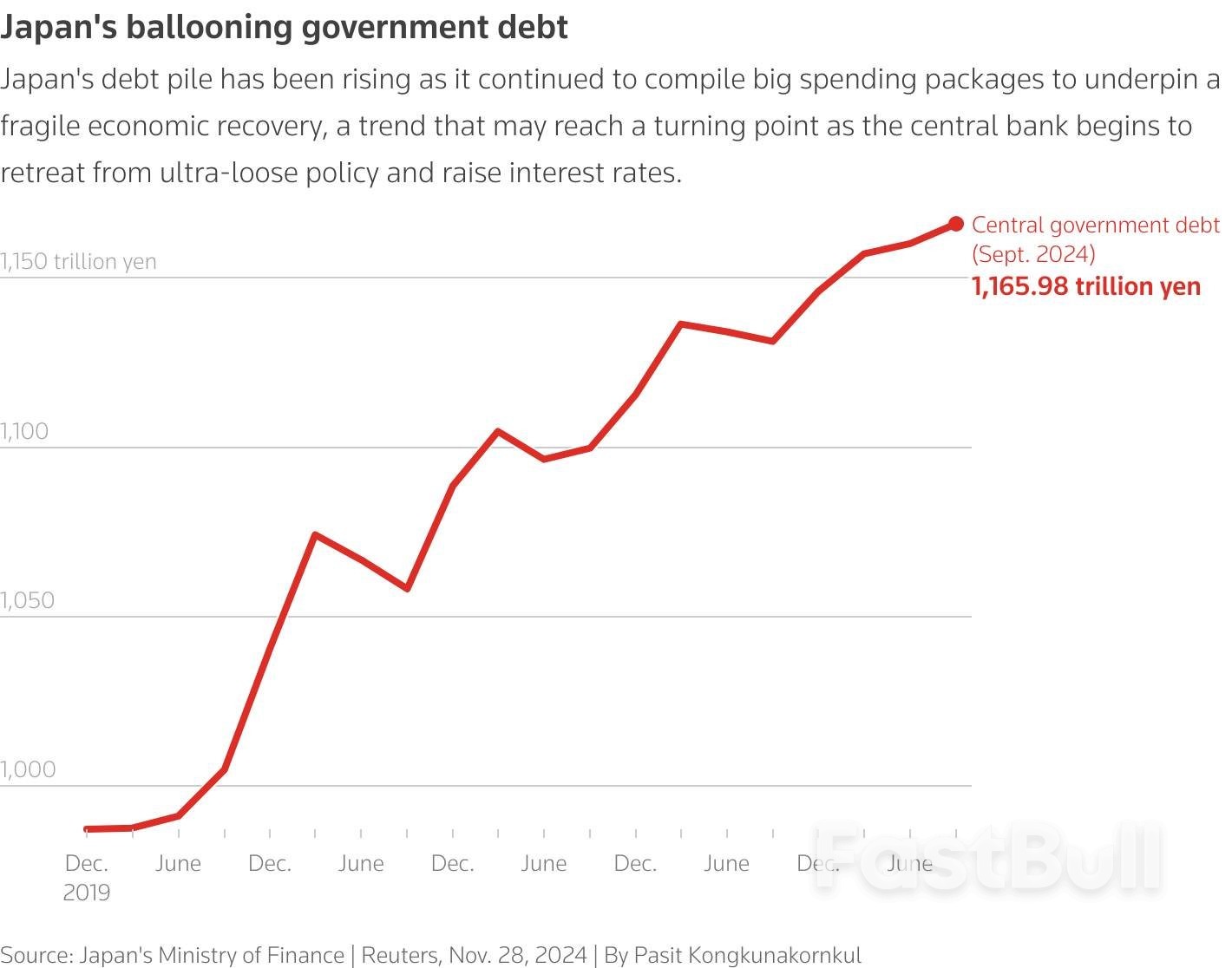

Ishiba has supported the Bank of Japan's policy of gradually lifting interest rates from near zero as inflation picks up in the world's fourth-biggest economy, while trying to curb the biggest government debt burden in the industrial world.

But if opposition groups gain traction with their pressure on the BOJ to avoid rate hikes and for the government to cut the sales tax, that could boost bond yields and complicate the bank's efforts to normalise monetary policy, some analysts say.

The BOJ declined to comment on the potential impact of the election on monetary policy.

"There's a 50% chance the ruling coalition could lose its majority in the upper house, which could lead to increased debate about cutting Japan's consumption tax rate," said Daiju Aoki, chief Japan economist at UBS SuMi Trust Wealth Management.

"That would push up Japan's long-term interest rates by stoking concern over the country's finances," he said.

Sohei Kamiya, head of the upstart right-wing party Sanseito, has criticised the BOJ for slowing its bond buying when the economy remains weak.

"The Ministry of Finance and BOJ should work hand in hand in taking aggressive steps for a few years to boost domestic demand," Kamiya told a press conference this month.

Another small group, the Japan Innovation Party, wants the BOJ to go slow in raising rates to restrain the cost of interest on the government's debt.

Yuichiro Tamaki, head of the Democratic Party for the People, a party seen as a strong candidate to join Ishiba's coalition, has urged the BOJ to loosen, not tighten, monetary policy to keep the yen from rising and hurting the export-reliant economy.

Even if the coalition keeps its majority, Ishiba may need to ditch his hawkish fiscal tilt and boost spending to cushion the economic blow from threatened U.S. tariffs and rising costs of living.

"There's a good chance the government will compile an extra budget to fund another spending package to the tune of 5 to 10 trillion yen ($35 billion-$70 billion). That would push up bond yields further," said former BOJ board member Makoto Sakurai, who expects the central bank to avoid raising rates at least until March.

Japan's public debt is equal to 250% of gross domestic product, far above that of Greece at 165%. The government spends nearly a quarter of its budget to finance a 1,164-trillion-yen ($7.9-trillion) debt pile, with the cost expected to rise steadily as the BOJ exits zero-interest rates.

To be sure, inflation - above the BOJ's 2% target for three years - boosts nominal tax revenues, which can help the government avoid ramping up bond issuance to fund further spending.

But cutting the sales tax rate, an idea Ishiba has ruled out for now, would leave a bigger hole in Japan's finances. Once a fringe idea, cutting the 10% sales tax is now among Japan's most popular economic policy proposals.

In a recent poll by the Asahi newspaper 68% of voters thought a sales tax cut was the best way to cushion the blow from rising living costs, compared with 18% who preferred cash payouts.

If the sales tax is on the chopping block after the election, it is the kind of vital issue that could prod Ishiba to dissolve the lower house and call a snap election - a move that would prolong political uncertainty.

If Ishiba were to step down, an LDP race to replace him could revive market attention to candidates like Sanae Takaichi, an advocate of aggressive monetary easing whom Ishiba narrowly beat in the party's leadership race last year.

Unlike Ishiba, who gave a quiet nod to BOJ policy normalisation, Takaichi has said it would be "stupid" for the central bank to raise rates.

All this would mean the BOJ's rate hikes, already on pause due to uncertainty over U.S. tariffs, could be put on hold even longer.

"We may need to brace for a long period of political uncertainty and market volatility," said Naomi Muguruma, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities.

"That would just give the BOJ another reason to sit on the sidelines and wait for the dust to settle."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up