Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US dollar trades at its weakest levels since late July ahead of Thursday’s CPI data. US treasury yields have already done some heavy lifting for USD bears, but apparently more needed to take the greenback to new cycle lows.

US dollar at the brink – but shouldn’t it already be lower still?The US dollar has weakened since last Thursday, with Friday’s weak August US jobs report sparking most of the move, as expectations for a 25-basis point cut at next week’s FOMC meeting firmed up and the odds of a 50-basis point cut, if still low, are rising. Thursday’s US August CPI print is the next event risk of note ahead of the FOMC meeting next Wednesday. The combination of lower treasury yields all along the US yield curve and at least stable risk sentiment should be the sweet spot for a weaker US dollar. But the recent focus on the very long end of global yield curves and whether further stress would prompt a policy response – seen needed first in Japan and the UK and even in France, has likely kept some residual safe haven bid in the US dollar that is offsetting much of the negative pressure on the currency. That’s a working theory, at least. For now, while the US bears are in control and the US dollar looks on the technical brink, visibility is poor unless we get a significant bid into global long bonds outside of the US – a bit more color on USDJPY in the look at the chart below.

The French Prime Minister Bayrou lost yesterday’s confidence vote in the National Assembly by a resounding margin, as widely expected, and President Macron looks set to appoint the fifth prime minister in two years, as he is seemingly running short of appropriate candidates for the unthankful position. Germany-France 10-year yield spreads have blown wider in early trading today to absorb the news, but are only a few basis points beyond the recent highs, currently at 82 basis points as of this writing, only about a single basis point higher than the highest daily close of the cycle from late August. France’s debt mountain remains a structural issue, but does it fade to a slow burn rather than sparking any imminent further uncertainty?

Chart: USDJPYTraditionally, the recent collapse in US 10-year yields would have driven a sharp sell-off in USDJPY, but the recent stress in bond yields at the longest end of the Japanese yield curve (the benchmark 30-year JGB hit all-time highs within the last week and is still only a few basis points below those highs, contrasting with the benchmark US 30-year yield, which has tumbled over 30 basis points from recent highs in the last few trading sessions). That tension of the divergence in well tamed US yields versus Japan’s long yields still suggesting uncomfortable pressure on the longest JGBs (in part also on political turmoil in Japan as the PM is resigning and the opposition is clamoring for more welfare spending) keeps the “normal” signals of lower US yields from driving the USD lower here. Technically, we are none the wiser here in either direction until we close south of perhaps 146.20 or above 149.15.

Source: Saxo

Source: SaxoLooking aheadAgain, we have the US August CPI data up tomorrow, with a benign figure likely to raise expectations for a 50-basis point rate cut next week from the FOMC. The technical situation for the US dollar looks pivotal here and possibly ready for a breakdown, with the only reservation that we have already seen so much that could have already driven the US dollar weaker still. AUDUSD is one of the closest USD pairs to a breakout – trading as high as 0.6615 today versus the high for the year at 0.6625 from back in July.

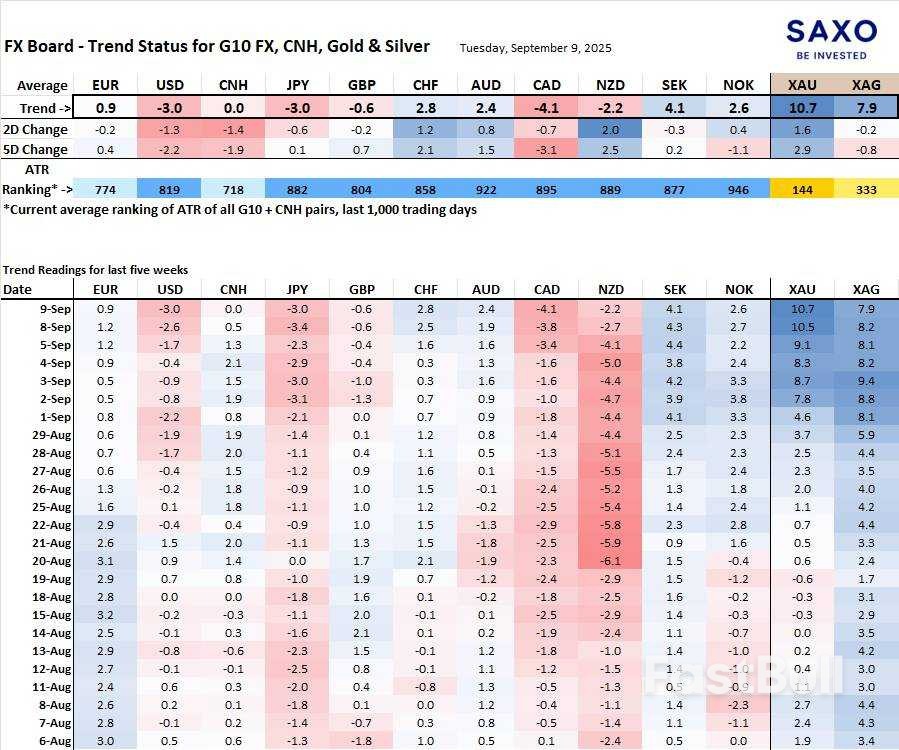

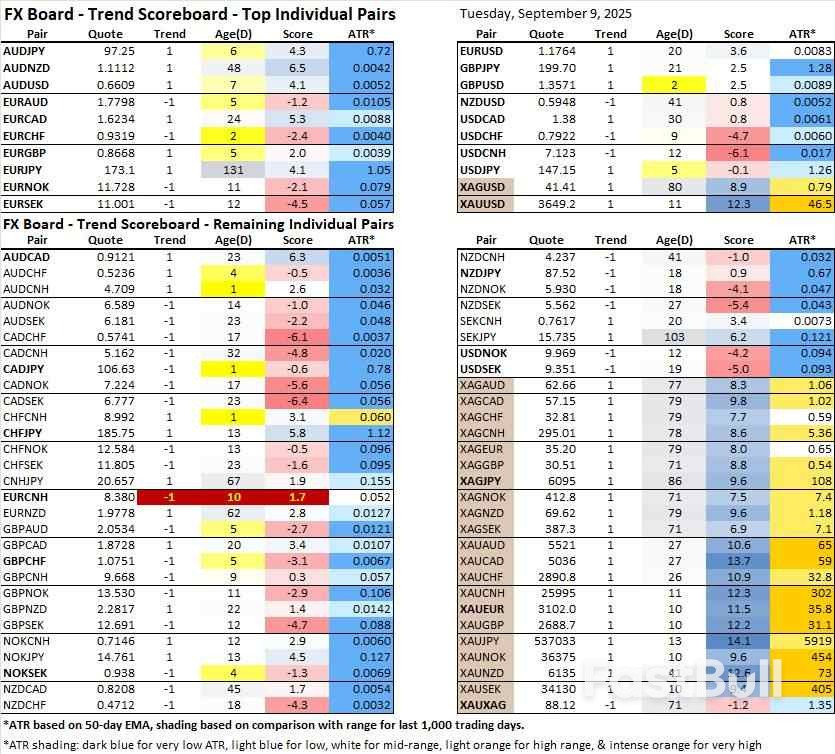

FX Board of G10 and CNH trend evolution and strength.Note: If unfamiliar with the FX board, please see a video tutorial for understanding and using the FX Board.

Both the US dollar and Japanese yen are weak if for different reasons – the US on collapsing yieds and anticipation of Fed cutting, the yen on concern that the bond market is destabilizing and political uncertainty. CAD is in a world of hurt as it follows the US dollar lower on an economy nosediving, in part on tariff-driven woes. On the positive side, the Swedish krona sticks out, possibly on its pristine balance sheet, something that the Swiss can also relate to, while gold and silver are blistering hot with incredibly strong bull trend readings.

Table: NEW FX Board Trend Scoreboard for individual pairs.Fresh USD bearish trend signals in recent days in GBPUSD and humorously enough in USDJPY (the trend signal is useless when currency pairs are caught in a trading range as the moving averages meander back in forth within the range). Note the French concerns have also weighed on the euro in some crosses like EURAUD and EURGBP of late.

Several months ago, stocks briefly crashed over concerns about a trade war and a slowing economy. Now, the S&P 500 (^GSPC 0.21%) is trading at an all-time high even as recent economic data makes it clear the labor market is grinding to a halt.

Friday's employment report showed the U.S. added just 22,000 jobs in August, missing expectations of 75,000 net new jobs. The report continued a recent streak of weak jobs growth and included a downward revision of 27,000 jobs over the prior two months. The economy lost 13,000 jobs in June and gained 79,000 in July, meaning that job growth has averaged less than 30,000 over the last four months, significantly less than what's considered a healthy job market (at least 100,000 job gains per month).

For investors, the jobs report is important not just because it's a major indicator of the health of the overall economy, but also because it impacts the Federal Reserve's interest rate decisions. The Federal Reserve has a dual mandate to keep both unemployment and inflation low, generally targeting a 2% inflation rate, and a weak jobs report makes it more likely that the Fed will cut rates at its next meeting on Sept. 16-17. The central bank tends to cut rates when the economy is weak in order to stimulate growth, and raise rates when the economy is overheated and inflation is too high, in order to control the economic cycle.

With job growth looking sluggish for the fourth straight month, the Fed is more likely to cut rates at the September meeting than it was before the update, and lower rates tend to be good for stocks. They make it easier for businesses to borrow and invest, and they make stocks more attractive versus bonds, so investment capital tends to rotate from bonds into stocks in low-rate environments. Low rates are especially beneficial to growth stocks because they lower the discount rate in discounted cash-flow valuations, meaning earnings in the distant future are worth more than they previously were.

However, investors didn't quite know what to make of the jobs report on Friday as stock futures initially popped on the news due to the increased chances for an interest rate cut, but then gave back those gains in the regular trading session, and all three major indexes finished in the red with the S&P 500 down 0.5% in afternoon trading. The small-cap Russell 2000 index, which is more sensitive to interest rates due to the volatile nature of small-cap stocks, was trading higher for part of the session.

Friday's movement is a reminder that rate cuts alone aren't enough to drive stocks higher, especially if the cause is job losses and an increased potential for recession.

While the S&P 500 was down on the move, individual stocks don't move in lockstep with the broad-market index, and some sectors figure to be winners from a rate cut, especially those most sensitive to interest rates.

That includes homebuilders and other stocks directly tied to the housing market. The SPDR S&P Homebuilders ETF (XHB 0.18%), for example, was up 1.6% Friday afternoon, and Opendoor Technologies (OPEN -9.17%), the home-flipper that has surged lately on interest from meme stock investors as well as hopes for rate cuts, traded up by double-digit percentages.

Among the losers on Friday were cyclical sectors with the most exposure to a recession, like energy, which was down 2.4% in afternoon trading, and financials, which was off 2.1%.

There's only one more major economic release that's likely to influence the Fed's September decision. That's the August Consumer Price Index (CPI) report, which is due out Sept. 11.

Inflation has been creeping higher, and an uptick could make the Fed's decision more difficult, but a rate cut seems more likely than not at this point, especially after Fed Chair Powell alluded to one in his closely watched Jackson Hole speech in mid-August. In fact, there's a chance the Fed could cut rates by 50 basis points, rather than the standard 25 bps, especially if signs of trouble in the labor market increase and the CPI report shows cooler inflation than expected.

Today’s XAU/USD chart shows that gold continues to set records in September. The price has risen above $3,650 per ounce for the first time in history – one of the main drivers being expectations of a Federal Reserve rate cut on Wednesday, 17 September.

Easier monetary policy is generally seen as boosting gold’s appeal – this has pushed XAU/USD nearly 6% higher since the start of September. However, the chart highlights three reasons why further upside may be limited.

1. Long-term channel:

Over the course of 2025, gold price movements have formed an ascending channel (shown in blue), and today XAU/USD is trading close to its median line. This is where supply and demand typically balance out. Buyers may consider the post-September rally overstretched, while sellers could view the all-time high as an opportunity to take profits.

2. Rectangle pattern target reached:

The range between $3,250 and $3,440 that developed mid-year can be interpreted as a rectangle pattern. Following the bullish breakout, the implied target of $3,630 has already been achieved.

3. RSI signals risk:

The RSI indicator is close to forming a bearish divergence.

Given the steep angle of the orange support line, a correction – for example, towards the psychological level of $3,550 – might occur.

In summary, gold’s upward momentum may start to slow. At the same time, given the market’s inertia, traders may have little reason to expect a decisive shift away from bullish dominance. Still, next Wednesday could bring surprises.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up