Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

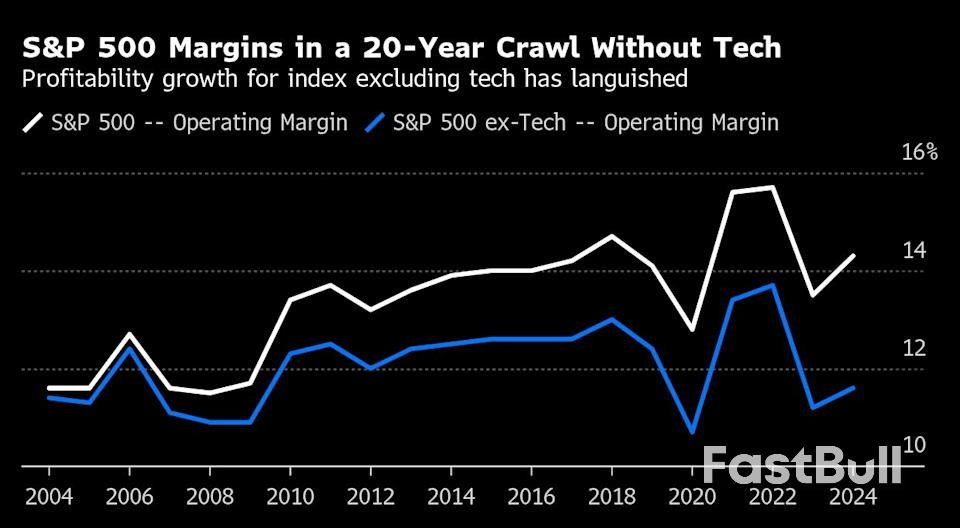

The S&P 500’s profitability is highly dependent on the technology sector, making it vulnerable to new tariffs. Rising levies threaten corporate margins, with non-tech companies having little cushion to absorb shocks.

On 22 April, a terror attack in the Baisaran Valley near Pahalgam in Indian-administered Jammu & Kashmir claimed the lives of 26 people, mostly Indian tourists. This is the deadliest attack in the disputed territory since 2019 when a car bomb targeting a convoy of buses carrying Indian paramilitary soldiers killed 40 people in Pulwama. More alarmingly, it is the biggest attack targeting civilians in over two decades. The Resistance Front (TRF), a proxy for Lashkar-e-Taiba – a Pakistan-based terrorist organization – has claimed responsibility for the attack, while the civilian government in Pakistan has denied any involvement.

When the government of Prime Minister Narendra Modi assumed power in 2014, it extended an olive branch to Pakistan, inviting then Pakistani Prime Minister Nawaz Sharif and other South Asian leaders to Modi’s inauguration. Modi even visited Sharif on his birthday in 2015.

But relations between India and Pakistan have since deteriorated. In 2016, India carried out so-called ‘surgical strikes’ inside Pakistan-administered Kashmir in response to an attack on an Indian army facility in Uri. In 2019, India launched airstrikes inside Pakistani territory following the Pulwama terror attack. The Modi government’s decision to end the special autonomous status of Indian-administered Kashmir in August 2019 further soured relations between New Delhi and Islamabad.

A degree of benign neglect has since crept into the bilateral relationship with Islamabad preoccupied with internal instabilities and tensions on its borders with Afghanistan and Iran, while New Delhi has sought to focus on India’s global role and aspirations rather than its chronically difficult relationship with Pakistan. This became apparent during last month’s Raisina Dialogue – India’s premier foreign policy conference – where there was hardly any discussion on India’s neighbourhood.

Whether due to the deterrent effect of the two countries’ nuclear arsenals or simply due to other priorities, there has been a degree of strategic restraint in the India–Pakistan relationship in recent years. A ceasefire along the Line of Control (LoC) demarcating Indian and Pakistan-administered Kashmir has largely held since 2021. In 2022, a missile accidentally launched by India landed in Pakistani territory, but did not trigger a retaliatory response by Islamabad. And despite its more assertive posturing, New Delhi has sought to minimize collateral damage in its retaliatory actions. Of all the countries that Pakistan shares borders with, the border with India has been the most stable in recent years.

The attack comes at a time when the Pakistani military is on the back foot following a string of terrorist attacks inside Pakistan and eroding public support for the army following the arrest and imprisonment of former prime minister Imran Khan and the persecution of his supporters. Pakistani army chief Asim Munir has sought to reaffirm the importance of the military to the preservation of the Pakistani state. In a speech last week he also referred to Kashmir as Pakistan’s ‘jugular vein’.

Although the civilian government in Islamabad has denied involvement, there is precedent for attacks on India taking place during periods when the Pakistani military feels it is being marginalized. In 1999, an attempt at rapprochement between the civilian governments in Islamabad and New Delhi – referred to the Lahore bus diplomacy – was derailed after Pakistani military-backed militants launched attacks in the Kargil area of Kashmir, leading both countries to war for the fourth time

The attack also took place when US Vice President JD Vance was visiting India, suggesting it was timed to draw international attention to the Kashmir issue while the spotlight was on India. Similarly, a terror attack took place in Kashmir shortly before President Clinton’s India visit in 2000.

The Modi government has been tough on security since assuming power and Modi himself has been referred to as India’s ‘chowkidar’ (or guard) – akin to Israeli Prime Minister Benjamin Netanyahu’s ‘Mr Security’ moniker. The government has pledged to pursue terrorists wherever they may be (‘ghus ke marenge’). In a speech earlier this week, Modi stated that ‘India will identify, track and punish every terrorist and their backers,’ and would pursue the perpetrators ‘to the ends of the earth’. A robust response by India should therefore be expected – including possible military action.

The Indian government has already taken the unprecedented step of suspending the 1960 Indus Water Treaty. This World Bank-brokered water-sharing agreement for rivers that traverse both countries has survived several periods of hostility between India and Pakistan. The Pakistani government has declared any attempt by India to divert waterflows in violation of the treaty an ‘act of war’. New Delhi has also ordered the closure of the Attari-Wagah border crossing, reduced the diplomatic presence in both countries, and imposed further restrictions on Pakistani nationals travelling to India.

Pakistan has responded in kind and has also closed its airspace to Indian-owned and operated airlines and suspended trade with India, including through third countries. It has also announced that it is suspending all bilateral agreements with India, including the Simla Agreement, which established the LoC. A breakdown of the ceasefire along the LoC and a broader tit-for-tat military escalation cannot be ruled out. Limited skirmishes have already been reported.

New Delhi had been lauding the return of stability to Kashmir in recent years. Elections held in the territory last autumn were largely peaceful with a high voter turnout. Investment and tourism have flourished. This progress will be derailed by the latest attack.

Beyond the impact on Kashmir and India–Pakistan relations, this incident will also have broader regional implications. South Asia is among the least economically integrated regions of the world. The South Asian Association for Regional Cooperation (SAARC) has not held a summit in over a decade, attributed in large part to mistrust in the India–Pakistan relationship.

While New Delhi has tried to develop workaround solutions, such as promoting other regional initiatives, South Asian countries continue to lobby for the resumption of SAARC as the region’s most inclusive and all-encompassing regional forum. But the Pahalgam attack makes this even less likely to happen anytime soon.

For now, there are limited signs of external pressure on India to show restraint in its response to the attack. During previous periods of heightened tensions, the US has played a prominent role in de-escalating tensions, but not this time.

The US recently extradited a Canadian national convicted of complicity in a 2008 attack by Pakistan-based militants in Mumbai, something New Delhi had been demanding for many years. While this demonstrates the Trump administration’s more forthcoming approach to working with India on anti-terrorism cooperation, the US is unlikely to get involved beyond possible intelligence sharing.

Without significant international pressure to de-escalate, the only real restraints on both parties are concerns of a possible nuclear escalation and the impact of a conflict on their economies.

The foreign ministry of China has called on Washington to cease misleading the public about the status of bilateral tariff negotiations. Guo Jiakun, a spokesperson for the ministry, stated in a press briefing that China and the United States are not currently engaged in discussions or consultations regarding the tariff issue.

This statement comes after U.S. President Donald Trump claimed on Thursday that trade talks between the two nations were in progress. However, both China’s foreign and commerce ministries have denied the existence of such negotiations.

In addition, Guo mentioned that he was not aware of any plans by China to exempt tariffs on certain U.S. imports. The recent exchange of remarks between Beijing and Washington has added to the uncertainty about the commencement and possibility of talks on high tariffs imposed on each other’s goods.

U.S. stock index futures rose Friday as investors piled into technology and artificial intelligence stocks following strong earnings from Google owner Alphabet, with the tone also helped by the de-escalation of trade tensions.

At 05:20 ET (09:20 GMT), Dow Jones Futures gained 12 points, or 0.1%, S&P 500 Futures rose 18 points, or 0.3%, and Nasdaq 100 Futures climbed 60 points, or 0.3%.

The main Wall Street indices closed Thursday with sold gains, putting them on a three-day winning streak and on course for a positive week.

As of Thursday’s close, the S&P 500 has a week-to-date gain of nearly 4%, the Dow Jones Industrial Average is up more than 2% and the NASDAQ Composite is more than 5% higher.

Sentiment has received a boost Friday following a report that China is considering giving an exemption to some U.S. products to its steep retaliatory tariffs and is asking businesses to identify goods that could be eligible.

Citing a source close to the matter, Reuters said a taskforce from China’s Ministry of Commerce is putting together a list of items that might be exempted and asking companies to submit their own requests.

Investors had already been encouraged by indications that U.S. President Donald Trump’s administration may be softening its stance towards Beijing. Trump has made China a central target of his aggressive tariff agenda, raising levies on the world’s second-largest economy to at least 145%.

On the economic calendar, the final reading of the University of Michigan’s consumer sentiment survey is set to be released. The preliminary data showed that households had a deteriorating view of the economy and expected higher inflation due in large part to the global trade tensions.

Alphabet (NASDAQ:GOOGL) shares rallied strongly premarket, after the tech giant reported clocked much stronger than expected earnings for the first quarter and announced a $70 billion buyback.

The company also reaffirmed its ambitious AI development plans, offering more confidence that AI-driven demand for chips and data centers will persist. The company is among Wall Street’s biggest spenders on AI.

Still, Alphabet did flag some potential headwinds from macroeconomic uncertainty, while growth in its ad business revenue, which is its biggest moneymaker, also shrank from the prior quarter .

But Alphabet’s earnings set a strong precedent for other major Wall Street tech stocks, especially those with heavy exposure to AI.

That said, Intel (NASDAQ:INTC) slid 5% as weak guidance offset consensus-beating earnings, with the struggling chipmaker also flagging heightened concerns over macro headwinds from a trade war.

A barrage of company earnings are due in the coming weeks, including from tech giants Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL), although the focus is likely to be more on guidance for the current year, especially in the face of heightened economic uncertainty.

Other key companies like AutoNation (NYSE:AN), Colgate-Palmolive (NYSE:CL), AbbVie (NYSE:ABBV), Phillips 66 (NYSE:PSX) and Centene (NYSE:CNC) are set to report their quarterly results before the bell on Friday.

Oil prices edged higher, but the market was headed for a weekly decline amid concerns about oversupply from the Organization of the Petroleum Exporting Countries.

Both the Brent and West Texas Intermediate crude contracts were set to decline nearly 2% this week after Reuters reported that several oil producing nations in the OPEC cartel are pushing to accelerate output hikes in June, extending May’s surprise boost, as internal disputes over quota compliance deepen.

OPEC and allies like Russia, a group known as OPEC+, will meet on May 5 to finalize their plans for June output levels.

Aggressive U.S. tariff announcements could end up denting consumer prices rather than fueling inflationary pressures, European Central Bank Governing Council member Robert Holzmann told Bloomberg News.

Speaking to Bloomberg in Washington, where he is attending the International Monetary Fund’s spring meetings, Holzmann said that broader uncertainty around the Trump administration’s erratic tariff plans has left upcoming ECB decisions on interest rates "completely open."

Holzmann added that policymakers do not known "where we’ll end up," but noted that he agreed with ECB President Christine Lagarde’s recent assessment that the net impact of the levies seems to be deflationary rather than driving up prices.

The comments come after the ECB, which has slashed borrowing costs seven times since last June, is considering its next policy moves against a backdrop of widespread concern over the effect of Trump’s tariffs. Markets are currently pricing in two more quarter-point reductions before the end of 2025, as well as a 60% chance of a third, Bloomberg reported.

Earlier this month, Trump unveiled elevated duties on many countries, citing the need to rebalance perceived unfair trade practices, reshore manufacturing jobs, and boost government revenue. However, following deep ructions in stock and bond markets, Trump announced a 90-day delay to the tariffs, and has suggested that the White House is looking to secure dozens of trade deals with individual nations.

Economists have flagged that Trump’s tariffs stand to push up inflation and weigh on growth in the U.S., and potentially spread to other parts of the global economy. Businesses, meanwhile, have warned that uncertainty around the on-and-off levies has made it difficult to plan out future investment decisions.

Holzmann said that he anticipates this lack of clarity "created by the U.S. will persist" beyond the 90-day postponement, adding that there will be "scars in the economy" even if Trump ends up lowering the tariffs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up