Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy that investors believe as they bid the S&P 500 back up to record territory to end the month.

Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy that investors believe as they bid the S&P 500 back up to record territory to end the month.

Private payrolls lost 33,000 jobs in June, the ADP report showed, the first month jobs decreased since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000.

"Though layoffs continue to be rare, a hesitancy to hire and a reluctance to replace departing workers led to job losses last month," Nela Richardson, ADP's chief economist, said in a press release published Wednesday morning.

To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May's soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week.

This week, the government's nonfarm payrolls report will be out on Thursday with economists expecting a healthy 110,000 increase for June, per Dow Jones estimates. Economists are expecting the unemployment rate to tick higher to 4.3% from 4.2%. Some economists could revise down their jobs reports estimates following ADP's data.

Weekly jobless claims data is also due Thursday, with economists penciling in 240,000. This string of labor stats comes during a shortened trading week, with the market closing early on Thursday and remaining dark on Friday in honor of the July 4 holiday.

The bulk of job losses came in service roles tied to professional and business services and health and education, according to the ADP. Professional/business services notched a decline of 56,000, while health/education saw a net loss of 52,000.

Financial activity roles also contributed to this month's decline with a drop of 14,000 on balance.

But the contraction was capped by payroll expansions in goods-producing roles across industries such as manufacturing and mining. All together, goods-producing positions grew by 32,000 in the month, while payrolls for service roles overall fell by 66,000.

The Midwest and Western U.S. saw the strongest contractions in June, declining by 24,000 and 20,000, respectively. Meanwhile, the Northeast shed 3,000 roles. The Southern U.S. was the sole region tracked by the ADP to see payrolls expand on net in the month, recording an increase of 13,000 positions.

The smallest firms tended to see more job losses this month than their larger counterparts. In fact, businesses with more than 500 employees saw the biggest payroll growth in the month with an increase of 30,000, per the ADP. By comparison, businesses with fewer than 20 employees accounted for 29,000 lost roles on net.

Annualized income growth decreased modestly from May for both job stayers and hoppers. The rate of pay increase for those staying in their jobs ticked down to 4.4% from 4.5%, while those getting new roles slid to 6.8% from 7%.

The S&P 500 is up more than 4% for the year, posting a stunning comeback in the second quarter after worries about President Donald Trump's tariff fights nearly sent the benchmark into a bear market.

The International Monetary Fund (IMF) believes the European Central Bank (ECB) should maintain its current 2% deposit rate unless significant shocks alter the inflation outlook, according to Alfred Kammer, head of the IMF’s European Department.

Speaking on Wednesday at the ECB Forum on Central Banking in Sintra, Portugal, Kammer told Reuters that "risks around euro zone inflation are two-sided."

"This is why we think the ECB should stay the course and not move away from a 2% deposit rate unless there is a shock that materially changes the inflation outlook. Right now we don’t see anything of such magnitude," Kammer stated.

The ECB has reduced rates by two percentage points since June 2024 and has indicated a pause for July, though financial markets still anticipate another cut to 1.75% before the end of the year.

The IMF’s position differs from market expectations partly due to its higher inflation forecast for next year compared to the ECB’s projections. While the ECB expects price growth to fall below its 2% target for 18 months starting from the third quarter, with inflation reaching a low of 1.4% in early 2026, the IMF forecasts inflation at 1.9% for next year.

Kammer explained the difference: "For next year, we see inflation at 1.9%, which is above the ECB’s own projections, partly because we take a different view on energy prices."

Bank of England policymaker Alan Taylor said on Wednesday that a soft landing for Britain's economy is now at risk and that economic data had recently argued for five interest rate cuts in 2025 rather than four.

"Previously, I had seen a UK soft landing in the cards, with some remaining upside risks to inflation from the bump in 2025," Taylor said in a speech at a European Central Bank summit in Sintra, Portugal.

"Now I see that soft landing as being at risk, and greater probability of a downside scenario in 2026 pushing us off track, as demand weakness and trade disruptions build."

Economists use the term "soft landing" for a situation where employment rises and economic growth continues after a cycle of rising interest rates.

Taylor has voted to cut interest rates in five out of seven Monetary Policy Committee meetings since he joined in September. In May, he backed an outsized 0.5 percentage-point cut, followed by a 0.25 percentage-point cut in June.

He told Bloomberg TV on Wednesday that he did not believe bigger interest rate cuts were necessarily needed.

However, having only eight Monetary Policy Committee meetings per year posed an "integer problem" for policymakers seeking a faster pace of easing, he told Bloomberg TV.

Taylor, who has caught the eye of economists since joining the MPC because of his clarity about his own expectations for the path of interest rates, said in his speech the MPC would be "well-served" by finding a vehicle for communicating its beliefs on future rates.

"After some shocks and noise clouded my view of the economy and global developments in the first quarter, my reading of the deteriorating outlook suggested to me that we needed to be on a lower rate path, needing five cuts in 2025 rather than the market-implied quarterly pace of four," Taylor said.

Charts published in Taylor's speech showed interest rates could fall to around 2.25% in the second half of next year if his downside scenario for the economy comes to fruition.

The BoE held interest rates at 4.25% last month, and investors are betting on the central bank to reduce borrowing costs in two further quarter-point moves to 3.75% by the end of the year.

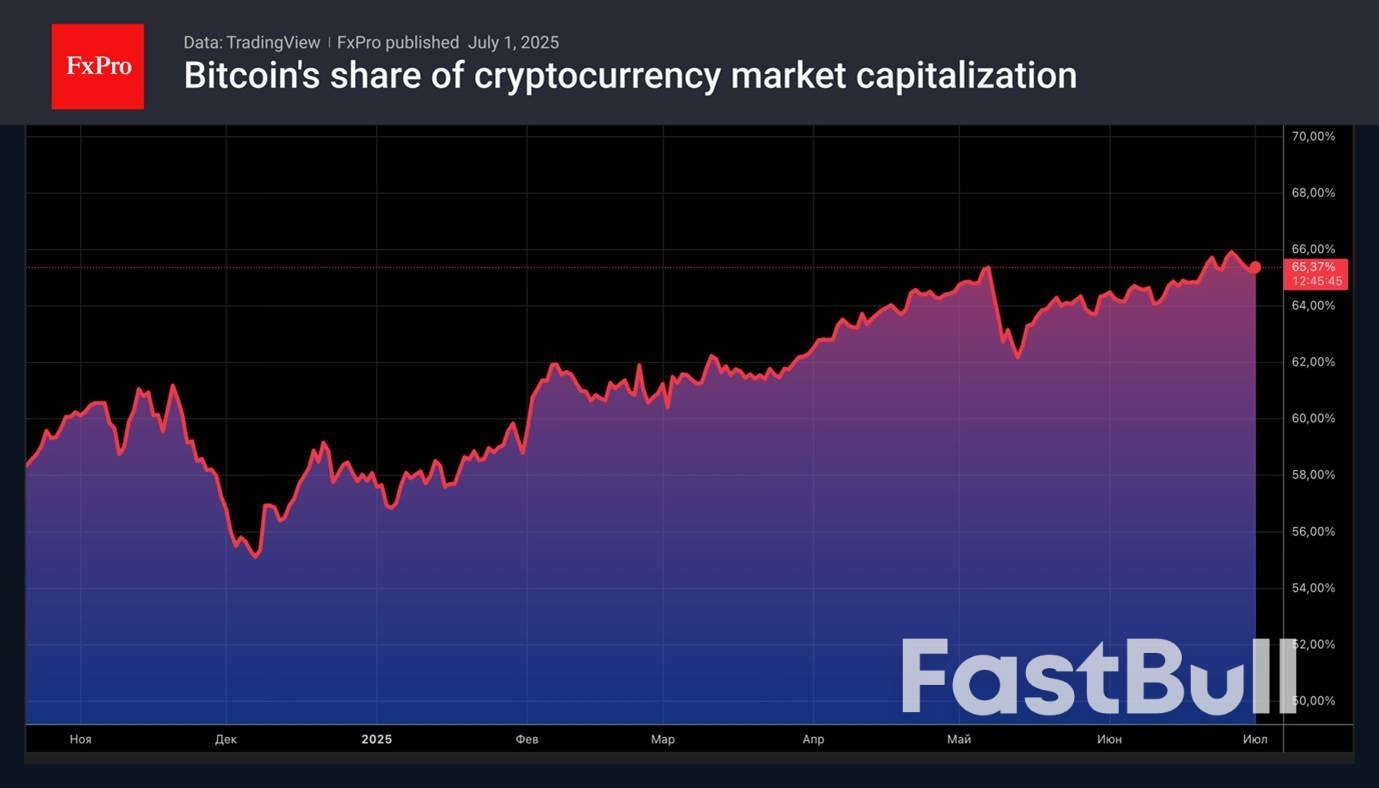

Bitcoin is absorbing most of the cash coming into the digital asset market. Its share in the cryptocurrency market structure increased by 10 percentage points to 65% in the first half of 2025. This is the highest it’s been since January 2021. In contrast the capitalisation of altcoins has fallen by $300 billion since the beginning of this year. Thanks to developed infrastructure, support from the White House and regulation, larger tokens are displacing smaller competitors.

The MarketVector Digital Assets 100 Small-Cap Index, which covers the bottom half of the 100 largest digital assets, initially doubled after Donald Trump’s election results in November. However, it then lost all its gains and fell by 50% in 2025. Bitcoin on the other hand, has risen by almost 14% since January and reached a new record high in May. Cryptocurrencies are benefiting from capital inflows into specialised exchange-traded funds and high global risk appetite.

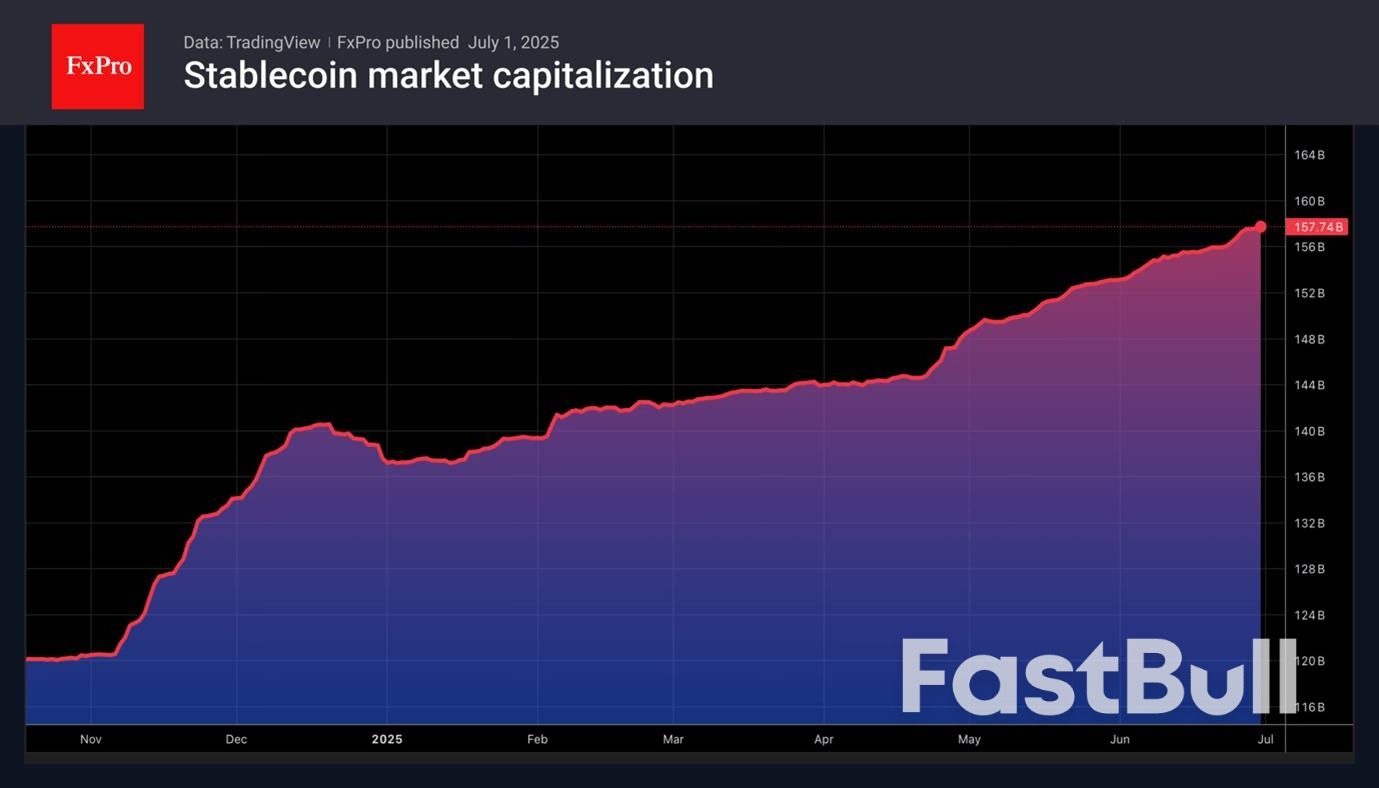

The only competition for Bitcoin comes from stablecoins. The adoption by Congress of legislation regulating their circulation is increasing investor interest in this type of digital asset. In the first half of the year alone, the market capitalisation of stablecoins grew by $47 billion. Not only banks but also large companies such as Amazon are exploring opportunities for their implementation.

Bitcoin is showing little interest in restoring its correlation with US stock indices. The S&P 500 and Nasdaq Composite managed to update their record highs in June, but Bitcoin is in no hurry to do so. The link between the traditional markets and crypto was broken during the armed conflict in the Middle East. Currently the digital assets leader is cautiously watching the approach of the 9th of July, the expiry date of the White House’s 90-day tariff delay.

The escalation of trade wars will increase the risks of a pullback in US stock indices. According to Bank of America, the bubble in the US stock market continues to inflate. If it bursts, all risky assets will suffer. It is not surprising that Bitcoin is cautious. On the contrary, new records for the S&P 500 will allow bitcoin bulls to aim for a new all-time high.

Japanese Prime Minister Shigeru Ishiba said on Wednesday he was determined to protect his country's national interests as trade negotiations with the U.S. struggled and President Donald Trump threatened even higher tariff rates on the Asian ally.

"Japan is different from other countries as we are the largest investor in the United States, creating jobs," Ishiba said in a public debate with opposition party leaders.

"With our basic focus being on investment rather than tariffs, we'll continue to protect our national interest," he said.

Trump on Tuesday cast doubt on a possible deal with Japan, indicating that he could impose a tariff of 30% or 35% on imports from Japan - well above the 24% rate he announced on April 2 and then paused until July 9.

Japanese broadcaster TV Asahi reported on Wednesday that Japan's tariff negotiator Ryosei Akazawa was organising his eighth visit to the United States for trade talks as early as this weekend.

Brent crude prices are expected to drop to the low- to mid-$60 per barrel range in the near term as traders eye an expected uptick in OPEC+ production and a seasonal slowdown in fuel demand, according to analysts at UBS.

In a note to clients, the brokerage predicted that oil markets will see a "larger surplus" after the key summer travel period, adding that prices are anticipated to move lower from current levels.

Crude prices were little moved Wednesday, as traders digested progress towards an Israel-Hamas ceasefire and a build in U.S. inventories ahead of an upcoming meeting of the Organization of the Petroleum Exporting Countries and its allies, a producer group known commonly as OPEC+.

At 03:32 ET, Brent futures inched up 0.1% to $67.16 a barrel and U.S. West Texas Intermediate crude futures were unchanged at $65.45 a barrel.

U.S. President Donald Trump on Tuesday evening said Israel had agreed to the conditions needed to finalize a 60-day ceasefire with Hamas, while also urging the Palestinian group to accept the deal.

Meanwhile, data from the American Petroleum Institute showed that U.S. oil inventories grew 0.68 million barrels in the week to June 27, a build that followed five weeks of deep, outsized draws in U.S. oil stockpiles, and raised some questions over demand during the summer.

For the nascent third quarter, the UBS analysts marginally raised their Brent price target by $3 to $65 a barrel, reflecting a "slightly higher risk premium in the very near term." A risk premium refers to the extra return investors want for holding oil investments.

However, with recent ructions in oil markets cooling following a ceasefire between Israel and Iran last month, the UBS strategists said that they expect traders’ focus will "shift back to funamentals."

"While oil demand has remained more resilient than feared and U.S. onshore activity response to lower prices has been quick, we still see the oil market moving into larger surpluses over the next three quarters," the analysts said.

They noted that this outlook was primarily linked to potential "OPEC+ production increases," predicting that all eight of its members will lift output in August. The jump in production is likely to have a greater impact on prices after the summer "as oil demand comes off seasonally, especially in the Middle East," they said.

Other factors that could impact oil prices include uncertainty around the OPEC+ production plans, the trajectory of sweeping U.S. tariffs, and the risk of a flare up in Israel-Iran tensions denting supply flows, the analysts said.

Against this backdrop, they marginally raised their annual Brent price forecast by $1 to $67 per barrel.

The eurozone’s unemployment rate increased to 6.3% in May from 6.2% in April, according to data released by the European Union’s statistics agency Eurostat on Wednesday.

This small increase was contrary to economists’ expectations, as a consensus poll had predicted the rate would remain steady at 6.2%.

Despite the rise, the unemployment rate in the 20-nation currency area remains close to historically low levels. The April figure of 6.2% had matched the eurozone’s record-low unemployment rate.

Eurostat had previously revised March’s unemployment rate higher to 6.4%.

The slight uptick in May comes as European companies face economic uncertainty related to tariffs and geopolitical tensions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up