Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Aussie is flying high on the run-up in metals and now strong employment data, but the move may be overdone. Elsewhere, GBP remains in a world of hurt and USDJPY is dancing nervously around the 155.00 figure as market perhaps reluctant to challenge Japanese officialdom.

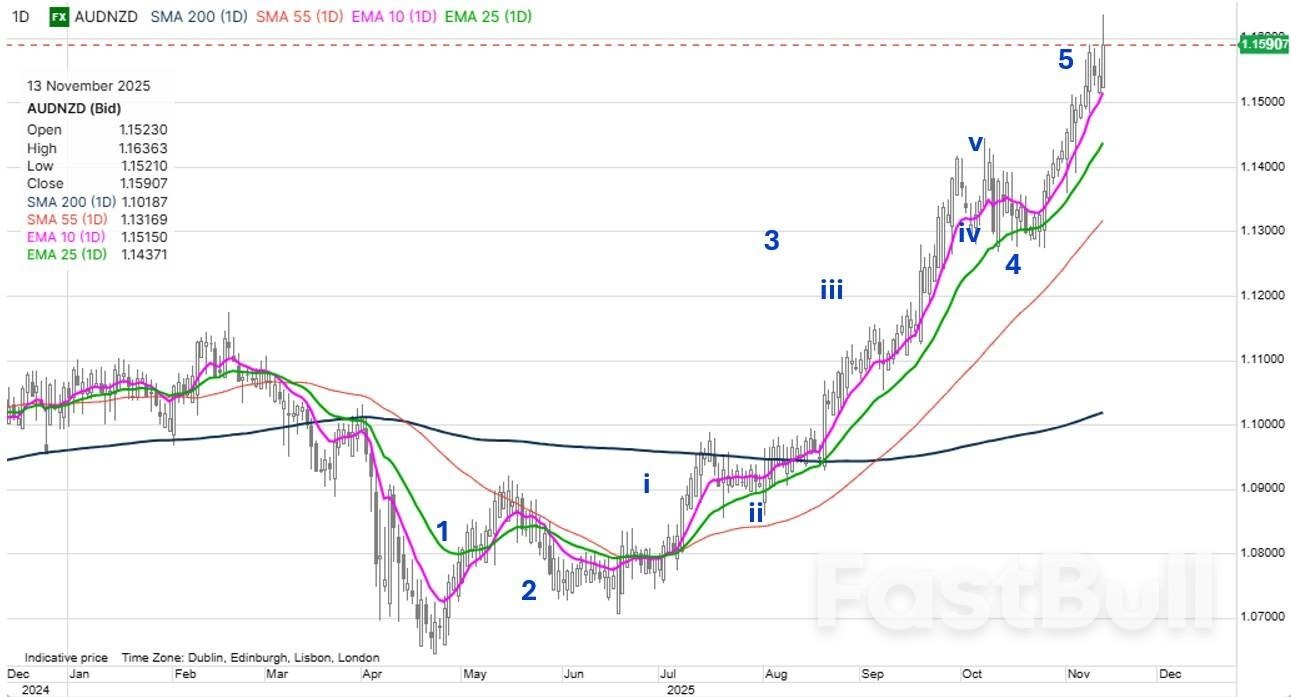

Chart focus: AUDNZDThe AUDNZD pair has been one of this year's great trenders, driven by the ever-wider divergence in yields at the front of the yield curve as Aussie rates have remained firmly anchored and even risen sharply from the October lows - especially overnight on the strong AU employment data - while NZ rates trended consistently lower from July through mid-October before stabilizing. Arguably the yield spread – currently at 107 basis points for 2-year swaps, a level last seen in when AUDNZD was trading 1.25+ justifies further upside to 1.2000 and beyond, but near term, have to wonder if this is as good as it gets. Note the beautiful Elliott Wave patterns from the lows to the latest surge higher looking like a "fifth wave of wave five". Yes, the saying goes that we should follow the trend until it bends, but this may be as good as it gets for a while. To prove the point, however, we would need a sharp rejection of this latest surge above 1.1600.

Source: Saxo

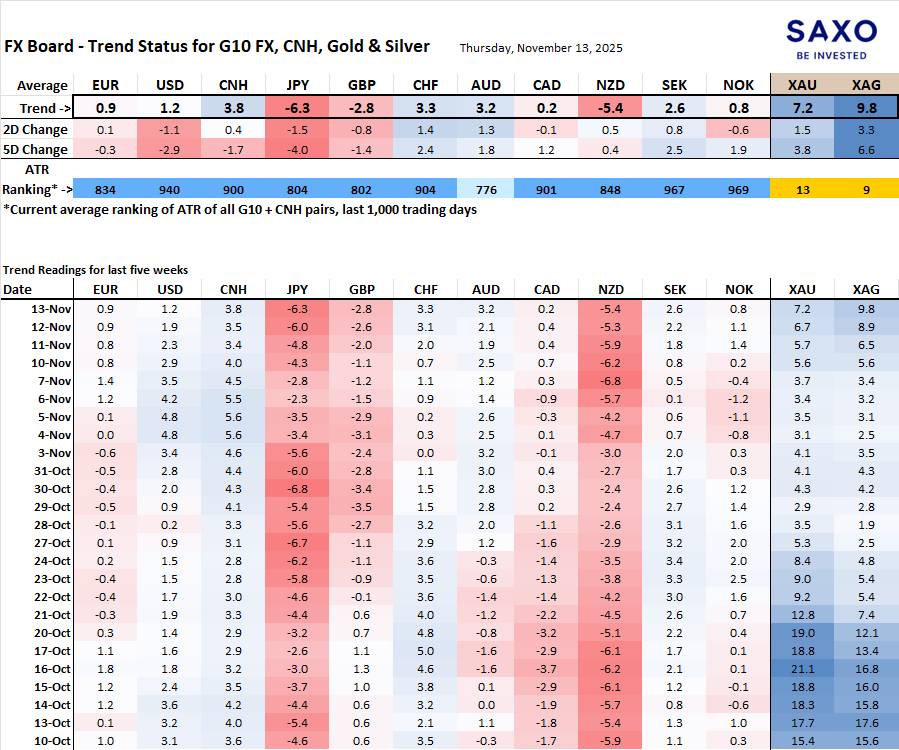

Source: SaxoThere is a lot going on in Washington and some interesting new policy impulses in the mix from Treasury Secretary Bessent. Will the market fret new fiscal excess as Trump goes hard populist to throw bread at the masses? The US dollar has been quiet, but needs to send a signal here soon and seems to be trying this morning. USDCAD and AUDUSD suggest USD is softening – as does EURUSD this morning above 1.1600 – today could prove pivotal if the latter sticks a strong close.

FX Board of G10 and CNH trend evolution and strength.Note: If unfamiliar with the FX board, please see a video tutorial for understanding and using the FX Board.

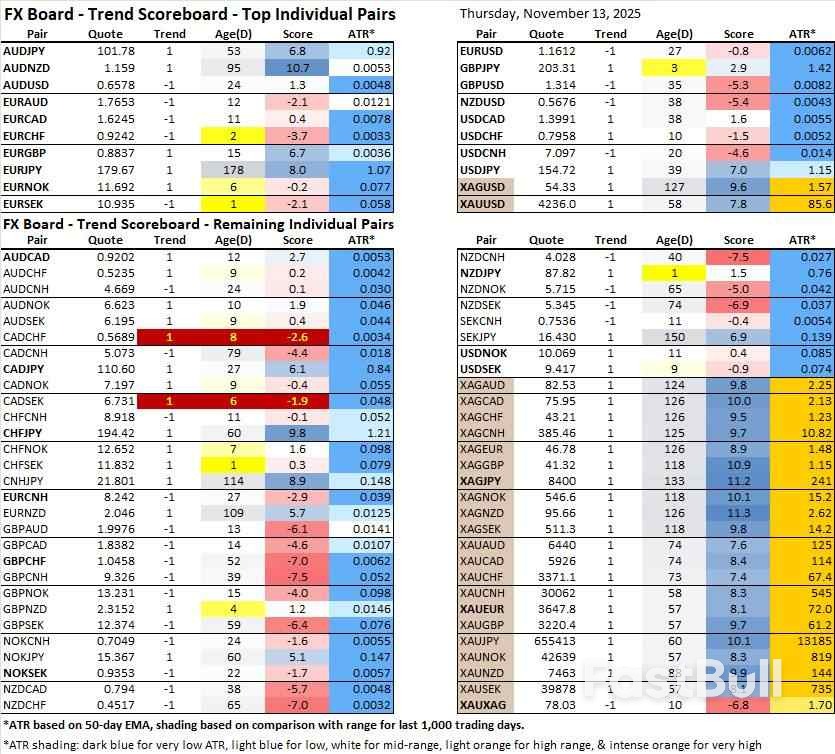

JPY weakness remains the strongest signal, together with NZD weakness – although the latter may be getting overdone as the NZD shorts may be overplayed here. CNH strength sticks out, especially on the move overnight versus the US dollar.

EURSEK has flipped back to negative and enjoys a seasonal tailwind to the downside through year-end. Elsewhere, the AUDUSD threatens an upside trend flip, while the USDCHF "uptrend" is likewise looking on tilt, as is EURUSD soon if it sticks a rally well above 1.1600 for two or three days.

US Treasuries outperformed Bunds yesterday. Yields dropped between 2.2 (2-yr) and 4.7 (7- to 10-yr bucket) bps. The majority came right after the cash market open, catching-up with the Nov 11 release by ADP. The creator of the unofficial monthly payrolls report recently started providing weekly updates as well. Tuesday's print showed companies shedding 11.3k jobs a week in the four weeks through October 25. Longer maturities including the 10-year found a bottom after a $42bn 10-yr Note auction tailed slightly with bidding metrics a tad weaker.

The currently outsized market relevance of alternatively sourced data (such as ADP's) due to a lack of official government releases may fade in coming weeks. A bill to end the 43-day long shutdown passed the House in a 222-209 vote, despite two Republicans defecting and with the support of six Democrats. President Trump signed that bill into law overnight, supporting risk sentiment. The White House instructed staff to return to their offices starting today but it'll take several weeks at least to overcome the backlog. It means no jobless claims or October CPI that were otherwise scheduled for today.

WH Press Secretary Leavitt said yesterday that it's unlikely that last month's inflation figures will be published at all. The same goes for the payrolls report, although some expect the Bureau of Labour Statistics to combine two months (October and November) into one statistic to catch-up. German rates yesterday eased between 0.3 and 2.6 bps in a bull flattening move, navigating through a flurry of ECB speeches. FX markets were a sea of calm and we expect more of the same today.

EUR/USD overcame European weakness into the US open and ended the day marginally higher just shy of 1.16. DXY treaded water around 99.5 with a weaker JPY preventing losses for the trade-weighted index. USD/JPY rose to a new 9-month high (154.79). Sterling faced selling pressures over the last couple of sessions amid Labour's internal disarray spilling on the streets, a weak labour market report and sub-par Q3 growth. EUR/GBP appreciates to 0.884, the strongest level since April 2023. UK GDP expanded by 0.1% compared to the 0.2% expected and with the accompanying monthly series revealing underwhelming dynamics (-0.1% m/m in September after stagnating the month before).

The numbers are another blow to chancellor Reeves going into the critical Autumn Budget on November 26, which is expected to end up in Labour breaking its 2024 election manifesto through introducing additional taxes. To help fill a fiscal hole of as much £35bn, the UK Treasury has presented the Office of Budget Responsibility with plans to cut household bills and lower inflation (through lowering regulated prices). That should pave the way for further BoE rate cuts and lower borrowing costs. The OBR delivers the economic forecasts to which the UK fiscal rules are being measured against.

Strong October Australian labour market data strengthen the view that the Reserve Bank of Australia is finished with its policy normalization cycle. The number of employed people rose by 42k, beating 20k consensus. Details showed an even bigger increase in full-time employment (+55k) which was partly offset by less part-time jobs (-13k).

The unemployment rate dropped back to summer levels (4.3%) after spiking to 4.5% in September. The participation rate remained steady at 67%. Hours worked rose by 0.5% M/M, outpacing the 0.3% M/M employment growth. The AUD government bond curve bear flattens this morning with yields rising up to 10 bps at the front end of the curve. The Aussie dollar profits marginally, currently changing hands around AUD/USD 0.6550.

he UK October housing market survey from the Royal Institution of Chartered Surveyors (RICS) showed the national price balance slightly declining from -17% to -19% in October. Details showed new buyer enquiries at the weakest level since April (-24%) as uncertainty surrounding the upcoming Autumn Budget (potential changes to property-related taxes including stamp duty, capital gains and inheritance tax) not only led to reduced buyer demand, but also sales and new property listings.

Above target inflation and rising unemployment are also negative for the overall market. Agreed sales registered a net balance of -24%, down from -17%. A net balance of +7% surveyors anticipates a modest improvement in 2026. New vendor instructions (-20%) hit the lowest level since 2021.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up