Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

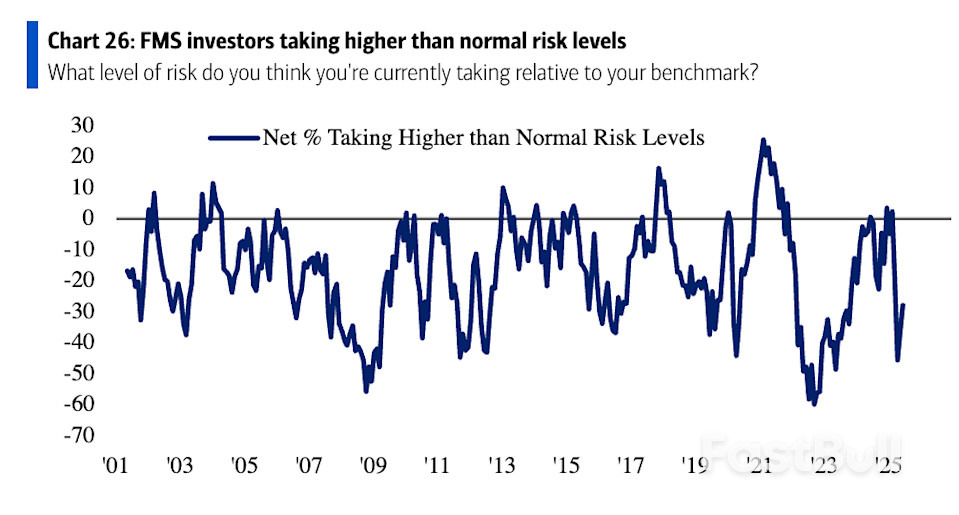

Despite stocks nearing record highs, investor sentiment remains cautious due to economic and geopolitical uncertainty. Low equity exposure and risk appetite may actually support further gains, suggesting the rally still has room to run.

The International Energy Agency forecasts global oil demand to peak and plateau by the end of this decade, with China's demand peaking earlier than previously anticipated.

While oil supply is expected to outpace demand growth, geopolitical risks and trade tensions introduce significant uncertainties to the oil market.

There is a notable divergence in viewpoints between the IEA and OPEC regarding future oil demand, with OPEC predicting continued growth beyond the current decade.

A peak in global oil demand is still on the horizon, the International Energy Agency (IEA) said on Tuesday, doubling down on its forecast that demand will plateau by the end of the decade.

China’s oil demand, which increased by a cumulative 6 million barrels per day (bpd) in the decade to 2024, is set to peak earlier than previously expected, the agency said in its annual Oil 2025 report for the medium term.

While China – the world’s top crude oil importer – accounted for 60% of the global increase in oil consumption in 2015-2024, “the picture to 2030 looks very different,” the IEA said.

China’s demand is on track to peak in 2027 – two years earlier than previously thought – amid “an extraordinary surge in EV sales, the continued deployment of trucks running on liquefied natural gas (LNG), as well as strong growth in the country’s high-speed rail network, along with structural shifts in its economy.”

Global oil demand is forecast to rise by 2.5 million bpd from 2024 to 2030, reaching a plateau around 105.5 million bpd by the end of the decade, per the agency’s latest estimates.

Annual global growth will slow from about 700,000 bpd in 2025 and 2026 “to just a trickle over the next several years, with a small decline expected in 2030, based on today’s policy settings and market trends,” the IEA said.

The agency expects below-trend economic growth, weighed down by global trade tensions and fiscal imbalances, and accelerating substitution away from oil in the transport and power generation sectors.

At the same time, the increase in global oil supply is “set to far outpace demand growth in coming years,” according to the agency.

“Based on the fundamentals, oil markets look set to be well-supplied in the years ahead – but recent events sharply highlight the significant geopolitical risks to oil supply security,” IEA Executive Director Fatih Birol said.

If no major supply disruptions occur, the oil market will be comfortably supplied through 2030, the agency reckons, but warned that “significant uncertainties remain, especially given rising geopolitical risks and heightened trade tensions.”

The IEA’s “peak demand on the horizon” narrative once again clashes with OPEC’s view of growing oil demand at least into the 2040s.

Just last week, OPEC Secretary General, Haitham Al Ghais, said that oil demand would continue growing over the coming decades as the world’s population increases.

“Simply put, there is no ‘peak in oil demand’ on the horizon,” Al Ghais said at The Global Energy Show Canada in Calgary, Canada.

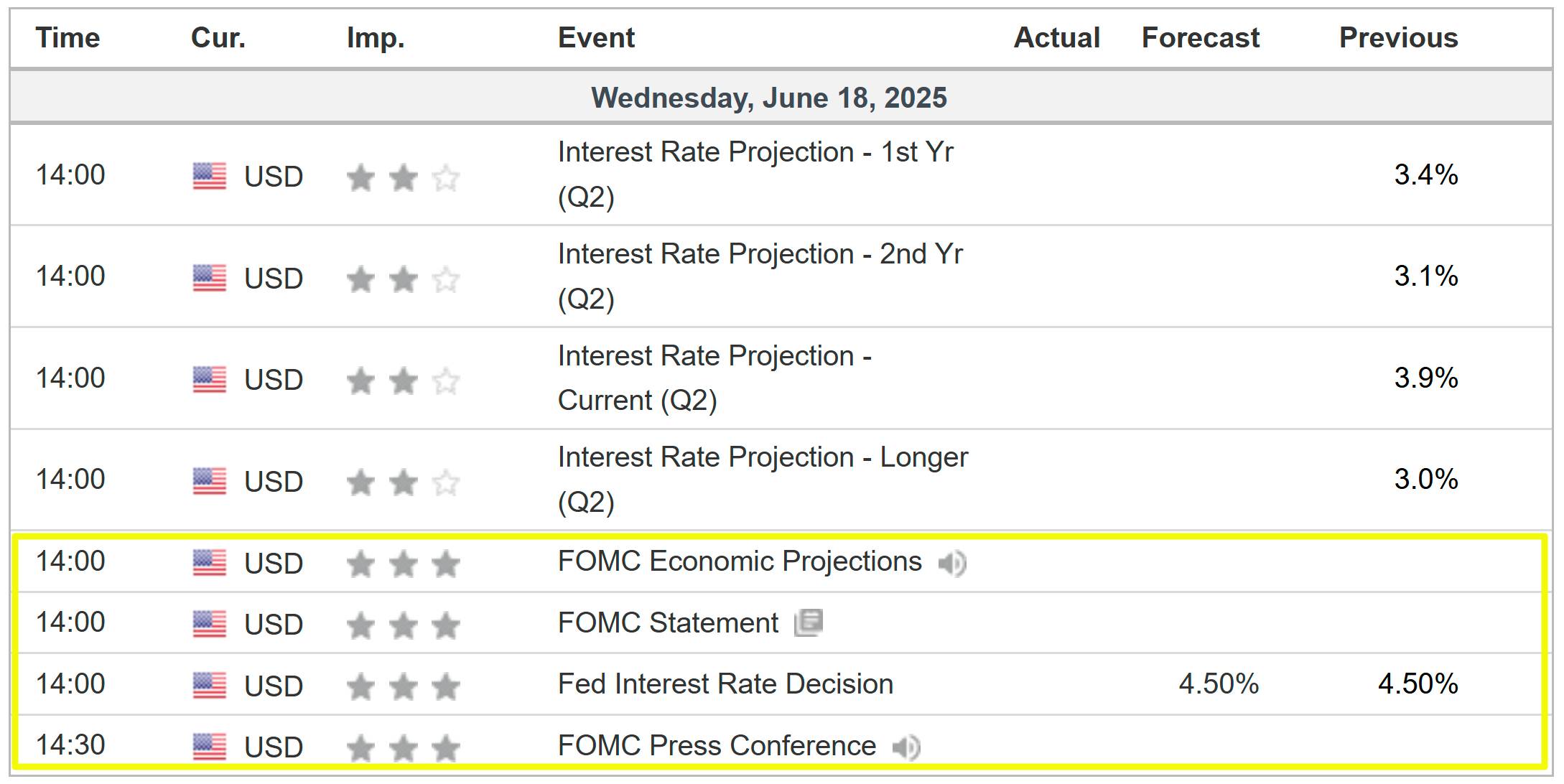

The Federal Reserve’s June policy meeting arrives at a critical moment for the stock market, with the benchmark S&P 500 sitting around 3% below its February record high despite a barrage of lingering uncertainty, including persistent trade war fears and fresh geopolitical headwinds between Israel and Iran.

As such, a lot will be on the line when the Fed delivers its latest interest rate decision at 2:00 PM ET on Wednesday. While the US central bank is widely expected to hold rates steady at 4.25%-4.50%, investors are eager for any hints about whether it might be poised to lower borrowing costs in the coming months.

Markets currently expect two rate cuts by the end of this year, with the next one likely in September, as per the Investing.com Fed Rate Monitor Tool.

Alongside the rate decision, Federal Open Market Committee (FOMC) officials will also release their new quarterly economic projections for interest rates, inflation, and unemployment, known as the ‘dot plot’.

The last dot plot, released in March, revealed a consensus among Fed officials for two cuts in 2025.

If FOMC policymakers stick with that forecast, it could reinforce bullish sentiment—especially since recent economic data shows some softening. But if the outlook shifts to just one cut (or pushes the timeline further out), expect a market recalibration and possible pressure on stocks and risk assets.

Post-meeting comments from Fed Chair Jerome Powell at 2:30 PM ET will be closely watched and could move the market as his words often carry as much weight as the policy decision itself. Powell is likely to emphasize a data-dependent approach, citing the need for further clarity on the economic and inflationary impact of President Donald Trump’s trade tariffs before adjusting rates.

Speaking of Trump, the president’s repeated public calls for rate cuts and criticism of Powell could complicate the Fed’s messaging, though Powell is expected to reaffirm the central bank’s independence.

Financial markets may see muted initial reactions to a widely anticipated hold, but equities, bonds, gold, and the US Dollar could move based on the updated dot plot and Powell’s comments.

If the Fed signals a dovish pivot—hinting at potential rate cuts in the near future due to confidence in declining inflation—equity markets could rally, as lower borrowing costs typically support corporate earnings and valuations. Growth stocks, particularly in technology, which are sensitive to interest rates, would likely see the most benefit.

Bond yields, such as those on the 10-year Treasury, could decline in anticipation of looser monetary policy, boosting fixed-income assets.

Conversely, a hawkish stance—suggesting that rates will remain higher for longer to combat stubborn inflation—could pressure risk assets like stocks, as higher interest rates increase borrowing costs and dampen economic growth prospects.

In this scenario, the US dollar might strengthen, as elevated rates attract capital inflows, while commodities like gold could face headwinds due to a stronger currency and higher opportunity costs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up