Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

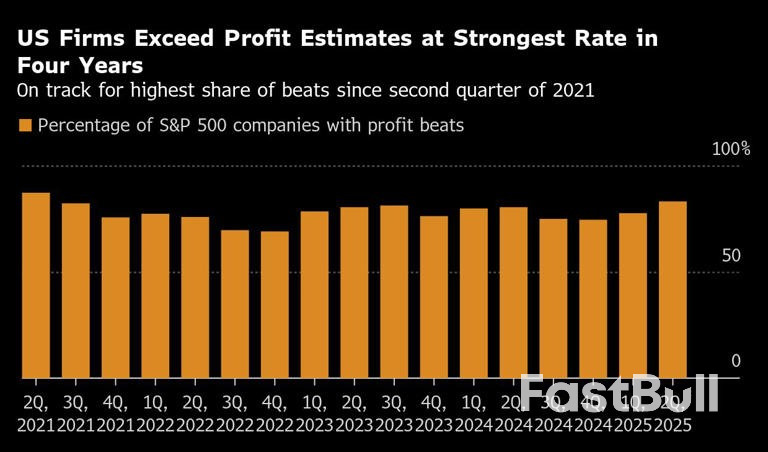

With 83% of S&P 500 firms beating profit estimates, corporate earnings are fueling a powerful rally. Solid results and upbeat guidance support gains, though high valuations and investor euphoria pose risks.

The Bank of Canada will hold its overnight interest rate steady at 2.75% on July 30 for the third consecutive meeting thanks to a recent rise in inflation and a fall in unemployment, according to a Reuters poll of economists that still found many expect at least two more cuts this year.

The Canadian central bank has cut rates by a total of 225 basis points since June 2024, but has been on hold since March as policymakers await news on where a confusing barrage of U.S. tariff threats will eventually settle.The trade outcome is crucial to the outlook, given that more than 80% of Canada's exports go to its southern neighbour.

Hefty import duties on goods ranging from steel and aluminium to automobiles have already dampened Canadian business and household sentiment.

A recent threat from U.S. President Donald Trump to impose an across-the-board 35% tariff on goods not covered by the existing free trade agreement between Canada, the U.S. and Mexico has led to further confusion.

That lack of clarity, combined with recent data on inflation and jobs, will keep the BoC on the sidelines next week, according to all 28 economists in the July 21-25 Reuters survey.

"In response to unexpectedly positive data and renewed trade tensions ... we expect the Bank to continue to hold rates," wrote James Knightley, chief international economist at ING.

"Nonetheless, with the risks skewed toward more economic weakness, we think risks are towards two, rather than just one, rate cut before the end of the year."

Nearly two-thirds of the economists surveyed, 18 of 28, forecast that the BoC would cut its policy rate by 25 basis points in September to 2.50%. While there was no clear consensus on where that rate would be by the end of 2025, more than 60% of the economists - 17 - predicted at least two more reductions this year, including five who predicted three.

Canada's economy, which shrank 0.1% in April after growing at an annualised pace of 2.2% in the first quarter, is expected to have contracted 0.5% in the second quarter, according to the median forecast in the poll.

It is forecast to stagnate this quarter before expanding 0.8% in the fourth quarter, with the economy forecast to grow an average 1.3% this year and in 2026.

Nearly half of the forecasters - 10 of 21 - expect the economy to enter a technical recession, defined as two consecutive quarters of contraction, at some point this year.

Businesses remain cautious and are keeping hiring and investment under check, the latest BoC survey showed earlier this week.Demand in the housing market, a pillar of the economy and household wealth, has remained weak despite falling interest rates and house prices.

"Interest rates don't appear to be low enough to stimulate housing activity, and business capital spending is likely to be muted until it's clear the Canada-U.S.-Mexico trade deal will be renewed," said Avery Shenfeld, chief economist at CIBC Capital Markets.

"So barring a much better outcome for trade talks than we currently expect, we see the BoC cutting rates two more times over the balance of the year."

Canadian inflation, which rose to 1.9% last month, is expected to average around 2% - the midpoint of the BoC's 1%-3% target - through at least 2027, though core price pressures are likely to remain elevated, median forecasts in the poll showed.

President Donald Trump said on Friday he had a good meeting with Federal Reserve Chair Jerome Powell and got the impression Powell might be ready to lower interest rates.

"We had a very good meeting ... I think we had a very good meeting on interest rates," Trump told reporters.Trump clashed with Powell during a rare presidential visit to the U.S. central bank on Thursday, and criticized the cost of renovating two historic buildings at its headquarters.Trump, who called Powell a "numbskull" earlier this week for failing to heed the White House's demand for a large reduction in borrowing costs, said he did not intend to fire Powell, as he has frequently suggested he would.

An Opec+ panel is unlikely to alter existing plans to raise oil output when it meets on Monday, four Opec+ delegates said, noting the producer group is keen to recover market share while summer demand is helping to absorb the extra barrels.

The meeting of the Joint Ministerial Monitoring Committee (JMMC), which includes top ministers from the Organization of the Petroleum Exporting Countries and allies led by Russia, is scheduled for 1200 GMT on Monday.

Four Opec+ sources told Reuters the meeting is unlikely to alter the group's existing policy, which calls for eight members to raise output by 548,000 barrels per day in August. Another source said it was too early to say.

Opec and the Saudi government communications office did not respond to a request for comment.

Opec+, which pumps about half of the world's oil, has been curtailing production for several years to support the market. But it reversed course this year to regain market share, and as US President Donald Trump demanded Opec pump more to help keep a lid on gasoline prices.

The eight Opec+ producers hold a separate meeting on August 3 and remain likely to agree to a further 548,000 bpd increase for September, three of the sources said, as reported by Reuters earlier this month.

This would mean that, by September, Opec+ will have unwound their most recent production cut of 2.2 million bpd, and the United Arab Emirates will have delivered a 300,000 bpd quota increase ahead of schedule.

The JMMC meets every two months and can recommend changes to Opec+ output policy.

Oil prices have remained supported despite the Opec+ increases thanks to summer demand and the fact that some members have not raised production as much as the headline quota hikes have called for. Brent crude was trading close to US$70 a barrel on Friday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up