Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Global markets rose on optimism over US-China trade talks, boosting Asian equities and oil. The dollar strengthened, UK job data disappointed, and select European stocks gained on upgrades and corporate news.

USD/JPY ranges within daily cloud (144.43/145.59) also between daily Tenkan and Kijun-sen lines, with Kijun-sen (145.38) capping the action today.

Near term technical structure is slightly bullishly aligned, with growing positive momentum and repeated close above Tenkan-sen supporting the notion.

On the other hand, overbought stochastic might be limiting factor that partially offsets positive signals.

Sideways near-term mode to be expected as long as price holds within the cloud, as strong downside rejection on Monday and upside rejection today supports scenario.

Firmer direction signals to be expected on clear break of either boundary of daily cloud, with dollar being underpinned by optimism on US China trade talks, though support was so far insufficient for stronger movements.

Markets await release of US inflation data this week, to get more clues about Fed’s action in the near future.

Signals that Bank of Japan will keep its monetary policy unchanged in the meeting next week, could be initial negative signal for yen.

Sustained break below cloud base / daily Tenkan to weaken near term structure and risk test of supports at 143.65/00 and 142.40 on stronger acceleration.

Conversely, firm break of cloud top to generate bullish signal and expose targets at 146.15/38 (Fibo 61.8% of 148.64/142.11 / May 29 spike high).

Res: 145.29; 145.59; 146.15; 146.38.

Sup: 144.33; 143.65; 143.00; 142.40.

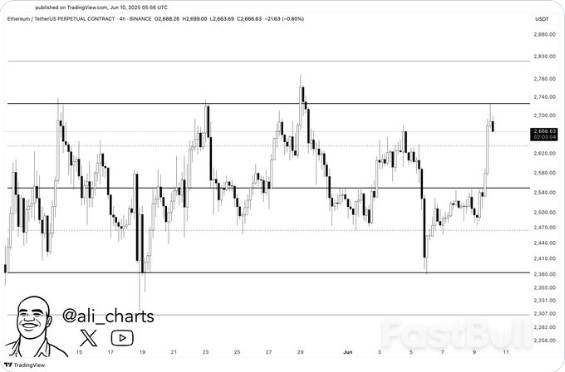

Ethereum (ETH), at this price of $2,750, continues to be a tough challenge, as it has previously prevented the cryptocurrency from increasing. There have been many moments when Bitcoin tried to break away from this level, but it didn’t. There has been a careful review of whether ETH can keep its current level, as it would support any movement towards growth.

The chart by @ali_charts explains that traders should wait for a decisive breakout before deciding on their next moves. Without breaking $2,750, any short-term profits could be fast to vanish. Should the price movement stall, it might mean that traders fell for a bull trap and had to face quick losses. Ethereum’s upcoming movements will depend on its price point.

If Ethereum is turned away from the $2,750 resistance, its price may drop to support levels at $2,500 and $2,380. These levels come from consolidations and substantial recoveries that occurred in these industries before. Ethereum appears to always come back to these points when growth becomes weaker, which could help it minimize a significant drop.

The chances of a correction rise as investors’ confidence lowers or significant economic changes occur. Traders should watch the movements around these supports, since going beyond them can result in more price declines. They provide a set of guidelines for figuring out potential short-term support during times of doubt.

According to the Binance chart, from early 2025 until June 10, Ethereum went from a low of $1,500 to trading close to $2,679. The current RSI number is 61.69, so the price movement is overbought, and this could slow down the market or result in a brief price fall.

At this moment, the MACD is in negative territory at -12.19, demonstrating that investors are still cautious. Still, recent price hikes suggest that an upswing is possibly near. Even with this price increase, signs are warning investors, meaning they should wait for stronger reasons to trade in a certain direction. Since the price of Ethereum is still confined to a range, traders are watching the $2750 level that could decide where the market heads next.

The US and China resumed talks into a second day in London, with financial markets on edge as the world’s largest economies try to agree to allow exports of key tech and industrial goods and avoid escalating their trade war.

The teams led by US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng were reconvening on Tuesday just after 10.40am at Lancaster House. The Georgian-era mansion near Buckingham Palace has hosted major addresses by UK prime ministers, speeches by central bank governors and parties for Britain’s royal family.

Speaking to reporters as officials arrived, US Commerce Secretary Howard Lutnick said talks are going well and are expected to go all day on Tuesday.

US President Donald Trump told reporters at the White House on Monday that “we are doing well with China. China’s not easy”, adding that he was “only getting good reports” from the nearly seven-hour session on Monday. Bessent said after day one they had a “good meeting”.

Bond and currency markets are closely monitoring the talks for clues on the potential economic impact. The Bloomberg Dollar Spot Index, which has fallen sharply this year as trade tensions undermine confidence in US assets, is around its lowest levels since 2023.

The key issue this week is re-establishing terms of an agreement reached in Geneva last month, in which the US understood that China would allow more rare earth shipments to reach American customers. The Trump administration accused Beijing of moving too slowly, which threatened shortages in domestic manufacturing sectors.

In return, the Trump administration is prepared to remove a recent spate of measures targeting chip design software, jet engine parts, chemicals and nuclear materials, people familiar with the matter said. Many of those actions were taken in the past few weeks as tensions flared between the US and China.

“A US decision to rollback some portion of the technology controls would very much be viewed as a win by China,” said Dexter Roberts, a non-resident senior fellow at the Atlantic Council’s Global China Hub. “If we think back to the last administration, the possibility of the US unwinding any controls was pretty much unthinkable.”

A month ago Beijing and Washington agreed to a 90-day truce through mid-August in their crippling tariffs to allow time to resolve many of their trade disagreements — from tariffs to export controls.

At the same time, Trump’s trade team is scrambling to secure bilateral deals with India, Japan, South Korea and several other countries that are racing to do so before July 9, when the US president’s so-called reciprocal tariffs rise from the current 10% baseline to much higher levels customised for each trading partner.

Meanwhile, Chinese President Xi Jinping on Tuesday held his first phone conversation with South Korea’s newly elected President Lee Jae-myung and called for cooperation to safeguard multilateralism and free trade.

“We should strengthen bilateral cooperation and multilateral coordination, jointly safeguard multilateralism and free trade, and ensure the stability and smoothness of global and regional industrial chains and supply chains,” Xi said, according to a CCTV report.

Iran is set to propose a framework agreement in its ongoing nuclear discussions with the United States, according to a senior official. This raises the possibility of an interim agreement, which could pave the way for more comprehensive negotiations in the future.

The Deputy Foreign Minister of Iran, Majid Takht-Ravanchi, announced this development during an interview with the state-run Islamic Republic News Agency on Tuesday. He revealed that Tehran is preparing a fresh proposal concerning its nuclear activities. This proposal will be presented during the sixth round of talks with Washington, scheduled to take place in Oman on Sunday.

Takht-Ravanchi explained that the current proposal doesn’t consist of a lengthy text, as they aim to avoid presenting a comprehensive and extensive agreement or memorandum that could be challenging and time-consuming to prepare. He added that if an agreement is reached on this proposed framework, more detailed discussions about its specifics will commence.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up