Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto stocks experienced significant gains on April 9 as the S&P 500 posted its third-largest single-day gain since World War II.

Above: Pound to Dollar rate shown at 15-minute intervals, with GBP/EUR. Click for closer inspection.

Above: Pound to Dollar rate shown at 15-minute intervals, with GBP/EUR. Click for closer inspection.

Gold rose again after posting its biggest one-day gain in 18 months, as confusion over US President Donald Trump’s tariff agenda drove investors to buy the precious metal as a haven.

Bullion climbed as much as 1.6% on Thursday and was trading less than $50 short of last week’s all-time high. That’s after it closed up 3.3% on Wednesday in a whipsaw day for markets. The precious metal has also been supported by a weaker greenback.

Gold’s initial surge in the previous session came after US tariffs on around 60 trading parters kicked in, fueling market upheavals and increasing worries about a global recession. Then Trump announced a 90-day pause to higher tariffs on 56 countries and the European Union, which will now be taxed at the 10% baseline rate.

“When you’re in a crisis and gold is selling off, that’s telling you you’ve got a liquidity problem,” Carlyle Group Inc.’s Jeff Currie told Bloomberg Television on Thursday. “Then boom, they came out with the reprieve, gold bounced back up which is telling you liquidity came back into the system,” he said.

Still, Trump also hiked duties on China to 125%, effective immediately, after Beijing announced plans to retaliate with an 84% tariff to start Thursday. Those moves are exacerbating concerns the world’s two biggest economies will become enmeshed in a crippling trade war.

Markets rallied after Trump’s tariff-pause announcement. US stocks had their best day since the financial crisis, with the S&P 500 soaring nearly 10%, after slumping to the fringe of a bear market in the past week.

The constant back-and-forth of the US administration’s tariff plan has rocked the world, as investors scramble to find direction and certainty. That’s generally been supportive for gold, which is up 19% this year. The metal has also been bolstered by hopes for more Federal Reserve monetary easing and central-bank buying.

“We remain quite positive for gold,” Dominic Schnider, head of commodities and Asia Pacific currencies at UBS Global Wealth Management, said on Bloomberg Television. “The next step is going to be, at some point, the Fed coming in — and that gives the next leg up for gold.”

According to Wu Blockchain, the crypto market witnessed a sharp rebound following Trump’s announcement of a 90-day tariff pause. Ethereum surged 15%, breaking past $1,600. XRP climbed 15.3%, trading over $2 for the first time in weeks. The total crypto market cap jumped 8.13% to hit $2.61 trillion. This marks a strong recovery from earlier trade-war-induced losses. Additionally, Bitcoin spiked to $82,900, with market sentiment turning decisively bullish. Liquidations totaled $587 million in 24 hours, with short positions accounting for $374 million.

Moreover, the stock market reacted with enthusiasm. The S&P 500 posted a 9.52% gain, its best day since 2008. Meanwhile, the Nasdaq soared 12.16%, the second-largest single-day rally in its history. Mega-cap tech stocks including Nvidia, Apple, Microsoft, Tesla, Amazon, and Meta all logged gains exceeding 10%. Hence, optimism from the tariff reprieve spilled over across asset classes.

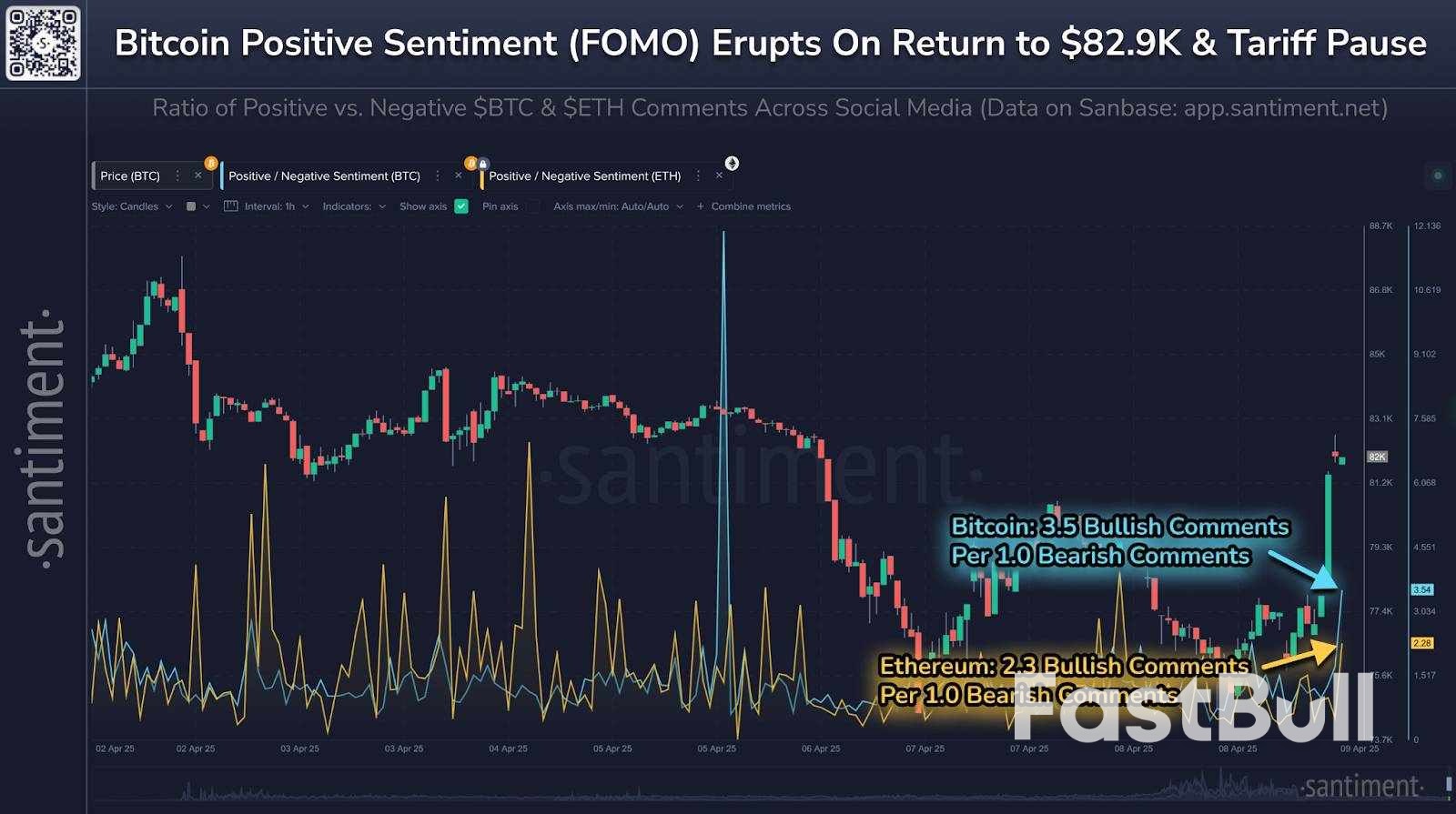

Santiment data shows social media sentiment has shifted dramatically. Traders now post 3.5 bullish comments for every 1 bearish mention on Bitcoin. Ethereum follows with a 2.3-to-1 bullish ratio. Consequently, retail investors have started reacting to the news, driving further buying pressure.

Besides, the recent Bitcoin price surge from $73,000 to $82,900 reflects this psychological shift. The strongest sentiment spike came on April 5, aligning with the initial rebound. Additionally, Ethereum's social sentiment shows sustained improvement since April 7. These indicators suggest renewed investor confidence, despite underlying macroeconomic uncertainties.

Source: Santiment

Source: SantimentTrump’s move to set a temporary 10% tariff for non-retaliating nations calmed trade war fears. However, tensions with China persist. China retaliated by hiking tariffs by 84% on U.S. goods. In response, Trump vowed to raise tariffs on Chinese imports to 125%, up from 104%. Despite these threats, markets rallied. Investors seemingly bet on the reprieve being extended or turning into longer-term negotiations.

Hence, market participants must remain cautious. While short-term rallies may continue, the unresolved nature of global trade tensions still looms large. Moreover, the current crypto rally appears driven by FOMO and speculative momentum.

TOKYO — World markets soared on Thursday, with Japan’s benchmark jumping more than 9%, as investors welcomed U.S. President Donald Trump’s decision to put his sharp tariff hikes on hold for 90 days, though he excluded China from the reprieve.

In early trading, Germany’s DAX initially gained more than 8%. It was up 7.5% at 21,141.53 a bit later, while the CAC 40 in Paris gained 7.2% to 7,360.23. Britain’s FTSE 100 surged 5.4% to 8,090.02.

However, U.S. futures edged lower and oil prices also declined. Chinese shares saw more moderate gains, given yet another jump in the tariffs each side is imposing on each others’ exports.

The future for the S&P 500 was down 0.4% while that for the Dow Jones Industrial Average edged 0.2% lower.

Analysts had expected the global comeback given that U.S. stocks had one of their best days in history on Wednesday as investors registered their relief over Trump’s decision.

On Thursday, Japan’s benchmark Nikkei 225 jumped 9.1% to finish at 34,609.00, zooming upward as soon as trading began.

Australia’s S&P/ASX 200 soared 4.5% to 7,709.60. South Korea’s Kospi gained 6.6% to 2,445.06. Hong Kong’s Hang Seng added 2.4% to 20,750.65. The Shanghai Composite rose 1.2% to 3,223.64.

Investors went “from fear to euphoria,” Stephen Innes, managing partner at SPI Asset Management, said in a commentary.

“It’s now a manageable risk, especially as global recession tail bets get unwound, and most of Asia’s exporters breathe a massive sigh of relief,” he said, referring to the tariffs on China, which Trump has kept.

On Wall Street, the S&P 500 surged 9.5%, an amount that would count as a good year for the market. It had been sinking earlier in the day on worries that Trump’s trade war could drag the global economy into a recession. But then came the words investors worldwide had been waiting and wishing for.

“I have authorized a 90 day PAUSE,” Trump said, saying more than 75 countries are negotiating on trade and not retaliating against his latest increases in tariffs.

Treasury Secretary Scott Bessent later told reporters that Trump was pausing his so-called ‘reciprocal’ tariffs on most of the country’s biggest trading partners, but maintaining his 10% tariff on nearly all global imports.

China was a huge exception, though, with Trump saying tariffs are going up to 125% against its products. The trade war is not over, and an escalating battle between the world’s two largest economies can create plenty of damage.

U.S. stocks are also still below where they were just a week ago, when Trump announced worldwide tariffs on what he called “Liberation Day.”

But on Wednesday, at least, the focus on Wall Street was on the positive. The Dow Jones Industrial Average shot to a gain of 2,962 points, or 7.9%. The Nasdaq composite leaped 12.2%. The S&P 500 had its third-best day since 1940.

The relief came after doubts had crept in about whether Trump cared about the financial pain the U.S. stock market was taking because of his tariffs. The S&P 500, the index that sits at the center of many 401(k) accounts, came into the day nearly 19% below its record set less than two months ago.

That surprised many professional investors who had long thought that a president who used to crow about records for the Dow under his watch would pull back on policies if they sent markets reeling.

Wednesday’s rally pulled the S&P 500 index away from the edge of what’s called a “bear market.” That’s what professionals call it when a run-of-the-mill drop of 10% for U.S. stocks, which happens every year or so, graduates into a more vicious fall of 20%. The index is now down 11.2% from its record.

Wall Street also got a boost from a relatively smooth auction of U.S. Treasurys on Wednesday. Earlier jumps in Treasury yields had rattled the market, indicating increasing levels of stress. Trump said he had been watching the bond market “getting a little queasy.”

Higher yields on Treasurys put pressure on the stock market and push upward on rates for mortgages and other loans for U.S. households and businesses.

U.S. Treasury yields historically have dropped — not risen — during scary times for the market because the bonds are usually seen as some of the safest possible investments. This week’s sharp rise had brought the yield on the 10-year Treasury back to where it was in late February.

After approaching 4.50% in the morning, the 10-year yield pulled back to 4.34% following Trump’s pause and the Treasury’s auction. That’s still up from 4.26% late Tuesday and from just 4.01% at the end of last week.

In energy trading, benchmark U.S. crude fell 81 cents to $61.54 a barrel. Brent crude, the international standard, declined 93 cents to $64.55 a barrel.

In currency trading, the U.S. dollar fell to 146.77 Japanese yen from 147.38 yen. The euro cost $1.0986, up from $1.0954.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up