Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Fed Chair Jerome Powell signaled that the U.S. may be entering an era of structurally higher interest rates due to frequent supply shocks, while the central bank begins developing a five-year strategic policy...

U.S. retail sales growth slowed in April as the boost from households front-loading motor vehicle purchases ahead of tariffs faded and consumers pulled back on spending elsewhere against the backdrop of an uncertain economic outlook.

The apprehension over the economy's prospects, sparked by President Donald Trump's on-again, off-again tariffs policy, was underscored by retail giant Walmart (WMT.N), opens new tab, which on Thursday joined the list of companies from airlines to auto manufacturers that have either withdrawn or refrained from giving financial guidance.

Wholesale prices for services like airline tickets and hotel rooms fell last month, other data showed, also flagging softening demand, which does not bode well for an anticipated rebound in growth this quarter after the economy contracted in the January-March period for the first time in three years.

"We are now witnessing the first-order effects of tariffs on the economy through reduced spending," said Tuan Nguyen, a U.S. economist at RSM US. "While a recession is no longer our base case over the next 12 months due to the recent reduction in tariffs, the likelihood has increased that the U.S. economy will experience several quarters of sluggish growth."

Retail sales edged up 0.1% last month after an upwardly revised 1.7% surge in March, the Commerce Department's Census Bureau said. Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, would be unchanged after a previously reported 1.5% jump in March. Estimates ranged from a 0.6% decline to a 0.4% gain.

Retail sales have see-sawed this year amid Trump's announcements of import duties. Though Washington and Beijing struck a 90-day truce in their trade war last weekend, slashing tariffs on imports, uncertainty remained over what happens thereafter.

Sales at auto dealerships dipped 0.1% after accelerating by 5.5% in March. Receipts at sporting goods, hobby and musical instrument stores slumped 2.5%, while receipts at miscellaneous store retailers fell 2.1%.

Online retail store sales rose 0.2% while receipts at food services and drinking places, the only services component in the report, increased 1.2% after rebounding by 3.0% in March.

Economists view dining out as a key indicator of household finances. An analysis of Bank of America credit card data suggested most households remained financially sound, thanks to a resilient labor market characterized by low layoffs.

Bank of America Institute, however, noted "we see some increase in the share of households making only the minimum payment on their credit cards, suggesting building pressures for some households."

Stocks on Wall Street were trading lower. The dollar fell against a basket of currencies. U.S. Treasury yields declined.

Retail sales excluding automobiles, gasoline, building materials and food services fell 0.2% in April after an upwardly revised 0.5% gain in March.

These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Economists had forecast core retail sales would climb 0.3% after a previously reported 0.4% advance in March.

Consumer spending ended the first quarter on a strong note, putting consumption on a higher growth trajectory heading into the second quarter.

Economists expect a modest rebound after the economy contracted at a 0.3% rate pace last quarter amid a flood of imports, triggered by businesses trying to beat tariffs.

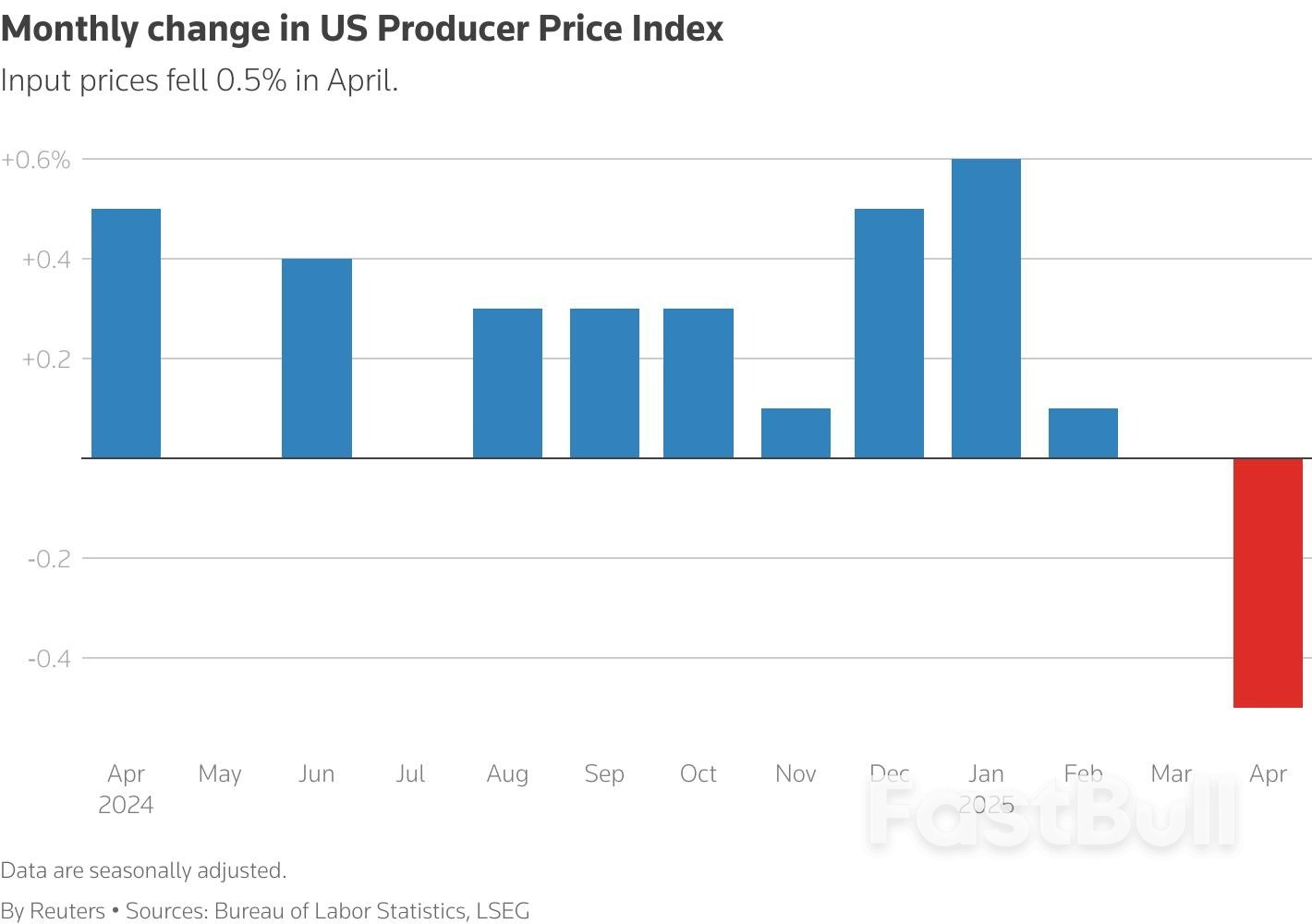

A separate report from the Labor Department showed the Producer Price Index for final demand dropped 0.5% in April as the cost of services declined by the most since 2009, pulled down by ebbing demand for air travel and hotel accommodation.

The PPI was unchanged in March. Economists had forecast the PPI would rise 0.2%. In the 12 months through April, the PPI increased 2.4% after climbing 3.4% in March.

A column chart titled "Monthly change in US Producer Price Index" that tracks the metric over the past year.

In addition to his protectionist trade policy, Trump has cracked down on immigration and repeatedly expressed his desire to make Canada the 51st U.S. state and acquire Greenland. Those actions have been followed by a sharp drop in tourism, with lower airline ticket sales and hotel and motel bookings.

Wholesale services prices dropped 0.7%, the largest decline since the government started tracking the series in December 2009, after rising 0.4% in March. Prices for hotel and motel rooms dropped 3.1% after easing 0.5% in March. Portfolio management fees plunged 6.9%, while airline fares fell 1.5%.

Portfolio management fees, hotel and motel accommodation and airline fares are among the components that go into the calculation of the core Personal Consumption Expenditures (PCE) Price Index, one of the inflation measures tracked by the Federal Reserve for its 2% target.

Combined with tame consumer price readings in April, economists estimated that core PCE inflation rose 0.1% after being unchanged in March. Core PCE inflation was forecast to have increased 2.5% on a year-over-year basis in April after rising 2.6% in March. With retailers like Walmart and automakers like Ford Motor, however, raising prices in response to tariffs, any moderation in inflation is likely to be temporary.

Fed Chair Jerome Powell warned on Thursday that "we may be entering a period of more frequent, and potentially more persistent, supply shocks - a difficult challenge for the economy and for central banks."

Economists expected core PCE inflation to peak at around 3.6% this year and that the U.S. central bank would resume cutting interest rates either in September or December. The Fed left its benchmark overnight interest rate in the 4.24%-4.50% range earlier this month.

"The pendulum keeps swinging in a hawkish direction as Powell talks about supply shocks and reiterates the importance of keeping inflation expectations anchored," said David Russell, global head of market strategy at TradeStation. "While recent data has been benign, there could be pressures building toward higher inflation."

Reporting by Lucia Mutikani; Editing by Chizu Nomiyama, Nick Zieminski and Paul Simao

U.S. retail sales rose just 0.1% in April, sharply down from March’s revised 1.7% surge, according to Commerce Department data released Thursday. Economists had anticipated flat sales, and the weak print underscores consumer fatigue as tariff-induced buying fades. Households, previously front-loading vehicle purchases ahead of a 25% global car tariff, appear to be retreating, particularly on discretionary spending.

Stripping out autos, gasoline, building materials, and food services, core retail sales fell 0.2%—a disappointment versus the 0.3% gain forecast. This core measure, key to GDP calculations, suggests consumer momentum may be stalling as broader economic uncertainty weighs on sentiment.

The Producer Price Index (PPI) for final demand fell 0.5% in April, its largest drop in over a year. Final demand services drove the decline, down 0.7%, led by steep margin compression in trade services—especially machinery and vehicle wholesaling, which sank 6.1%. Goods prices were flat, despite notable declines in energy (-0.4%) and food (-1.0%).

Core PPI, which excludes volatile food, energy, and trade services, edged down 0.1%—its first decline since April 2020. Year-over-year, the index rose 2.4%, suggesting producer inflation remains moderate. For traders, the combination of weakening services pricing and soft core readings raises red flags for corporate margins, especially in the retail and transportation sectors.

The Philadelphia Fed’s May Manufacturing Business Outlook Survey signaled ongoing weakness, with the current activity index at -4.0—up from -26.4 in April, yet still in contraction. New orders rebounded into positive territory, but shipments declined again, and elevated input costs remain a concern. Still, expectations for future growth rose sharply, with the six-month outlook index climbing to 47.2.

In contrast, the NY Fed’s Empire State index dropped to -9.2 from -8.1, marking a third consecutive monthly decline. While new orders improved, hiring and confidence lagged. Prices paid surged to 59.0, the highest in over two years, complicating any dovish outlook from the Federal Reserve.

Initial jobless claims held steady at 229,000 for the week ending May 10, while the four-week average edged up to 230,500. Continued claims also rose marginally, suggesting the labor market remains stable but is not tightening further—a critical input for Fed policy expectations.

The combination of soft retail sales, a declining PPI, and weak regional manufacturing data suggests headwinds for consumer demand and corporate revenue growth. Despite isolated signs of resilience, such as steady employment and future business optimism in Philadelphia, the broader signal leans bearish in the short term for consumer discretionary and retail sectors. Traders should monitor further consumer data and Fed commentary closely, especially with inflation pressures diverging between goods and services.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up