Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

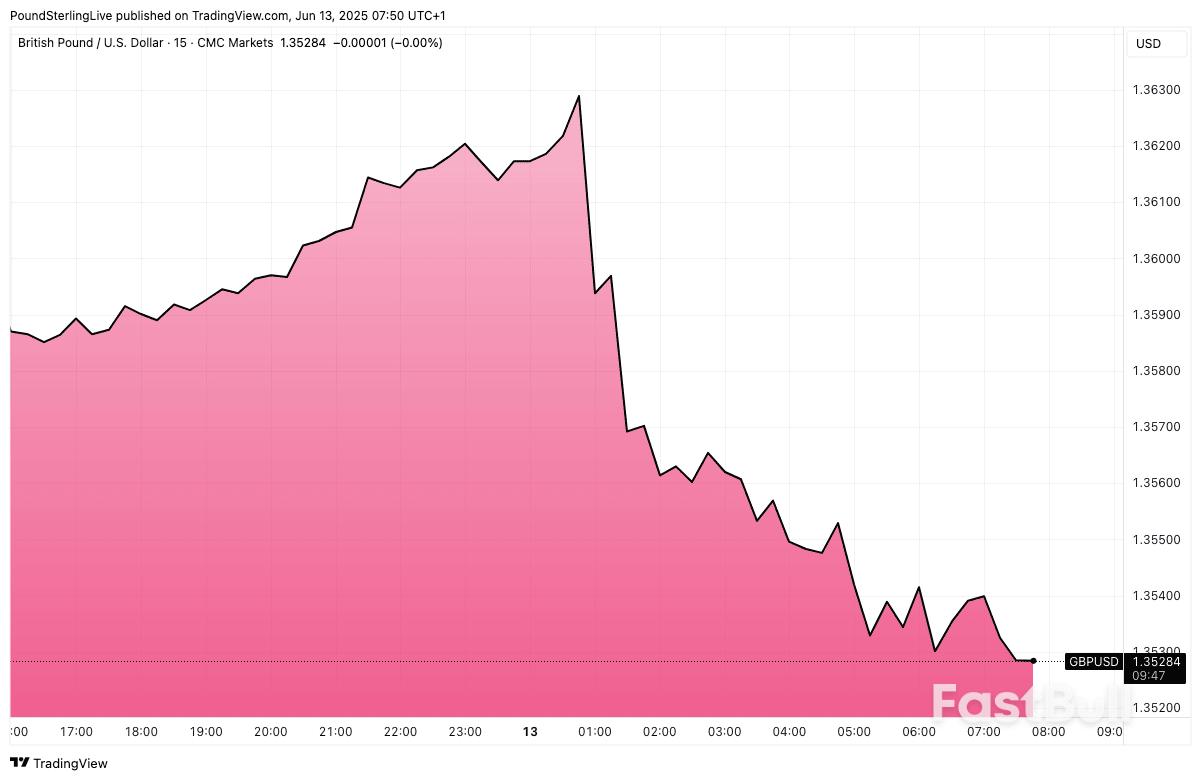

The Dollar never lost its safe-haven status. Keep an eye on oil.

Iran announced it will continue its nuclear activities following airstrikes by Israel, a move confirmed by Iran's state television. The airstrikes have heightened tensions in the region, drawing international attention.

This development underscores the continuing geopolitical tensions between Iran and Israel, potentially impacting global diplomacy and markets.

Iran's commitment to its nuclear program remains steadfast. This declaration comes despite Israeli airstrikes targeting Iranian facilities, as reported by ChainCatcher news. The Atomic Energy Organization of Iran (AEOI), led by Mohammad Eslami, plays a crucial role in managing these activities, often emphasizing Iran's right to pursue nuclear advancements.

The geopolitical landscape faces uncertainty as regional and global actors weigh responses. The E3, consisting of France, Germany, and the UK, maintain focus on possible repercussions, including sanctions that may disrupt traditional financial pathways. The Iranian military has issued warnings of retaliation against Israel and the United States, adding to the crisis's complexity.

Market and community reactions reflect anxiety over potential broader conflicts. Crypto markets, historically volatile during geopolitical crises, show no direct impact according to the latest data. However, stakeholders remain cautious, closely watching for any shifts that may disrupt financial stability or investor sentiment.

Did you know? During previous Iran-Israel tensions, Bitcoin trading volumes often spiked as investors sought safe-haven assets, highlighting geopolitical impacts on crypto markets.

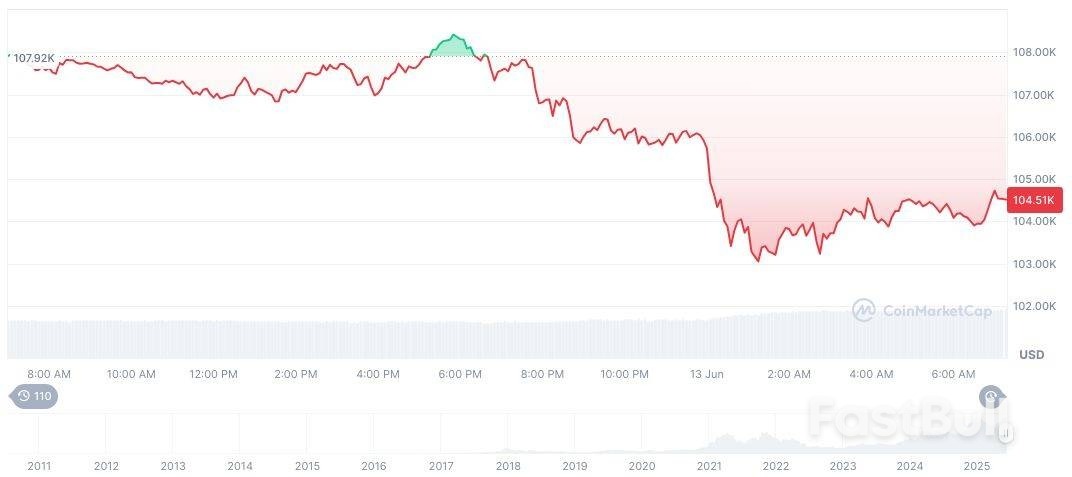

According to CoinMarketCap, Bitcoin (BTC) trades at $105,029.34 with a market cap of $2.09 trillion, maintaining dominance at 63.86%. Data reflects a 2.17% dip over 24 hours but a 1.22% increase over the past week. The 24-hour trading volume of $72.05 billion represents a 36.31% change, showcasing significant market activity.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 12:44 UTC on June 13, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 12:44 UTC on June 13, 2025. Source: CoinMarketCapThe falling out between US President Donald Trump and Elon Musk, a onetime fixture at the White House, has abated for now. But one of the key factors that sunk the relationship remains: the One Big Beautiful Bill Act (‘OBBB’), condemned by Musk as an ‘abomination’ that will result in ‘crushing’ debt, is proceeding through Congress.

Proponents tout the bill as the most consequential in US history, but Musk is right to point out its risks. His focus on fiscal irresponsibility is warranted, but only illuminates part of the lasting damage the OBBB could cause to US economic foundations.

As written, the bill delivers or extends expansive tax cuts, including campaign promises on tip and overtime income. It also launches new child savings accounts, and bolsters immigration enforcement and military spending. Offsetting its price tag are unprecedented benefit cuts that will strip millions of health coverage and nutritional support. All told, the OBBB in its current form renders the poorest Americans worse off while funnelling the bulk of its benefits to the top quintile, and disproportionately to the richest.

Beyond this accounting, however, other facets of the bill deserve special scrutiny. Its fiscal cost, the threat it presents to foreign investment, and the clean energy rollback it pursues threaten lasting damage to US economic dynamism and competitiveness.

The OBBB’s immense debt burden – $2.4 trillion over a decade – has elicited concern across the ideological spectrum, even as the White House argues it strengthens the nation’s fiscal trajectory.

Even before the OBBB, the US spent more on interest payments – over $1 trillion last year – than national defence. Adding lavishly to the national debt when interest rates are high and unemployment low is deeply irresponsible and could push the fiscal burden to alarming heights, increasing borrowing costs for consumers and businesses. The OBBB is, in the words of Republican Congressman Thomas Massie, a ‘debt bomb ticking’. But many of his peers remain unconvinced, instead holding fast to expectations of an economic boom.

The crux of the fiscal debate is the recurring claim that tax cuts spur adequate economic activity to pay for themselves. OBBB’s proponents have embraced this notion, disproven time and again, even as reputable independent analyses find to the contrary. With the World Bank trimming the outlook for the US economy due to policy uncertainty and trade barriers, achieving the promised growth is increasingly improbable.

This fiscal expansion lands amid investor unease. Moody’s May downgrade of US debt and April’s bond market jitters add to other warning signs that investors are reconsidering the appeal and safety of dollar assets. Heightened fiscal pressures will leave the nation vulnerable to external shocks and hamstring its capacity to make transformational economic and security investments.

An obscure provision, Section 899, threatens to further alienate foreign investors by creating a retaliatory tax on individuals and entities from nations imposing ‘unfair’ digital services or profit-shift taxes – countries supplying more than 80 per cent of US foreign direct investment (FDI).

Foreign investors’ expansive US holdings – roughly 20 per cent of equities, 30 per cent of Treasuries, 30 per cent of corporate credit, and significant FDI – catalyse US job creation, growth, and innovation. The OBBB threatens this advantage, risking outflows that would harm US businesses, workers, and investors.

Treasury Secretary Scott Bessent maintains that Section 899 empowers the US to reassert tax sovereignty where other countries overreach. But, in the context of the administration’s unilateral economic agenda (including tariffs), it looms as another coercive tool that could ‘transform a trade war into a capital war’. Even if the tax is never imposed – let alone reciprocal retaliation – its passage could chill investment, by calling into question the fundamental openness of the US system.

A final threat to US competitiveness is the OBBB’s rollback of clean energy incentives as US energy demand surges.

Hobbling clean energy development could needlessly constrain supply and force suboptimal policy decisions, especially given the huge energy demands of AI and data centres. Indeed, Trump’s eagerness to strike deals during his May visit to the Gulf attests to energy’s strategic potency in the AI context.

Panned by its detractors as market-distorting giveaways, the Biden administration’s 2022 Inflation Reduction Act subsidies sparked a wave of energy investments, with the bulk of projects located in Republican-held districts.

But the OBBB threatens incentives for businesses and households alike, including those for EVs, which Musk reportedly fought to save. By repealing and restricting tax credits for clean electricity production and investment, the bill undermines renewable energy development and financing. Complex restrictions on relationships with foreign entities would further harm investment.

The current administration has sidelined climate priorities. But ensuring energy security and domestic production remain paramount, especially as US oil and gas producers face challenging market dynamics. The administration acknowledges as much, in particular in its push to build nuclear energy, which has a crucial role to play. But even an aggressive buildout would take years to bring substantial new capacity online.

In the intervening years, undermining rapid deployment of renewables could constrain energy supply and drive up energy costs.

Likewise, withdrawing support from nascent sectors like enhanced geothermal is profoundly short-sighted, allowing rivals to seize a strategic advantage as China did with solar production, sacrificing US deployment prospects and future export leadership. The rollback pulls against the administration’s own energy dominance objectives and chills innovation, with ripple effects into other sectors.

Congressional jockeying is far from over. The OBBB’s reliance on ‘reconciliation,’ which allows Republicans to pass a bill without Democratic support, means a small group of legislators can wield outsize influence. Consternation is building within the Republican caucus and lobbying groups, and tweaks are likely to emerge on energy subsidies and Section 899, which could mitigate some risk.

Material changes to the fiscal impact, however, will be difficult given factional disputes over various tax and benefit provisions, though some lawmakers have signalled opposition that could delay the bill.

Still, the OBBB’s general shape is set. With pressure for a legislative victory mounting, it is a must-pass politically for Republicans. Failure to do so before the expiration of Trump’s first term tax cuts would lead to higher rates.

It is also a must-pass for another urgent reason – the need to lift the fast-approaching debt ceiling and avoid default. Absent action to do so, the Treasury will no longer be able to meet its obligations in the coming months, inviting unprecedented catastrophe. Even approaching the deadline could spook markets.

Ultimately, the OBBB’s fiscal irresponsibility, discouragement of foreign investment, and damage to energy innovation would sap American economic strength. As Congress wrangles over the bill’s details and Trump and Musk’s feud fades, it remains to be seen what of consequence will endure, and at what cost to whom. All eyes are now on the Senate, to see if it tempers the bill’s most reckless excesses.

Gold prices are solidly up and hit a five-week high in early U.S. trading Friday, on strong safe-haven demand following the overnight Israeli attacks on Iran that are being called major. Silver prices are modestly up. August gold was last up $41.90 at $3,444.30. July silver prices were last up $0.095 at $36.39.

Risk aversion in highly elevated Friday amid the most severe military escalation between Israel and Iran in decades. Targeted Israeli airstrikes overnight killed several of Iran’s top generals and nuclear officials, paralyzing Tehran’s command structure and leaving the regime reeling. Israel said it is preparing for further military action.

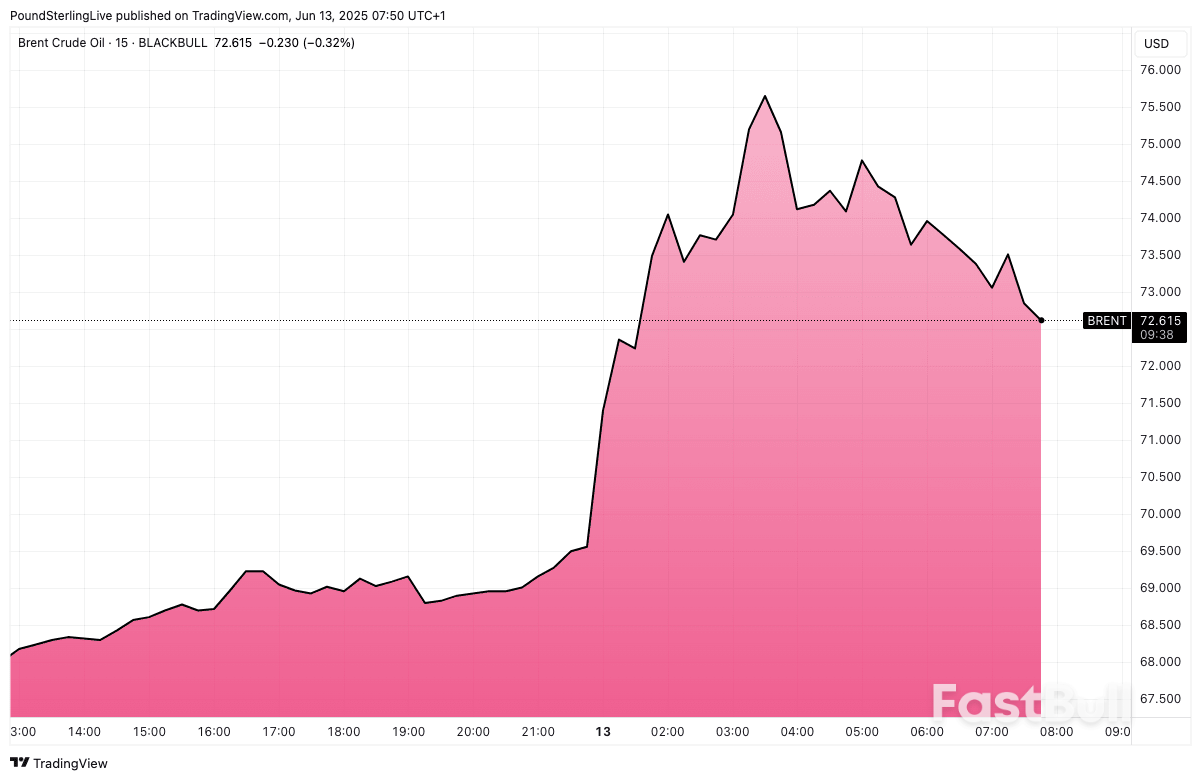

Gold prices rose to a five-week high and crude oil prices surged after Israel launched a wave of military strikes against Iranian nuclear and missile sites, raising fears of a broader Middle East conflict that could severely disrupt global energy supplies.

In a post on Truth Social, Trump declared, “Iranian leaders didn’t know what was about to happen. They are all DEAD now, and it will only get worse! There has already been great death and destruction, but there is still time to make this slaughter, with the next already planned attacks being even more brutal, come to an end. Iran must make a deal, before there is nothing left, and save what was once known as the Iranian Empire.”Asian and European stocks were mostly lower overnight. U.S. stock indexes are pointed to sharply lower openings today in New York.

The key outside markets today see the U.S. dollar index solidly up. Nymex crude oil futures prices are sharply higher, hit a five-month high and trading around $74.00 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently at 4.34%.

U.S. economic data due for release Friday is light and includes the University of Michigan consumer sentiment survey.

Technically, August gold futures bulls have the solid overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at last week’s high of $3,427.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $3,250.00. First resistance is seen at the overnight high of $3,467.00 and then at $3,477.30. First support is seen at $3,400.00 and then at Thursday’s low of $3,358.50. Wyckoff's Market Rating: 8.0.

July silver futures bulls have the solid overall near-term technical advantage. Prices are trending higher on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $40.00. The next downside price objective for the bears is closing prices below solid support at $34.00. First resistance is seen at this week’s high of $37.03 and then at $37.50. Next support is seen at $36.00 and then at this week’s low of $35.58. Wyckoff's Market Rating: 7.5.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up