Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Australian Dollar starts the new week on a soft footing owing to disappointing Chinese data.

A measure of New York state factory activity fell sharply in September as demand slumped, reflected in faltering new orders and shipments.

The Federal Reserve Bank of New York’s general business conditions index decreased nearly 21 points to -8.7, figures issued Monday showed. Readings below zero indicate contraction, and the figure was lower than all estimates in a Bloomberg survey of economists.

The measures of current new orders as well as shipments both dropped to the worst readings since April 2024.

Manufacturing has struggled and the sector lost jobs for the past four months amid lingering uncertainty from President Donald Trump’s erratic trade policy and crackdown on immigration. The Institute for Supply Management’s manufacturing index shrank in August for a sixth straight month.

The New York Fed’s index had reached a nine-month high in August after languishing in contraction territory for the prior four months.

Meanwhile, gauges of prices paid for materials as well as those received by state manufacturers edged down somewhat but were still elevated, according to the Monday report.

A gauge of factory employment contracted for the first time since May and a measure of hours worked also fell.

The six-month outlook index for overall activity in New York state looks somewhat more positive than current conditions, but “optimism remains subdued,” according to the statement.

The survey responses were collected between Sept. 2 and 9.

The dollar slipped on Monday at the start of a week of central bank policy decisions, including from the U.S. Federal Reserve, while the euro eased slightly after Fitch downgraded France's credit rating late last week.

Sterlingrose 0.5% to $1.3619, its strongest since early July, while the dollar was down 0.2% against the Japanese yenat 147.38 yen.

The euro nudged up against the dollar, but slipped about 0.1% each against sterlingand the yen. The common currency was also down about 0.3% each against the Norwegianand Swedish crowns.

Fitch Ratings downgraded France's sovereign credit score after hours on Friday, citing the government's rising debt burden. The move strips the euro zone's second-largest economy of its AA- status.

The downgrade was largely priced in by the markets in advance, as reflected in the muted reaction seen in the euro to the announcement, said Nick Rees, head of macro research at Monex Europe.

Analysts have pointed out that while fiscal worries in France could limit the euro's gains in the near term, they are unlikely to spur a meaningful decline in the currency.

Data shows that speculative net long positions on the euro against the U.S. dollar (EURNETUSD=) continue to hold strong, ticking up to $18.4 billion as of the week ended September 8, near a two-year peak.

The euro's resilience is underpinned by expectations of Federal Reserve policy easing alongside diminishing prospects for further European Central Bank rate cuts.

"The widening policy divergence opening up between the ECB and Fed heading into year-end will help to lift EUR/USD towards the 1.2000-level although the pair is currently struggling to break out of the recent trading range between 1.1500 and 1.1800," analysts at MUFG said in a note.

Investors are closely monitoring this week's key rate decisions in the U.S., Japan, United Kingdom, Canada and Norway, with the Federal Reserve's decision on Wednesday taking centre stage.

Money markets are fully pricing in a 25 basis-point Fed rate cut, with a 5% chance of an outsized 50 bp reduction.

Just as important will be Fed members' "dot plot" projections for rates, and guidance from Fed Chair Jerome Powell for gauging the extent and pace of further easing.

"We expect the statement to acknowledge the softening in the labour market, but do not expect a change to the policy guidance or a nod to an October cut," analysts at Goldman Sachs said in a note.

Both the Bank of England and Bank of Japan are expected to keep policy rates unchanged this week. Analysts are focusing on the BoE's plans to slow its reduction of government bond holdings and the BOJ's commentary to gauge the likelihood of a rate hike over the remainder of the year.

Among other currencies, the dollar was weaker against the Swiss franc, as well as the Norwegianand Swedish crowns.

The onshore yuanmeanwhile got a slight lift from a weaker greenback despite Monday's grim economic data, which showed China's factory output and retail sales in August logged their weakest growth since last year.

Also on investors' radars were talks between U.S. and Chinese officials, who concluded a first day of talks in Madrid on Sunday on their strained trade ties and a looming divestiture deadline for Chinese short-video app TikTok.

China’s economy showed further signs of weakness last month, with important data revealing factory output and consumption rising at their weakest pace for about a year.The disappointing data adds pressure on Beijing to roll out more stimulus to fend off a sharp slowdown in the world’s second-largest economy, which has struggled to fully recover from the Covid-19 pandemic, with a debt crisis denting its once-booming property sector and exports facing stronger headwinds.Economists were split over whether policymakers should introduce more near-term fiscal support to hit their annual 5% growth target, with manufacturers awaiting more clarity on a US trade deal and domestic demand curbed by an uncertain job market and property crisis.

Industrial output grew by 5.2% year-on-year last month, National Bureau of Statistics data showed on Monday, the lowest reading since August 2024 and below the 5.7% rise in July. Retail sales, a gauge of consumption, expanded 3.4%, the slowest pace since November 2024, and cooling from a 3.7% rise in the previous month.“The activity data point to a further loss of momentum,” Zichun Huang, China economist at Capital Economics, wrote in a note. “While some of this reflects temporary weather-related disruptions, underlying growth is clearly sliding, raising pressure on policymakers to step in with additional support.”

Factory activity was hit by the hottest conditions since 1961 and the longest rainy season for the same period.Authorities are leaning on manufacturers to find new markets to offset Donald Trump’s unpredictable trade policy and weak consumer spending.Separate data this month showed factory owners have had some success diverting US-bound shipments to south-east Asia, Africa and Latin America, but the drag from the property crisis continues.“Lynn Song, chief economist, Greater China at ING, suggested the weak data indicated “further stimulus support could be needed to ensure a strong finish to the year”.

She said: “While it is too early to gauge the impact of the consumer loan subsidies coming into effect in September, it is likely that more policy support is still needed, given the broader slowdown across the board.” Song said there was a “high possibility” of further interest rate cuts in coming weeks.However, Zhaopeng Xing, senior China strategist at ANZ, said that while the data showed momentum in the world’s second-largest economy was weakening, it was not yet bad enough to trigger a new round of stimulus.

“Policies and measures to support service consumption are expected to offset the impact of aggregate demand this month,” he said, adding an official crackdown on firms aggressively cutting prices made domestic demand appear worse than it was.Chinese households, which have seen their wealth shrink in the real estate downturn, have tightened their purse strings as business confidence falters, dampening the jobs market.Unemployment edged up to a six-month high of 5.3% in August, from 5.2% a month prior and 5.0% in June.Meanwhile, new home prices fell 0.3% last month from July and 2.5% on an annual basis, a different NBS dataset showed.

South Korea's negotiations with the U.S. on a trade deal to lower tariffs have stalled amid concerns over the foreign exchange implications of a $350 billion investment fund, part of an agreement reached with President Donald Trump in July.

South Korean officials, who had argued that the package would mostly comprise loans and guarantees with limited direct investment, said last week they could not accept terms similar to those of a $550 billion investment package finalised this month by Japan.

Tokyo agreed to transfer money within 45 days after the U.S. selects a project, and that available free cash flows from investments would be split evenly until they reached an allocated amount, after which 90% would go to the U.S.

U.S. Commerce Secretary Howard Lutnick said on Thursday that there would be no flexibility for Seoul. "The Japanese signed the contract. The Koreans either accept that deal or pay the tariffs. Black and white, pay the tariffs or accept the deal."

Since South Korea's deal was announced in late July, there have been concerns among market participants that the resulting dollar demand will overwhelm the domestic currency market, depressing the won.

Since suffering traumatic capital flight during a financial crisis in the late 1990s, South Korea has retained a tight grip on its currency market. It started opening it to foreigners last year but there is still no offshore market to trade the won.

The daily average global won trade stood at $142 billion in 2022, compared with $1.25 trillion for the Japanese yen, according to a triennial survey by the Bank for International Settlements. The won accounted for 2% of global market share, against 17% for the yen.

The wonhit a 15-year low at the end of last year at around 1,476 to the dollar and now stands around 1,390.

Market participants say the $40 billion needed by the state pension fund every year for its overseas investments is already a heavy burden on the currency. Citi estimated that the investment package would generate dollar demand of around $100 billion each year from 2026 to 2028.

South Korea's economy is much smaller than Japan's. It had a current account surplus of $99 billion last year, compared with Japan's surplus of nearly $200 billion, and central bank foreign reserves of $416 billion in August, compared with Japan's $1.3 trillion.

The idea of seeking a foreign exchange swap line with the U.S. was raised publicly by Presidential Policy Secretary Kim Yong-beom last week, when he said the yen's status as a key international currency and an unlimited swap line between Japan and the U.S. put Tokyo in a stronger position.

Finance Minister Koo said last week there would be an announcement on foreign currency when tariff negotiations conclude and he told Reuters on Monday he thought the U.S. would "contemplate" a currency swap line, after a local media outlet said the government had passed the request to the U.S.

The U.S. Federal Reserve has standing swap line arrangements with the central banks of Canada, Britain, Japan, the European Union and Switzerland.

It established temporary swap lines of $60 billion each with the Bank of Korea and eight other central banks in March 2020 during the COVID-19 pandemic.

After the swap line expired in December 2021, the Fed offered the Bank of Korea a safety net of $60 billion through repurchase agreements, enabling it to borrow dollars with its holdings of U.S. Treasuries as collateral.

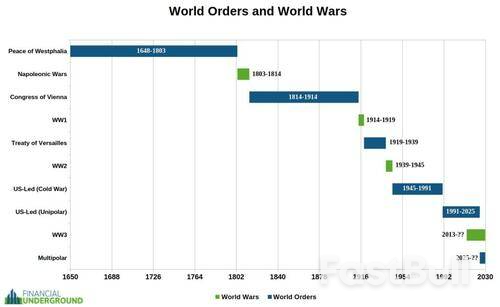

Finnish President Alexander Stubb told Bloomberg's Francine Lacqua in a recent interview that today's global landscape resembles a "1918, 1945, or 1989 moment in world history." In other words, Stubb argues the world is at a critical juncture where the existing world order will inevitably give way to a new one.In a wide-ranging interview, Stubb described how resilience is part of Finland's "DNA," forged through centuries of rule under Sweden and Russia before independence in 1917.

"So you basically, you never give up, you just have to keep on pushing and grinding through the tough stuff. And I think a lot of Fins have that ingrained into the system because remember, we're a poor country. You know, first we were under Sweden for 700 years, then under Russia for a little bit over a hundred," Stubb explained.Stubb previously served as Prime Minister and Finance Minister, but left politics in 2016 after his party suffered an election defeat. He had no intention of returning to the political sphere until Russia invaded Ukraine in 2022."Had Russia not attacked Ukraine, I would not have run for president of Finland," the president emphasized.

Stubb warned that Russia's imperialist attitude remains a significant concern. He said that countries often fail to learn from their past struggles and instead look to the future, warning that President Vladimir Putin's vision of a "one Russia, one religion, one leader" model is incompatible with liberal democracy. He added that the odds of a peace deal between Ukraine and Russia are low.With an 833-mile land border with Russia, Finland formally joined NATO in April 2023. The country maintains one of Europe's strongest defense postures, with universal conscription of around 900,000 trained reserves and advanced weaponry.

"Well, I mean, our mentality is that the better you prepare, the less likely you're gonna end up in, in a war. Finland has a larger artillery than France and Germany combined, despite being a small country with a fraction of the German and French population per capita," Stubb said.The most interesting part of Stubb's conversation with the Bloomberg reporter was his discussion of an emerging new world order, as signs grow that the post-World War II system is fracturing, shifting from a unipolar movement to a multipolar state.

"Right now we are living in a 1918, 1945, or 1989 moment in world history. And now we're in a similar situation. We don't know where the world is gonna go," Stubb pointed out.Separate from the Stubb-Lacqua interview, International Man's Nick Giambruno noted earlier this year about the emergence of "Trump's New World Order."

He stated, "President Trump seems to recognize that maintaining it is not just unrealistic but unsustainable. He appears to have decided that it is in the US's best interest to transition to a multipolar reality on its own terms rather than be forced into it by a chaotic collapse."Giambruno called this era a "volatile adjustment period as the unipolar world order gives way to a multipolar one."

This "volatile adjustment period" that Giambruno refers to is exactly why the Trump administration has accelerated its Hemispheric Defense strategy. We've already highlighted for readers the companies best positioned to capitalize on this long-term trend, which is expected to play out for years - especially ahead of the volatile 2030s.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up