Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Pakistan and the U.S. have resolved to conclude trade talks next week, the South Asian nation said on Wednesday after a meeting between its Finance Minister Muhammad Aurangzeb and U.S. Commerce Secretary Howard Lutnick.

Pakistan and the U.S. have resolved to conclude trade talks next week, the South Asian nation said on Wednesday after a meeting between its Finance Minister Muhammad Aurangzeb and U.S. Commerce Secretary Howard Lutnick.

The negotiations, focused on reciprocal tariffs, are part of a broader push to reset economic ties at a time of shifting geopolitical alignments and Pakistan’s efforts to avoid steep U.S. duties on exports.

“Both sides showed satisfaction on the ongoing negotiations and resolved to conclude the trade negotiations next week,” Pakistan's finance ministry said in a statement, adding that a longer-term strategic and investment partnership is also under discussion.

Pakistan faces a 29% tariff on exports to the U.S. under President Donald Trump’s measures to target countries with large trade surpluses with the U.S.

Pakistan’s surplus was around $3 billion in 2024.

To offset the imbalance and ease tariff pressures, Islamabad has offered to import more U.S. goods, including crude oil, and to open up investment opportunities through concessions for U.S. firms in Pakistan's mining sector.

Earlier this week, the two countries co-hosted a webinar promoting investment in Pakistan’s mineral sector, including the $7 billion Reko Diq copper-gold project.

Senior officials from both governments and U.S. investors discussed public-private partnerships and regulatory reforms.

The U.S. Export-Import Bank is reviewing financing proposals worth $500 million to $1 billion in Reko Diq.

Trump, who hosted Pakistan's army chief Field Marshal Asim Munir at the White House last week, has earlier said trade helped avert a deeper conflict between Pakistan and India.

Following Bitcoin’s drop below the $100,000 mark over the weekend, fresh narratives are surfacing about where the top crypto might be headed next. Despite more than $63 billion flowing into the crypto market in 2024, Bitcoin has only managed a modest 13% gain year-to-date, raising questions about what’s holding back the top cryptocurrency.

According to 10x Research, the usual catalysts such as ETF inflows, stablecoin activity, and corporate accumulation are in play, yet Bitcoin is no longer reacting the way it did during last year’s rally. Unlike the booming reaction in 2024, Bitcoin is now behaving differently, suggesting something deeper is shifting.

| Level | Price | Type | Description |

| Resistance | $110,000 | Bullish Target | Next key upside level if $97K support holds; seen as a potential rebound zone. |

| Resistance | $106,000 | Recovery Level | BTC has bounced to this level after the weekend dip; signals renewed interest. |

| Neutral | $100,000 – $106,000 | Consolidation Zone | BTC may range between these levels until CPI or macro catalysts emerge. |

| Support | $100,000 | Psychological Support | Former key level now acting as minor support after the recent drop. |

| Support | $97,000 | Key Entry Point | Closely watched as a final dip zone; considered a solid re-entry point. |

Instead of sparking a big rally, 10x Research says traders are showing their bullishness in quieter ways. They’re adapting to lower market volatility and putting their money into fewer top coins. This shift in strategy might be slowing down Bitcoin’s short-term gains, even though there’s still plenty of money flowing into the market.

The report also revisits the Fed’s surprise 50 bps rate cut in September 2024, which was met with skepticism. Bond yields surged, indicating investors weren’t convinced it was the right move. Meanwhile, inflation, which dropped from 3.5% in April 2024 to a stable 2.4%, has remained steady for three straight months. However, the expert’s warnings that tariffs would reignite inflation have so far proven inaccurate.

Meanwhile, unemployment has held steady at 4.2% for nearly a year, defying recession fears. With macro fundamentals stabilizing and the Fed’s tone becoming more dovish, many expected a stronger Bitcoin rally. Yet, the market seems to be waiting for clearer signals.

With inflation steady and liquidity still flowing, all eyes are now on the July 15 CPI report as the next big market catalyst. 10x Research hints that Bitcoin’s next move may depend less on money flowing in and more on how market participants continue to adapt to these changing geopolitical and financial scenarios.

Looking at the current sentiment, Analyst Astronomer suggests the decline may not be over yet, with a possible final dip before the price bounces back. The $97,000 zone is being watched closely as a key level for buyers to re-enter the market.

If support holds, Bitcoin could aim for a rebound toward $110,000. Weekend lows tend to be retested, and with sentiment shifting following a ceasefire deal between Israel and Iran, Bitcoin has already climbed back to $106,000.

This geopolitical development, along with improving market mood, has brought renewed buying interest. The overall outlook remains cautiously bullish, with investors eyeing $97,000 as a solid entry point if another dip happens.

The euro’s latest rally is approaching a pivotal level that could either stall its momentum or unlock the next leg toward $1.20, a target strategists and traders have circled for months.

After climbing as much as 1.6% in the past three days, the common currency is closing in on $1.17 — a zone that holds the heaviest notional volume in euro-bullish options so far this month, according to Depository Trust & Clearing Corporation data. That makes it a potential inflection point.

A break and hold above $1.17 could open the door for an accelerated push toward $1.20, a level last seen four years ago. If resistance holds, however, expect some profit-taking or flow-rebalancing first.

HSBC strategists increased their year-end forecast for the euro to $1.20 from $1.15 last week as they predict broad dollar weakness in the coming months. Danske Bank A/S analysts reiterated their 12-month euro forecast of $1.20 last month while Deutsche Bank AG strategists see a rally to that level by December.

The euro climbed as high as $1.1641 on Tuesday, its strongest intraday level since October 2021, as easing geopolitical tensions and softer US economic data fueled fresh demand for the common currency. The announcement of a ceasefire between Iran and Israel, along with cautious remarks from Federal Reserve Chair Jerome Powell, helped spark the latest push.

Money markets are pricing in a total of 59 basis points of Fed easing by year-end, compared with 25 basis points by the European Central Bank. The process of bringing inflation back to 2% is almost over, ECB Chief Economist Philip Lane said Tuesday, despite some remaining price pressures.

Options markets suggest investors retain conviction in a stronger euro. Risk reversals — which reflect the difference in pricing between bullish and bearish bets — jumped Tuesday by the fourth-largest margin in more than three years, signaling a decisive return of bullish sentiment. The shift followed a brief period in which the dollar found support from rising oil prices.

The broader picture remains constructive. DTCC data shows more than 60% of notional euro options volume this month has favored calls. The euro was trading little changed near $1.1610 on Wednesday.

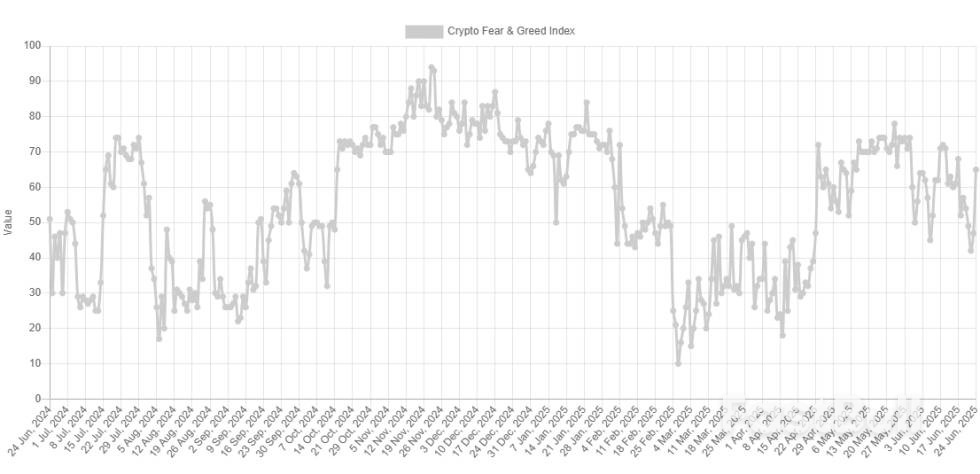

As Bitcoin and other digital assets recover, data shows the sentiment among cryptocurrency investors has returned to a state of greed.

The “Fear & Greed Index” refers to an indicator made by Alternative that measures the net sentiment held by the average trader in the Bitcoin and wider cryptocurrency spaces.

The index uses the data of the following five factors to determine the market sentiment: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends.

The metric represents the calculated mentality as a score lying between 0 and 100. The former end point corresponds to a state of maximum fear, while the latter one to that of maximum greed.

Here’s what the index says regarding the current sentiment among the investors:

As displayed above, the Bitcoin Fear & Greed Index has a value of 65, which suggests the traders currently share a majority sentiment of greed. This is a notable change compared to yesterday, when the indicator was sitting at 47, meaning that the investor mentality was overall neutral.

The holder sentiment earlier declined as a result of the geopolitical situation surrounding the Israel-Iran conflict. Following the announcement of a ceasefire between the nations, prices bounced back and it would appear that with them, so did the investor mood.

The ceasefire has since been violated, so it’s possible that tomorrow’s Fear & Greed Index would be less bullish. That said, Bitcoin has held surprisingly well despite the news, which could imply that the sentiment may also remain the same.

Historically, BTC and digital assets in general have tended to move in the direction that goes against the expectations of the investors. This means that an overly greedy market makes tops likely, while an extremely fearful one bottoms.

At present, the level of greed in the market isn’t too strong, but the fact that it has seen a notable jump alongside the recovery run could still be to take note off. In the scenario that hype keeps increasing in the coming days, another reversal could turn more probable for Bitcoin and company.

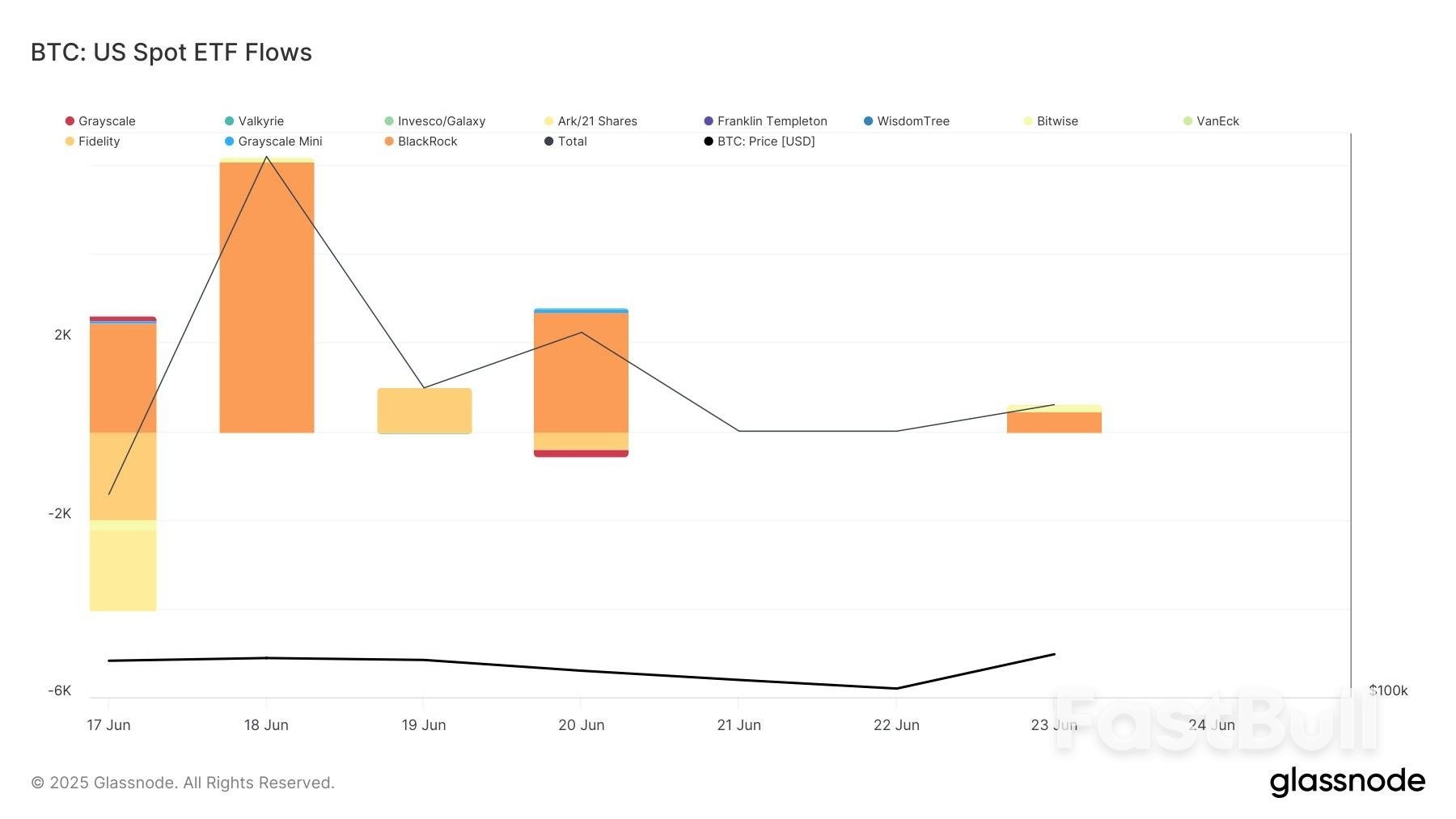

In some other news, the US-based Bitcoin spot exchange-traded funds (ETFs) saw net inflows yesterday, 23rd June, as pointed out by the analytics firm Glassnode in an X post.

As displayed in the above graph, the US Bitcoin spot ETFs saw net inflows of around 598 BTC on this date, despite the geopolitical tensions. “Although the inflows were modest, no major outflows were recorded either, which is notable signal of investor confidence,” notes Glassnode.

Bitcoin has already made recovery beyond the level it was trading at before the plunge, as its price is now back at $106,000.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up