Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Fed Governor Bowman: Freezing Bank Capital Levels Allows Fed To Correct Any 'Deficiencies' In Stress Test Models

US Federal Reserve Votes To Maintain Large Bank Stress Capital Buffers Until 2027 As It Considers Stress Test Changes

Toronto Stock Index .GSPTSE Unofficially Closes Up 175.53 Points, Or 0.54 Percent, At 32564.13

The Nasdaq Golden Dragon China Index Closed Up 1.9% Initially. Among Popular Chinese Concept Stocks, Yilong Energy Rebounded 64%, Jinko Solar Rose 8%, Yum China Rose 4.6%, Zai Lab Rose 3.7%, Canadian Solar Rose 3.3%, Li Auto Rose 2.2%, NetEase Fell 5.3%, 21Vianet Fell 5.6%, And WeRide Fell 6.3%

On Wednesday (February 4), The Bloomberg Electric Vehicle Price Return Index Rose 0.65% To 3533.63 Points In Late Trading. The Index Rose Throughout The Day, Exhibiting A "V"-shaped Pattern, Fluctuating At High Levels Between 2:00 PM And Midnight Beijing Time, Reaching A High Of 3561.87 Points In Early Trading. Among Its Components, BMW Closed Up 3.88%, Ola Electric Mobility Ltd. Rose 3.6%, STMicroelectronics Closed Up 3.6%, Porsche P911 Rose 3.5%, Li Auto H Shares Closed Up 3.43%, And Zhejiang Leapmotor H Shares Closed Up 2.88%, Ranking Sixth. Chilean Chemical And Mining Company Sqm Fell 5.3%, Mp Materials Fell 6.2%, WeRide Fell 7.2%, And Solid Power Fell 9.5%

The Yen Fell More Than 0.7%, Nearing 157 Yen. In Late New York Trading On Wednesday (February 4), The Dollar Rose 0.74% Against The Yen To 156.91 Yen, Trading Between 155.70 And 156.94 Yen During The Day, Continuing Its Upward Trend. The Euro Rose 0.64% Against The Yen To 185.26 Yen, Fluctuating At High Levels Since 10:00 AM Beijing Time; The Pound Rose 0.42% Against The Yen To 214.229 Yen, Giving Back About Half Of Its Gains Since 10:00 PM

Bill Pulte, Head Of The Federal Housing Finance Agency, Said That If Fannie Mae And Freddie Mac Go Public, They May Sell 2.5% To 5% Of Their Shares

Nymex March Gasoline Futures Closed At $1.9652 Per Gallon, And Nymex March Heating Oil Futures Closed At $2.47 Per Gallon

[Key Republican Senator Scott: Powell Did Not Commit A Crime At The Hearing] U.S. Republican Senator Tim Scott Stated That Federal Reserve Chairman Jerome Powell Did Not Commit A Crime When Answering Questions At A Congressional Hearing Last Summer. "I Think He Made A Serious Error Of Judgment. He Wasn't Prepared For That Hearing. I Don't Believe He Committed A Crime At The Hearing," Scott Said

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference

No matching data

View All

No data

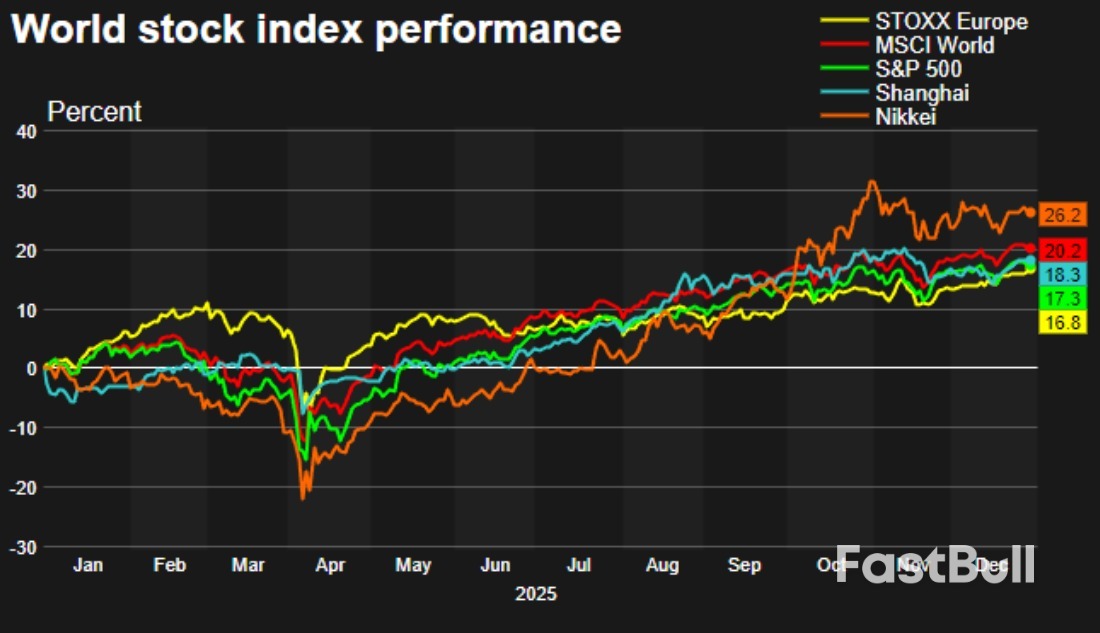

The year 2025 was one of great volatility for global markets, as US tariffs, geopolitical worries and the possibility of an artificial intelligence bubble spooked investors.

The year 2025 was one of great volatility for global markets, as US tariffs, geopolitical worries and the possibility of an artificial intelligence bubble spooked investors. It was also the year that Wall Street was knocked off its perch, as rival markets grew at more than twice the speed.

Once again, gold outshone them all. The precious metal rose about 65 per cent over the year, its best performance since 1979, with prices hitting an all-time high of $4,500 an ounce.

It was a tough year for so-called digital gold, Bitcoin. After nearing a record $125,000 in the autumn, it ended the year around 7 per cent lower at roughly $88,000.

Past performance only tells us so much, though. What really matters is what happens next. So, what does 2026 hold for the major asset classes?

Emerging markets beat all comers to rise 25 per cent across 2025, according to Fidelity International. European equities followed at 23 per cent, while Asia Pacific and the UK both climbed about 20 per cent. Japan also did well.

The US market lagged, rising just 10 per cent after gains of more than 20 per cent in each of the previous two years.

It's been a roller coaster of a year, says Jemma Slingo, pensions and investment specialist at Fidelity International. "Yet since the tariff shock in April, investors have largely focused on positives such as easing inflation, lower interest rates and resilient corporate earnings."

Equities climbed despite economic worries, but with talk of a US recession in 2026, that may be harder to sustain. Relief could come from interest rate cuts. Both the US Federal Reserve and Bank of England cut in December, and Shannon Saccocia, chief investment officer for wealth at Neuberger, expects more in 2026.

"This would help reaccelerate subdued economic growth, creating a positive undercurrent to further support risk assets," she says, while warning that policy mistakes remain a risk amid internal Fed divisions.

Another concern is whether the AI boom deflates. Martin Connaghan, senior investment director at Murray International Trust, points to high stock valuations, slowing growth, rising debt and geopolitical uncertainty. "When markets are concentrated and expectations are high, the margin for error is small."

Peter Branner, chief investment officer at Aberdeen Investments, expects US growth to recover as inflation eases. Europe may benefit from fiscal loosening, while China could slow. AI remains a key factor, but he cautions: "As AI-driven equities are getting expensive, investors should consider building further diversification."

Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management, says investors must hold firm in equities in general. "Markets remain expensive, with AI concentrating excesses, but macroeconomic conditions do not justify a massive withdrawal from risk."

Outlook: US tech is no longer the only game in town. Broader diversification looks sensible. More volatility is inevitable.

Gold's long-term record is extraordinary. It began the millennium at just over $288 an ounce and is up 1,462 per cent since then, turning $10,000 into $156,200.

The rally continued in 2025 as political tension, falling rates, central bank buying and economic uncertainty boosted demand, says Kate Marshall, lead investment analyst at Hargreaves Lansdown. "Goldman Sachs estimates central banks will target around 20 per cent of reserves in gold, but China is currently around 8 per cent. That should support the price, but we don't expect the same returns in 2026."

Fawad Razaqzada, market analyst at Forex.com, says gold has worked as an inflation hedge and may struggle if price pressures fall. "But talk of a peak is premature."

A BullionVault survey shows gold investors predicting prices of $5,136 in 2026.

Outlook: Gold has defied sceptics for years. The pace of growth will surely slow, but sheer momentum could drive the price on.

Bitcoin delivered its usual volatility. It plunged to $75,000 in April during US President Donald Trump's "liberation day" tariff scare, surged to nearly $125,000 in October, then faded as AI valuation fears returned.

Chris Beauchamp, chief market analyst at IG, says sentiment has been bruised. "Crypto investors have seen plenty of false dawns in recent months, but recent lows provide a foundation for further gains."

Alex Thorn, head of firm-wide research at Galaxy Digital, says 2026 is one of the hardest years to forecast, with crypto still in a broader bear phase. Bitcoin could even turn "boring", the one thing nobody expects, although Galaxy still sees the price hitting $250,000 in 2027.

Outlook: Bitcoin got a real bounce from US President Donald Trump but must now find other reasons to fly.

The US dollar is down nearly 10 per cent this year, and Lukman Otunuga, senior market analyst at FXTM, says: "Its decline reflects a loss of US exceptionalism as tariffs, rate cuts and political noise took their toll."

With the European Central Bank already cutting rates to 2 per cent, the dollar has room to recover if Fed easing continues.

Dagmara Fijalkowski, head of global fixed income currencies at RBC Global Asset Management, says this will be a big boost for one region. "Emerging currencies will continue to be the main beneficiary of further US dollar depreciation."

Outlook: The dollar looks vulnerable in 2026 unless US inflation proves sticky and delays further cuts.

Oliver Salmon, director of Savills World Research, says 2025 marked a turning point for commercial property markets after years of subdued activity. "Capital values have bottomed out, average deal sizes are increasing, and debt is once again contributing positively to returns."

He expects momentum to build in 2026, with global real estate investment forecast to rise 15 per cent to more than $1 trillion.

Outlook: Falling interest rates should support the next leg of the recovery.

Arielle Ingrassia, associate director at UK wealth manager Evelyn Partners, says bonds delivered income and stability in 2025, offsetting political and inflationary turbulence. "Crucially, elevated yields meant bonds delivered compelling income, reinforcing their contribution to overall portfolio returns."

Mr Melman warned that with fiscal policy set to be expansionary in the US, Japan and Germany, and government debt and deficits continuing to grow, long-term government bonds look less attractive. "Particularly if political pressure influences central banks."

Outlook: Bonds remain important diversifiers, but yields may drift lower as easing continues.

One major market lagged in 2025: India. Kate Marshall at Hargreaves Lansdown says high expectations and stretched valuations left it exposed when sentiment shifted. "While uncomfortable, this kind of reset is not unusual after a strong run and does not undermine India's longer-term potential," she says.

Morgan Stanley, Goldman Sachs and HSBC all expect Indian equities to rebound and hit new highs in 2026.

Outlook: This year's underperformer could turn things around in 2026.

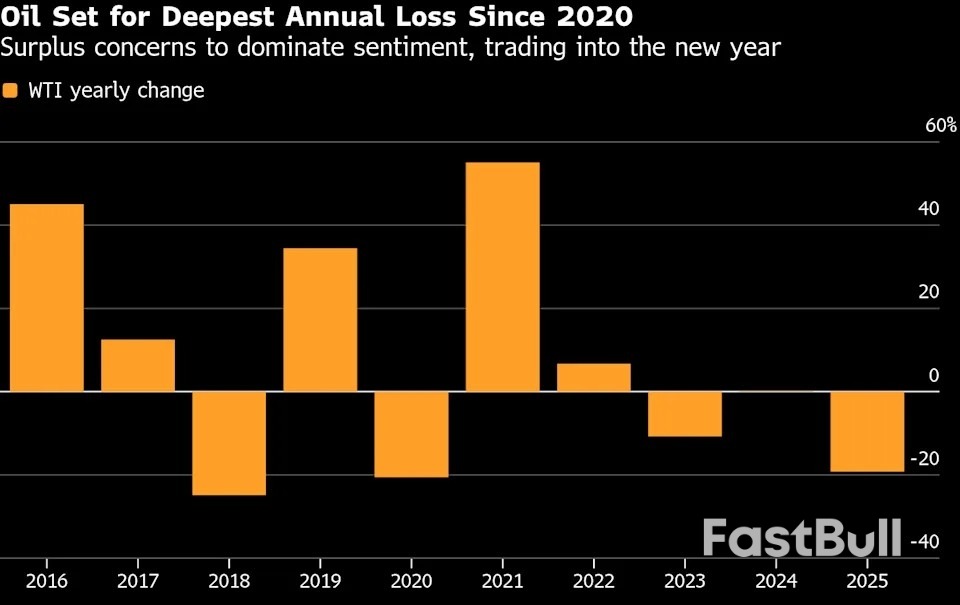

Gold and silver fell on the last trading day of 2025, though both remained on track for the biggest annual gain in more than four decades as a banner year for precious metals drew to a close.

Spot gold hovered around $4,320 an ounce, while silver slid toward $71. The two have seen exceptional volatility in thin post-holiday trading, plunging Monday before recovering Tuesday and dropping again Wednesday. The big swings prompted exchange operator CME Group to raise margin requirements twice.

Both metals are on track for their best year since 1979, supported by strong demand for haven assets amid mounting geopolitical risks and by interest-rate cuts by the US Federal Reserve. The so-called debasement trade — triggered by fears of inflation and swelling debt burdens in developed economies — has helped supercharge the scorching rally.

In gold, the bigger market by far, those factors spurred a rush by investors into bullion-backed exchange-traded funds, while central banks extended a years-long buying spree.

Gold is up about 63% this year. In September, it eclipsed an inflation-adjusted peak set 45 years ago — a time when US currency pressures, spiking inflation and an unfolding recession pushed prices to $850. This time around, the record run saw prices smash through $4,000 in early October.

"In my career, it's unprecedented," said John Reade, a market veteran and chief strategist at the World Gold Council. "Unprecedented by the number of new all-time highs, and unprecedented in the performance of gold exceeding the expectations of so many people by so much."

Silver has notched up a gain of more than 140% during the year, driven by speculative buying but also by industrial demand. The metal is used extensively in electronics, solar panels and electric cars. In October, it soared to a record as tariff concerns drove imports into the US, tightening the London market and triggering a historic squeeze.

The new peak was then passed the following month as US rate cuts and speculative fervor drove prices higher. The rally topped out above $80 earlier this week — in part reflecting elevated buying in China.

Yet the latest move swiftly reversed, with the market closing down 9% Monday then swinging the following two days. In response to the extreme volatility, CME Group again raised margins on precious-metal futures, meaning traders must put up more cash to keep their positions open. Some speculators may be forced to shrink or exit their trades — weighing on prices.

"The key driver today is the CME raising margins for the second time in just a few days," said Ross Norman, chief executive officer of Metals Daily, a pricing and analysis website. The higher collateral requirements are "cooling the markets off," he said.

The enthusiasm for gold and silver has extended into the wider precious metals complex in 2025, with platinum breaking out of a years-long holding pattern to hit a new high.

The metal is on course for a third annual deficit, following disruptions in major producer South Africa, and supply will likely remain tight until there's clarity on whether the Trump administration will impose tariffs.

Prices for silver, platinum and palladium all sagged Wednesday, though there's little sign of enthusiasm waning.

The year's "surprise was how safe-haven metals turned into momentum trades — silver in particular," said Charu Chanana, chief market strategist at Saxo Markets in Singapore.

Silver traded down 7.1% at $70.83 an ounce as of 3:20 p.m. in New York. Gold slipped 0.5% to $4,317.41 an ounce, while the Bloomberg Dollar Spot Index was up little-changed.

Copper closed December 31, 2025 near $5.6 per pound, finishing the year more than 40% higher and marking one of its strongest annual performances on record.

Unlike past rallies tied to booming industrial demand, this surge was fueled primarily by trade positioning and tightening supply, not a broad-based consumption rebound.

A defining feature of 2025 was the aggressive relocation of physical copper into the United States. Throughout the second half of the year, traders and manufacturers pulled forward imports to build inventories ahead of expected tariffs from the incoming Trump administration. This pre-emptive buying distorted traditional trade routes.

The result was a sharp drawdown in Asian and European warehouse stocks, while U.S. inventories swelled. Prices responded accordingly, reflecting scarcity outside the U.S. rather than a synchronized pickup in end demand.

Supply stress amplified the price impact of these trade maneuvers. In Chile, the world's largest copper producer, output fell to its lowest level in two decades, pressured by declining ore grades and persistent water shortages. Earlier in the year, a major mine closure in Panama removed roughly 1.5% of global supply, further tightening balances.

These disruptions left little buffer in a market already grappling with limited new mine development, turning logistical shocks into outsized price moves.

Beneath the surface, fundamental demand offered little confirmation of a traditional bull cycle. China's property sectorcontinued to struggle through 2025, and global manufacturing PMIs spent much of Q4 in contraction territory. Outside tariff-driven stockpiling, consumption growth remained subdued.

This disconnect underscores how the 2025 rally was shaped more by who needed copper where, rather than how much copper the global economy was actually using.

Looking ahead, analysts expect market distortions to persist. The U.S. premium, the price gap between New York's Comex and London's LME, hit record highs in December 2025, reflecting the extreme pull of metal into the U.S. Goldman Sachs expects this volatility to extend into early 2026 as trade policies are formalized.

Despite weak demand signals, several banks have raised 2026 price forecasts, citing structural scarcity and limited mine supply. Consensus targets for mid-2026 now cluster between $5.60 and $6.00 per pound, driven by a growing view that the world is simply running out of mineable copper.

For now, copper's strength reflects a market dominated by policy risk and supply constraints, not a classic industrial upswing, an imbalance likely to keep prices elevated and volatile into the new year.

South Korea's exports maintained growth momentum in December, easing concerns over global trade protectionism and tariff-related uncertainty that had weighed on the country for much of the year.

The value of shipments adjusted for working-day differences increased 8.7% from a year earlier in December, according to data released Thursday by the custom's office. That compared with a 13.3% gain initially reported for the full month of November.

Unadjusted exports rose 13.4%, and overall imports increased by 4.6%, resulting in a trade surplus of $12.2 billion.

The ongoing growth in exports offers some relief for South Korea after months of negotiations with the US over a trade deal. The agreement by the US to impose an across-the-board 15% tariff on Korean goods brought relief compared with higher duties imposed in the spring, though the level of taxation is still higher than in the period before Donald Trump began his second term as US president.

Strong AI-related demand continues to support Korea's export performance, underscoring the economy's reliance on the global chip cycle.

The trade data also follow a decision in late November by the Bank of Korea to keep its benchmark interest rate at 2.5% as policymakers balance the desire to support the economy against financial stability risks.

Governor Rhee Chang Yong said the board members remain evenly split over the near-term outlook, highlighting a cautious stance on any additional easing.

With exports equivalent to more than 40% of gross domestic product, the year-end resilience may give the central bank more room to stay patient as it monitors risks ranging from household debt to currency volatility.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up