Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

OPEC+’s surprise announcement that it will further accelerate oil production may seem like a threat to an already oversupplied market, but the actual market impact is likely to be limited.

OPEC+’s surprise announcement that it will further accelerate oil production may seem like a threat to an already oversupplied market, but the actual market impact is likely to be limited.

The same cannot be said of the political benefits for the group's leader Saudi Arabia, which is seeking to reassert group discipline while expanding its market share and solidifying its relationship with the United States.

The Organization of the Petroleum Exporting Countries plus Russia and other allies, the group collectively known as OPEC+, agreed on Sunday to begin unwinding 1.65 million barrels per day of production cuts that were set to remain in place until the end of 2026.

The group of eight core OPEC+ members said it will raise its oil output target by 137,000 bpd in October.

At this pace, it will take the group 12 months to remove the full tranche of 1.65 million bpd of cuts, leaving the alliance with another 2 million bpd of production cuts still in place until the end of 2026. OPEC+ said it retained options to accelerate, pause or reverse hikes at future meetings. It scheduled the next meeting of the eight countries for October 5.

The group had already raised production quotas by about 2.5 million bpd, around 2.4% of global demand, between April and September. This put downward pressure on oil prices, which have declined by about 18% from their 2025 high in mid-January to $67 a barrel.

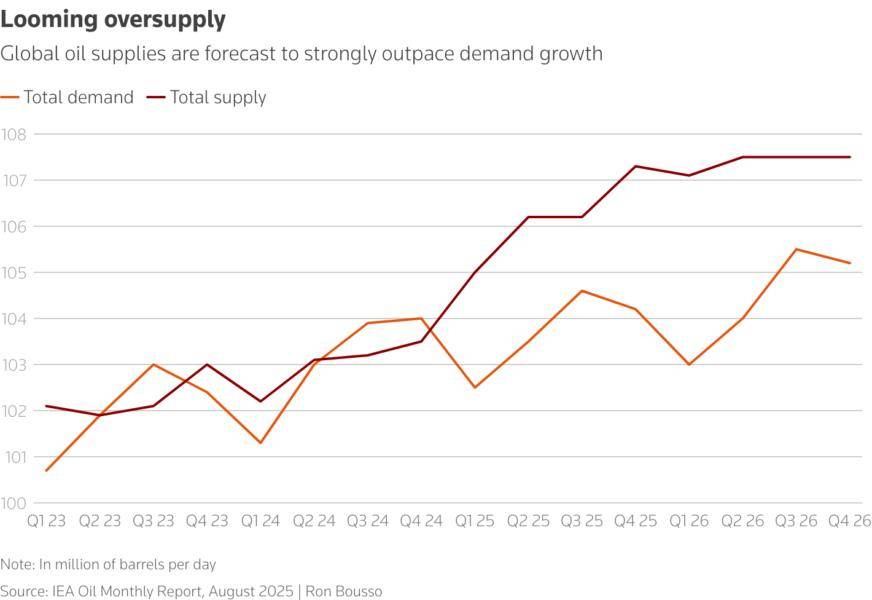

The new additions seemingly come at the worst possible moment for the market, which is widely expected to have already entered an extended period of oversupply due to production increases in Argentina, Canada, the United States and elsewhere.

The International Energy Agency previously forecast that supply would outstrip demand by an average of 3 million bpd between October 2025 and the end of 2026 – and that was before Sunday’s announcement.

In theory, adding more barrels in this environment should weigh heavily on oil prices.

In practice, however, the impact may be muted.

An analysis of OPEC+ production suggests the actual additions are likely to be far more modest than advertised, as most members are already producing at or near full capacity.

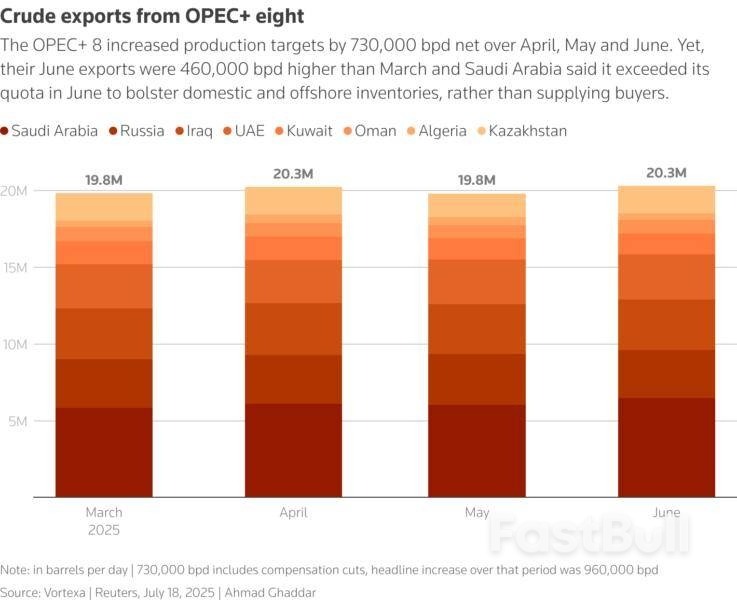

In March 2025, just before the group began unwinding its first layer of cuts, joint production reached 31.83 million bpd, only 1 million bpd below its 32.88 million bpd production target for September, according to IEA figures.

That was largely because several OPEC+ members, notably Kazakhstan, the United Arab Emirates and Iraq, had already far exceeded their OPEC+ production quotas. In July, that trio jointly outpaced their September quotas by some 500,000 bpd.

The new quotas are therefore not actually going to add many additional barrels to the market because, for the most part, these guidelines are simply catching up with the reality on the ground.

For Saudi Arabia, however, the changes are significant. The Kingdom’s output is set to increase from 9.07 million bpd in March to 9.98 million in September. This will leave it with around 2.2 million bpd of spare capacity, according to IEA estimates, far more than any other OPEC+ member.

Under the tranche of cuts that are now being unwound, Saudi Arabia and Russia each reduced output by roughly 500,000 bpd. But Russia has little, if any, spare capacity, given that strict Western sanctions have limited investments in new production.

Saudi Arabia therefore stands to benefit the most from this rollback, with Riyadh well positioned to capture more market share, in particular from U.S. shale firms that will need to slow down drilling activity in the face of lower oil prices.

Saudi Energy Minister Prince Abdulaziz bin Salman, the architect of the original OPEC+ supply cuts, now appears to be firmly back in the driver's seat after spending years battling the group’s breakdown in internal discipline.

And, importantly, this new move gives Riyadh the ability to garner valuable political capital, as U.S. President Donald Trump has urged OPEC to lower oil prices. The Saudis can now show that they are trying to do just that.

The Saudis therefore appear willing to withstand an environment of low oil prices for an extended period of time both to make long-term gains in market share and to support its relationship with its key ally.

Indeed, Saudi Crown Prince Mohammed bin Salman is reportedly scheduled to visit Washington, D.C., in November. This follows Trump's visit to the Gulf nation in May when Riyadh pledged to invest $600 billion in the United States while Washington agreed to sell Saudi Arabia an arms package worth $142 billion. It's safe to say that supply cuts and crude prices will be on the agenda for the new meeting in November.

OPEC+’s new production targets are therefore unlikely to significantly disrupt the oil market – and thus probably will not massively shift prices – but they could still have long-term consequences because of the geopolitical backdrop.

Japanese Prime Minister Shigeru Ishiba resigned on Sunday, ushering in a potentially lengthy period of policy uncertainty at a shaky moment for the world's fourth-largest economy.

Having just ironed out final details of a trade deal with the United States to lower President Donald Trump's punishing tariffs, Ishiba, 68, told a press conference he must take responsibility for a series of bruising election losses.

Since coming to power less than a year ago, the unlikely premier has overseen his ruling coalition lose its majorities in elections for both houses of parliament amid voter anger over rising living costs.

He instructed his Liberal Democratic Party - which has ruled Japan for almost all of the post-war period - to hold an emergency leadership race, adding he would continue his duties until his successor was elected.

"With Japan having signed the trade agreement and the president having signed the executive order, we have passed a key hurdle," Ishiba said, his voice seeming to catch with emotion. "I would like to pass the baton to the next generation."

Ishiba has faced calls to resign since the latest of those losses in an election for the upper house in July. The LDP had been scheduled to hold a vote on whether to hold an extraordinary leadership election on Monday.

Concern over political uncertainty prompted a sell-off in Japan's yen currency and its government bonds last week, with the yield on the 30-year bond hitting a record high on Wednesday.

Investors are focusing on the chance of Ishiba being replaced by an advocate of looser fiscal and monetary policy, such as LDP veteran Sanae Takaichi, who has criticised the Bank of Japan's interest rate hikes.

Ishiba narrowly defeated Takaichi in last year's LDP leadership run-off. Shinjiro Koizumi, the telegenic political scion who has gained prominence as Ishiba's farm minister tasked with trying to cap soaring prices, is another possible successor.

"Given the political pressure mounting on Ishiba after the LDP's repeated election losses, his resignation was inevitable," said Kazutaka Maeda, economist at Meiji Yasuda Research Institute.

"As for potential successors, Koizumi and Takaichi are seen as the most likely candidates. While Koizumi is not expected to bring major changes, Takaichi’s stance on expansionary fiscal policy and her cautious approach to interest rate hikes could draw scrutiny from financial markets," Maeda said.

Since the ruling coalition has lost its parliamentary majority, the next LDP president is not guaranteed to become prime minister, although that is likely as the party remains by far the largest in the lower house.

Whoever becomes the next leader may choose to call a snap election to seek a mandate, analysts said. While Japan's opposition remains fractured, the far-right, anti-immigration Sanseito party made big gains in July's upper house election, bringing once-fringe ideas into the political mainstream.

Nearly 55% of respondents to a poll by Kyodo news agency published on Sunday said there was no need to hold an early election.

Michael Brown, senior research strategist at financial markets brokerage Pepperstone, said there was likely to be further selling pressure on the yen and long-dated bonds on Monday.

"That selling pressure is likely to come first from the market now needing to price a greater degree of political risk, not only in terms of the LDP leadership contest, but also the potential for a general election to be held if the new leader seeks a mandate of their own," Brown said.

'NO TIME TO LOSE'

Ishiba, a party outsider who became leader on his fifth attempt last September, wrapped up his brief tenure by completing the trade deal with Japan's biggest trading partner, pledging $550 billion of investments in return for lower tariffs.

Trump's tariffs, especially those targeted at Japan's critical automotive sector, had forced Japan to downgrade its already weak growth outlook for the year.

Ishiba said he hoped his successor could ensure the deal is executed and Japan continues generating wage gains to assuage voter concerns over living costs.

He also expressed concern about the security environment his successor will inherit, pointing to an unprecedented gathering of Chinese, Russian and North Korean leaders in Beijing for a massive military parade last week.

Yoshinobu Tsutsui, chairman of Japan's biggest business lobby, Keidanren, said there was "no time to lose" with mounting domestic and international challenges.

"We hope the new leader will foster unity within the party, establish stable political conditions, and move swiftly to implement necessary policies," Tsutsui said.

Some voters too are hoping for a steady hand in uncertain times.

"With all the turmoil around tariffs right now, I hope the next prime minister will be someone who can properly manage the tariff issues and handle diplomacy more effectively," Maki Utsuno, a 48-year-old chemistry researcher, told Reuters outside a busy train station in downtown Tokyo on Sunday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up