Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

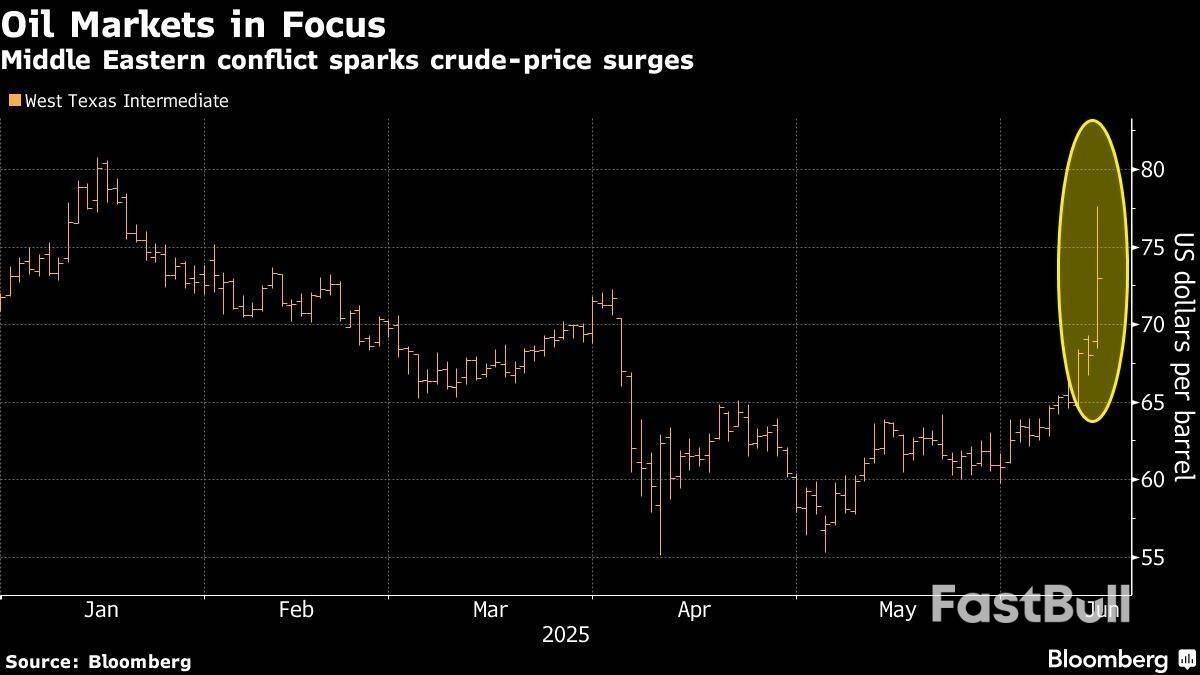

Stock markets in Asia moved higher at the start of trading on Monday, pulling back some of their losses from the end of last week. Oil prices surged as a conflict between Israel and Iran continued to escalate.

Stock markets in Asia moved higher at the start of trading on Monday, pulling back some of their losses from the end of last week. Oil prices surged as a conflict between Israel and Iran continued to escalate.

The Nikkei 225 index was up around 0.8% at the open, while US equity futures reversed earlier losses to edge higher. A broad gauge of Asian stocks was up around 0.2%.

Stocks had tumbled on Friday as investors reacted to reports that Israel had launched airstrikes against Iran, and the conflict between the two escalated over the weekend with a series of attacks from both sides.

A Bloomberg gauge of the dollar was slightly up in early trading Monday, while safe haven currency the Japanese yen lost ground. Brent crude rose as much as 5.5% in early trading.

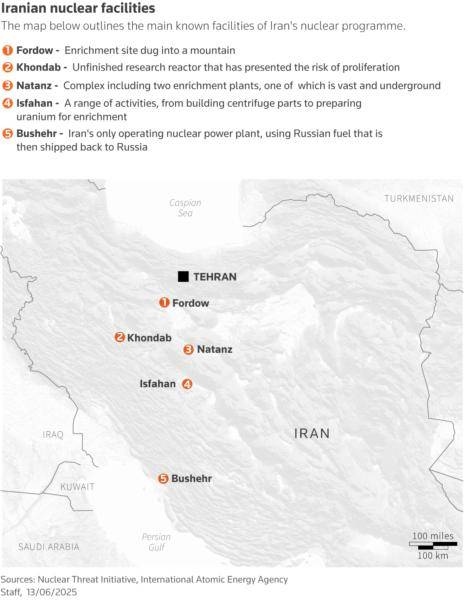

Still, there is plenty of uncertainty for markets at the moment. Israel launched an attack on the giant South Pars gas field in the Persian Gulf, forcing the shut down of a production platform, after air strikes on Iran’s nuclear sites and military leadership last week.

“Markets should be prepared for a prolonged period of uncertainty,” said Wolf von Rotberg, an equity strategist at Bank J. Safra Sarasin. “Hedging against potential oil supply-chain disruptions via exposure to the energy market and adding to gold, which may see an acceleration of its structural uptrend, are the best ways to protect a portfolio against a further escalation in the Middle East.”

A major concern for investors is that the conflict leads to a prolonged disruption to the supply of oil. That could weigh on the global economy and potentially fuel a round of inflation just as many central banks pivot towards easing. The Federal Reserve and the Bank of Japan are among a raft of central banks set to announce interest rate decisions this week.

In the region, most Middle East stock indexes dropped on Sunday. Egypt’s main gauge was the worst performer, seeing the biggest losses in more than a year on concern that a halt in Israeli gas production will cause fuel shortages. In Saudi Arabia, the Tadawul gauge’s declines were limited by Aramco, which gained on higher oil prices. Israel’s benchmark ended higher as military supplier Elbit Systems Ltd. rallied.

Open hostilities between Israel and Iran entered a fourth day on Monday with no sign of easing, stoking fears of a wider war in the oil-rich region.

Iran fired several waves of drones and missiles over the last 24 hours, while Israel hit the Islamic Republic’s capital, Tehran, killing another key military official.

Since Friday, 224 people have been killed in Iran, according to the government, which said most of the casualties were civilians. Iranian attacks left 14 people dead and around 400 injured, Israel’s emergency services said.

Tensions between the two countries erupted into direct conflict on Friday, when Israel launched surprise attacks on Iranian military and nuclear sites. Since then, its air campaign has underscored Israeli air superiority and exposed the constraints facing Tehran’s ability to respond effectively.

For Iran, the showdown poses a strategic dilemma. It can’t risk appearing weak, yet its retaliatory options are shrinking — and proxy forces it supports across the region have been largely deterred by Israeli action.

After having urged Iran to reach a nuclear deal on the onset of the Israeli attacks, US President Donald Trump on Sunday said Iran and Israel “should make a deal, and will make a deal.”

“We will have PEACE, soon, between Israel and Iran!” he said on Truth Social. “Many calls and meetings now taking place.”

He also said, in later comments to reporters, that “but sometimes they have to fight it out.”

There was little else suggesting an imminent breakthrough.

“We are in an existential campaign,” Israeli Prime Minister Benjamin Netanyahu said as he visited the site of a missile strike on the coastal city of Bat Yam on Sunday. “Iran will pay a very heavy price for deliberately murdering our citizens, women and children.” His defense minister said the “regime in Tehran” was now a target.

Israeli military said it hit military sites in various parts of Iran and killed the intelligence chief and other key officials of the Islamic Revolutionary Guard Corps.

The tit-for-tat weighed on financial markets, with equities in Saudi Arabia, Egypt and Qatar dropping on Sunday. The Egyptian pound weakened about 1.8% to beyond 50 per dollar in local trades. Israeli stocks rose, led by defense company Elbit Systems Ltd.

Investor caution elsewhere was also on display as trading resumed Monday in Asia, though the magnitude of the moves outside of energy remained relatively contained.

Oil futures traded around 2% higher, compounding steep gains from Friday. The dollar strengthened against all Group of 10 countries in a sign of defensive positioning. US equity index futures, meanwhile, were fractionally lower after declines of more than 1% for the S&P 500 and Nasdaq 100 on Friday.

Iran reported an explosion at one of its natural gas plants linked to the giant South Pars field on Saturday. While the country exports little gas and Israel appears not to have targeted its oil fields or crude-shipment facilities, the move risks pushing up global energy prices — which soared on Friday — even more.

The United Nations’ nuclear watchdog the International Atomic Energy Agency said multiple strikes on Iran’s uranium-conversion facility at Isfahan, south of Tehran, resulted in serious damage.

Iran’s deputy foreign minister, Kazem Gharibabadi, told state television that “we will no longer cooperate with the agency as we did before.”

According to Iran’s Fars news service, a key parliamentary committee said Tehran should no longer adhere to the nuclear Non-Proliferation Treaty, the bedrock arms-control agreement that compels signatories to accept inspections.

For now, it’s unclear if the government will take such steps.

Arch-enemies Israel and Iran have long fought a shadow war. The Jewish state’s been accused of cyber attacks and assassinating Iranian scientists, while Tehran’s funded anti-Israel militias in the Middle East.

Those tensions soared after Hamas, a Palestinian group backed by Iran, attacked Israel on Oct. 7, 2023. That led to Israel and Iran firing missiles and drones on each other twice last year.

Still, this is their most serious conflict yet. Since the fighting began, struck Iran’s nuclear and military sites using jets and drones, and killed several top commanders and atomic scientists.

Israel said it was aiming to end Iran’s ability to build a nuclear bomb, which it sees as an existential threat. Tehran maintains its atomic program has purely civilian purposes.

The attacks on Iran’s defenses seem to have given Israel air superiority over the Islamic Republic, including its capital.

The Israeli military on Sunday urged Iranians to “immediately evacuate” areas near weapons-production facilities and “not return until further notice.”

Netanyahu said his military would “strike at every site and every target of the Ayatollah regime,” while Iran’s Supreme Leader Ayatollah Ali Khamenei has said Israel will “pay a very heavy price.”

The conflict sent shockwaves through global markets last week, with investors buying haven assets such as gold.

Iran canceled its next round of nuclear talks with the US scheduled for Oman on Sunday. The same day, Trump reiterated that the US wasn’t involved in Israel’s attacks and said he could still get a nuclear deal with Iran.

He’s set to meet other leaders of the Group of Seven major economies in Canada and the conflict will be at the forefront of their talks. Israel is calling on Washington and European nations to help it attack Iran, arguing that is what’s needed to stop Tehran developing a nuclear weapon.

While the US has helped defend Israel by intercepting missiles and drones, Trump has not yet indicated if the US will join in the strikes on Iran.

For all that Israel’s already damaged Iranian atomic sites and says it will continue to strike them, many Western analysts say it needs US help to destroy some key facilities located deep underground.

Middle Eastern leaders and Russian President Vladimir Putin are voicing increasing concern that the conflict could spiral out of control. They have urged both sides to calm the situation quickly.

Germany’s Foreign Minister Johann Wadephul, speaking to local broadcaster ARD, urged regional states to talk with Iran, while Berlin continues engaging with Israel.

Germany, France and the UK are, he said from Qatar, ready to negotiate with Iran over its nuclear program.

It’s unclear if Tehran is entertaining last-resort options such as attacking tankers in the Strait of Hormuz, through which Middle Eastern states ship about a fifth of the world’s oil.

That type of action may draw the US, the world’s most powerful military, into the conflict, something Tehran has probably calculated it can’t afford, according to Bloomberg Economics analysts. That’s partly because the Iranian economy is already weak, with inflation at almost 40%, and public frustration with the government is high.

Key points:

Israel and Iran kept up their attacks, killing and wounding civilians and raising concern among world leaders meeting in Canada this week that the biggest battle between the two old enemies could lead to a broader regional conflict.

The Iranian death toll in four days of Israeli strikes, carried out with the declared aim of wiping out Iran’s nuclear and ballistic missile programs, had reached at least 224, with 90% of the casualties reported to be civilians, an Iranian health ministry spokesperson said.

At least 10 people in Israel, including children, have been killed so far, according to authorities there.

Group of Seven leaders began gathering in the Canadian Rockies on Sunday with the Israel-Iran conflict expected to be a top priority.

German Chancellor Friedrich Merz said his goals for the summit include for Iran to not develop or possess nuclear weapons, ensuring Israel's right to defend itself, avoiding escalation of the conflict and creating room for diplomacy.

"This issue will be very high on the agenda of the G7 summit," Merz told reporters.

Before leaving for the summit on Sunday, U.S. President Donald Trump was asked what he was doing to de-escalate the situation. "I hope there's going to be a deal. I think it's time for a deal," he told reporters. "Sometimes they have to fight it out."

Iran has told mediators Qatar and Oman that it is not open to negotiating a ceasefire while it is under Israeli attack, an official briefed on the communications told Reuters on Sunday.

Explosions shook Tel Aviv on Sunday during Iran’s first daylight missile attack since Israel’s strike on Friday. Shortly after nightfall, Iranian missiles hit a residential street in Haifa, a mixed Jewish-Arab city, and in Israel's south.

In Bat Yam, a city near Tel Aviv, residents braced on Sunday evening for another sleepless night after an overnight strike on an apartment tower.

"It's very dreadful. It's not fun. People are losing their lives and their homes," said Shem, 29.

Images from Tehran showed the night sky lit up by a huge blaze at a fuel depot after Israel began strikes against Iran's oil and gas sector - raising the stakes for the global economy and the functioning of the Iranian state.

Brent crude futureswere up $1.17, or 1.6%, to $75.39 a barrel by 0015 GMT, while U.S. West Texas Intermediate crude futuresgained $1.11, or 1.6%, to $74.14. They had surged more than $4 earlier in the session.

In Washington, two U.S. officials told Reuters that Trump had vetoed an Israeli plan in recent days to kill Iran's Supreme Leader Ayatollah Ali Khamenei.

When asked about the Reuters report, Netanyahu told Fox News on Sunday: "There's so many false reports of conversations that never happened, and I'm not going to get into that."

"We do what we need to do," he told Fox's "Special Report With Bret Baier."

Israel began the assault with a surprise attack on Friday that wiped out the top echelon of Iran's military command and damaged its nuclear sites, and says the campaign will escalate in coming days.

The intelligence chief of Iran's Revolutionary Guards, Mohammad Kazemi, and his deputy were killed in attacks on Tehran on Sunday, Iran's semi-official Tasnim news agency said.

Iran has vowed to "open the gates of hell" in retaliation.

Trump has lauded Israel's offensive while denying Iranian allegations that the U.S. has taken part and warning Tehran not to widen its retaliation to include U.S. targets.

Two U.S. officials said on Friday the U.S. military had helped shoot down Iranian missiles that were headed toward Israel.

The U.S. president has repeatedly said Iran could end the war by agreeing to tough restrictions on its nuclear program, which Iran says is for peaceful purposes but which Western countries and the IAEA nuclear watchdog say could be used to make an atomic bomb.

The latest round of nuclear negotiations between Iran and the U.S., due on Sunday, was scrapped after Tehran said it would not negotiate while under Israeli attack.

Hours after Israel launched preemptive strikes on Iran last Friday, Prime Minister Benjamin Netanyahu put out a video message addressing the Iranian people directly.

“Israel's fight is not against the Iranian people,” he said. “Our fight is against the murderous Islamic regime that oppresses and impoverishes you.”

It was a brazen move — even the government’s biggest domestic critics wouldn’t choose Netanyahu over Supreme Leader Ayatollah Ali Khamenei — but it suggested his goal goes far beyond scuttling US nuclear talks he’s long opposed. It showed how Israel is trying to exploit the Islamic Republic’s weaknesses to foment economic unrest and spark the overthrow of the clerical regime that’s ruled Iran for almost half a century.

Israel, having spent the past 20 months dismantling Iran’s so-called axis of resistance — the group of armed partners that it backs in Middle Eastern countries — struck an Islamic Republic whose economy has been crippled by decades of sanctions, leaving its leaders cash-strapped and vulnerable to domestic unrest. Now Tehran faces a dilemma: how far can it go against Israel without pushing things so far that the US joins in? How much of an appetite does it have for a war of attrition that could spur domestic unrest?

By Saturday, Netanyahu — pressing his advantage and confident of US support — was anticipating the collapse of Khamenei’s rule.

“Our pilots over the skies of Tehran will deal blows to the Ayatollah regime that they cannot even imagine,” Netanyahu said in a message that started with a birthday greeting for US President Donald Trump. “I can tell you this, we have indications that senior leaders in Iran are already packing their bags. They sense what's coming.”

Netanyahu told Fox News on Sunday that regime change “could certainly be the result because the Iran regime is very weak,” though he said “the decision to act” was up to Iranians.

Israel’s attacks on Iran — the worst military assault on the Islamic Republic since it was invaded by Iraq in 1980 — underscore how Tehran’s regional might has bean dealt a serious blow along with its inability to protect some of its most sensitive national assets and its 90 million citizens. Crude surged as much as 13% on Friday in London, the biggest intraday jump since Russia invaded Ukraine in 2022 — emphasizing the high stakes for energy supplies from any hostilities in the Persian Gulf.

Since Hamas’ Oct. 7, 2023 attack on Israel, Netanyahu has said the country has worked in a “systematic, measured and organized” way to dismantle Iran’s regional proxy network. It began with the decimation of Hamas, Tehran’s proxy, and continued with the dramatic pager attack and assassinations targeting Iran-backed Hezbollah in Lebanon. “As promised, we are transforming the face of the Middle East,” he said in December, in what’s become a common refrain.

But the apparent precision and swiftness with which Israel managed to kill the very top of Iran’s military chain of command on Friday has left many in Tehran stunned, particularly as it came less than a year after a Hamas leader — Ismail Haniyeh — was assassinated by Israel while he was being hosted by the Iranian government in one of its own guesthouses in the capital.

“Iran’s breaking point seems to have come a lot sooner than I would have expected,” said Saeed Laylaz, an economist and former advisor to Iran’s reformist President Masoud Pezeshkian who’s long called for a reform of the regime. “I thought its capacity for resistance was far greater than this.”

In northern Tehran, where residents reported numerous strikes and explosions, middle class Iranians were fearful and in a state of panic. Parisa, a 37-year-old who owns a gym in a busy commercial district in the area, said everyone she knew was trying to flee to rural towns or the northern Caspian region. Gasoline stations have been inundated and have started rationing fuel to 10 liters (2.6 gallons) per car.

At least five others in the city reported the same situation, including shortages of bottled water and other essentials in many supermarkets.

“We just don’t know where to go or what to do,’’ said Parisa, who didn’t want to give her full name because of the sensitivity of speaking to foreign media. “The highways leaving the city are completely locked in traffic. People are saying that something bad is going to happen in Tehran tonight but we don’t know what or even if it’s true.”

How the conflict escalates will determine whether a wider regional war breaks out and the future of Iran’s nuclear ambitions. The regime has perhaps around 2,000 ballistic missiles it could use to attack Israel, and, if cornered, regional oil infrastructure or US military installations. But fear of dragging the US into war and jeopardizing its improved relations with Gulf states such as Saudi Arabia is likely to prevent Iran from choosing either of those options.

Iran’s access to global financial markets, international banking and the world’s oil market has been hit by sanctions. Importantly, those have reduced crude exports, severely denting foreign currency earnings and Tehran’s ability to fix dilapidated infrastructure. Late last year, officials in charge of the world’s second-biggest natural gas reserves were forced to impose blackouts on key industries and hoard gas supplies as investment-starved power stations buckled under record levels of demand.

As the rial's value plummeted and spending power nose-dived, anti-government protests increased in frequency and scope. Iran’s judiciary and security apparatus cracked down on dissent — even hanging young people arrested at demonstrations. Europe started to increase sanctions for human rights abuses.

In the months leading up to Friday’s strikes, Israel war-gamed a range of scenarios analyzing whether an attack would fully decapitate the Islamic Republic, according to documents seen by Bloomberg and Western officials familiar with the matter, determining that there was a risk that Iranians might rally around the government. It also estimated the severe economic impact a prolonged conflict would have on the country, and the political instability that would create, according to an Israeli and Western intelligence assessment seen by Bloomberg.

“A prolonged conflict with Israel, coupled with intensified sanctions, risks deeper economic blowback for Iran,” it said. “This could lead to further plunges in the currency, exacerbating the already high inflation and diminishing purchasing power. Such conditions are likely to increase middle-class discontent and fuel social unrest, potentially leading to fresh protests.”

Yet Iran’s experience of surviving decades of trade blockades and sanctions as well as a long and bloody war with Iraq in the 1980s means its population is resilient to turmoil and economic instability. Backed by US and European support and the region’s most advanced military technology, Israel's population is not used to wars of attrition — or at least wasn’t until October 2023 — so it's unclear how it could sustain a long campaign where Iran continues to retaliate.

By Sunday, as strikes on Tehran continued — including on a key oil refinery and industrial areas in the south of the city — the sense was growing within Iran that the fighting is only likely to intensify and that the country’s military is preparing for a prolonged fight.

Surrender at this point is unthinkable for Iran’s leadership, who see Israel’s attacks as a declaration of war on their country, said Fouad Izadi, an academic at Tehran University who for years has staunchly backed Khamenei and the Islamic Revolutionary Guard Corps.

“Iran has thousands of ballistic missiles so I think Iranian leaders will use most of those missiles and kill a few thousand of Americans before they engage in a surrender,” Izadi said. “Iran’s hope was a peaceful resolution. The Americans didn’t want to have it, they wanted war and I think that’s what they’re going to get.”

A person familiar with Trump’s thinking said that Netanyahu pressed the American president about confronting Iran from the moment he re-took office in January, and it was clear throughout the US-Iran nuclear talks — which began in April — that the Israeli leader was determined to strike. On Saturday, Axios reported that Israel has urged the US to join its fight to destroy Iran’s nuclear program, citing two unnamed Israeli sources.

Trump has given contradictory statements. On Sunday, he said Iran and Israel “should make a deal, and will make a deal,” suggesting he wants a ceasefire. He separately told ABC News the same day that the US could become involved in the conflict.

Iran’s talks with the US — designed to resolve the standoff with Tehran by curbing its nuclear activities in return for sanctions relief — have collapsed for now. Abbas Araghchi, Iran’s foreign minister and lead negotiator, said attending a scheduled round of negotiations on Sunday would be “unjustifiable” in light of Israel’s assault. Oman, which has been mediating the talks, confirmed the two sides won’t be meeting.

With that, Israel has already notched a victory, according to Ellie Geranmayeh, deputy director of the Middle East and North Africa Program at the European Council on Foreign Relations. The strikes “were designed to kill President Trump’s chances of striking a deal,” she said. “This was a major attack initiated by Israel, designed to up the ante against Tehran and drag the region into confrontation.”

Still, several officials in the Middle East, Europe and the US say Iran is likely to contain its military response to Israeli targets and avoid a wider conflagration that would draw in the US. Trump is also saying he thinks he can still negotiate a deal with Tehran.

Iran’s Gulf-Arab neighbors, with whom it’s rebuilt ties over the past two years, are alarmed by Israel’s actions and don’t want to be drawn into the conflict, according to senior officials in the region. Iran’s missiles can target regional oil installations and infrastructure, but it’s unlikely to want to alienate the new relationships it’s built. Instead, Iran knows its neighbors are fearful of being caught in the middle and are pushing for de-escalation with Trump.

Some in the region have privately celebrated efforts to derail Tehran’s nuclear program, which they’ve long taken issue with, according to a senior Gulf official.

And while a mounting war is deeply concerning, it’s unlikely Iran would widen its attacks beyond Israel, the senior Gulf official who spoke on condition of anonymity said. The official cited past attacks on Iran by Israel and other provocations by the US, such as the 2020 killing of a top Iranian general. During those, Tehran’s responses were carefully calibrated to avoid a full-fledged war.

Still, a Gulf official who declined to be named because of the sensitivity of the matter, said Israel’s strikes could have catastrophic consequences for the region beyond Iran itself, given the potential for radiation leaks.

Israel says it’s determined to destroy Iran’s nuclear program, but it still needs the US to do that successfully. At best, given the current state of play, Israel sets Iran’s program back by a year if it attacks it alone, all while potentially causing Tehran to build the bomb.

Some Iranians have also come out onto the streets to call for the state to make a dash for an atomic weapon. That indicates Israel's strikes might boost support for a nuclear weapons program, even though Islamic Republic has always insisted its atomic program is for peaceful means only.

Whether the US joins Israel’s attacks depends on what Iran does next. While Trump says he knew of the strikes beforehand, he’s denied US involvement beyond help Israel intercept Iranian missiles and drones. Still, he’s used the assaults as leverage, asking Iran to agree to a deal.

That would be unthinkable now, according to Tehran University’s Izadi. And there’s still reason to believe that Iran’s defenses are far from spent.

One Western official who declined to be named because of the sensitivity of the matter, said it’s too soon to write off Iran’s capabilities, adding that the country has held back in its past attacks on Israel.

Iran still has a substantial arsenal of ballistic missiles, which Israel’s air defenses struggled to cope with in April and October last year — and appear to be struggling with now — and its proxies in Yemen, the Houthis. They have proven they can both strike Israel and can choke off trade in the Red Sea, as well as harass US naval ships. In a worst-case scenario, Tehran could take the unprecedented step of shutting the Strait of Hormuz, which could send oil as high as $130 a barrel, according to JPMorgan Chase & Co. While crude jumped on Friday, it’s still below $75.

A French official, who spoke on condition of anonymity, said Israel’s attacks are likely to further radicalise Khamenei and his theocratic rule but they won’t end his leadership or collapse the Islamic Republic. Iran still has allies in the region, including Pakistan and Gulf Arab nations, who may welcome a weakened Tehran but not one blighted by a dangerous power vacuum, the official added.

Every time Iran has been attacked or threatened, the fiercely nationalistic country has rallied together. So, despite widespread discontent, regime change is unlikely to occur at the hands of Israel's bombs.

“Iran has been weakened this past year, but it is not inherently weak, especially based on its performance the past few days,” Bader Al-Saif, assistant professor at Kuwait University and an associate fellow at Chatham House, said.

“It has shown that it has the weapons arsenal it needs for now,” he said. “If Iran feels its regime is under serious threat, all bets are off, which increases the risk of everyone.”

Gold rose toward a record on Monday as an escalating conflict between Israel and Iran drove investors toward haven assets.

The precious metal climbed as much as 0.6% early on Monday in Asia to trade around $3,450 an ounce, about $50 short of an all-time peak set in April. The two countries hit each other with barrages of missile and drones over the weekend, with the hostilities pushing up energy prices on the threat to energy infrastructure and transport in the region.

The sudden upsurge of geopolitical risk has added more impetus to a rally that’s primarily been driven by the threat to global economic growth from President Donald Trump’s aggressive tariff agenda. Gold has rallied more than 30% in 2025, with central banks seeking to diversify away from the dollar being another significant driver.

The 1.4% jump in the precious metal on Friday came after a two-day gain as weak US inflation and jobs data fueled bets the Federal Reserve will cut interest rates later this year. Lower rates tend to benefit bullion as it doesn’t pay any interest.

Spot gold rose 0.4% to $3,446.77 an ounce as of 7:10 a.m. in Singapore. The Bloomberg Dollar Spot Index added 0.1% after dropping 0.8% last week. Silver was steady, while platinum and palladium advanced.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up