Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

NZD to stay weak despite U.S. dollar softness, with sharper declines expected against the euro.

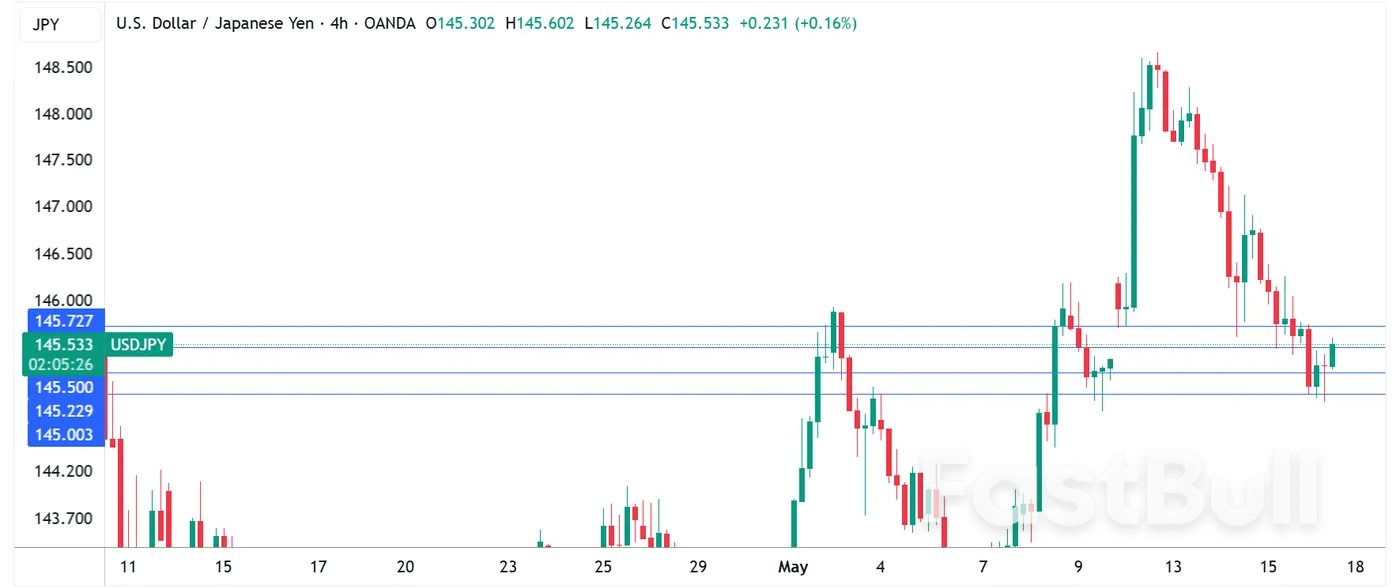

The Japanese yen is steady on Friday, after gaining 2% over the past three days. In the European session, USD/JPY is trading at 145.52, down 0.09% on the day.

Japan’s GDP report was a major disappointment, as the economy contracted for the first time in a year. The economy declined by 0.7% in the first quarter, a sharp reversal from the upwardly revised 2.4% gain in Q4 2024. This was below the -0.2% market estimate. Quarterly, GDP declined 0.2%, down from 0.6% in the fourth quarter and weaker than the market estimate of -0.1%.

The weak GDP report preceded the US tariffs which took effect in April. The tariffs will be felt in the second quarter and will likely dampen growth. Japan’s export sector is under pressure due to escalating trade tensions and domestic consumption has been weak. This had led to calls from some lawmakers to increase fiscal spending to cushion the expected blow from the the tariffs.

The Bank of Japan can’t be pleased with the soft GDP numbers. The Bank is looking for stronger consumption and higher wage growth before it raises interest rates. The uncertainty over Trump’s trade policy has forced the BoJ into a wait-and-see stance, hoping that US tariff policy will become more clear in the following months.

The US releases UoM consumer sentiment and inflation expectations for May later today. Consumer sentiment is expected to improve to 53.4 from an upwardly revised 52.2. Inflation expectations surged in April to 6.5% from 4.7% and are projected to rise to 6.6%, as consumers remain anxious about inflation.

Deutsche Bank (ETR:DBKGn) analysts on Friday projected a significant increase in the U.K.’s consumer price index (CPI) for April, with expectations set for a year-over-year rise to 3.42%.

This forecast comes as the country faces a confluence of factors that are likely to drive up inflation, including substantial hikes in energy and water bills, adjustments to vehicle excise duty, and the impact of the National Living Wage (NLW) and employer National Insurance Contributions (NICs).

The analysts at Deutsche Bank anticipate that these changes will particularly affect food, core goods, and certain service sectors, such as hospitality and leisure.

They also expect the core CPI, which excludes volatile food and energy prices, to jump to 3.72% year-over-year.

Services CPI is predicted to escalate even further, potentially reaching 4.92% year-over-year, with the Retail Price Index (RPI) climbing to 4.26% year-over-year.

Deutsche Bank’s analysis suggests that the timing of the index collection day, which they assume will be April 15, could significantly influence the inflation figures, especially in the context of hotel prices, package holidays, and airfares due to the later than usual Easter weekend.

In the housing sector, private rents are expected to remain steady, but social rents are forecasted to rise by 1% month-over-month. Other housing-related costs, including sewerage bills, could see an increase of nearly 21%.

For transportation, the analysts predict that airfares will see a 17% month-over-month increase, while vehicle excise duty and air passenger duty changes are expected to add 5-7 basis points to the headline CPI.

Communication prices are also set to rise, with broadband and mobile phone bills anticipated to see increases of 6.3% and 4%, respectively. The communication price basket overall is projected to go up by 4.4% month-over-month in the CPI measure.

For recreation and personal services, minimum wage and employer NICs increases are expected to be significant factors. Deutsche Bank estimates that catering prices will rise by 1.1% month-over-month in the CPI, with hotel prices potentially increasing by 6%. Package holiday prices are forecasted to go up by 0.3% month-over-month.

Core goods inflation is also expected to see a variety of price rises, with health goods, clothing, and furniture prices all anticipated to experience seasonal gains. In the food, alcohol, and tobacco categories, the analysts predict an overall rise of 0.4% month-over-month for the CPI basket, with an annual rate increase to 3.8%.

In the energy sector, while pump prices are expected to decrease, the Ofgem Price Cap is projected to push inflation higher. The energy basket is estimated to rise by 1.6% month-over-month, resulting in an annual CPI rate of -0.8%.

Looking ahead, Deutsche Bank expects a bumpy two quarters before inflation begins to descend.

They foresee headline CPI stalling at around 3.4% year-over-year for the rest of the year, peaking at 3.65% year-over-year in September.

Core CPI is also expected to remain elevated at 3.6% year-over-year over the same period. However, a gradual slowdown in services CPI is anticipated, dropping to around 4.4% year-over-year in Q4-2025.

The analysts project an average annual CPI rate of 3.3% for this year, 2.4% for next year, and 2% for 2027. For RPI, the annual rate is expected to track around 3.9% this year before slowing to 3.3% next year.

The notable rise in Bitcoin's price highlights its rebound from previous lows, drawing attention from market analysts. Its movement underscores a positive shift in market dynamics.

Bitcoin has been trading near the $100,000 level, marking a significant upsurge since the start of 2025. The cryptocurrency's renewed momentum follows a drop earlier in the year. Prices have risen over 14% in the past month.

Analysts, including Tracy Jin from MEXC, predict that current trends could propel Bitcoin toward $150,000. As Tracy Jin, COO, MEXC, mentioned,

Institutional interests have waned, but improved on-chain metrics illustrate a potential bullish trend.

The market's recovery impacts investment strategies, with companies cautious yet optimistic. Institutional inflow remains subdued compared to 2024, reflecting current economic uncertainties and evolving market strategies.

Apparent demand has surged to 65,000 BTC, indicating a market rebound. Continued positive demand could stabilize prices above previous highs, with historical data suggesting potential growth.

Bitcoin's consistent gains highlight shifting dynamics and potential upward trends. Forecasts for the year-end suggest further price increases, potentially boosted by technological advancements and increased investor confidence.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up