Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Reserve Bank of New Zealand (RBNZ) has cut interest rates by 25 basis points to 3.25%, citing weak domestic growth and rising global risks, with projections indicating further rate cuts into 2026....

French President Emmanuel Macron will meet his Indonesian counterpart Prabowo Subianto in Jakarta on Wednesday, and defence ties with Paris' biggest arms client in Southeast Asia are expected to be on the agenda.

Indonesia is the second leg of Macron's regional trip after Vietnam, where the two countries signed deals worth over $10 billion. He is scheduled to fly to Singapore on Thursday.

Indonesia's foreign ministry said the two sides would discuss "existing strategic partnerships," without giving specific details about the areas of discussion.

In 2022, the two countries signed an $8.1 billion defence deal that included an order for 42 Rafale fighter jets made by France's Dassault Aviation (AM.PA), opens new tab, as well as a series of agreements including submarine development and ammunition.

"Some commitments need follow-up and Indonesia has shown interest in some other military hardware, but there has been no progress yet," said Khairul Fahmi, a military expert at Indonesia-based Institute for Security and Strategic Studies.

No Rafale jets have been delivered to Indonesia yet. The chief of the Indonesian Air Force Mohamad Tonny Harjono said in February that six jets would arrive in Indonesia in early 2026, state news agency Antara reported.

Aside from the Rafale deal, Indonesia in 2024 struck an agreement with French state-owned shipyard Naval Group to buy two "Scorpene" submarines, and in 2023 announced the purchase of 13 long-range air surveillance radars from France's Thales.

Prabowo, who became president last year, was the defence minister when these deals were signed.

Macron's delegation to mineral-rich Indonesia includes French mining group Eramet's new CEO Paulo Castellari. Eramet (ERMT.PA), opens new tab chairwoman Christel Bories said they would look to discuss mining permits in relation to the Weda Bay nickel mine.

Indonesia is the world's largest producer of nickel, and also holds the biggest known reserves of the metal. Eramet and other companies have complained about reduced volume allowances.

The group also has been in talks with Indonesia's new sovereign wealth fund, Danantara, about battery supply-chain investments, with Eramet still wanting to get into nickel processing after dropping a plan to build a plant with BASF last year.

Reporting by Ananda Teresia and Stanley Widanto in Jakarta, and Gus Trompiz in Paris; Writing by Gibran Peshimam; Editing by John Mair

Key Points:

Bitcoin surpassed the $110,000 mark on May 26, 2025, amid strong trading activity and macroeconomic factors.

The event boosts Bitcoin's stance as a dominant cryptocurrency, while experts remain attentive to potential fluctuations due to global economic conditions.

Bitcoin's price movement to $110,000, a critical psychological level, occurred after it dipped to $106,000 on May 25. Strong institutional support led by key players, like Michael Saylor, who said, "Bitcoin is an unparalleled store of value that continues to gain traction among institutional investors," has been instrumental in this achievement, highlighting his fervent advocacy for Bitcoin as a store of value. The current US President's delay in implementing tariffs on the EU appears correlated with the price increase.

Financial markets witnessed a surge with digital asset inflows reaching $3.3 billion weekly, supporting Bitcoin's climb. Institutional investments fuel growth while market analysts project support for a move toward $115,000. The cryptocurrency market experienced over a 2% rise as a result of these factors, signaling continued confidence.

The situation's implications involve potential economic and financial shifts influencing prices. Bitcoin's upward trajectory may affect investor decisions globally. Long-term holder accumulation and Bitcoin ETFs were instrumental in this price increase, with predictions suggesting recently established support could push prices to higher targets.

Experts caution that if institutional inflows slow or regulatory pressures mount, a price correction below $110,000 may occur. Continued market interest and technical analyses suggest maintaining current levels could solidify future growth trends.

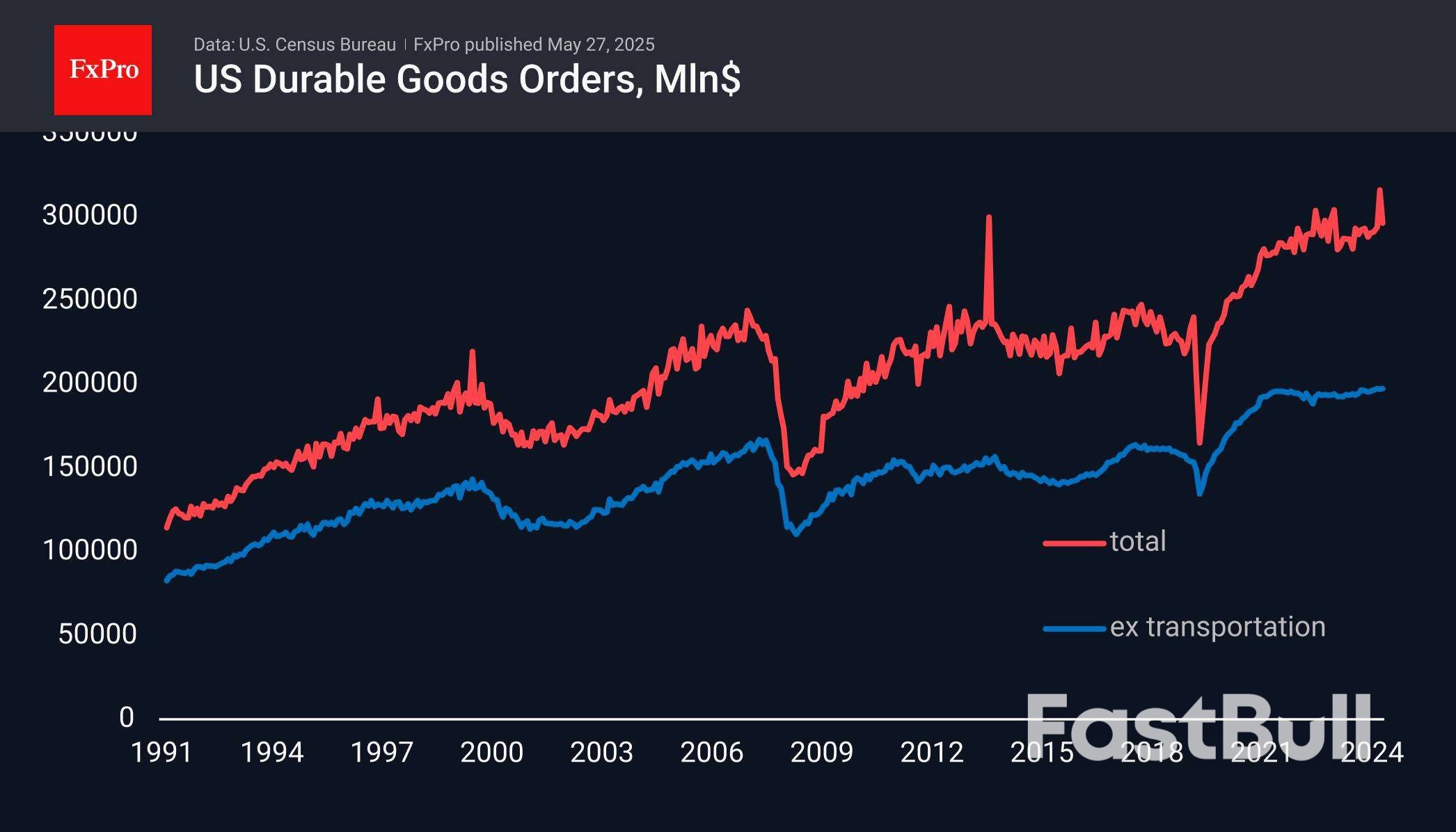

Preliminary estimates of durable goods orders in the US showed a less sharp than expected dip in April. The decline was 6.3% versus a 7.5% jump a month earlier and an expected 7.6% drop.

The volatility is almost entirely due to the transport sector, and without that component, there was a 0.2% gain for the month after a commensurate decline earlier. This indicator has been near a plateau for the past three years, adding only 1% in money over that time against a 12% rise in the Core CPI and a 9% rise in Core PPI. Simply put, America has been cutting investment in durable goods for about as long as the Fed has been shrinking its balance sheet.

In the short term, the current report is relatively positive for demand for US assets, including the dollar, coming in above expectations. However, in the medium term, it is worth paying attention to the decline in orders expressed in real prices. This may indicate a growing threat of stagnation, if not contraction, of the US economy, bringing the Fed rate cut closer.

The FxPro Analyst Team

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up