Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Elon Musk's explosive feud with President Trump triggered one of the worst personal wealth losses in history, wiping out $34 billion from his net worth...

In recent statements, FED Board Member Adriana Kugler said that inflation currently poses a greater risk than weak employment.

Kugler stated that the impact of customs duties on prices has not yet been fully seen, and said, “Inflation will be the primary effect, other effects will emerge over time.” Kugler said that the inflation experience during the pandemic period still has an impact on expectations, and noted that inflation resulting from customs duties may not be a one-time effect.

“My focus right now is inflation. Once the tariffs are fully in place, we can start talking about other impacts, but that hasn’t happened yet,” Kugler said.

Kugler also noted that the tax regulation that came into effect during the term of President Donald Trump may not have a contractionary effect in general, but rather a demand-stimulating effect, which could put pressure on prices.

Kugler also touched on the labor market, noting that unemployment is still at historically low levels, and that the decrease in immigrant inflows could further tighten the labor market. Kugler said that these effects could begin to be felt in some sectors towards the end of the year, and that it was too early to expect large-scale job losses due to artificial intelligence.

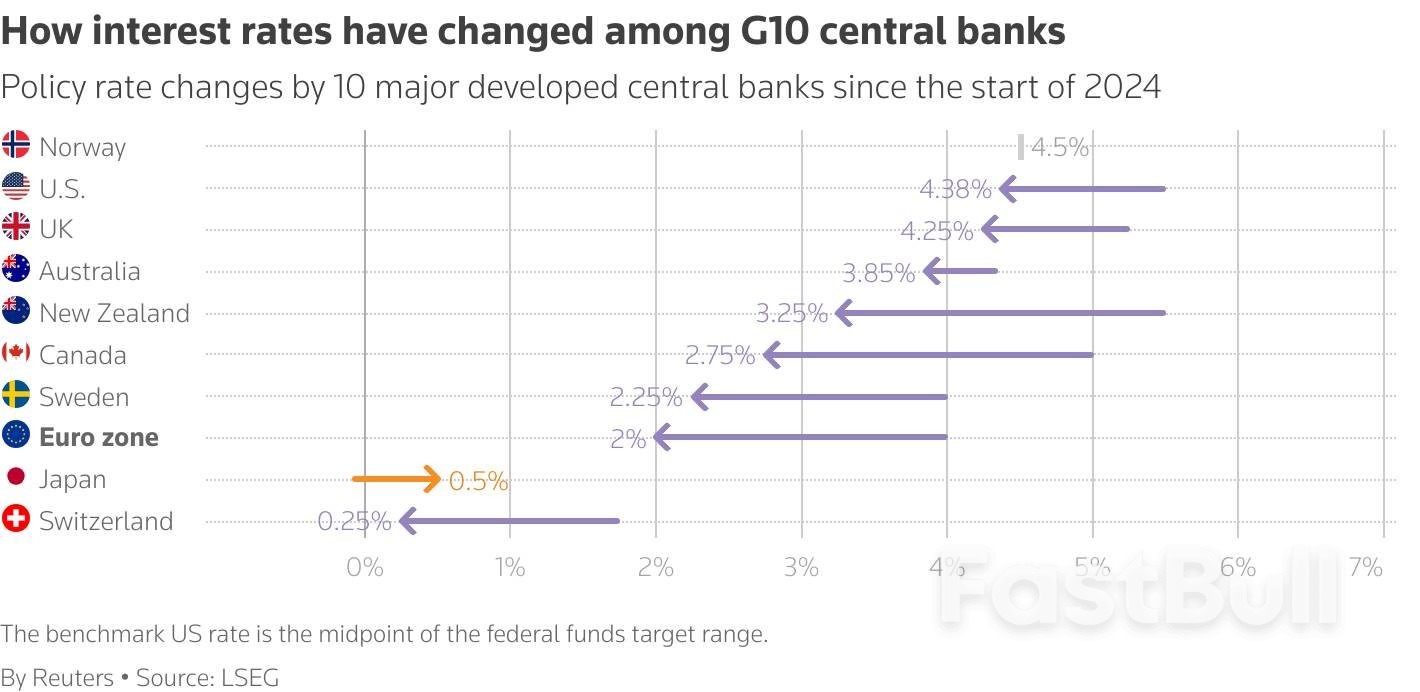

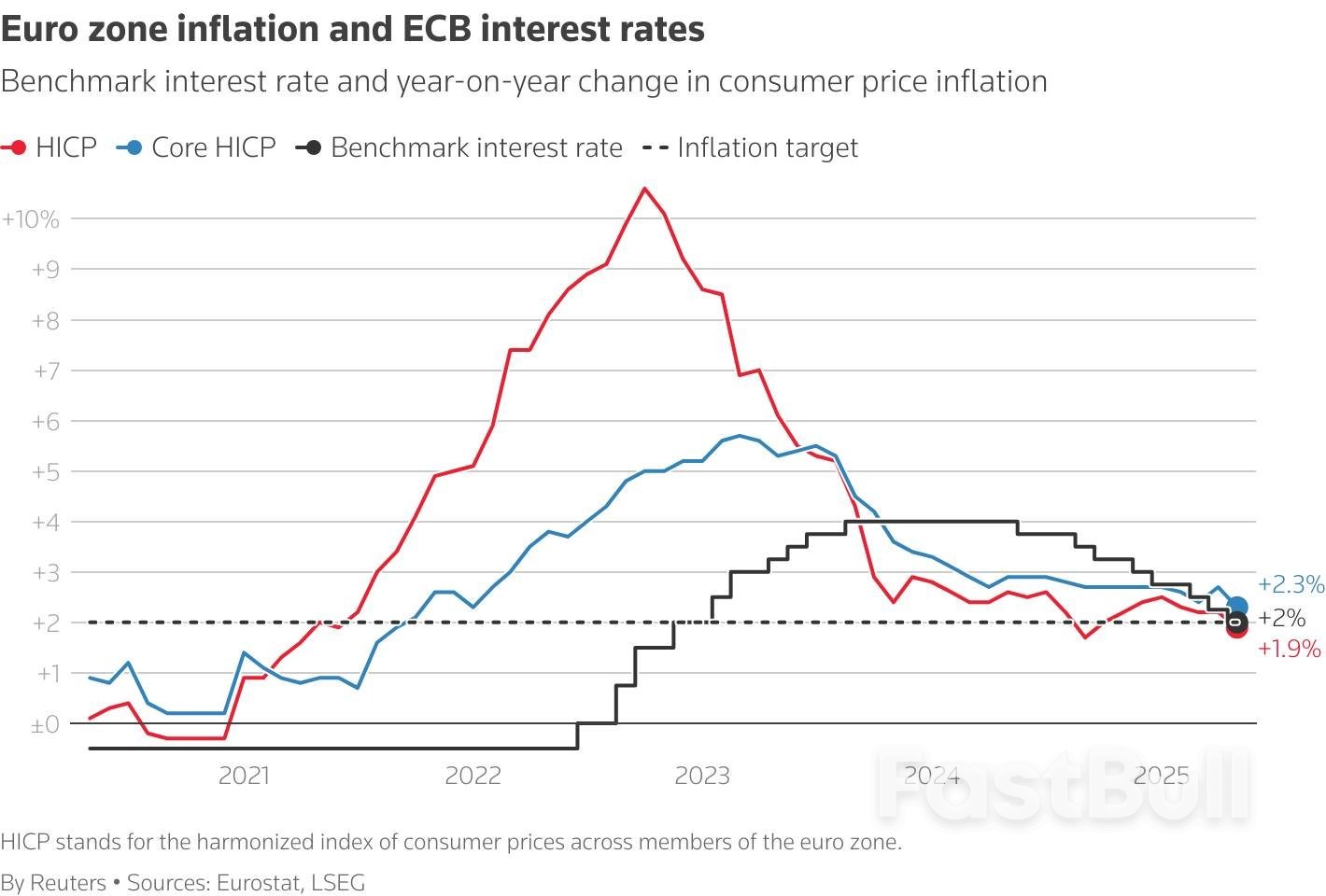

The European Central Bank cut interest rates as expected on Thursday but hinted at a pause in its year-long easing cycle after inflation finally returned to its 2% target.

The ECB has lowered borrowing costs eight times, or by 2 percentage points since last June, seeking to prop up a euro zone economy that was struggling even before erratic U.S. economic and trade policies dealt it further blows.

With inflation now just below 2%, ECB President Christine Lagarde said the central bank for the 20 countries that share the euro was in a "good position" with the current rate path, a signal investors took to mean a break in cuts, if not an end to policy easing.

Sources close to the discussion also said the time has come for at least a break since the ECB has already done the legwork in taming inflation and additional support was not needed for now, especially since little new data would be available by the July meeting.

Speaking to Reuters on condition of anonymity, four sources with direct knowledge of the discussion said there was broad agreement around the table about sitting tight in July, and a few even made the case for a longer pause, barring unexpected market turbulence.

Lagarde was less explicit but also hinted at steady policy at the next meeting.

"We are well-positioned after that 25 basis point rate cut and with the rate path as it is," Lagarde told a press conference. "With today's cut, at the current level of interest rates, we believe we are in a good position."

The interest rate path implied by markets sees a pause in July and anticipates just one more cut in the deposit rate toward the end of the year, possibly in December.

"I think we are getting to the end of a monetary policy cycle that was responding to compounded shocks, including COVID, including the war in Ukraine, the illegitimate war in Ukraine, and the energy crisis," Lagarde said.

Economists also saw her words as a clear indication of a pause and some even bet that the ECB's most aggressive easing cycle since the global financial crisis of 2008-2009 might be at a close.

"We think the ECB is done cutting rates now, but this view is contingent on no major negative surprises surfacing and economic outlook to gradually become more robust in line with the ECB's forecasts," Nordea said in a note to clients.

Thursday's decision was virtually unanimous, and the sources said only Austria's Robert Holzmann objected. Holzmann did not return calls seeking comment.

"Our central view is that today's cut is likely the last for some time," HSBC said in a note.

Lagarde also said the euro zone appeared to be attracting more foreign investment, a sign of growing investor confidence and part of the reason why the euro has firmed so much since the U.S. administration embarked on its global trade war.

But there is exceptional uncertainty in the outlook.

Falling energy prices and a stronger euro could put further downward pressure on inflation, said Lagarde, adding that effect could be reinforced if higher tariffs led to lower demand for euro exports and re-routing of overcapacity to Europe.

Depending on the outcome of the trade war with the United States, inflation and growth could significantly differ from projections, the ECB said, as it took the unusual step of releasing alternative scenarios to its forecasts.

The case for a pause rests on the premise that the short- and medium-term prospects for the currency bloc differ greatly and may require different policy responses.

Inflation is set to dip in the short term and undershoot the ECB's target next year, but increased government spending and higher trade barriers will add to price pressures later.

The added complication is that monetary policy impacts the economy with a 12-to-18 month lag, so support approved now could be giving help to a bloc that no longer needs it.

"In our baseline, we expect the ECB to pause at the July meeting and deliver a final rate cut in September," PIMCO portfolio manager Konstantin Veit said. "A more recessionary configuration will likely be needed for the ECB to go faster and further in this cutting cycle."

Acknowledging near-term weakness, the ECB cut its inflation projection for next year.

U.S. President Donald Trump's tariffs are already damaging activity and will have a lasting impact even if an amicable resolution is found, given the hit to confidence and investment.

Most economists think inflation could fall below the ECB's 2% target next year, triggering memories of the pre-pandemic decade when price growth persistently undershot 2%, even if projections show it back at target in 2027.

Further ahead, the outlook changes significantly.

The European Union is likely to retaliate against any permanent U.S. tariffs, raising the cost of trade. Firms could relocate some activity to avoid trade barriers but changes to corporate value chains are also likely to raise costs.

Higher European defence spending, particularly by Germany, and the cost of the green transition could add to inflation while a shrinking workforce due to an ageing population will keep wage pressures elevated.

US hiring likely moderated further in May and the unemployment rate was little changed, suggesting employers are yet to implement big changes to their headcount in response to President Donald Trump’s trade policy.

Nonfarm payroll growth probably decelerated to 125,000 last month after handily beating expectations for a second month in April, according to the median estimate in a Bloomberg survey of economists. While that would still represent a healthy rate of job growth, the estimates vary widely from 75,000 to 190,000 payrolls. Unemployment is seen holding at 4.2%.

The report from the Bureau of Labor Statistics is expected to show Friday that the labor market is generally holding up in the face of mounting uncertainty driven by Trump’s on-and-off tariffs. Layoffs remain low and many companies have put expansion plans on ice, indicating a preference to see the extent to which tariffs will impact their businesses before making major adjustments to payroll.

“Businesses have learned the lesson of past recessions that if they are overly proactive in laying off staff or pulling back on investment into economic softness, it can be hard to get those people back,” BNP Paribas economist Andrew Husby said. “We think that dynamic remains in full effect, and we see a low-hiring, low-layoff environment continuing in the US this spring.”

Recent data and surveys largely support a gradual slowdown in economic activity, including an increase in recurring filings for unemployment insurance that’s consistent with low hiring levels.

Economists generally expect to see some weakness in trade-exposed sectors now that a surge in imports that helped boost payrolls in transportation and warehousing, retail and wholesale trade in the first quarter has mostly subsided. Pantheon Macroeconomics noted those industries added nearly 200,000 jobs in the six months leading up to April — when the bulk of Trump’s tariffs were announced — but said the pre-tariff buying frenzy has now likely peaked.

“The impact of the trade war on payroll growth likely shifted last month from tailwind to headwind,” Pantheon economists Samuel Tombs and Oliver Allen said in a report.

The tide is seen turning at a time when other sectors are already flashing warning signs. The federal government has now cut jobs for three months as Trump moves forward with plans to substantially downsize the public workforce and cut back government spending. “With each passing month it becomes more likely that federal civil servant layoffs will show up,” Bank of Nova Scotia economist Derek Holt wrote last week, but added that they are likely “to continue to be offset by state and local government hiring.”

In the coming months, it will become more difficult for the labor market to take all these hits at once, said Joseph Brusuelas at RSM US LLP. “The problem right now is that we just do not see monthly labor flows and churn as sufficiently strong to absorb any increase in layoffs linked to government downsizing and trade-related disruptions to transportation, warehousing and retail,” he said in a note.

Economists also flagged that because Easter fell in April this year — later than usual — that likely helped boost leisure and hospitality payrolls that month. “We are assuming a 25,000 boost to April and drag on May,” Morgan Stanley economists led by Michael Gapen wrote.

“The key drag on headline job gains will likely come from leisure and hospitality,” Bloomberg Economics’ Anna Wong said, adding that she’s expecting a decline of nearly 40,000 payrolls in this sector. “Even taking into account the date of Easter Sunday — April 20 this year vs March 31 last year — spring travel has been slow, particularly for international tourism.”

Another one-off factor likely to play a part in May’s report is the weather. Jefferies economist Thomas Simons noted that some parts of the East Coast and the South saw more rainfall than average in May, which may have dampened hiring in leisure as well as construction.

Forecasters generally expect the unemployment rate to remain unchanged at 4.2% for a third month. Economists and policymakers have argued that a slowdown in immigration, which has translated into fewer workers joining the labor market, is coming at a time when hiring is shifting into a lower gear, which is helping keep a lid on unemployment.

“Labor force growth will also be slower in 2025 due to less immigration, so less job growth is needed to hold the unemployment rate steady,” Comerica Bank’s Bill Adams wrote.

BLS said earlier this week it will correct “minor errors” from April’s data in the May employment report. Major labor-force measures — such as the unemployment rate, labor force participation rate, and employment-population ratio — were unaffected, the agency said.

Japan’s exports fell in the first 20 days of May as the Trump administration’s sweeping tariffs continued to disrupt trade.

Exports measured by value dropped 3% from the same period a year earlier, the Finance Ministry reported Friday. That compared with a 2.3% gain in the first 20 days of April, and a 2.0% rise for all of that month. Growth in exports has averaged 6.2% over the year through April.

Japan’s trade balance was in the red, with a deficit of ¥1.1 trillion ($7.7 billion). The 20-day data don’t provide details such as a breakdown of exports to specific countries or regions. The figures for the full month of May are set to be released on June 18.

Autos, steel and chips and other electonic components lead the exports lower while coal, non-ferrous metal and crude oil drove down the import, according to the Finance Ministry. The yen averaged 143.02 against the US dollar during the period in May, 8% stronger than the same period a year earlier, which weighed on the readings for yen-denominated exports and imports, according to the ministry.

The trajectory for trade will be a key factor determining whether Japan’s economy enters a technical recession in the current quarter after weak external demand and sluggish private consumption resulted in a contraction in the previous period. In April, exports to the US fell, led by a drop in autos.

As with other nations, Japan faces a 25% tariff on cars and their parts and a minimum 10% levy on other goods across the board. President Donald Trump doubled a levy on steel and aluminum to 50% in early June, and the 10% tariff is set to revert to 24% in early July, barring a deal.

On May 12, the US and China, Japan’s two biggest trading partners, announced that they had reached a temporary agreement on reducing tariffs. But tensions have flared since then, with Trump complaining earlier this week that Chinese leader Xi Jinping is “hard to make a deal with.”

Japan and the US are continuing to negotiate on the tariffs as they eye possibly announcing a deal on the sidelines of the Group of Seven leaders’ gathering in Canada later this month. Japan’s top trade negotiator Ryosei Akazawa said upon arrival in Washington Thursday that he would continue to press for a removal of all tariffs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up