Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Global markets waver as eurozone inflation drops, the OECD cuts growth forecasts, and hopes rise for a Trump-Xi meeting. Trade tensions, weak earnings, and ECB policy dominate investor focus.

Chinese people travelled more over the three-day Dragon Boat holiday this year, but spending remained below pre-pandemic levels, government data showed on Tuesday - indicators that are closely watched as barometers of consumer confidence.

Consumption in the world's second-largest economy has suffered amid sputtering growth and a prolonged property crisis, with uncertainty from the U.S.-China trade waralso weighing on consumer confidence.

The latest data painted a mixed picture for China's consumer economy. Travellers took an estimated 119 million domestic journeys from Friday to Monday, up 5.7% from the same holiday period last year, according to the Ministry for Tourism and Culture.

Overall spending over the period rose to 42.73 billion yuan ($5.94 billion, a year-on-year increase of 5.9%, but the average amount spent per traveller was a little under 360 yuan ($50), according to Reuters calculations, remaining stubbornly below 2019 levels of around 410 yuan per trip.

The Dragon Boat Festival took place from May 31 to June 2 - and is celebrated throughout the country with local dragon boat races. Many people take the opportunity to have short holidays, crowding train stations and airports around the country.

Cross-border journeys rose 2.7% to 5.9 million, with 231,000 foreign nationals entering the country visa-free during the holiday, broadcaster CCTV said late on Monday.

China has been expanding its visa policy, with citizens of 43 countries granted visa-free access, while visa-free transit for up to 240 hours in China is available for 54 countries.

Rail lines saw the peak of return passenger flow on June 2, with authorities adding 1,279 trains to more than 11,000 passenger trains overall across the country, while road travel was up 3% year-on-year, with 600 million car journeys recorded, mostly travelling short distances.

Chinese also boosted spending on entertainment over the holiday, with cinema box office revenue reaching 460 million yuan ($63.9 million), surpassing last year’s 384 million yuan, according to data from online ticketing platform Maoyan.

Tom Cruise’s latest movie "Mission: Impossible - The Final Reckoning" topped charts, and generated 228 million yuan, half of the total revenue during the holiday period, which was seen as a positive indicator for the upcoming summer season.

OPEC raised oil production last month as the group began a series of accelerated increases spurred by Saudi Arabia, according to a Bloomberg survey.

The 12 members of the Organization of the Petroleum Exporting Countries boosted supplies by 200,000 barrels a day in May to 27.54 million barrels a day, the survey showed. The Saudis accounted for about half of the increase.

OPEC and its allies stunned oil markets in early April by announcing they would start to revive output at three times the planned rate, briefly sending crude prices to a four-year low. Brent futures have since recovered slightly, trading near $65 a barrel in London on Tuesday.

Delegates have described the shift as a strategy designed by Riyadh to punish the coalition’s rogue members and recoup lost market share. At the weekend, the Saudis pressed OPEC+ to ratify a third super-sized hike, despite some objections from its partners.

Saudi Arabia bolstered production by 110,000 barrels a day to 9.08 million barrels a day in May, the survey showed, though this hike fell short of the full amount the kingdom could have added under the agreement.

The next biggest boost came from Libya, which is exempt from OPEC+ quotas as it gradually recovers from years of conflict and instability. The North African exporter added 50,000 barrels a day to an average of 1.32 million barrels a day.

Iraq kept output flat, possibly in observance of its obligation to compensate for earlier overproduction. It pumped 4.18 million barrels a day, still considerably above its target, according to the survey.

The United Arab Emirates added just 10,000 barrels a day to 3.31 million barrels a day. Like Iraq, data compiled by Bloomberg indicate the UAE is exceeding its quota significantly, though figures compiled by OPEC’s secretariat in Vienna show both countries broadly in line with their commitments.

Saudi Arabia has warned fellow members it could push through several more accelerated monthly hikes — set at 411,000 barrels a day for the group — to fully reverse the latest restraints by October.

The OPEC+ nations involved in the accord to restore halted supplies, which also include Russia and Kazakhstan, will hold another call on July 6 to review levels for August.

U.K. economic growth is expected to be stifled by an ongoing squeeze on the country's public finances, the Organisation for Economic Cooperation and Development (OECD) said on Tuesday.

The U.K. is expected to grow 1.3% in 2025 before slowing to 1% in 2026, the OECD said in its latest global economic outlook report, "dampened by heightened trade tensions, tighter financial conditions, and elevated uncertainty."

The organization projected that growth will "remain modest," impacted by bolstered trade tensions and uncertainty surrounding consumer confidence and business sentiment.

"The drag on external demand, private consumption, and business investment is projected to more than offset the positive effects of last autumn's budgetary measures on government consumption and investment," the OECD said.

While the budget deficit is expected to improve from 5.3% in 2025 to 4.5% in 2026, according to OECD forecasts, debt interest spending remains high. Public debt is set to continue rising and to reach 104% of GDP [gross domestic product] in 2026, the OECD said.

The Labour government and Finance Minister Rachel Reeves have repeatedly said their priority is to boost growth and get the country's public finances in order. In government spending plans announced last October, Reeves committed to self-imposed fiscal rules that day-to-day spending must be met by tax revenues, pledging public debt will fall as a share of economic output by 2029-30.

She has repeatedly said the fiscal rules are "non-negotiable" despite the measures leaving her little wiggle room to act in the case of unexpected economic shocks, amid lackluster growth for the U.K., higher borrowing costs and wider global trade tensions and uncertainty for businesses.

While the OECD agreed that "fiscal prudence is required as the monetary stance is easing gradually," it cautioned that "efforts to rebuild buffers should be stepped up in the face of strongly constrained budgetary policy and substantial downward risks to growth, while productivity-enhancing public investments should be preserved."

The government's "very thin fiscal buffers" might not prove sufficient to offer support without breaching fiscal rules if further shocks materialize.

The report comes just over a week ahead of U.K. Chancellor Rachel Reeves delivering her first "Spending Review," in which she will set out long-term public spending plans for government departments.

Since coming to power just over a year ago, the Labour government has already announced a raft of welfare spending cuts, employer tax rises and planning reforms designed to reduce red tape and boost infrastructure projects and housing development. It also announced an increase in defense spending to 2.5% of GDP by 2027 that will be funded through cuts in overseas aid.

After restricting public borrowing and ruling out further tax rises, there is now mounting speculation that Reeves could announce further budget cuts in the spending review on June 11.

The OECD urged the government to stick to its plans to strengthen public finances and to deliver on its ambitious fiscal plans, including through the upcoming review.

"A balanced approach should combine targeted spending cuts, including closing tax loopholes; revenue-raising measures such as re-evaluating council tax bands based on updated property values; and the removal of distortions in the tax system," it noted.

It also called on the U.K. to reverse a decline in labor market participation by implementing pro-work reforms to the welfare state "while protecting the most vulnerable."

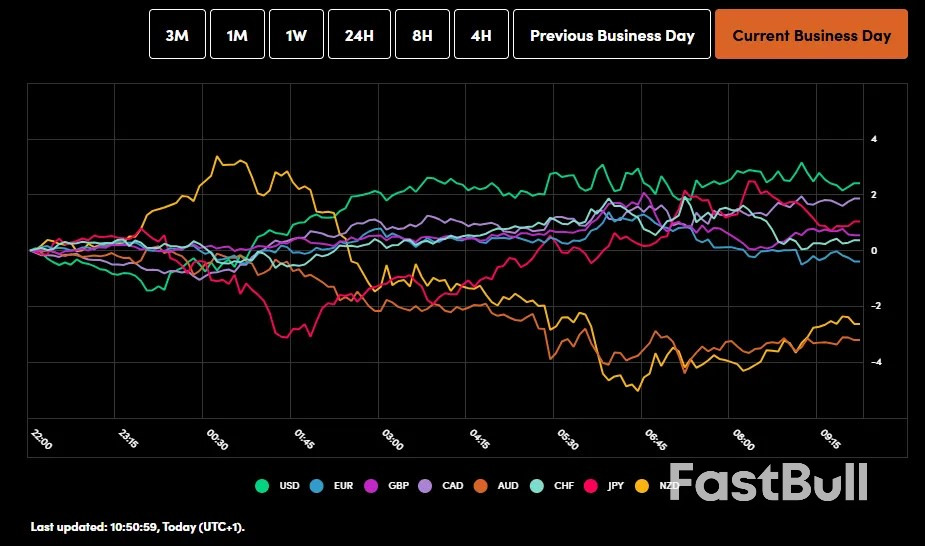

Understanding global currency movements is crucial for anyone tracking financial markets, including those in the cryptocurrency space, as macro trends often influence investor sentiment across assets. Recently, the focus has been on the Asia FX Market, where activity has remained relatively muted, particularly concerning the performance of the Australian Dollar.

The Australian Dollar (AUD) has experienced downward pressure recently, a trend closely watched by traders globally. Several factors contribute to this softening, primarily centered around domestic economic conditions and the outlook from the Reserve Bank of Australia (RBA). Unlike some other major currencies that have seen volatility, the AUD’s recent moves appear more directly tied to specific local developments.

This performance contrasts with periods when the AUD acted more as a risk-on currency, heavily influenced by global growth prospects and commodity prices. The current narrative is more about internal economic dynamics.

Beyond the AUD, the wider Asia FX Market has seen a generally muted trading environment. Many regional currencies have traded within narrow ranges, showing limited directional conviction. This could be attributed to a balance of global factors, such as US dollar strength or weakness, and specific country-level economic developments or central bank actions.

While the AUD has shown distinct weakness, other currencies in the region might be reacting to different pressures. For instance, some might be influenced by trade data with major partners, capital flows, or domestic inflation trends. The overall picture is one of caution, with investors perhaps waiting for clearer signals from major global economies or central banks.

| Influence Factor | Potential Impact |

|---|---|

| US Dollar Strength | Often weakens local Asian currencies |

| China’s Economic Performance | Significant impact on trade-reliant economies |

| Local Inflation Rates | Influences domestic monetary policy |

| Geopolitical Events | Can cause capital flight or safe-haven flows |

Currently, a lack of strong catalysts, either positive or negative, seems to be keeping volatility suppressed across much of the region, with the AUD being a notable exception due to its specific domestic issues.

The stance of the Reserve Bank of Australia (RBA) is a primary driver of the Australian Dollar‘s value. Central banks influence currency values through interest rate decisions, quantitative easing/tightening, and forward guidance on future policy intentions. The recent tone from the RBA has been perceived as dovish, meaning they are less inclined to raise rates further and potentially more open to cutting rates sooner than previously anticipated or compared to other central banks.

This dovish posture typically makes a country’s currency less attractive to foreign investors seeking higher yields. When the RBA signals potential rate cuts, the expected return on Australian dollar-denominated assets decreases, reducing demand for the currency. Conversely, a hawkish stance (signaling rate hikes) tends to strengthen a currency.

The market carefully analyzes every RBA statement and speech for clues about the future path of interest rates. Any hint of a shift towards easing monetary policy can trigger a sell-off in the AUD, while unexpected hawkishness can lead to a rally. Understanding the nuances of RBA Monetary Policy is essential for predicting AUD movements.

The dovish shift in RBA Monetary Policy is largely a reaction to recent Economic Data Australia has released. Data points such as inflation, retail sales, employment figures, and GDP growth provide the RBA with insights into the health of the economy and inflationary pressures. If these indicators suggest slowing growth or easing inflation, the RBA has more room, or indeed feels pressure, to consider lowering interest rates to stimulate economic activity.

Recent data releases that have likely influenced the AUD’s softening and the RBA’s dovish tone include:

These data points collectively paint a picture of an economy that may be cooling, providing the RBA with the justification for a less restrictive monetary policy stance. Traders react swiftly to these releases, adjusting their expectations for future rate hikes or cuts, which directly impacts the Currency Performance of the AUD.

The outlook for Currency Performance across Asia, including the Australian Dollar, remains heavily dependent on a confluence of factors. Globally, the trajectory of US interest rates and the performance of the US dollar will continue to play a significant role. Domestically, in countries like Australia, the focus will remain squarely on incoming economic data and the subsequent signals from central banks like the RBA regarding their monetary policy path.

For the AUD specifically, key watchpoints include:

For the broader Asia FX Market, the key will be how regional economies navigate global economic conditions and whether domestic policies can provide stability or growth impulses. Investors will look for signs of recovery in major economies like China and assess how central banks across the region respond to inflation pressures and growth needs.

In conclusion, the recent softening of the Australian Dollar is a direct consequence of weaker Economic Data Australia has reported and the increasingly dovish tone from the RBA Monetary Policy makers. While the broader Asia FX Market remains largely subdued, the AUD’s specific challenges highlight the importance of domestic fundamentals and central bank guidance in driving Currency Performance. Traders and investors will need to closely monitor these factors for potential shifts in the current trends.

Swati Dhingra, a policymaker at the Bank of England, expressed concern on Tuesday about potential downside risks for the U.K.’s inflation outlook.

She suggested that the recent spike in inflation was primarily due to rising energy bills, rather than a fundamental shift in supply and demand pressures.

Dhingra released her annual report to Parliament’s Treasury Committee, in which she stated, "On balance, the risks to inflation and growth appear to me to be tilted to the downside."

She pointed to household energy bills and past energy shocks as the main contributors to the near-term increase in headline inflation.

Regulated price increases also played a role, but to a lesser extent.

In her report, Dhingra emphasized that these factors have more influence on the current inflation situation than any imbalance in underlying supply and demand pressures.

This perspective suggests a cautious outlook on the U.K.’s economic climate, particularly in relation to inflation and growth.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up