Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

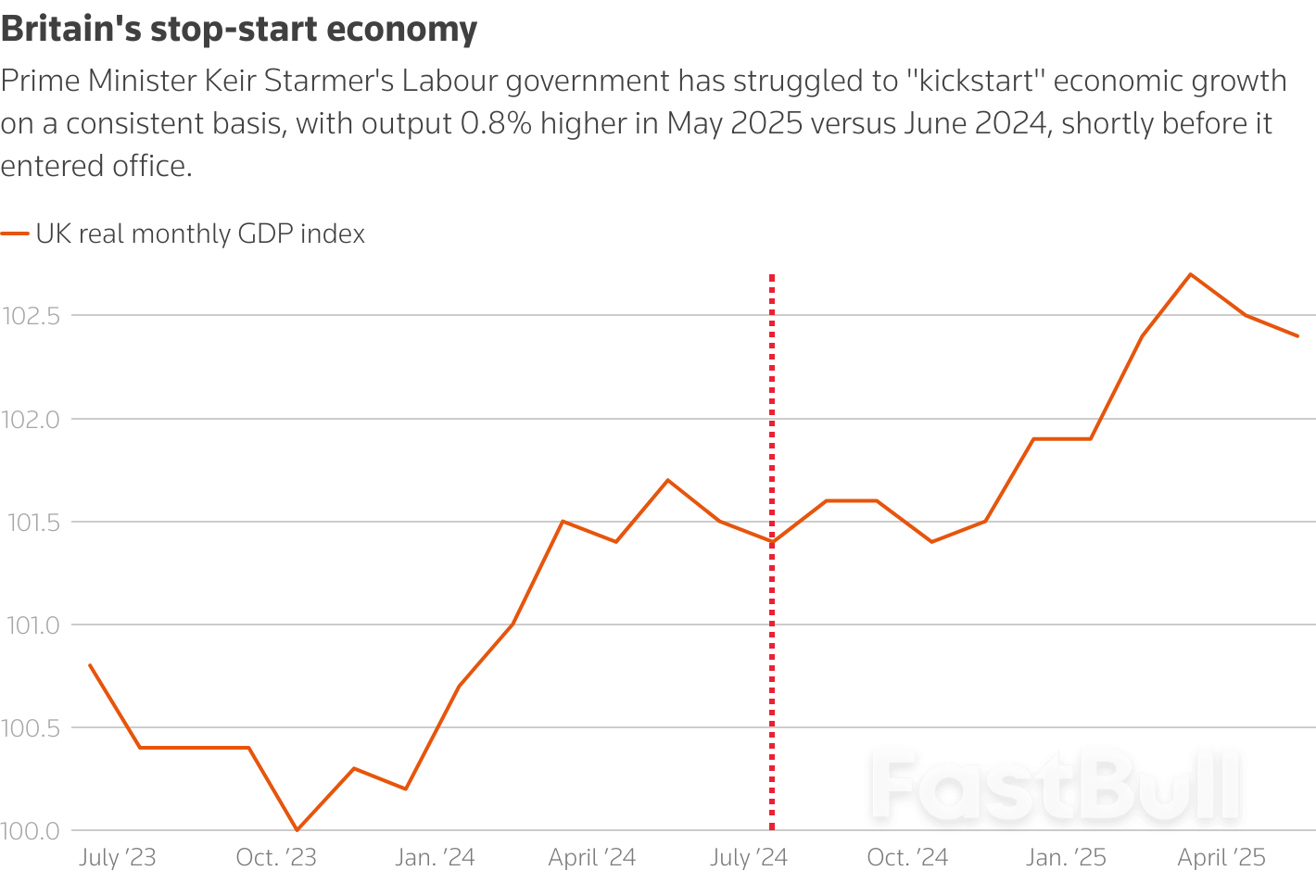

Market sentiment weakened as Trump imposed a 35% tariff on Canada, Bitcoin hit a record high, UK GDP shrank again, and European stocks, including the DAX, declined amid trade tensions.

Canada's unemployment rate surprisingly dropped a tick to 6.9% in June as employment increased in wholesale and retail trade and health care and social assistance, data showed on Friday.

The economy added 83,100 new jobs in June, the first net increase since January, Statistics Canada said. Most of this employment growth was in part-time work.

Analysts polled by Reuters had estimated the unemployment rate to tick up to 7.1% from 7% in May, with no job additions. The jobs report usually has a standard error of around 32,000 between two consecutive months.

This is the final jobs report before the Bank of Canada's monetary policy decision on July 30 and a better than expected unemployment and job addition numbers is likely to tilt the bank towards another hold in its policy rate.

The June inflation data coming next week will be the final number which will help the central bank seal its decision.

Money markets are betting that the odds of a rate cut this month are at just 30%, a slight change from Thursday after U.S. President Donald Trump threatened to impose 35% tariffs on all Canadian imports from Aug. 1, which will be over and above the already existing tariffs on various sectors. (0#CADIRPR)

While the number of unemployed Canadians in June hardly changed from May, it was up 9% to 128,000 on a year-over-year basis and over one in five unemployed people had been searching for work for 27 weeks or more in June, an sharp increase from June 2024.

Statistics Canada said the layoff rate in June did not show any major uptick and remained low at 0.5% relative to historical averages barring recessionary periods.

Tariff exposed sectors such as transportation and manufacturing had been showing signs of strain for the three months through May.

The employment in transportation dropped by 3,400 people in June while manufacturing posted a jump of 10,500, StatsCan said.

The biggest increase in employment was a 33,600 jump seen in wholesale and retail trade. Healthcare and social assistance saw a jump of 16,700 people while agriculture sector shed 6,000 people in June.

The participation rate, or the number of people employed and unemployed in the total population was at 65.4% in June, up from 65.3% in May.

The average hourly wage of permanent employees - a gauge closely tracked by the BoC to ascertain inflationary trends - grew by 3.2% to C$37.22.

Markets may be inadvertently giving President Donald Trump the green light to escalate tariffs, according to analysts at Wolfe Research.

Despite a barrage of new trade threats this week, including a 35% tariff proposal on Canada and potential increases to the baseline tariff rate, stocks continue to hit record highs.

"Trump’s explicit argument tonight that a 15–20% baseline is manageable because ’the tariffs have been very well-received... the stock market hit a new high today’ underscores our longstanding argument that market stabilization will serve as permission to push harder," Wolfe wrote.

The firm noted that Trump has now sent letters to 23 countries threatening new tariffs worth roughly $60 billion annually, while also announcing 50% copper tariffs and floating the possibility of 200% duties on pharmaceuticals.

Yet none of the threats have sparked a material market selloff.

“If Trump won’t blink unless forced to by markets, and markets won’t react until he actually implements a major tariff escalation, then it seems totally plausible that some of these tariffs will go into effect on August 1,” Wolfe said.

Wolfe suggested that tariffs on Asian exporters and smaller trade partners, excluding those already in negotiations or under trade deals, may be digestible without disrupting financial markets.

A baseline tariff increase from 10% to 20% on this segment would raise about $60 billion in revenue, said the firm.

Wolfe also interpreted recent Wall Street Journal reporting that Trump needed to be convinced by Bessent to grant a delay as “hawkish,” suggesting Trump is becoming less patient with trading partners and more inclined to act unilaterally.

“If the President’s ‘reserve price’ for trade deals is going up based on market permissiveness and his patience wearing thin, that also reinforces our expectation that sectoral tariffs will be sticky,” Wolfe wrote.

The Houthis have clearly been ramping up their attacks on Israeli interests and assets out of Yemen, and on Thursday another ballistic missile strike on Tel Aviv was attempted.

Israel's military said it intercepted a missile launched from Yemen, shortly after conducting airstrikes on Houthi targets. The Iran-aligned group later confirmed responsibility for the launch, calling it a "qualitative military operation" involving a ballistic missile.

Prior missile intercept over Tel Aviv in June, via AFP

Prior missile intercept over Tel Aviv in June, via AFPAs a result, multiple alert sirens were active across Israel during the dawn hours. All of this comes after the Houthis attacked and sank two commercial vessels bound for Israel, in complex operations which they boasted of and captured on film.

Israel is now reportedly formally asking the United States to renew its military strikes on the Iran-backed group, according to Kan public broadcaster..

Israel told the US that the attacks on shipping "can no longer remain solely an Israeli problem," and called for "more intense combined attacks against Houthi regime targets — not just [Israeli] air force fighter jet strikes, but also a renewal of American attacks and the formation of a coalition including additional countries."

"A broad coalition is needed to convey to the Houthi regime that it is in danger," an anonymous Israeli defense official told Kan.

At the moment, the Houthis are still actively targeting Tel Aviv international airport, along with any vessel in the Red Sea bound for Israel. Ben Gurion airport has been directly hit at least once during the conflict.

President Trump had in May declared a US ceasefire with the Houthis, to the chagrin of Israel, which stepped up its own aerial attacks on Yemen.

Trump, perhaps realizing the futility of the US bombing raids - amid Houthi resolve - essentially declared 'victory' and departed the war theatre. Many war analysts believe that the Houthis cannot ultimately be defeated short of a full, comprehensive ground operation.

On July 11, 2025, Bitcoin (BTC) surged past $118,000, marking a historic high. According to CoinMarketCap real-time data, Bitcoin rose 6.56% in the past 24 hours, 7.5% over the week, and an impressive 152% year-to-date.

Market sentiment is blazing hot, with investors on social media cheering: “BTC broke $118,000, the Asian session is still soaring, those waiting for a pullback are missing out!”

However, the rapid ascent caught pullback-awaiting investors off guard, as no meaningful correction materialized—and FOMO took hold across the board.

The biggest short-term driver behind Bitcoin’s break above $118,000 is institutional capital inflows.

In particular, spot Bitcoin ETFs have served as the “rocket fuel” for this rally. According to Bloomberg, as of July 11, global Bitcoin ETFs saw record weekly net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) alone netting $448 million on July 10.

A market participant on social media noted: “Institutional buying is unstoppable—IBIT accumulation is directly pushing BTC to new highs, retail simply can’t keep up!”

Through massive ETF purchases, institutions have sharply reduced Bitcoin’s available supply on exchanges. Glassnode data shows that on July 11, BTC holdings on major crypto exchanges declined to 1.8 million BTC, the lowest level in three years.

The resulting supply-demand imbalance has directly propelled price gains. At the same time, ETF-driven FOMO has gripped retail investors.

Fearful of missing out on further gains, many abandoned their wait-and-see strategies and rushed in, amplifying upward momentum.

Social sentiment captures this echo: “ETF inflows are like a flood—BTC just won’t stop!” This synergy between institutions and retail stands at the heart of Bitcoin surpassing $118,000.

Bitcoin’s rise is underpinned by strong market momentum. On the night of July 10, BTC broke the key $114,000 level, and during the Asian trading session on July 11, it pushed past $118,000.

Glassnode shows on‑chain transaction volume spiked 35% at the breakout—reaching a monthly peak—indicating unprecedented market participation.

One social media trader stated: “Volume exploded when BTC crossed $114,000—this is a full-on bull signal, no pullback in sight.”

Asia’s trading surge injected massive energy. Crypto exchanges in Hong Kong and Singapore hit monthly highs in night trading, with Binance and OKX seeing BTC volume spike 45% during the early hours of July 11.

Especially between 2 AM and 4 AM HKT, activity surged and leveraged trading climbed. Investors commented online: “Asian session buys have gone crazy—BTC directly blasted past $118,000!”

This fervent activity not only cemented the upward move, but also squeezed out pullback opportunities.

Social media has become the sentiment barometer of investor frenzy. After Bitcoin topped $118,000, hashtags like #Bitcoin and #BTCnewhigh exploded, with discussions generating over 60 million views.

As one investor wrote: “BTC hit $118,000—retail still waiting for a $110k pullback? You don’t wait in a bull market, get on board now!” Such comments resonated widely, prompting even more investors to abandon wait-and-see postures and join the rally.

In this bull cycle, pullback windows have become extraordinarily brief—or non-existent. At the end of June, BTC dipped from $110,000 to $105,000, only to recover within 48 hours.

The July 11 breakout came without any discernible pullback—the price shot from $116,000 straight through $118,000, leaving those waiting for it in the dust.

One social media user complained: “Every time I wait for a pullback, the market just pumps instead—it feels like it’s mocking me.”

Several factors lie behind this phenomenon. First, institutional buying heavily suppresses pullback potential. ETFs and large institutions buying into dips quickly absorb selling pressure.

For example, when BTC briefly fell to $115,000 during trading on July 10, buying demand lifted it back above $116,500 in under two hours. Second, global crypto market liquidity is higher and order book depth deeper, meaning retail selling rarely moves the needle.

As one investor put it: “Institutions were waiting at $115k—retail hoping for $110k? No chance!” So those expecting 10–20% deep pullbacks were repeatedly disappointed, missing optimal entry points.

Compared to 2017 or 2021’s bull cycles, the 2025 Bitcoin market is fundamentally different. Previously, retail-driven speculation led to swings of 20–30%, creating entry windows. Now, with institutional dominance, everything has changed.

Companies like MicroStrategy have continued to buy: as of July 11, their holdings exceed 250,000 BTC, while exchange BTC supply sits at a three‑year low of 1.8 million BTC. This shortage has made prices highly responsive to buys and resilient to sells.

One trader commented: “Institutions setup at $110k—retail waiting for $100k? Forget it!” Institutional depth not only lifts the market floor, but compresses the pullback timeline.

For instance, after BTC broke $112,000 on July 9, a correction was expected—but institutions quickly drove it to $118,000, blindsiding patient traders. Under this new market regime, “waiting for pullback” is obsolete strategy—and missing out is inevitable.

DROP THE “PERFECT LOW” FIXATION

Historical BTC bull runs repeatedly show that chasing “the perfect dip” often means missing the rally entirely. Instead, adopt a staggered buying approach.

For example, gradually build positions around $105,000, balancing risk and participation. Disciplined entry trumps blind waiting for perfection.

Online discussions capture the regret of those left behind: “Every time a pullback seems possible, prices fly and my mindset collapses.”

Many retail traders give in to FOMO or regret, lacking clear plans. The takeaway: investors need structured strategies—like target-based approaches or dollar-cost averaging—to stay on course.

Emotional control is equally crucial. When BTC topped $118,000, social media buzz surged—and with it, panic and FOMO. Those who stayed calm, focused on on-chain data and fundamentals, were better equipped to make rational decisions.

As one analyst advised: “Don’t let hype on social media cloud your judgment—set your plan, that’s how you win in a bull market.”

For those hesitant to chase high prices, derivatives offer viable alternatives. Short-term call options—e.g., July expiration at $120,000—let you play the upside with fixed risk. One market participant said: “Don’t want to chase high?

Buy a call option—low cost, high potential upside.” Similarly, futures hedging can lock in profits or protect against dips.

Derivatives offer exposure with lower capital and reduced fear of missing out. For instance, on July 11, BTC options volume on Binance surged 60%, highlighting traders’ eagerness to deploy derivatives in this rally.

But caution is key—derivatives require sophistication, and high leverage can lead to liquidations. As shared online: “Options let me profit and sleep easy during the bull run.”

On July 11, 2025, Bitcoin rocketed past $118,000, fueled by institutional capital, market momentum, supply scarcity, and rampant FOMO.

Investors hoping for a pullback were left behind—pulled down by narrow correction windows, new market dynamics, and emotion-based trading. Social media captures the mood: “BTC won’t wait—you board now or get left behind.”

The lesson is clear: in bull markets, waiting for the perfect dip can mean missing the rally. Investors must rethink their approach—embrace staggered entry, reinforce discipline, and make smart use of tools like derivatives.

The hurdle for another interest rate cut by the European Central Bank is "very high" as the euro zone economy is holding up better than expected despite uncertainty over trade, ECB board member Isabel Schnabel said in an interview published on Friday.

Having halved its policy rate in just a year, the ECB has signalled it will now stay put and see how the economy copes with a simmering global trade war stoked by U.S. President Donald Trump.

Schnabel expressed a clear preference for keeping rates steady as inflation was moored at ECB's 2% target, the euro zone economy was proving resilient and more government spending in Germany was brightening the outlook.

"Inflation is projected to be at 2% and inflation expectations are well anchored," Schnabel told financial newswire Econostream. "In view of this, our interest rates are also in a good place, and the bar for another rate cut is very high."

The ECB cut its policy rate to 2% last month - a level that Schnabel said was "becoming accommodative". The ECB's official range for the neutral rate, which is neither accommodative nor restrictive, is 1.75% to 2.25%.

She said she would only back a cut if she saw "signs of a material deviation of inflation" from 2% and spoke against "fine-tuning" the rate in response to data such as swings in oil prices.

The ECB's chief economist Philip Lane also said recently that the central bank would react to "material" changes in the euro zone's inflation outlook and ignore "tiny" ones.

Striking a different tone to some of her colleagues, Schnabel played down recent strength in the euro's exchange rate, saying its "pass-through" to inflation would be limited and it reflected an improved economic outlook.

"It seems that the uncertainty is weighing less on economic activity than we thought, and on top of that, we’re expecting a large fiscal impulse that will further support the economy," she said. "So overall, the risks to the growth outlook in the euro area are now more balanced."

She argued tariffs would prove inflationary over the medium term because of higher costs and less efficient supply chains, "which are not included in our standard projection models".

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up