Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

AUD/USD started a decent increase above the 0.6150 and 0.6200 levels. NZD/USD is also rising and might aim for more gains above 0.5850.

AUD/USD started a decent increase above the 0.6150 and 0.6200 levels. NZD/USD is also rising and might aim for more gains above 0.5850.

· The Aussie Dollar rebounded after forming a base above the 0.6000 level against the US Dollar.

· There is a connecting bullish trend line forming with support at 0.6260 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD is consolidating gains above the 0.5765 zone.

· There is a key bullish trend line forming with support at 0.5825 on the hourly chart of NZD/USD at FXOpen.

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.5940 support. The Aussie Dollar was able to clear the 0.6065 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6200 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6315 zone. A high was formed near 0.6314 and the pair recently started a consolidation phase.

There was a move below the 0.6300 level. The pair remained above the 23.6% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the downside, initial support is near the 0.6260 level. There is also a connecting bullish trend line forming with support at 0.6260. The next major support is near the 0.6220 zone. If there is a downside break below the 0.6220 support, the pair could extend its decline toward the 0.6205 level.

Any more losses might signal a move toward 0.6065 and the 61.8% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6315. The first major resistance might be 0.6340. An upside break above the 0.6340 resistance might send the pair further higher.

The next major resistance is near the 0.6385 level. Any more gains could clear the path for a move toward the 0.6450 resistance zone.

On the hourly chart of NZD/USD on FXOpen, the pair started a steady increase from the 0.5515 zone. The New Zealand Dollar broke the 0.5670 resistance to start the recent increase against the US Dollar.

The pair settled above 0.5765 and the 50-hour simple moving average. It tested the 0.5850 zone and is currently consolidating gains. The pair corrected lower below the 0.5840 level. However, the bulls are active above the 0.5825 level.

The NZD/USD chart suggests that the RSI is stable above 50. On the upside, the pair might struggle near 0.5850. The next major resistance is near the 0.5880 level.

A clear move above the 0.5880 level might even push the pair toward the 0.5920 level. Any more gains might clear the path for a move toward the 0.6000 resistance zone in the coming days.

On the downside, immediate support is near the 0.5825 level. There is also a key bullish trend line forming with support at 0.5825. The first key support is near the 0.5765 level. The next major support is near the 0.5670 level and the 50% Fib retracement level of the upward move from the 0.5485 swing low to the 0.5853 high.

If there is a downside break below the 0.5670 support, the pair might slide toward the 0.5570 support. Any more losses could lead NZD/USD in a bearish zone to 0.5515.

The European Central Bank meets on Thursday to set monetary policy amidst a turbulent time for financial markets as US President Trump’s trade policies continue to wreak havoc. Having already lowered its deposit rate by 150 basis points to 2.50%, the ECB was contemplating a pause in April to assess the impact of the previous easing. But the economic outlook has deteriorated markedly since the beginning of April when Trump launched his reciprocal tariffs, targeting virtually all of America’s trading partners.

Whilst it is too soon to gauge the immediate hit on businesses, the scale of the market fallout suggests investors are in panic mode. For the ECB, the outlook is complicated by German’s massive fiscal stimulus, as it’s uncertain whether this will be enough to cushion the entire Eurozone from Trump’s trade salvos.

Nevertheless, with inflationary pressures across the euro are subsiding once again, playing it safe and cutting rates further is probably the better option for the ECB. Traders are convinced policymakers will lower rates by 25 bps at the April meeting and have priced in further two cuts before the year end.

The dovish expectations haven’t been a huge drag on the euro, however, as the Eurozone’s large trade surplus with the rest of the world has been providing the currency with some safe-haven attributes during this tumultuous period. And with the US dollar coming under pressure again, the euro has jumped above the $1.13 level.

Unless President Christine Lagarde surprises with a very dovish rhetoric in her press briefing, the euro is unlikely to react much. In fact, a greater risk is if Lagarde disappoints the markets by not sounding dovish enough.

On the data front, Germany’s ZEW economic sentiment index will be watched on Tuesday, along with the Eurozone’s final CPI estimate for March on Wednesday.

A day of before the ECB, the Bank of Canada will announce its decision but it’s doubtful if it will cut rates again. The minutes of the BoC’s March meeting revealed that policymakers would have kept rates unchanged at 3.0%, instead of cutting them, had it not been for Trump’s tariffs. Trade tensions have only intensified since the last meeting, but investors see only a 40% chance of a 25-bps reduction.

Canada has obtained a temporary reprieve from the White House, with the 25% tariffs on pause for the goods that fall under the USMCA agreement. Yet, the high degree of uncertainty about what level of duties Canadian exporters will be facing in the months and years ahead is likely to weigh on the economy.

The problem for the BoC, however, is that it’s already slashed rates by a total of 225 bps, and more importantly, CPI readings have started to pick up again. With Canada imposing its own retaliatory tariffs on some US goods, inflation will probably rise further in the coming months.

Hence, investors will be watching Tuesday’s CPI report very closely, as there’s a reasonable chance the BoC may opt for another rate cut the following day.

If that turns out to be the case, the Canadian dollar might suffer a mild pullback against the US dollar.

The pound initially benefited from the dollar’s weakness but as the stock market selloff accelerated, the bulls ran out of steam and cable took a tumble. Aside from the risk-off sentiment and worries about the impact of tariffs on the UK economy, rising gilt yields have also been weighing on sterling as this would make it more difficult for Keir Starmer’s government to respond to an economic slowdown with looser fiscal policy.

The primary strain on sterling, however, is the expectation that the Bank of England will need to reduce rates more aggressively this year amid the worsening outlook. A 25-bps rate cut is 90% priced in for the May meeting, but those expectations could change next week if the incoming employment and CPI data fuel concerns about persisting inflation.

The headline rate of CPI fell more than forecast in February to 2.8% y/y and may ease further in March before edging up again. The CPI report is out on Wednesday, while ahead of that on Tuesday, the latest employment stats will come to the fore. In particular, wage growth will be key for the BoE decision.

Stronger-than-expected numbers could dampen rate cut bets, potentially giving the pound a leg up.

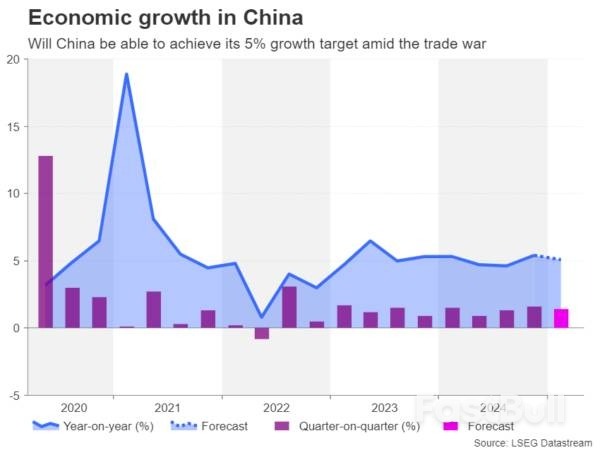

China will publish its latest GDP estimate on Wednesday as it refuses to give in to Trump’s demands for fairer trade treatment, escalating the war. The Chinese economy grew by 5.4% y/y in the fourth quarter of 2024 but is projected to have slowed to 5.1% in Q1.

Industrial production and retail sales numbers for March will also be released on the same day. The data is unlikely to spur much reaction even if there’s a significant surprise either to the downside or upside as investors will be more concerned about how China navigates itself through Trump’s trade storm.

With Chinese exports now being charged 125% levies and US goods facing similar tariffs, trade between the world’s two largest economies could shrink drastically in the coming months. The government may therefore choose to accompany the GDP press conference with a fresh stimulus announcement as it tries to boost domestic consumption to counter Trump’s tariffs.

The Australian dollar would be the biggest beneficiary from any significant stimulus update out of Beijing, as speculation grows about whether or not the Reserve Bank of Australia will cut rates at its next meeting on May 20. A 25-bps rate cut has become fully priced in following the spike in trade frictions and next week’s employment report, due on Thursday, may not necessarily change those bets much.

The New Zealand dollar has also endured quite a bit of volatility since Trump’s reciprocal tariffs were unveiled, as risk-sensitive currencies have been caught between the swings in equity markets, hopes of more stimulus by China, and expectations of steeper domestic rate cuts.

However, the focus for the kiwi on Thursday will be the quarterly CPI prints. The Reserve Bank of New Zealand just trimmed its cash rate to 3.5% and another 25-bps cut is almost fully baked in for the May meeting.

A hotter-than-expected CPI figure could dent those expectations slightly but probably not too significantly.

Staying in the region, Japan will also be publishing CPI numbers. Prior to the market turmoil, the Bank of Japan was expected to deliver nearly two rate increases in 2025. But the odds have now fallen to less than one hike. If the March CPI readings out on Friday show that inflation in Japan is not going to dissipate quickly, the yen could stretch its latest advance against the greenback.

Finally, retail sales figures will be the highlight in the United States where it’s going to be a relatively lighter agenda. Tariff headlines are bound to dominate, however, as the uncertainty sparked by Trump’s erratic decisions is making markets nervous even as he rows back on some of the measures.

Trump’s position on China is in particular focus as neither side appear to be easing up on their defiant stance.

Still, an upbeat retail sales report on Wednesday could lift sentiment on Wall Street and provide support to the US dollar by lessening the risk of a recession.

Retail sales are forecast to have risen by 1.3% m/m in March, compared to a 0.2% increase in the prior month.

Industrial production figures are also due on Wednesday. Other data will include the Empire State manufacturing index on Tuesday, as well as building permits, housing starts and the Philly Fed index on Thursday.

Most Western markets will be shut on Friday for the Easter celebrations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up