Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

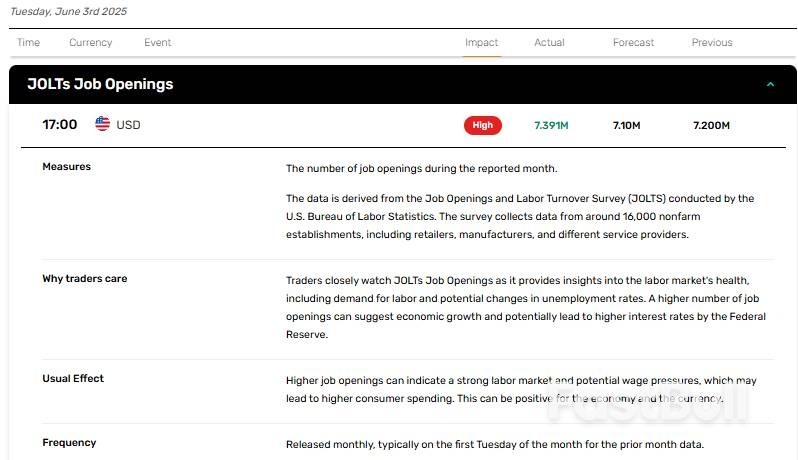

On June 3, 2025, the U.S. released JOLTs Job Openings report for April. The report indicated that JOLTs Job Openings increased from 7.20 million in March to 7.391 million in April, compared to analyst forecast of 7.10 million.

Key Points:

On June 3, 2025, the U.S. released JOLTs Job Openings report for April. The report indicated that JOLTs Job Openings increased from 7.20 million in March to 7.391 million in April, compared to analyst forecast of 7.10 million.

The report showed that the job market remained in decent shape in April despite tariff turmoil. Analysts expected that tariff uncertainty would put some pressure on the job market.

Today, traders also had a chance to take a look at the Factory Orders report for April. The report indicated that Factory Orders decreased by -3.7% on a month-over-month basis, compared to analyst forecast of -3%.

U.S. Dollar Index tested session highs after the release of the better-than-expected JOLTs Job Openings report. Currently, U.S. Dollar Index is trying to settle above the 99.30 level.

Gold markets tested session lows as traders focused on job market data. Stronger dollar and rising Treasury yields put pressure on precious metals. Profit-taking serves as an additional bearish catalyst for gold in today’s trading session.

SP500 made an attempt to settle above the 5940 level as traders reacted to the report. It remains to be seen whether job market data will provide sufficient support to stocks as traders are cautious after the strong rebound from April lows.

Bank of Japan Governor Kazuo Ueda said the country's economy can withstand the hit from U.S. tariffs and sustain a cycle of rising inflation accompanied by wage growth, signalling the bank's readiness to raise interest rates further.

Uncertainty over U.S. trade policy and the range oftariffsimposed by President Donald Trump's administration could hurt Japan's exports, prod firms to delay capital expenditure plans, and discourage them from raising wages, Ueda said on Tuesday.

While an agreement between the U.S. and China to scale back reciprocal tariff rates is perceived by markets as a positive development, uncertainty over the outlook remains high, he said.

"Recent tariff policies will exert downward pressure on Japan's economy through several different channels," Ueda said in a speech, warning that corporate and household sentiment is already worsening.

"That said, we expect that Japan's economy can withstand such downward pressure" as historically high corporate profits serve as a buffer, he said.

He also said Japan's tight labour market means the economy will likely sustain a trend in which wages and prices rise in tandem - a key prerequisite for further rate hikes.

While underlying consumer inflation will stagnate temporarily, there is no change to the BOJ's view that it will gradually rise toward its 2% target, Ueda said.

"Although developments in trade policies since early spring have had a larger impact on Japan's economy than we had expected, progress towards achieving our price target continues to gain momentum," he added.

Japan's economy contracted in the first quarter and export growth slowed in April, in an early sign of the toll steep U.S. tariffs could inflict on the fragile recovery.

The darkening economic outlook forced the BOJ to sharply cut its growth and inflation forecasts on May 1, and has complicated its decision around the timing of the next rate hike.

While slowing growth could weigh on inflation, consumer price data for April showed that companies continued to pass on rising costs for a wide range of goods, Ueda said.

"If trade negotiations between countries proceed and uncertainty over trade policies diminish, overseas economies will resume a moderate growth path. That, in turn, will accelerate Japan's economic growth," he said.

Ueda remained mum on the possible timing of the BOJ's next rate increase, saying that will depend on economic and price developments ahead.

South Korea woke on Wednesday to a new liberal president, Lee Jae-myung, who vowed to raise the country from the turmoil of a martial law crisis and revive an economy reeling from slowing growth and the threat of global protectionism.

Lee's decisive victory in Tuesday's snap election stands to usher in a sea change in Asia's fourth-largest economy, after backlash against a botched attempt at military rule brought down Yoon Suk Yeol just three years into his troubled presidency.

With 100% of the ballots counted, Lee had won 49.42% of the nearly 35 million votes cast while conservative rival Kim Moon-soo had taken 41.15% in the polls that brought the highest turnout for a presidential election since 1997, according to National Election Commission data.

The 61-year-old former human rights lawyer called Tuesday's election "judgment day" against Yoon's martial law and his People Power Party's failure to stop the ill-fated move.

"The first mission is to decisively overcome insurrection and to ensure there will never be another military coup with guns and swords turned against the people," Lee said in a victory speech outside parliament.

"We can overcome this temporary difficulty with the combined strength of our people, who have great capabilities," he said.

Lee was officially confirmed as president by the National Election Commission on Wednesday and immediately assumed the powers of the presidency and commander in chief.

An abbreviated inauguration is planned at parliament at 11 a.m. (0200 GMT), an Interior Ministry official said.

[1/2]Lee Jae-myung, the presidential candidate for South Korea's Democratic Party, waves as he leaves to meet his supporters, in Incheon, South Korea, June 3, 2025. REUTERS/Kim Soo-hyeon REFILE - CORRECTING INFORMATION Purchase Licensing Rights, opens new tab

A daunting slate of economic and social challenges await the new leader, including a society deeply scarred by divisions following the martial law attempt and an export-heavy economy reeling from unpredictable protectionist moves by the United States, a major trading partner and a security ally.

The government under a caretaker acting president had made little progress in trying to assuage crushing tariffs announced by U.S. President Donald Trump's administration that would hit some of the country's major industries, including autos and steel.

"President Lee will find himself with little to no time to spare before tackling the most important task of his early presidency: reaching a deal with Trump," the Washington-based Center for Strategic and International Studies said in an analysis.

The White House said the election of Lee was "free and fair" but the United States remained concerned and opposed to Chinese interference and influence in democracies around the world, according to a White House official.

The alliance between the U.S. and South Korea remains "ironclad," the official said.

Lee has expressed more conciliatory plans for ties with China and North Korea, in particular singling out the importance of China as a major trading partner while indicating reluctance to take a firm stance on security tension in the Taiwan strait.

Still, Lee has pledged to continue Yoon's engagement with Japan and said the alliance with the United States is the backbone of South Korea's global diplomacy.

The martial law decree and the six months of ensuing turmoil, which saw three different acting presidents and multiple criminal insurrection trials for Yoon and several top officials, marked a stunning political self-destruction for the former leader and a drag on an economy already slowing in growth.

Lee has pledged to boost investment in innovation and technology to fuel the country on another growth trajectory while increasing support for middle and low-income families.

Reporting by Joyce Lee, Ju-min Park, Daewoung Kim, Yeobin Park, Hyunsu Yim, and Ju-min ParkAdditional reporting by David Brunnstrom and Jeff Mason in WashingtonWriting by Jack Kim, Ed Davies, Josh SmithEditing by Sandra Maler

South Korean stocks and won gained, as Lee Jae-myung’s widely-expected win in the presidential election ended a months-long political leadership vacuum.

The nation’s stock benchmark Kospi jumped 1.5%. The won rose 0.3% against the dollar on Wednesday, extending its rally into a second trading session.

The election outcome removes one of the biggest overhangs impacting the local market — how the country proceeds politically after former President Yoon Suk Yeol’s brief imposition of martial law last year, which led to his ouster and Tuesday’s snap election.

Market focus now turns to Lee’s policies aimed at shoring up growth, centered on more government spending, improved corporate governance and stronger labor protections, as well as wrapping up ongoing tariff negotiations and currency talks with the Trump administration. Korea’s economy contracted in the first quarter, underscoring its weakness even before US President Donald Trump’s announcement of tariff hikes in early April.

Despite political uncertainties and a sluggish economy, Korean stocks and the won have shown resilience this year, outperforming most of their Asian peers. The won got support after Yoon was removed in April, and it’s one of Asia’s best performers.

“Clearly South Korea expects and hopes to put this chapter behind them, and global investors just are looking for more clarity,” Massimiliano Bondurri, SGMC Capital’s founder and chief executive, said in a Bloomberg TV interview Tuesday. “That’s why you’ve seen a strong rally up to now. And we think that could continue.”

READ: South Korea Elects Lee President, Capping Six Months of Chaos

Kospi has risen about 12% year-do-date before the election, reflecting investors’ scouring for value after it dipped into a bear market earlier this year on concerns over US tariffs. The gauge was strengthened by the rallies in industrial and energy sectors, including nuclear energy stocks, shipbuilders and arms exporters.

Financial stocks also contributed to Kospi’s surge in the run-up to the election on bets that corporate reform policies pledged by the candidates would bear fruit.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up