Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices and Japanese auto stocks surged following a landmark U.S.-Japan trade deal that reduces tariffs and signals stronger demand, but the optimism is tempered by regional growth downgrades from the Asian Development Bank...

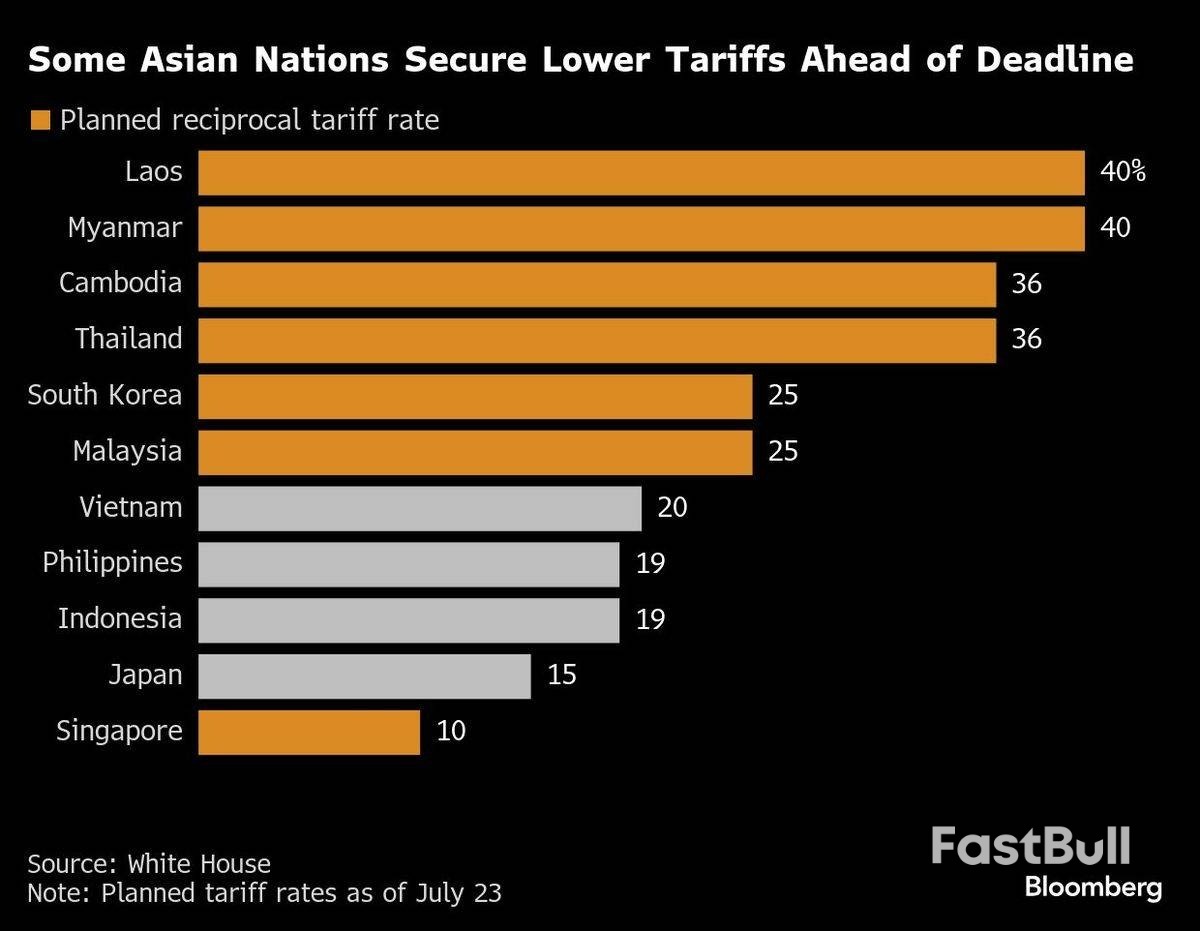

After months of uncertainty, President Donald Trump’s latest tariff deals are providing clarity on the broad contours of a new trade landscape for the world’s biggest manufacturing region.

Trump on Tuesday announced a deal with Japan that sets tariffs on the nation’s imports at 15%, including for autos — by far the biggest component of the trade deficit between the countries.

A separate agreement with the Philippines set a 19% rate, the same level as Indonesia agreed and a percentage point below Vietnam’s 20% baseline level, signalling that the bulk of Southeast Asia is likely to get a similar rate.

“We live in a new normal where 10% is the new zero and so 15% and 20% doesn’t seem so bad if everyone else got it,” said Trinh Nguyen, senior economist for emerging Asia at Natixis. At a 15%-20% tariff level, it’s still profitable for US companies to import from abroad rather than produce similar goods at home, she said.

Meantime, US Treasury Secretary Scott Bessent said he’ll meet his Chinese counterparts in Stockholm next week for their third round of talks aimed at extending a tariff truce and widening the discussions. That suggests a continuing stabilisation in ties between the world’s two largest economies after the US recently eased chip curbs and China resumed rare earths exports.

“We’re getting along with China very well,” Trump told reporters on Tuesday. “We have a very good relationship.”

Throw it all together and a level of predictability is finally emerging after six months of tariff threats that had at one point jacked up tariff levels to 145% on China and near 50% on some smaller Asian exporters. Investors cheered the moves, with Asian shares rising the most in a month and contracts for the S&P 500 up 0.2%. The Nikkei-225 index in Japan jumped 3.2%, with Toyota Motor Corp. and other carmakers leading the gains.

“What’s been interesting to me is that equity markets still have been fairly rosy about the changes,” Albert Park, chief economist at the Asian Development Bank, said in a Bloomberg Television interview. “I’m not sure they’ve priced in fully all of the effects that are likely to occur from the disruption of higher tariff rates.”

Back in April, Trump hit the pause button on the steepest levies after a rare combination of weakening US stocks, bonds and the dollar showed investors were unnerved by his protectionist salvos. That bought time for policymakers from Tokyo, Manila and across the globe to negotiate more palatable deals.

Although the latest deals bring some relief, key questions remain. The Trump administration is still considering a range of sectoral tariffs on goods like semiconductors and pharmaceuticals that will be critical for Asian economies including Taiwan and India — both of which have yet to announce tariff agreements with the US.

South Korea is also more exposed to sectoral tariffs, even though the Japan deal provides a potential template for new President Lee Jae Myung.

As Trump moves quickly on talks with countries accounting for the bulk of the US trade deficit, he has said he may hit around 150 smaller countries with a blanket rate of between 10% and 15%.

With some certainty on tariff levels now emerging, businesses with complex supply chains across Asia and still reliant of the US consumer can start to game out how they’ll shift operations to minimise the hit to sales.

Just like the first trade war in 2018, the latest tariff announcements are likely to spur companies to increasingly shift production outside of China. The average tariff rate on the world’s second-largest economy remains the highest in the region, and continued White House pressure on the nation’s technology and trade ambitions means companies may find more stability elsewhere.

Companies and industry groups have been flagging for months that uncertainty is worse than tariffs for investment. The manufacturing sector across the Asean region saw the most notable weakening since August 2021, according to S&P PMI, led by a sharper decrease in new orders, major job cuts and weaker purchasing activity.

The front-loading of shipments from Asia to the US to get ahead of the incoming levies will likely slow once the new rates kick in. While there’s relief that tariff rates for Southeast Asian economies and 15% for Japan are lower than some of Trump’s earlier threats, the reality is that they’re far higher than they were before he took office.

The latest deals “continue the trend of tariff rates gravitating towards the 15-20% range that President Trump recently indicated to be his preferred level for the blanket rate instead of 10% currently,” Barclays plc analysts including Brian Tan wrote in a note. That skews risks to GDP growth forecasts for Asia “to the downside,” they wrote.

For US consumers who have so far been spared the tariff ticket shock, economists warn there’s likely to be some pass through in the months ahead. Goldman Sachs Group Inc economists now expect the US baseline “reciprocal” tariff rate will rise from 10% to 15% — an outcome that threatens to fuel inflation and weigh on economic growth.

Federal Reserve Chair Jerome Powell has argued he wants to see where tariffs land and how they filter through the economy before cutting interest rates — much to the annoyance of Trump.

For now, the US president is hailing a win on trade, and investors seem overall relieved.

“I just signed the largest trade deal in history — I think maybe the largest deal in history — with Japan,” Trump said at an event at the White House on Tuesday after announcing the deal on social media. “It’s a great deal for everybody.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up