Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Ethereum Drops Out Of Global Top 50 Asset Market Cap Ranking, Now 56Th] January 31, According To 8Marketcap Data, After A 14.43% Cumulative Decline In 7 Days, Ethereum'S Current Market Cap Is $305.6 Billion, Falling Out Of The Top 50 Global Asset Market Cap Ranking, Currently Ranked 56Th

[Ethereum Plunges Below $2600, 24-Hour Loss Extends To 4.9%] January 31, According To Htx Market Data, Ethereum Dropped Below $2600, With A 24-Hour Decline Widening To 4.9%

[Melania Trump's Documentary Released, Costing Over 500 Million Yuan, Fails At Global Box Office, Receives 1.7 Rating] According To Xinhua News Agency, The Documentary "Melania: 20 Days To History" (hereinafter Referred To As "Melania"), Featuring First Lady Melania Trump, Was Released In Theaters Worldwide On January 30th, But Has Been Met With A Lukewarm Reception In Many Countries. Multiple International Media Outlets Reported That Ticket Sales In Theaters In The UK, Canada, And Even The US Have Been Dismal, With Some Screenings Almost Entirely Empty. On Rotten Tomatoes, A Globally Renowned Film And Television Rating Website, The Film Received A Low Score Of 1.7. The Film's Production And Promotion Costs Reached A Staggering $75 Million (approximately 521 Million Yuan, Similar To The Rumored Cost Of "Ne Zha 2"), Drawing Criticism For Amazon Founder Jeff Bezos's Massive Investment

Four Killed In Gas Explosion At Residential Building In Iran's Ahvaz - Iran's State-Run Tehran Times

IAEA: Chornobyl Site Briefly Lost All Off-Site Power. Ukraine Working To Stabilize Grid And Restore Output, No Direct Impact On Nuclear Safety Expected

IAEA: Ukrainian Npps Temporarily Reduced Output This Morning After Technological Grid Issue Affected Power Lines

Tigrayan Official And Humanitarian Worker: One Person Killed, Another Injured In Drone Strikes In Ethiopia's Tigray Region

Explosion In Iran's Southern Port Of Bandar Abbas , Iranian Media Denies Report Commander Of Revolutionary Guards Targeted

[Epstein Documents Continue To Be Released, Involving Multiple US Political And Business Figures] The US Department Of Justice Announced On January 30 That It Would Release The Remaining Documents, Totaling Over 3 Million Pages, Related To The Case Of The Late Billionaire Jeffrey Epstein. According To US Media Reports, The Documents Reveal That Numerous Prominent US Political And Business Figures Knew And Associated With The Businessman, Who Was Suspected Of Sex Crimes And Died Mysteriously In Prison. These Include Commerce Secretary Howard Lutnick, Entrepreneur Elon Musk, And Stephen Bannon, An Advisor During Trump's First Presidential Term

Moldova's Government: Problems In Ukraine's Power Grid Led To Moldova's Energy System Emergency Shutdown

[Bitcoin Falls Below $83,000, 24-Hour Gain Narrows To 0.53%] January 31, According To Htx Market Data, Bitcoin Fell Below $83,000, With A 24-Hour Growth Narrowing To 0.53%

[Canada Plans To Establish Defense Bank With Multiple Countries] Canadian Finance Minister François-Philippe Champagne Said On January 30 That Canada Will Work Closely With International Partners In The Coming Months To Establish A Defense Bank To Raise Funds For Maintaining Collective Security. Champagne Posted On Social Media Platform X That Day That More Than 10 Countries, Under Canada's Auspices, Discussed The Establishment Of A "Defense, Security And Reconstruction Bank." He Did Not Specify Which Countries Were Involved In The Discussions. According To Reuters, Supporters Hope The Proposed Defense Bank Will Be A Global Nation-support Institution With A AAA Credit Rating, Raising $135 Billion For Defense Projects In Europe And NATO Member States

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan's manufacturing sector activity fell at the fastest pace in six months in September, driven by further declines in new orders, a private sector survey showed on Wednesday.

Japan's manufacturing sector activity fell at the fastest pace in six months in September, driven by further declines in new orders, a private sector survey showed on Wednesday.

The S&P Global flash Japan Manufacturing Purchasing Managers' Index (PMI) dropped to 48.4 in September from 49.7 in August, further below the 50.0 threshold that separates growth from contraction to the lowest reading since March.

The data showed the manufacturing output index also falling to the lowest in six months, while the index for new orders hit a five-month low.

The decline in new orders was linked by some firms to cautious inventory policies amid challenging market conditions, contributing to a fall in production. The decline in export orders, however, eased from August's 17-month low.

The broader outlook for Japan's export-reliant economy remains uncertain due to U.S. tariffs and an expected central bank rate hike.

Meanwhile, cost pressures for manufacturers abated somewhat. Input price inflation has eased to levels not seen since early 2021, although output inflation accelerated from August.

The services PMI in contrast was a bit more upbeat, at 53.0 in September, only slightly down from August's 53.1, having remained in expansionary territory for six months.

"The surveys suggest that the service sector remains a key growth engine, and saw a further solid increase in activity, which helped to offset a deepening reduction in manufacturing production," said Annabel Fiddes, economics associate director at S&P Global Market Intelligence.

The services sector has benefited from robust domestic demand, even though it faced challenges from declining export orders. Employment in the services sector also saw a slight rise, helping offset manufacturing jobs, which in September shrank for the first time since November last year.

The composite PMI, which combines both manufacturing and services, decreased to 51.1 in September from August's six-month high of 52.0, marking the slowest growth in overall business activity since May.

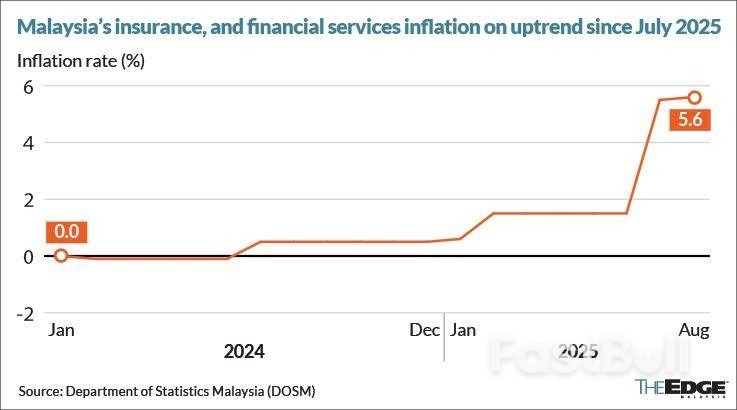

Malaysia’s insurance and financial services inflation is expected to remain on an upward trajectory in the coming months, economists said, following sharp increases in July and August driven by higher hospital benefits and motor insurance premiums.The inflation for the insurance and financial services group rose 5.5% in July and 5.6% in August, the Department of Statistics Malaysia reported on Tuesday. Before that, the segment’s inflation rate held steady at 1.5% between February and June, after registering 0.6% in January.

“Judging from the breakdown within insurance and financial services which accounted for 2.7% of the consumer price index (CPI), the health insurance sub-index (1.3% of the total CPI) jumped 14.7% year-on-year over two consecutive months. Rising medical insurance premiums were the main driver,” said Bank Muamalat Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid.Asked if medical insurance premiums would continue climbing, he said: “It seems that way if the government’s intervention (to curb the rising medical costs) takes a while.

“Ideally, the intervention has to be accelerated,” he told The Edge.

Similarly, UOB Malaysia senior economist Julia Goh and TA Securities economist Farid Burhanuddin do not expect medical and motor premiums to come down anytime soon.

However, Goh noted that upcoming measures — including the basic medical and health insurance/takaful (MHIT) product, slated for roll-out in the second quarter of next year, and the diagnosis-related groups (DRG) payment model in 2027 — could help moderate the pace of increases in the inflation rate of insurance and financial services.

“Hopefully the new measures (such as MHIT and DRG) can help keep the rise in check. Maybe we should also watch for announcements in Budget 2026,” Goh added.To rein in higher medical costs, the government is rolling out its Reset strategy, which includes introducing a basic MHIT product, mandating price transparency, enhancing interoperability of electronic medical records, setting up Rakan KKM private wings in public hospitals, and adopting a DRG payment model.According to a joint Bank Negara Malaysia (BNM) and Health Ministry presentation at a media workshop in August, MHIT is slated to be launched in the second quarter of 2026. Meanwhile, the DRG — a fixed-fee, diagnosis-based hospital payment model — is targeted for 2027.

The government originally sought to implement the DRG by mid-2025, but Deputy Health Minister Datuk Lukanisman Awang Sauni told Parliament last month that more time was needed to build the system, finalise cost models, integrate hospital data and run pilot tests.Malaysia’s medical inflation jumped to 15% in 2024 — above the Asia-Pacific average of 10% — compared with 12.6% in 2023 and 10% in 2022.In response, BNM, which regulates insurers, announced interim measures in December last year. These include spreading premium increases over at least three years, pausing adjustments for policyholders aged 60 and above, and allowing reinstatement of lapsed policies without additional underwriting.

ASEAN’s clean energy boom is taking shape. But without coordination, the region risks being locked into low-value roles in the green economy. China has emerged as ASEAN’s largest clean energy financier and now dominates regional electric vehicle and battery markets. Yet beneath the investment momentum, policies, standards, skills development and knowledge transfer remain fragmented. A China–ASEAN clean energy–industrial mechanismcould fill this gap.

Across the region, operations such as nickel processing in Indonesia and mining in the Philippines have drawn criticism for unsafe labour conditions, community displacement and habitat loss. US tariffs of up to 3500 per cent on ASEAN solar exports imposed in April 2025 exposed how fragile regional supply chains are. Without a framework to align industrial policy, workforce upgrading and environmental safeguards, Southeast Asia risks remaining a low-cost assembly hub, dependent on external capital but unable to shape the rules of the energy transition.

For Beijing, deeper clean energy engagement with ASEAN aligns with strategic priorities such as diversifying export markets, embedding outbound manufacturing in emerging industrial hubs and locking in supply chains for critical minerals and green technologies. For ASEAN, China offers capital, technology, and scale.ASEAN already has platforms such as the ASEAN-China Clean Energy Cooperation Centre and the ASEAN+3 Clean Energy Roundtable Dialogue, but they lack the mandate and focus to align investment, industrial upgrading and governance on a regional scale. What is missing is a dedicated mechanism to link clean energy cooperation with industrial policy — one that embeds environmental, social, and governance (ESG) safeguards from the outset.

A China–ASEAN clean energy–industrial mechanism could anchor cooperation in labour and skills development. The mechanism could convene thematic working groups, support regional training hubs and co-design curricula with industry and academia to match labour upgrading with institutional commitment to build a capable workforce with structured training programs.

The mechanism could bridge the disconnect between capital and capacity. While investment is pouring into electric vehicles and renewable projects, enabling environments remain uneven. Drawing on models such as Singapore’s FAST-P and Indonesia’s Danantara, the mechanism could link Chinese policy banks, ASEAN state-owned enterprises and global financiers to develop ESG-anchored green industrial zones that pair infrastructure with manufacturing. A curated pipeline of bankable regional projects would turn capital inflows into strategic industrial capacity.The mechanism can also create the institutional alignment required to move from one-off projects to enduring partnerships. Clean energy capacity alone does not guarantee resilience — trust and transparency require policy coordination and governance capability. The mechanism could host Track 1.5 dialogues, enabling joint procurement reforms, decarbonisation case studies and ESG compliance workshops.

Verifiable sustainability safeguards must be continuous and enforceable, not just contractual at project outset. Improving ASEAN’s environmental record will require Chinese corporates to adopt higher operational standards, ASEAN ministries to embed clear ESG regulations and local authorities to enforce them consistently — with the mechanism serving as the channel to align and monitor these efforts.

Initial participation could focus on ASEAN members with significant clean energy and industrial cooperation with China, such as Indonesia, Vietnam and Malaysia, before expanding as political and market conditions allow. A smaller coalition of willing states sidesteps ASEAN consensus paralysis and gives proof of concept.But it would need a clear ministerial mandate spanning industry, labour and environment portfolios. The mechanism could be co-chaired by a standing Chinese lead ministry and a rotating ASEAN co-chair aligned with the ASEAN Chair, ensuring continuity on China’s side and regional ownership on ASEAN’s.

Private businesses’ roles would go beyond consultation. As conveners, firms could commit capital and expertise to joint research and development, ESG compliance and local partnerships on supply chains, helping translate government frameworks into tangible industry practice and durable benefits.For ASEAN, such a mechanism would operationalise centrality by aligning national strategies with regional goals and enabling coherent engagement with external partners. For China, it would provide a structured channel to address ESG concerns, reduce friction and ensure investments generate long-term goodwill and influence.

While the mechanism centres on China given its economic gravity, it would not operate in isolation. Japan and South Korea remain important partners whose engagement could be channelled through the existing roundtable dialogues. This would allow the mechanism to remain focused on aligning cooperation with China, while still complementing and reinforcing wider regional partnerships.

Left uncoordinated, Southeast Asia’s clean energy transition will continue in fragmented steps, leaving much of the value captured elsewhere. ASEAN must balance multiple partners, but China’s weight makes a dedicated mechanism necessary. The growing costs of fragmented bilateralism — from tariff shocks to nickel disputes — only strengthen the case for a structured channel, making pragmatic cooperation less a choice than a necessity.Such a mechanism would not erase the political frictions that have long hampered bilateral cooperation. But by starting with a smaller group of willing states and keeping its design lean and industry-facing, it offers a more credible path than past talk shops. Its durability will rest not on declarations, but on its ability to deliver tangible projects that serve both ASEAN and China’s climate and development needs in a turbulent global economy.

Key points:

A rash of suicides at New Mexico's Rio Grande Gorge Bridge forced authorities to close the span to pedestrians on Monday, as officials look for a way to install fencing or nets to stop people from taking their own lives at the landmark.Three people have jumped off the span to their deaths in the past three weeks, authorities said, contributing to a record number of deaths at the bridge so far this year.Taos County Sheriff's Office announced the indefinite closure after deputies descended into the 600-foot-deep (183-meter) gorge on Sunday to recover the remains of a local 15-year-old boy, the sixth person to die by suicide at the bridge in 2025.

On September 5, a 60-year-old U.S. Army veteran suffering from post-traumatic stress disorder drove 15 hours from San Antonio, Texas, to take his life at the bridge, the sheriff's office reported.Three days earlier, sheriff's deputies closed the bridge to recover the remains of a man from Albuquerque, New Mexico.The 1,280-foot (390-meter) steel-arch bridge five miles northwest of Taos has featured in movies and ads since its construction 50 years ago. It not only attracts tourists from across the world but has become a destination for people who wish to end their lives. The 600-foot fall is not survivable.

"The closure of the bridge to pedestrian traffic is a start," Sheriff Steve Miera said in a text message, adding that bridge suicides this year were at a record level. He said the bridge would reopen to pedestrians once the state can install effective barriers to prevent suicides.

Suicide prevention campaigner Ashley Roessler said safety barriers had to go up to replace an existing railing that is four feet (1.2 m) high and simple to climb over."We're making it too damn easy for people to kill themselves," said Roessler, founder of the New Mexico Fight for Life Foundation. "If you can just jolt someone, or make it harder, maybe that kid wouldn't have killed himself."Other bridges and buildings in the United States where suicides are common have put up nets or barriers.

A net along both sides of the Golden Gate Bridge in San Francisco reduced suicides by 73% in 2024 during its first year, cutting the number of deaths to eight from an average 30 a year, according to authorities.Suicides at the Sunshine Skyway Bridge in Tampa, Florida, have dropped to an average of three per year from 12 to 15 after an 11-foot-tall vertical net was installed in 2021.Crisis call boxes have been installed along the Rio Grande Gorge Bridge, and they were upgraded earlier this year, the New Mexico Department of Transportation said in its statement.

A 2018 study of the bridge determined the structure would have to be reinforced to support the weight of nets and fencing, according to press reports.New Mexico Transportation Secretary Rick Serna said he was working with the consultant on the 2018 study to get an updated evaluation. Until then, the number of security guards at the bridge has been increased to three from two, his department said in a statement.

Bank of Canada Governor Tiff Macklem suggested the US dollar’s status as a “global safe asset” may be hurt by President Donald Trump’s trade policies.

In a speech Tuesday, Macklem said global investors are considering whether US dominance in global financial flows will ebb as the Trump administration pulls back from global trade.

“President Trump’s ‘Liberation Day’ shook global confidence,” Macklem said.

Typically, investors would have expected tariffs to support the US currency, but the greenback instead has depreciated while the price of gold has risen, Macklem said. With the dollar weakened by about 10% against other major currencies since the start of the year, its “safe haven role was called into question,” he said.

“It’s too early to know if this is the start of a new era,” Macklem said. While the greenback will likely remain the global reserve currency for the foreseeable future, he said, “for many, its value as a hedge in times of stress has been dented.”

UNITED NATIONS, Sept 23 (Reuters) - U.S. President Donald Trump said on Tuesday he believed Kyiv could retake all its occupied lands and that Ukraine should act now with Russia facing "big" economic problems, remarks that Ukraine's Volodymyr Zelenskiy hailed as a "big shift".

But it was unclear if Trump's words would be matched by a major change in U.S. policy, such as a decision to impose heavy new sanctions on Moscow. Trump has previously suggested Ukraine give up territory in order to make peace.

"Putin and Russia are in BIG Economic trouble, and this is the time for Ukraine to act," Trump wrote on Truth Social, shortly after he met Ukraine's leader on the sidelines of the United Nations General Assembly.

"After seeing the Economic trouble (the war) is causing Russia, I think Ukraine, with the support of the European Union, is in a position to fight and WIN all of Ukraine back in its original form," he said, describing Russia as a "paper tiger".

Trump's tone contrasted greatly with his red-carpet treatment for Russian President Vladimir Putin at a summit in Alaska last month, part of an ostensible push to expedite an end to Russia's war in Ukraine.

Zelenskiy has been urging the United States to ramp up sanctions pressure on Russia to coerce it into entering negotiations to end the war launched in February 2022, a call he repeated at the United Nations.

Ukraine's President Volodymyr Zelenskiy arrives to attend the 80th United Nations General Assembly, in New York City, New York, U.S., September 23, 2025. REUTERS/Kylie Cooper

The Ukrainian leader told reporters after his meeting with Trump that it had been "good, constructive," but declined to go into detail about much of the substance of their conversation.

Zelenskiy said on Tuesday they had discussed Russia's stuttering economy and that "there was an understanding" that Trump would be ready to provide security guarantees to Ukraine when the war is over.

He said that Trump had the influence and power to be a "game-changer" for Ukraine in the war, noting also that China retained influence over Russia.

The only firm commitment from Trump in his post was for the United States to "continue to supply weapons to NATO for NATO to do what they want with them," an apparent reference to a new mechanism allowing Europe to buy U.S. weapons for Ukraine.

Speaking to reporters, Russia's Deputy U.N. Ambassador Dmitry Polyanskiy cast skepticism on Trump's message.

"Don't get so excited about every tweet," said Polyanskiy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up