Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

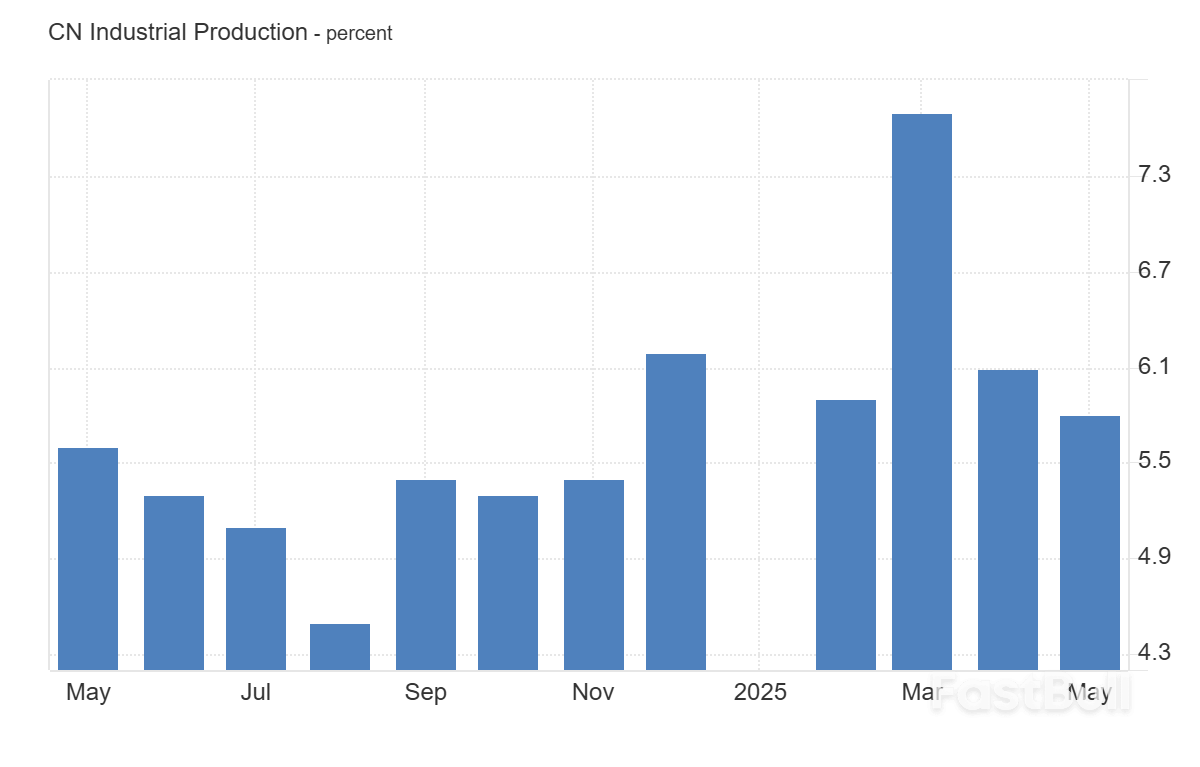

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tehran is signaling it wants to deescalate hostilities with Israel and is willing to resume nuclear talks with the US as long as Washington doesn't join the Israeli attacks, the Wall Street Journal reported.

Israel and Iran exchanged fire for the fourth consecutive day on Monday, stoking fears of an all-out war with the potential to drag in others in the oil-rich region and force the US into a more hands-on stance.

Iran fired several waves of drones and missiles over the last 24 hours, while Israel continued hitting the Islamic Republic’s capital, Tehran, and killing one more senior military official.

Since Friday, 224 people have been killed in Iran, according to the government, which said most of the casualties were civilians. Iranian attacks killed 24 people in Israel, according to the Israeli government press office, and injured 592.

Tehran is signaling it wants to deescalate hostilities with Israel and is willing to resume nuclear talks with the US as long as Washington doesn’t join the Israeli attacks, the Wall Street Journal reported Monday citing Middle Eastern and European officials it didn’t identify. A similar report by Reuters says Iran conveyed the message through Qatar, Saudi Arabia and Oman.

Oil fell on the WSJ report, with Brent futures dropping around 4 percent - they rose over 10 percent Friday. US Treasuries pared earlier drops and European bonds gained as traders reacted to diminishing concerns about inflation.

It’s not clear whether Israel would agree to stop missile strikes. Israeli officials have said they want to ensure Iran doesn’t have the capacity to build a nuclear weapon.

The exchange of missile salvos between Israel and Iran is the most serious escalation after years of shadow war. Analysts fear it might push the Middle East into a regional conflict, causing wider human loss and potentially disrupting energy flows and vital trade routes.

One missile landed near the US consulate in central Tel Aviv, causing minor material damages but no injuries to personnel, the ambassador to Israel, Mike Huckabee, said Monday. Many cars were crushed and buildings damaged in the area of the city where the strike happened.

For Iran’s government, the showdown poses an existential dilemma. It can’t risk appearing weak, yet its options are shrinking. Proxy forces across the region, which regularly rallied to its support in the past, have been debilitated by Israeli action over the past 20 months. Hezbollah, the Lebanese militia the US and others designate as a terrorist group, is noticeably absent from the conflict and hasn’t signaled it will start attacks on Israel.

Tensions between the arch-enemies erupted into full-blown conflict on Friday, when Israel attacked Iranian military and nuclear sites, and killed several top generals and atomic scientists. Since then, it has achieved air superiority over large parts of Iran, including Tehran, and degraded the ability of the Islamic Republic to defend against its strikes.

Iran has countered by firing drones and ballistic missiles at the Jewish state. Israel believes Iran still has thousands of missiles left, according to National Security Adviser Tzachi Hanegbi, who spoke in an interview with the Army Radio.

US President Donald Trump has sent contradicting signals since the onset of the Israeli attacks. He first urged Iran to reach a nuclear deal and, on Sunday, added it and Israel “should make a deal, and will make a deal.”

“We will have PEACE, soon, between Israel and Iran!” he said on Truth Social. “Many calls and meetings now taking place.”

Yet, shortly after, he also said “but sometimes they have to fight it out.”

Market sentiment at the start of the week was already less bearish before the WSJ report, with analysts betting attacks would subside in the near term.

“The market currently anticipates a limited conflict, though there is little indication that hostilities will end quickly,” said Jochen Stanzl, chief market analyst at CMC Markets.

The potential for disruption of key shipping routes if strikes continue will give policymakers trying to forecast risks to inflation pause. Navigation signals from hundreds of vessels in the Strait of Hormuz and the Persian Gulf went awry over the weekend, forcing seafarers to rely on less precise mechanisms which increase the risk of collisions.

Iran reported an explosion at one of its natural gas plants linked to the giant South Pars field on Saturday. While the country exports little gas and Israel appears not to have targeted its oil fields or crude-shipment facilities, the move risks pushing up global energy prices - which soared on Friday - even more.

The United Nations atomic watchdog convened an emergency meeting to assess Israel’s attacks on Iranian nuclear facilities and disrupted monitoring of the Islamic Republic’s stockpile of near-bomb grade uranium. The International Atomic Energy Agency’s board meets Monday in Vienna, just days after a divisive vote found Iran in non-compliance with its legal obligations.

The IAEA said multiple strikes on Iran’s uranium-conversion facility at Isfahan, south of Tehran, resulted in serious damage.

Iran’s deputy foreign minister, Kazem Gharibabadi, told state television that “we will no longer cooperate with the agency as we did before.”

According to Iran’s Fars news service, a key parliamentary committee said Tehran should no longer adhere to the nuclear Non-Proliferation Treaty, the bedrock arms-control agreement that compels signatories to accept inspections. For now, it’s unclear if the government will take such steps.

Arch-enemies Israel and Iran have long maintained simmering animosity. The Jewish state’s been accused of cyberattacks and assassinating Iranian scientists, while Tehran’s funded anti-Israel militias in the Middle East.

Those tensions soared after Hamas, a Palestinian group backed by Iran, attacked Israel on Oct. 7, 2023. That led to Israel and Iran firing missiles and drones on each other twice last year.

Still, this is their most serious conflict yet. Since the fighting began, Israel struck Iran’s nuclear and military sites using jets and drones, and killed several top commanders and atomic scientists.

Several waves of strikes in Iran were conducted overnight, targeting approximately 100 military targets, according to the Israeli Defense Forces spokesperson. He added one third of Iran’s missile launchers have been destroyed.

Israel said it was aiming to end Iran’s ability to build a nuclear bomb, which it sees as an existential threat. Tehran maintains its atomic program has purely civilian purposes.

Trump is set to meet other leaders of the Group of Seven major economies in Canada and the conflict will be at the forefront of their talks. Israel is calling on Washington and European nations to help it attack Iran, arguing that such help is needed to stop Tehran from developing a nuclear weapon.

While the US has helped defend Israel by intercepting missiles and drones, Trump has not yet indicated if the US will join in the strikes on Iran.

For all that Israel’s already damaged Iranian atomic sites and says it will continue to strike them. Several Western analysts say it needs US help to destroy some key facilities located deep underground.

KANANASKIS, Alberta, June 16 (Reuters) - Leaders from the Group of Seven nations began annual talks on Monday with wars in Ukraine and the Middle East adding to global economic uncertainty, as host Canada tries to avoid a clash with U.S. President Donald Trump.

The G7 leaders from Britain, Canada, France, Germany, Italy, Japan and the U.S., along with the European Union, are convening in the resort area of Kananaskis in the Canadian Rockies until Tuesday.

With an escalating Israel-Iran conflict, the summit in Canada is seen as a vital moment to try and restore a semblance of unity among democratic powerhouses.

Canada has abandoned any effort to adopt a comprehensive communique to avert a repeat of a 2018 summit in Quebec, when Trump instructed the U.S. delegation to withdraw its approval of the final communique after leaving.

Leaders have prepared several draft documents seen by Reuters, including one calling for de-escalation of the Israel-Iran conflict and other statements on migration, artificial intelligence and critical mineral supply chains. None of them have been approved by the United States, however, according to sources briefed on the documents.

"I do think there's a consensus for de-escalation. Obviously, what we need to do today is to bring that together and to be clear about how it is to be brought about," British Prime Minister Keir Starmer told reporters.

The first five months of Trump's second term upended foreign policy on Ukraine, raised anxiety over his closer ties to Russia and resulted in tariffs on U.S. allies.

Talks on Monday will centre around the economy, advancing trade deals, and China.

Efforts to reach an agreement to lower the G7 price cap on Russian oil even if Trump decided to opt out have been complicated by a temporary surge in oil prices since Israel launched strikes on Iran on June 12, two diplomatic sources said. Oil prices fell on Monday on reports Iran was seeking a truce.

The escalation between the two regional foes is high on the agenda, with diplomatic sources saying they hope to urge restraint and a return to diplomacy.

"We are united. Nobody wants to see Iran get a nuclear weapon and everyone wants discussions and negotiations to restart," France's President Emmanuel Macron told reporters in Greenland on Sunday before travelling to Canada.

He added that given Israel's dependence on U.S. weapons and munitions, Washington had the capacity to restart negotiations.

Trump said on Sunday many calls and meetings were taking place to broker peace.

Highlighting the unease among some of Washington's allies, Trump spoke on Saturday with Russian President Vladimir Putin and suggested the Russian leader could play a mediation role between Israel and Iran.

Macron dismissed the idea, arguing that Moscow could not be a negotiator because it had started an illegal war against Ukraine.

A European diplomat said Trump's suggestion showed that Russia, despite being kicked out of the group in 2014 after annexing Crimea, was very much on U.S. minds.

"In the eyes of the U.S., there's no condemnation for Ukraine; no peace without Russia; and now even credit for its mediation role with Iran. For Europeans, this will be a really tough G7," the diplomat said.

Ukraine's President Volodymyr Zelenskiy and NATO Secretary General Mark Rutte will attend the summit on Tuesday. European officials said they hoped to use the meeting, and next week's NATO summit, to convince Trump to toughen his stance on Putin.

"The G7 should have the objective for us to converge again, for Ukraine to get a ceasefire to lead to a robust and lasting peace, and in my view it's a question of seeing whether President Trump is ready to put forward much tougher sanctions on Russia," Macron said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up