Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Retail Sales (Oct)

Japan Retail Sales (Oct)A:--

F: --

P: --

Japan Retail Sales YoY (Oct)

Japan Retail Sales YoY (Oct)A:--

F: --

Japan Industrial Inventory MoM (Oct)

Japan Industrial Inventory MoM (Oct)A:--

F: --

P: --

Japan New Housing Starts YoY (Oct)

Japan New Housing Starts YoY (Oct)A:--

F: --

P: --

Japan Construction Orders YoY (Oct)

Japan Construction Orders YoY (Oct)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Oct)

Germany Actual Retail Sales MoM (Oct)A:--

F: --

France PPI MoM (Oct)

France PPI MoM (Oct)A:--

F: --

Germany Unemployment Rate (SA) (Nov)

Germany Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada GDP MoM (SA) (Sept)

Canada GDP MoM (SA) (Sept)A:--

F: --

Canada GDP YoY (Sept)

Canada GDP YoY (Sept)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Nov)

China, Mainland NBS Manufacturing PMI (Nov)A:--

F: --

P: --

China, Mainland Composite PMI (Nov)

China, Mainland Composite PMI (Nov)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Nov)

China, Mainland NBS Non-manufacturing PMI (Nov)A:--

F: --

P: --

South Korea Trade Balance Prelim (Nov)

South Korea Trade Balance Prelim (Nov)A:--

F: --

South Korea IHS Markit Manufacturing PMI (SA) (Nov)

South Korea IHS Markit Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

BOJ Gov Ueda Speaks

BOJ Gov Ueda Speaks China, Mainland Caixin Manufacturing PMI (SA) (Nov)

China, Mainland Caixin Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Nov)

India HSBC Manufacturing PMI Final (Nov)A:--

F: --

P: --

Italy Manufacturing PMI (SA) (Nov)

Italy Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.K. Mortgage Lending (Oct)

U.K. Mortgage Lending (Oct)A:--

F: --

U.K. M4 Money Supply YoY (Oct)

U.K. M4 Money Supply YoY (Oct)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Oct)

U.K. M4 Money Supply MoM (Oct)A:--

F: --

P: --

U.K. Mortgage Approvals (Oct)

U.K. Mortgage Approvals (Oct)A:--

F: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Nov)

Canada Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.S. ISM Inventories Index (Nov)

U.S. ISM Inventories Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Nov)

U.S. ISM Manufacturing New Orders Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Nov)

U.S. ISM Manufacturing Employment Index (Nov)A:--

F: --

P: --

U.S. ISM Output Index (Nov)

U.S. ISM Output Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Nov)

U.S. ISM Manufacturing PMI (Nov)A:--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Iran is set to propose a framework agreement in its ongoing nuclear discussions with the United States, according...

Iran is set to propose a framework agreement in its ongoing nuclear discussions with the United States, according to a senior official. This raises the possibility of an interim agreement, which could pave the way for more comprehensive negotiations in the future.

The Deputy Foreign Minister of Iran, Majid Takht-Ravanchi, announced this development during an interview with the state-run Islamic Republic News Agency on Tuesday. He revealed that Tehran is preparing a fresh proposal concerning its nuclear activities. This proposal will be presented during the sixth round of talks with Washington, scheduled to take place in Oman on Sunday.

Takht-Ravanchi explained that the current proposal doesn’t consist of a lengthy text, as they aim to avoid presenting a comprehensive and extensive agreement or memorandum that could be challenging and time-consuming to prepare. He added that if an agreement is reached on this proposed framework, more detailed discussions about its specifics will commence.

While gold prices remain heated and volatile at the top, its precious counterparts—silver and platinum—are attracting bullish interest and surging toward multi-year highs.

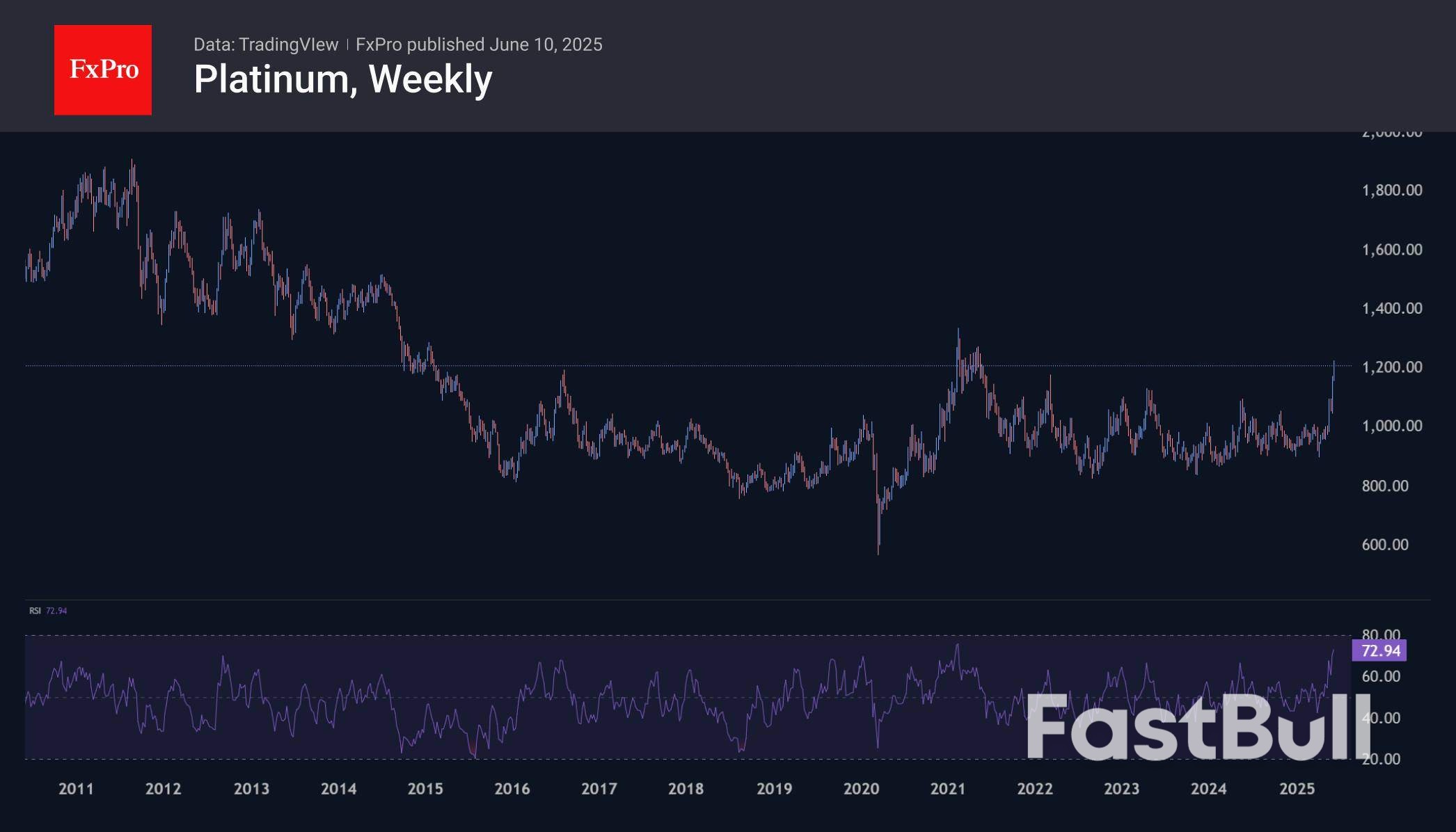

Platinum has gained about 35% from its lows at the beginning of the year at $900, reaching $1,225 at the start of the day on Tuesday. The latest rally brought the price back to the 2021 highs, ending a three-year sideways trend. Bulls intensified their push after successfully breaking through the $1,000 level in the middle of last month.

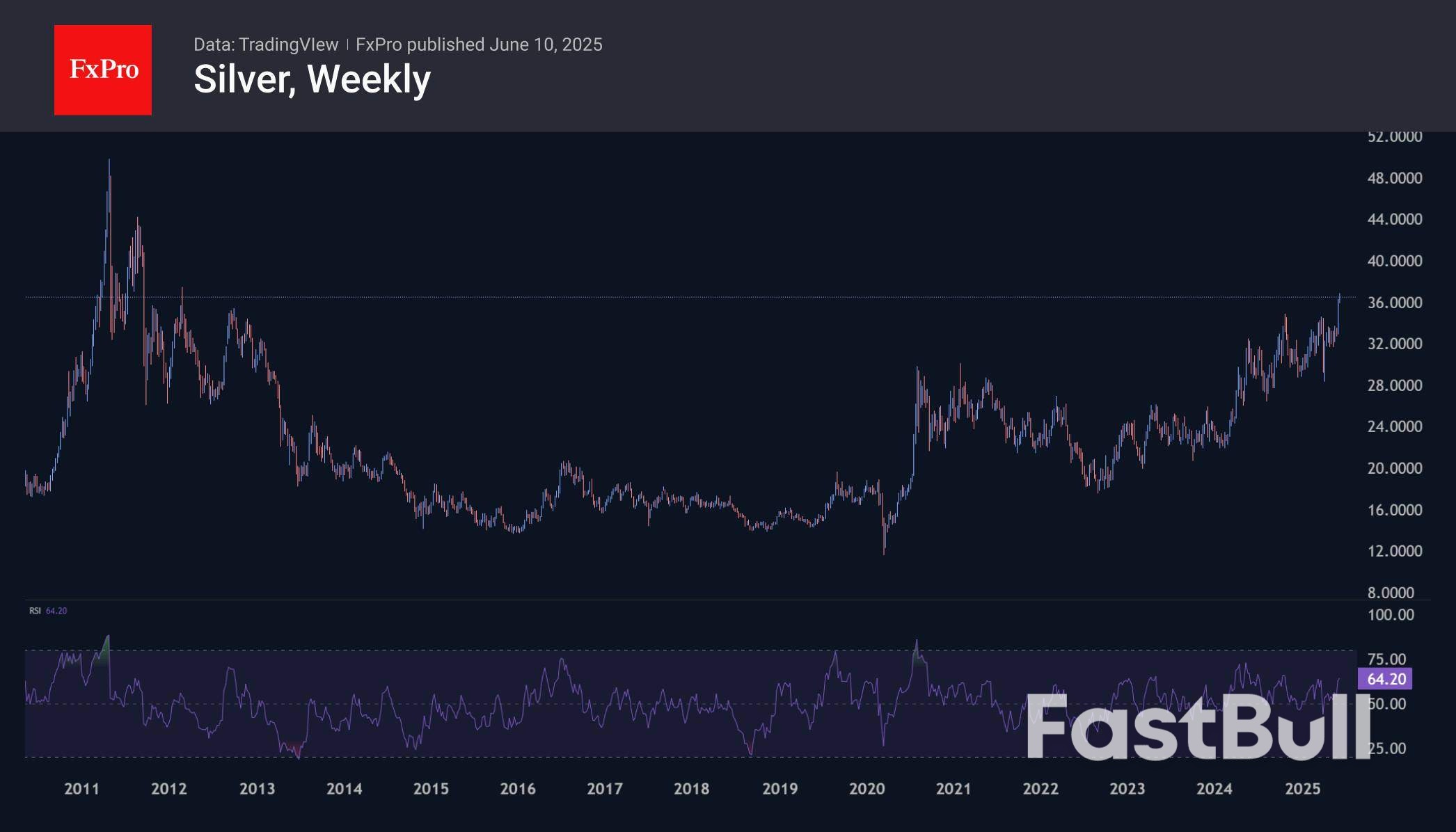

Silver is up 27% since the beginning of the year, accelerating its growth in the last couple of weeks after an 18% correction in early April. With the price reaching $36.9 on Monday, silver is trading at its highest level since February 2012.

In both cases, bulls were encouraged by the rapid correction in gold, which did not turn into a prolonged decline. This was a signal that gold was seeing profit-taking rather than a reversal of sentiment. In such conditions, traders look for alternatives. Since the platinum and silver markets are less liquid, price movements here are usually more significant.

In 2011, the silver rally pushed the price from less than $18 to almost $50. If the momentum that has been driving precious metals since the beginning of the year continues, bulls may aim to repeat the peaks of fifteen years ago or even try to exceed them. On weekly timeframes, silver is not overheated, with an RSI of 64. In 2011 and 2018–2019, only an RSI above 80 was a signal for a reversal.

Platinum has fallen sharply in recent years, falling out of focus for investors as the automotive industry has sought to move away from internal combustion engines, where platinum is actively used. In recent weeks, however, platinum has emerged as an alternative to gold as a metal for gold reserves. However, it has yet to prove its potential. The 2021 turning point is in the $1,200–1,300 range. Successfully overcoming this resistance level opens the way to $1,500 and then $1,900, which, in a bullish scenario, could well be reached by the end of the year.

US President Donald Trump said Iran was pressing to be allowed to enrich uranium in a potential nuclear deal with the US, expressing worry that Tehran was seeking too much.

“They’re just asking for things that you can’t do. They don’t want to give up what they have to give up. You know what that is. They seek enrichment. We can’t have enrichment,” Trump said on Monday at a White House event.

The president said there would be another meeting on Thursday (June 12) with Iranian negotiators. A spokesman for Iran’s foreign ministry during a press conference earlier Monday, said Tehran would send a counteroffer in the “coming days” via Oman, in response to a US proposal on its nuclear programme.

“They are good negotiators, but they’re tough. Sometimes, they can be too tough, that’s the problem,” Trump added. “So we’re trying to make a deal, so that there’s no destruction and death.”

Trump has previously said that he would not allow Iran to continue producing the material, while Tehran in the past has characterised that demand as a sticking point.

Trump’s comments followed a call earlier Monday with Israeli Prime Minister Benjamin Netanyahu, where he said the two discussed the nuclear talks, as well as the war in Gaza.

Trump has vowed to stop Tehran from acquiring nuclear weapons but Netanyahu has been skeptical of diplomatic efforts to curb Iran’s nuclear ambitions.

Trump in May said he told Netanyahu that a military strike against Iran would be “inappropriate to do right now” because it could jeopardise negotiations he said were close to an agreement. The New York Times had reported that Israel was weighing potential strikes on Iranian nuclear sites, a move officials in Tehran have warned could trigger a response and derail the talks.

Tensions are already high between Israel and Iran since the start of the war in Gaza, and amid Israeli strikes on Iran-backed groups.

The war in Gaza is also another flash point that is high on the agenda, following Israel’s move to intensify military operations against Hamas. Israel has been at war with Hamas since Oct 7, 2023, when the group — declared a terrorist organisation by the US and European Union — launched a surprise attack that killed about 1,200 people and resulted in 250 hostages being taken. More than 50 of those captives remain in Gaza, and Israel believes about 20 are alive.

Trump said the situation in Gaza was among the discussion points on the call.

“We discussed a lot of things, and it went very well, very smooth,” Trump said.

Israel’s response, aimed at rooting out Hamas from Gaza, has destroyed much of the territory and sparked a humanitarian crisis. Israel controls limited deliveries of aid assistance to Gaza’s population, which numbers about two million, and has blamed Hamas for diverting needed aid under a prior distribution system.

The war has also sparked a surge in antisemitic violence in the US, including an attack with Molotov cocktails, and a flamethrower on peaceful demonstrators in Colorado who were marching in support of Israeli hostages in Gaza.

Trump’s administration has seized on worries about antisemitism, including the wave of campus protests over the war, pressuring universities to overhaul their policies. And Trump last week unveiled a new travel ban, citing the terror attack in Boulder, Colorado, as justification for his administration’s hardline immigration policies and ramped-up deportations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up