Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Following the catastrophic blaze at Hong Kong’s Wang Fuk Court that killed at least 55 people, Chinese tech giants and industrial firms have pledged millions in emergency aid...

The United States is celebrating Thanksgiving, meaning trading activity across financial markets will be lower than usual today (and to some extent tomorrow). Yesterday, we noted a decline in volatility in the gold market.

Against this backdrop, the silver market is drawing attention – and may not allow traders to relax. As the XAG/USD chart shows, silver has risen by more than 7% since the start of the week.

It is reasonable to assume that the holiday-induced drop in liquidity has opened the door to broader price movements. It is not impossible that we may soon see an attempt to break the all-time high (around $54.45 per ounce), which as of this morning lies roughly 1% away.

Examining the XAG/USD chart, we can identify key swing points that allow us to outline an ascending channel. This week's strong advance has pushed silver into the upper half of that channel.

The bulls' strength is reflected in:

→ the steep slope of the orange channel, within which we see impulsive bullish candles followed by brief corrections – a classic pattern of a strong market;

→ a higher peak on the Awesome Oscillator.

Given this context, it is plausible that the median line could switch from resistance to support (as it has previously – shown by arrows), potentially helping the bulls gather the confidence needed to challenge the record high.

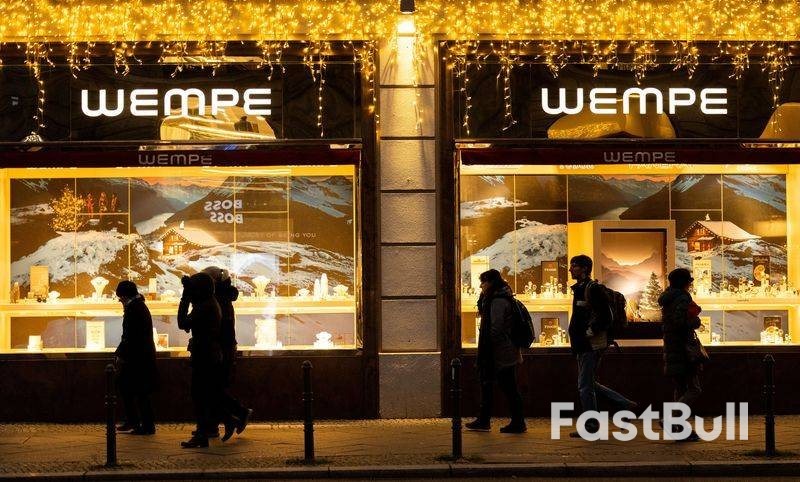

Consumer sentiment in Germany is set to improve slightly in December as households show more willingness to spend money ahead of the holiday season, though less rosy income prospects are preventing a stronger recovery, a survey showed on Thursday.

The consumer sentiment index, published by the GfK market research institute and the Nuremberg Institute for Market Decisions (NIM), rose to -23.2 points for December from -24.1 points the month before, in line with analysts' expectations.

Overall sentiment was boosted by a 3.3-point rise in consumers' willingness to buy for a second month in a row, bringing it to the same level as a year earlier at -6.0 points.

A 2.1-point dip in their readiness to save also helped.

"Consumer sentiment is currently at almost exactly the same level as last year. This is good news for retailers with an eye to year-end business: The data points to stable Christmas sales," said Rolf Buerkl, head of consumer climate at NIM.

"On one hand this shows a certain stability in consumer sentiment but on the other hand, it shows that consumers do not expect a drastic recovery in the short term," he added.

Households' economic expectations for the next 12 months fell nearly 2 points month on month, to -1.1 points, but were still 2.5 points higher compared with last year's level.

Germany's economy is expected to grow by only 0.2% in 2025 after two years of contraction as Chancellor Friedrich Merz's spending measures need time to translate into better conditions.

DEC NOV DEC

2025 2025 2024

Consumer climate -23.2 -24.1 -23.1

Consumer climate components

NOV OCT NOV

2025 2025 2024

- economic expectations -1.1 0.8 -3.6

- income expectations -0.1 2.3 -3.5

- willingness to buy -6.0 -9.3 -6.0

- willingness to save 13.7 15.8 11.9

The survey period was from October 30 to November 10, 2025.

An indicator reading above zero signals year-on-year growth in private consumption. A value below zero indicates a drop compared with the same period a year earlier.

According to GfK, a one-point change in the indicator corresponds to a year-on-year change of 0.1% in private consumption.

The "willingness to buy" indicator represents the balance between positive and negative responses to the question: "Do you think now is a good time to buy major items?"

The income expectations sub-index reflects expectations about the development of household finances in the coming 12 months.

The economic expectations index reflects respondents' assessment of the general economic situation over the next 12 months.

($1 = 0.8618 euros)

The USD/JPY pair fell to 156.13 on Thursday, with the Japanese yen recouping recent losses as markets remain on high alert for potential intervention by Japanese authorities.

Traders are speculating that the US Thanksgiving holiday, which typically sees lower liquidity and thinner market conditions, could provide a strategic "window" for regulators to intervene and support the yen. Notably, the mere risk of intervention is already acting as a deterrent, effectively capping the currency's recent decline.

Fundamentally, sentiment is also shifting as investors reassess the Bank of Japan's (BoJ) policy trajectory. Recent media reports suggest the central bank is actively preparing for a potential rate hike as early as next month. This shift is driven by persistent inflationary pressures, the pass-through effects of a weak yen, and a perceived easing of political pressure to maintain ultra-loose monetary settings.

Externally, the yen has found additional support from a broadly weaker US dollar. Markets have increased bets on further Fed easing, weighing on the greenback across the board.

H4 Chart:

On the H4 chart, USD/JPY is forming a consolidation range around 156.40. We anticipate a near-term decline to 154.90, which is likely to be followed by a technical rebound to retest the 156.40 level. A decisive upward breakout above this resistance would open the path for a more significant rally towards 158.47. However, following such a move, we would expect the formation of a new lower high and the start of a fresh downward impulse, targeting 154.00 and potentially extending the correction to 153.30. The MACD indicator supports this bearish medium-term bias. Its signal line is below zero, pointing downward, confirming that selling momentum remains strong.

H1 Chart:

On the H1 chart, the pair is developing a clear downward wave structure with an initial target at 154.90. We expect this target to be reached, after which a corrective wave of growth should emerge, retesting the 156.40 level from below. The Stochastic oscillator corroborates this near-term bearish view. Its signal line is below 50 and falling towards 20, indicating that short-term downward momentum remains intact for now.

The yen is strengthening on a confluence of intervention threats and a fundamental reassessment of BoJ policy. Technically, USD/JPY is in a corrective phase with an immediate target at 154.90. While a rebound to 156.40 is expected thereafter, the broader risk is tilted to the downside. A break above 158.47 would be required to invalidate the current bearish corrective structure. Traders should remain vigilant for intervention-driven volatility, particularly during periods of low liquidity.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up