Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold continues its rally, nearing $4,000 per ounce, fueled by geopolitical uncertainties such as the US government shutdown and political turmoil in France...

Shutdown-driven data blackout kept traders focused on Fed communications while haven demand pushed gold above $3,900, oil firmed on a small OPEC+ hike, Treasury yields nudged up, and equity futures stayed positive; the biggest movers were gold, WTI, U.S. Treasuries, U.S. stock futures, and Bitcoin under the same macro narrative.

The US Dollar starts the week consolidating after robust gains, with global risk sentiment, Fed policy outlook, and geopolitical uncertainties all playing major roles. The balance of strong data, slowing labor momentum, and persistent inflation will dictate the Dollar’s performance, with an eye on upcoming Fed statements and global event risks.

Central Bank Notes:

Next 24 Hours Bias

Weak Bullish

Gold’s record-setting rally is backed by safe-haven flows and dovish monetary policy expectations, but extreme overbought signals suggest caution for traders as volatility could increase if economic or policy surprises occur. Gold prices have surged to record highs, trading just under $4,000 per ounce amid global economic and political uncertainty, strong safe-haven demand, and expectations of further U.S. interest rate cuts.Next 24 Hours BiasMedium Bullish

The Australian Dollar (AUD) is experiencing a mixture of stabilizing domestic factors and shifting global sentiment. The AUD/USD pair traded near 0.6593 on October 6, reflecting a marginal decline of 0.16% from the previous session and a 0.07% weakening over the past month. The currency remains range-bound, with technical resistance around 0.6610 and near-term targets above 0.6700 if global risk appetite holds.

Central Bank Notes:

Next 24 Hours Bias

Weak Bullish

The New Zealand Dollar is likely to remain muted today, focused on upcoming policy action and further economic releases, with traders watching for signs of either a confirmed breakout or deeper downside if sentiment sours further. The NZD remains under pressure as markets widely expect the Reserve Bank of New Zealand (RBNZ) to cut rates at its next meeting, with consensus predicting a reduction from 3.00% to 2.75%. This expectation has weighed on the currency, as cuts typically diminish investor appeal.Central Bank Notes:

Next 24 Hours Bias

Medium Bearish

The Japanese Yen is under strong selling pressure entering primarily driven by political developments with the new LDP leader Sanae Takaichi, who is seen as favoring fiscal stimulus and looser monetary policy. This has led to expectations that the Bank of Japan will hold back on interest rate hikes, contributing to yen depreciation against major currencies, especially the US dollar. The yen’s weakness is coupled with cautious bets on incoming monetary policy changes and a mixed outlook on USD/JPY movements with potential short-term rebounds but overall downward pressure in the coming days.Central Bank Notes:

Next 24 Hours Bias

Strong Bearish

The latest developments for the oil market on Tuesday, October 7, 2025, revolve around OPEC+ announcing a modest increase in oil production by 137,000 barrels per day starting in November, the same increase as in October. This cautious move helped oil prices rise about 1-1.5% on Monday after some concerns over a potential supply glut. Brent crude oil was trading around $65.30 per barrel, and U.S. West Texas Intermediate crude around $61.59 per barrel.Next 24 Hours BiasWeak Bullish

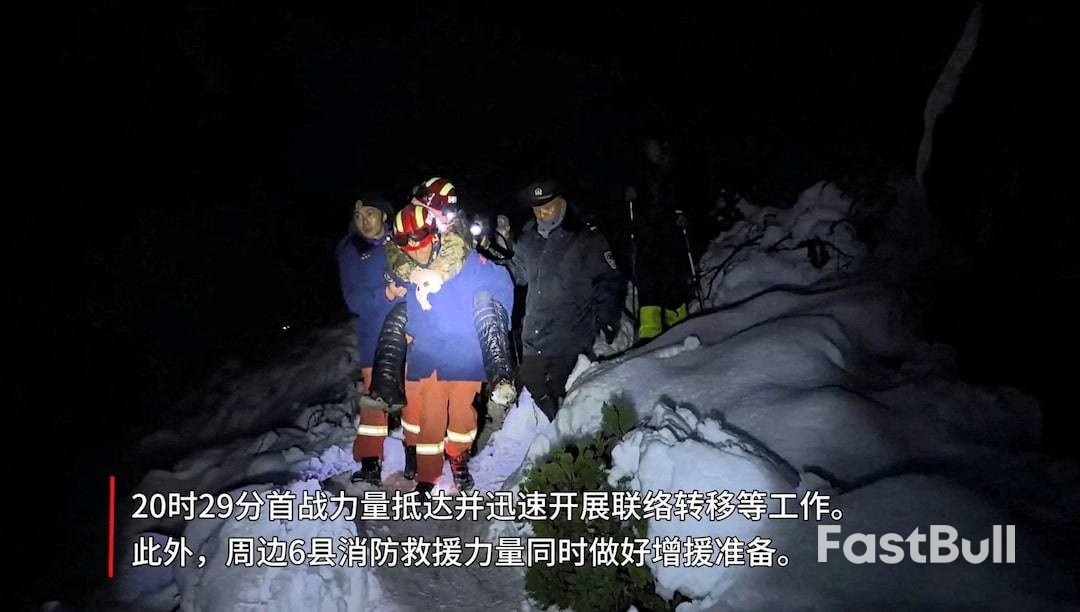

Efforts to evacuate more than 200 trekkers still stranded near the eastern face of Mount Everest in Tibet are expected to wrap up on Tuesday, a source familiar with the situation said, after snowstorms tore across western China.Outdoor enthusiasts have flocked to China's rugged interior since an eight-day holiday began on October 1, but a sudden blizzard over the weekend caught offguard hundreds of hikers hoping to catch a glimpse of Everest's Kangshung face.Their evacuation, which began on Monday, should be completed by Tuesday, said the source, who spoke on condition of anonymity in the absence of authorisation to speak to media on the matter. Tibet's regional government had no immediate comment.

Snow fell through Saturday in the Karma valley at an average altitude of 4,200 m (13,800 feet). On Sunday, rescuers guided to safety some 350 other hikers stranded in Tibet's remote Karma valley."Thankfully, some people ahead of us were breaking trail, leaving footprints we could follow - that made it a little easier," said Eric Wen, 41, adding that he trudged through 19 km (12 miles), most of it heavy snow, to leave the valley.

"Otherwise, it would've been impossible for us to make it out on our own."Regional authorities helped Wen and others on his expedition reach the Tibetan capital of Lhasa by Monday.First explored by Western travellers a century ago, the valley is relatively pristine. In contrast to the arid north face of the world's highest mountain, it is swathed in lush vegetation and untouched alpine forests fed by glacier melt.

North of Tibet, one trekker died of hypothermia and acute mountain sickness after being stranded by snowstorms on Sunday in a gully in the Qilian Mountains on the border of the western provinces of Qinghai and Gansu.By Monday evening, 213 in the Qilian area were pulled to safety, China Central Television (CCTV) said on Tuesday.On Tuesday, authorities further west in Xinjiang suspended hiking and camping in the lake district of Kanas in the Altai mountains.

On Sunday, police patrolling the area had encountered a group of 16 hikers, one of whom, showing symptoms of hypothermia and unable to move, was taken to hospital and is now in stable condition, CCTV said.Police have so far convinced more than 300 hikers heading for the area to turn back. On Tuesday, the broadcaster said highways had been cleared of dangerous ice and snow that had blanketed them over the weekend, stranding tourist vehicles.

As the USD/JPY chart shows, the Japanese yen has weakened sharply at the start of this week. Trading opened with a bullish gap, and today the exchange rate has risen to ¥150.65 per US dollar.

The yen’s decline followed the recent election, during which Japan’s ruling Liberal Democratic Party elected Sanae Takaichi as its new leader, paving the way for her to become the next prime minister. According to Reuters, Takaichi supports the late former Prime Minister Shinzo Abe’s “Abenomics” strategy, which focuses on stimulating the economy through aggressive spending and ultra-loose monetary policy.

The political factor has led to a sequence of higher highs and higher lows (A→B→C→D) on the chart – and it is already evident that the next peak, E, will form above the previous one. This suggests that the USD/JPY market has entered an upward trend following a flat phase that was particularly pronounced in August.

At the same time:

→ The A low has a long lower shadow, and the D low shows signs of a double-bottom pattern, indicating strong demand.

→ The ¥149 level may serve as support going forward, marking the edge of the gap.

→ The price has broken above the key psychological level of ¥150 per dollar.

→ These reversal points justify constructing an ascending channel (shown in blue).

The chart highlights the dominance of demand, as the price remains:

→ In the upper half of the channel;

→ Above a curved support line – trajectories of this kind often appear after strong market impulses.

Given the above, it is reasonable to assume that:

→ The USD/JPY rate may continue its upward movement;

→ However, bullish momentum is weakening, as suggested by the potential bearish divergence on the RSI indicator.

It is worth noting that in February and March, the price reversed several times near ¥151 per dollar, which may act as significant resistance – adding weight to the possibility of a corrective move in USD/JPY, perhaps towards the median of the current channel.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up