Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After a U.S. court blocked Trump’s tariffs, the administration still has multiple legal options—like Sections 122, 301, 232, and 338—to reimpose duties, though investigations and court appeals may delay action.

White House economic adviser Kevin Hassett said on Thursday three trade deals were nearly done and he expected more despite a trade court ruling that blocked most of President Donald Trump's tariffs.

"There are many, many deals coming. And there were three that basically look like they're done," Hassett said in an interview with Fox Business Network.

Hassett dismissed a U.S. trade court ruling on Wednesday that blocked most tariffs and found Trump had overstepped his authority as the work of "activist judges". He said he was confident the administration would win on appeal.

The administration's view is that numerous countries will open up their markets to American products in the next month or two, Hassett said.

"If there are little hiccups here or there because of decisions that activist judges make, then it shouldn't just concern you at all, and it's certainly not going to affect the negotiations," Hassett said.

There were three deals ready for Trump's review at the end of last week, Hassett said.

The number of Americans who filed for unemployment insurance for the first time last week, known as initial jobless claims, has seen a significant increase. The actual number of initial jobless claims came in at 240K, marking a substantial rise from the previous week and surpassing the forecasted figure.

The forecasted figure for initial jobless claims was set at 229K, indicating that the actual figure exceeded the forecast by 11K. This unexpected rise in jobless claims is a bearish sign for the U.S. dollar, as it suggests that the labor market may be experiencing some turbulence.

When compared to the previous week’s figure, the actual number of initial jobless claims has also increased. The previous number was 226K, meaning that there has been an increase of 14K in the number of individuals filing for unemployment insurance for the first time.

Initial jobless claims represent the earliest U.S. economic data available, and their impact on the market varies from week to week. However, a higher than expected reading is generally considered negative or bearish for the USD. Conversely, a lower than expected reading is viewed as positive or bullish for the USD.

The importance of these figures is underscored by their three-star rating. This means they are considered significant and are closely watched by analysts and investors alike.

While the increase in initial jobless claims may be a cause for concern, it is important to remember that these figures can fluctuate from week to week. Therefore, while this increase is notable, it does not necessarily indicate a long-term trend. Nonetheless, the financial markets will be closely monitoring future reports to see if this increase is a one-off event or the start of a new trend.

In conclusion, the rise in initial jobless claims is a surprising development that has exceeded both forecasted and previous figures. It will be critical to monitor these figures in the coming weeks to gain a clearer understanding of the state of the U.S. labor market.

The Gross Domestic Product (GDP), a primary indicator of the health of the economy, has shown a slight decline in recent figures. The annualized change in the inflation-adjusted value of all goods and services produced by the economy, a broad measure of economic activity, has fallen to -0.2%.

This figure, while still indicative of a contraction in the economy, is less severe than the forecasted -0.3%. Economists had predicted a sharper decline, but the actual GDP figure has managed to edge above this estimate, albeit still in negative territory.

When compared to the previous figure, the current GDP shows a significant downturn. The previous GDP was at a positive 2.4%, indicating a healthy expansion in the economy. The current figure of -0.2% signals a shift in the economic landscape, moving from growth to contraction.

This GDP data is released monthly, with three versions appearing a month apart - Advance, second release, and Final. Both the Advance and the second release are tagged as preliminary in the economic calendar, providing an early indication of the economic trend. The final figure is considered the most accurate representation of the state of the economy.

The GDP is a crucial figure for investors, businesses, and policymakers, as it provides a comprehensive overview of the economic activity within a country. A negative GDP indicates a contraction in the economy, which can signal a recession if sustained over multiple quarters.

While the GDP figure is slightly better than forecasted, the shift from the previous positive figure will undoubtedly have implications for economic policy and business decisions in the coming months. The focus will now be on whether this is a temporary downturn or the beginning of a sustained period of economic contraction.

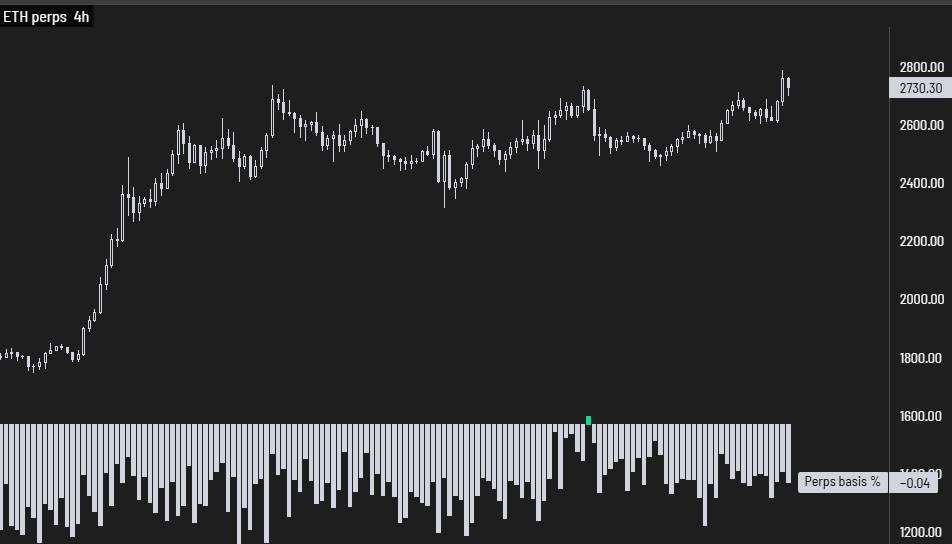

Ethereum (ETH) is showing strong signs of a technical breakout, with traders pointing to a potential surge toward the $3,000 level after clearing key resistance around $2,800.

As of press time, ETH is trading around $2,726 with a 3.13% daily gain and a market cap of $329 billion, according to CoinMarketCap. Momentum appears to be building, fueled by consistent spot premium and growing investor confidence.

Daan Crypto Trades noted that ETH’s spot premium remains “solid” despite lower ETF inflows compared to Bitcoin. “Relative to its market cap, it doesn’t need nearly as much to keep the move going,” he explained, adding that $2,800 remains a key resistance level.

Technical analysts across X are increasingly bullish. Ash Crypto declared, “ETHEREUM IS BREAKING OUT”, citing a breakout from a multi-week ascending triangle and targeting $3,000 as the next key level.

Merlijn The Trader echoed the sentiment, posting a chart with a clear bullish breakout pattern, captioned, “Breakout Incoming.”

While the price has not yet cleared the $2,800 zone decisively, traders are closely watching volume and follow-through strength for confirmation. If sustained, a break above this level could signal a resumption of Ethereum’s broader uptrend.

Bernstein Predicts $330 Billion Corporate Bitcoin Allocation in Next 5 Years

With macro conditions favorable and institutional appetite still present, ETH appears poised for a potential breakout—setting its sights on reclaiming the psychological $3,000 mark in the near term.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up