Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve kept its policy rate unchanged at 4.25%–4.50% on May 7 but warned of increasing risks to both inflation and employment, citing mounting uncertainty from President Trump’s unpredictable tariff agenda....

A three-day ceasefire declared by Russia came into effect on Thursday morning with skies over Ukraine's major cities quiet, in a change from successive nights of heavy attacks by Russian drones and ballistic missiles.

Ukraine's air force reported that after the start of the Kremlin-sponsored ceasefire Russian aircraft twice launched guided bombs on the Sumy region of northern Ukraine. There was no word on damage and Reuters could not independently verify the attacks.

The Russian ceasefire, coinciding with the 80th anniversary of the World War Two defeat of Nazi Germany, went into effect at midnight Moscow time (2100 GMT).

As part of the anniversary events, Russian President Vladimir Putin is hosting Chinese President Xi Jinping and other leaders in Moscow, and will review a military parade on Moscow's Red Square on May 9.

Ukraine has not committed to abide by the Kremlin's ceasefire, calling it a ruse by Putin to create the impression he wants to end the war, which began when Russia launched a full-scale invasion of Ukraine in February 2022. Putin says he is committed to achieving peace.

Ukraine launched successive drone attacks on Moscow this week, which had forced the closure of airports in the Russian capital and the grounding of airliners.

Apart from the Ukrainian air force reports about the two launches of guided bombs, there were no reports in Ukraine of any Russian long-range drones or missiles being launched on Ukrainian cities early on Thursday.

As of 3:45 am (00:45 GMT), the capital Kyiv was quiet, in contrast to 24 hours earlier when the city had reverberated with the sound of explosions from waves of Russian airborne attacks, and outgoing Ukrainian anti-aircraft fire.

It was not immediately clear if there was a pause in fighting on the frontlines between Russian and Ukrainian forces. A Reuters witness near the front in eastern Ukraine said early on Thursday he could hear no sounds of fighting.

Ukraine's President Volodymyr Zelenskiy said on Wednesday that his country stood by its offer to observe a 30-day ceasefire in the war with Russia.

"We are not withdrawing this proposal, which could give diplomacy a chance," Zelenskiy said in his nightly video address.

Russia, he said, had made no response to the 30-day offer except for new strikes.

"This clearly and obviously demonstrates to everyone who the source of the war is," the Ukrainian president added.

Zelenskiy also appeared to acknowledge the numerous drone attacks that have been targeting Russian sites, including the city of Moscow, as the World War Two commemorations approached.

"It is absolutely fair that Russian skies, the skies of the aggressor, are also not calm today, in a mirror-like way," he said on Wednesday.

Moscow Mayor Sergei Sobyanin, in a series of posts on the Telegram messaging app over a five-hour period, said 14 drones headed for the capital had been repelled or destroyed. This happened before the Kremlin-sponsored three-day ceasefire took effect.

The U.S. proposed the 30-day ceasefire in March and Ukraine agreed. Russia has said such a measure could only be introduced after mechanisms to enforce and uphold it are put in place.

Both countries are under pressure from U.S. President Donald Trump to bring a swift end to the war, the biggest conflict in Europe since World War Two.

Russian Foreign Ministry spokeswoman Maria Zakharova expressed surprise at remarks from U.S. envoy Keith Kellogg that Putin may be obstructing a comprehensive ceasefire.

"The only obstacle to the ceasefire is Kyiv, which violates agreements and is unwilling to seriously discuss the terms of a long-term ceasefire," Zakharova said.

Maros Sefcovic, European Commissioner for Trade and Economic Security; Interinstitutional Relations and Transparency, speaks to reporters in Singapore on May 7, 2025, after signing of the EU-Singapore Digital Trade Agreement (DTA), a landmark initiative enhancing digital economic cooperation between the European Union and Singapore.

The European Commission will announce on Thursday details of its next countermeasures against U.S. tariffs should negotiations with Washington fail, European Trade Commissioner Maros Sefcovic said on Wednesday.

"Tomorrow we will announce next preparatory steps, both in the area of possible rebalancing measures, and also in the areas important for the further discussions," Sefcovic told a news conference in Singapore after the signing of a digital trade agreement with the Southeast Asian country.

He added that he will work closely with member states and industries to prepare for every scenario.

"I would like to make it very clear that negotiations clearly come first, but not at any cost," he said.

The new measures would represent the EU's response to U.S. import tariffs on cars and so-called reciprocal tariffs on most other goods.

The 27-nation bloc had in April approved duties mostly of 25% on U.S. imports amounting to 21 billion euros ($23 billion), including maize, wheat, motorcycles and clothing. The duties have been paused until July, after U.S. President Donald Trump announced a 90-day suspension of reciprocal tariffs.

The EU faces 25% U.S. import tariffs on its steel, aluminum and cars. It also faces reciprocal tariffs of 10% for almost all other goods, a levy that could rise to 20% after the 90-day pause expires on July 8.

Sefcovic previously said U.S. tariffs now covered 70% of EU goods trade to the United States and could rise to 97% after further U.S. investigations into pharmaceuticals, semiconductors and other products.

Federal Reserve Chair Jerome Powell made clear he won’t be rushed into lowering borrowing costs until there’s more certainty on the direction of trade policy, which will have to come from the White House.

Powell and his colleagues held interest rates steady on Wednesday and, in their first meeting since President Donald Trump’s sweeping tariff announcements last month, said the risks of seeing higher inflation and unemployment had risen.

That scenario would force a tough choice, Powell said, between lowering borrowing costs to support the job market or keeping them elevated to contain price pressures. And in the meantime, he suggested uncertainty over the scope and scale of the tariffs — and the outcome of looming trade talks — will keep policymakers on hold for now.

“Absent a decisive turn in the US economic data, the FOMC seems comfortable remaining on hold indefinitely,” said James Egelhof, chief US economist for BNP Paribas, referring to the Federal Open Market Committee. “The FOMC is waiting for conviction of whether the next move is a cut based on the economy moving towards a recession or whether it’s a move towards more restrictive policy due to high inflation becoming entrenched into the economy.”

The rate-setting panel voted unanimously to keep the benchmark federal funds rate in a range of 4.25% to 4.5%, where it’s been since December.

Trump announced a series of larger-than-expected tariffs on April 2 but then paused some of them for 90 days. Levies on imports from China now total 145%. The on-again-off-again nature of the tariffs, paired with the lack of clarity on where trade policy will ultimately settle, has unleashed a wave of uncertainty across the economy.

While the levies are still being negotiated, economists widely expect the expansive tariffs to boost prices and weigh on growth.

Powell has been on the receiving end of severe criticism from Trump for not cutting rates. In his back-and-forth with reporters, the Fed chair emphasized the White House was in a better position to resolve the mounting risks and uncertainty, and indeed appeared to be moving in that direction. US and Chinese officials are set to meet later this week in Switzerland to discuss the tariffs.

“Ultimately this is for the administration to do. This is their mandate, not ours,” Powell said. “It seems we’re entering a new phase where the administration is beginning talks with a number of our important trading partners and that has the potential to change the picture materially.”

Recession concerns have grown in the US, and some businesses have reported pausing investment decisions given the uncertainty. Still, the labor market remains resilient, with employers adding 177,000 jobs in April. Fed officials described labor market conditions as “solid,” according to the statement.

Powell — acknowledging that consumer and business sentiment had darkened amid the erratic tariff announcements — said the hard data still paint a picture of a healthy economy.

“I think generally when we watch the Fed, they have much less of the ‘masters of the universe’ vibe going right now,” said Claudia Sahm, chief economist at New Century Advisors. “The Fed is very much at the whim of policies coming out of the White House. They’re reactive.”

Economists say it will take time for the full effect of the new tariffs to work through the economy. So far, the impact has mainly included a sharp decline in sentiment and a surge in imports. The US economy contracted at the start of the year for the first time since 2022, but a gauge of underlying demand stayed firm.

Futures markets show investors still expect about three interest-rate cuts this year, with odds of a cut as early as July at about 85%. Most economists and investors don’t expect the Fed to lower rates at its next meeting in June.

“You’re not going to have data by June that really give you enough information,” said Ellen Meade, a research professor of economics at Duke University and former special adviser to the Fed Board. “The earliest you’d really be thinking about is July, but frankly I think it’s September, and I’m not even convinced they’re going to cut.”

For those tracking global markets, including the dynamic world of cryptocurrency, shifts in major currency pairs like the USD/ZAR can offer valuable insights into broader economic sentiment. Recent analysis from UBS suggests a notable potential movement for this pair, indicating that conditions are aligning for the US Dollar to weaken against the South African Rand. This outlook is significantly tied to increasing trade deal optimism and a corresponding rise in global investor risk appetite.

UBS analysts point to specific factors underpinning their view that the USD/ZAR exchange rate may decline. A lower USD/ZAR rate means it takes fewer US Dollars to buy one South African Rand, effectively indicating a strengthening ZAR relative to the USD. The primary drivers identified are:

These two factors are often intertwined. Successful trade talks signal improved global economic health, which in turn boosts confidence and encourages risk-taking in the Forex market and beyond.

Emerging markets, like South Africa, are often highly sensitive to global trade flows and investor sentiment. Here’s why trade deal optimism is particularly impactful:

This positive feedback loop reinforces the case for a stronger ZAR when trade prospects improve, influencing the USD/ZAR pair.

Risk appetite is a key metric for understanding capital flows in the Forex market. It describes the level of risk that investors are willing to take on. When risk appetite is high, investors seek higher returns, often found in assets perceived as riskier, such as:

Conversely, when risk appetite is low (during periods of uncertainty or fear), investors flock to safe havens like:

The current environment, characterized by increasing trade deal optimism, is fostering higher risk appetite. This dynamic directly impacts the USD/ZAR pair, as capital flows move out of the safe-haven USD and into the higher-yielding, risk-sensitive ZAR.

A weakening USD/ZAR rate has several implications for different market participants:

While the UBS forecast highlights the potential for USD/ZAR to weaken, it’s crucial to remember that Forex markets are influenced by numerous factors. Potential challenges or risks include:

Therefore, while the current environment supports the UBS forecast, continuous monitoring of global and local developments is essential.

Given the UBS forecast and the factors at play, what should market participants consider?

This environment driven by trade deal optimism and rising risk appetite presents potential opportunities but also requires careful analysis and awareness of potential pitfalls.

In conclusion, UBS’s outlook for a potentially weaker USD/ZAR pair is strongly linked to the positive momentum generated by trade deal optimism and the resulting increase in global investor risk appetite. These factors create a favorable environment for emerging market currencies like the South African Rand. However, market participants must remain vigilant, as the complex interplay of global events, domestic conditions, and shifts in sentiment can quickly alter the trajectory of currency pairs in the volatile Forex market.

The Federal Reserve held interest rates steady at 4.25%-4.50% on May 8, 2025, amid growing economic uncertainties linked to tariffs.

The pause in rate changes reflects the Fed's focus on economic stability, with investors and markets responding cautiously to economic implications.

The Federal Reserve, led by Jerome Powell, kept interest rates stable within the 4.25%-4.50% range. This marks the third consecutive rate hold, consistent with market predictions amid economic uncertainties related to tariffs. Powell acknowledged the Fed's dual concerns: inflation and unemployment, highlighting the potential impact of tariffs.

The ongoing tariff issues could affect inflation and economic growth. Maintaining stable rates signals a cautious approach as the Fed navigates rising risks. Markets reacted by stabilizing interest rates on loans and mortgages, although sentiment remains tentative given potential inflation. Jerome Powell noted, "If the large increases in tariffs that have been announced are sustained, they're likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment."

Market reactions highlighted the Fed's warning of simultaneous inflation and unemployment threats. Bitcoin and Ethereum, sensitive to such policy stances, exhibited minor fluctuations. Powell's emphasis on tariff impacts likely influences future decisions, leaving investors alert to potential actions.

Did you know? Current Federal Reserve policies contrast with 2020-2021's low rate period, which significantly boosted crypto markets.

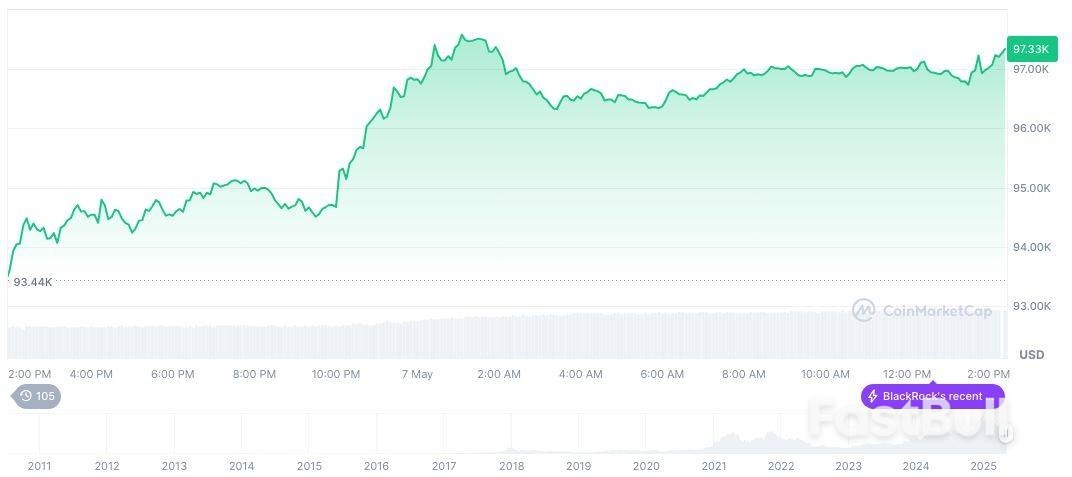

Bitcoin's price stands at $97,217.35 with a market cap of $1.93 trillion. Its 24-hour trading volume increased by 214.83% to $77.91 billion. Bitcoin's price rose 1.16% over 24 hours, 3.30% in a week, and 21.74% over 30 days, signaling fluctuating investor interest despite economic uncertainties.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 22:49 UTC on May 7, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 22:49 UTC on May 7, 2025. Coincu research suggests potential growth in crypto as investors seek alternatives amidst uncertain monetary policy. Speculative assets like Bitcoin and Ethereum might gain appeal, with market sentiment closely tied to future Fed actions. Historical data indicates shifts in crypto activity following similar economic events.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up