Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

EURUSD holds in extended consolidation under new multi-week high (1.1454) but keeps firm tone that boosts prospects for further growth.

EURUSD holds in extended consolidation under new multi-week high (1.1454) but keeps firm tone that boosts prospects for further growth.

Bullish daily studies (strong positive momentum, MA’s in bullish configuration and thick daily cloud underpinning near-term action) contribute to positive outlook

Rising 10DMA tracks the price action since May 19, and offers solid support at 1.1373 (also near broken Fibo 61.8% of 1.1573/1.1065 pullback) followed by daily Tenkan-sen (1.1332) which should hold dips and keep lower trigger at 1.1286 (daily cloud top) intact.

All eyes are on today’s ECB decision and Friday’s US NFP report which would provide fresh direction signals.

The European Central Bank is widely expected to cut rates by additional 25 basis points and likely to signal pause in its year-long easing cycle until autumn.

Traders will be focusing on President Lagarde’s press conference for more details about ECB’s action in coming months.

Eurozone inflation is at CB’s target zone, however the policymakers remain cautious about potential stronger negative consequences, as escalation of trade war would fuel inflation.

On the other hand, the two recent reports from the US labor sector were mixed, as JOLTS showed stronger than expected results in May while hiring in US private sector slumped last month (ADP report).

US Nonfarm Payrolls rose by 177K in April and economists expect 130K increase in May, though some banks lowered their expectations after disappointing ADP report results that added to growing worries about unexpected NFP drop.

The US dollar is in a downward trajectory and may accelerate losses on NFP miss that would provide fresh boost to the single currency and open way for potential retest of 2025 peak (1.1573).

Res: 1.1453; 1.1473; 1.1500; 1.1547.

Sup: 1.1404; 1.1373; 1.1357; 1.1332.

It was the bond market's turn to rally over the past 24 hours, with a stream of soft U.S. economic readings lifting hopes for Federal Reserve easing just as the European Central Bank is teed up for another rate cut on Thursday.

I'll discuss this and all of the market news below, and then in today's column, I explore Switzerland's deflation dilemma and explain why all investors should care what happens with the Swiss franc.

* U.S. PresidentDonald Trumpsigned a proclamation on Wednesday banning the citizens of 12 countries from entering the United States, saying the move was needed to protect against "foreign terrorists" and other security threats.

* Hardline conservative Republicans in the U.S. Senate and billionaire Elon Musk showed no sign of softening opposition to President Donald Trump's tax-cut and spending bill on Wednesday, as they pushed for deeper reductions in government outlays.

* The euro steadied near six-week highs against the dollar ahead of an expected interest rate cut from the European Central Bank on Thursday, while the U.S. currency recovered modestly from a dip after data renewed fears of slow growth and high inflation.

* Investors, consumers and policymakers may justifiably fear the specter of tariff-fueled inflation later this year and beyond, but Reuters columnist Jamie McGeever says it's powerful global disinflationary forces that are weighing most heavily right now.

* The Trump administration's latest efforts to curb U.S. petrochemical exports to China could end up hurting the U.S. energy sector just as much, or more, than the Chinese economy, argues Reuters columnist Ron Bousso.

The ECB is widely expected to cut its main interest rate to 2% later today, effectively bringing inflation-adjusted rates back to zero for the first time in almost two years as May headline inflation has already returned to target.

The big question now is whether the ECB will signal that it will pause during the summer while the murky global trade picture clears up - much as the Bank of Canada did on Wednesday.

Aside from questions about ECB boss Christine Lagarde seeing out her full term as president, the focus of the press conference will likely be on possible ECB plans for coping with potentially outsize euro strength ahead. There will also be close attention paid to the ECB's signalling regarding its balance sheet runoff.

European stocks (.STOXXE) pushed higher on Thursday. The euroheld above $1.14 ahead of the ECB decision, after the dollar skidded lower again Wednesday. The move in the greenback was largely driven by a series of weak readings on U.S. private sector jobs and service sector activity for May.

Wall Street stocksended Wednesday's session unchanged, and futures stalled ahead of today's open.

The latest economic news also dragged 10-year Treasury yieldsback down to their lowest levels in a month. The futures market is now pricing in some 56 basis points of Fed easing for the rest of the year, with a quarter point cut by September almost fully baked in.

President Donald Trump lost little time before pressuring Fed boss Jerome Powell to lower borrowing costs.

"ADP number out. 'Too Late' Powell must now lower the rate. He is unbelievable. Europe has lowered nine times," Trump said in a Truth Social post, referring to Wednesday's jobs data and - mistakenly - the seven ECB cuts so far in the current cycle.

The tariff picture remained unclear, meanwhile.

There is still no specific date or time set for this week's hotly anticipated call between Trump and China's President Xi Jinping, but Paris talks between U.S. Trade Representative Jamieson Greer and European Union counterpart Maros Sefcovic appeared to go well despite the doubling of steel tariffs this week.

Trump's deadline for countries to present their improved trade negotiations passed without any concrete developments.

Germany's new chancellor Friedrich Merz will hold his first face-to-face talks with Trump on Thursday in a high-stakes meeting in the Oval Office.

Meanwhile, the fate of Trump's 'big, beautiful' fiscal bill in the Senate also remained in the balance.

Hardline conservative Republicans and billionaire Elon Musk stepped up opposition to the tax cut and spending bill on Wednesday, pushing for deeper cuts, with Musk bemoaning "the fast lane to debt slavery."

The nonpartisan Congressional Budget Office estimated the bill - which would extend Trump's 2017 tax cuts and step up spending for the military and border security - will add about $2.4 trillion to the country's $36.2 trillion debt pile.

Elsewhere, MSCI's all-country stock index hovered just below Wednesday's new all-time high, with stocks in China and Europe advancing and South Korea's Kospi indexadding another 1% on top of Wednesday's 2% gains after the presidential election there this week.

Japan's Nikkeibucked the trend after another poor government bond auction there, despite reports yesterday that the Bank of Japan may consider slowing its balance sheet rundown.

And now for today's deep dive, I discuss Switzerland's return to deflation due to the supercharged Swiss franc and consider the wider implications for global investors.

Chart of the day

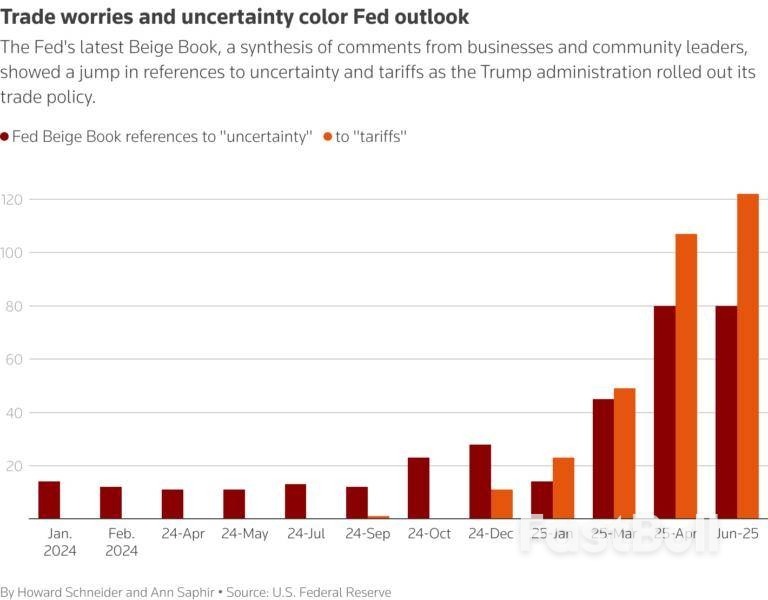

U.S. economic activity has declined and higher tariff rates have put upward pressure on costs and prices in the weeks since Federal Reserve policymakers last met to set interest rates, the Fed's latest "Beige Book" said on Wednesday. "On balance, the outlook remains slightly pessimistic and uncertain", concluded the report. "There were widespread reports of contacts expecting costs and prices to rise at a faster rate going forward."

* European Central Bank policy decision (8:15 AM EDT), economic projections and press conference from President Christine Lagarde

* U.S. April international trade balance (8:30 AM EDT), weekly jobless claims (8:30 AM EDT), Q1 revisions on unit labor costs and productivity (1:30 PM EDT); Canada April trade balance (8:30 AM EDT)

* Federal Reserve Board Governor Adriana Kugler, Kansas City Fed President Jeffrey Schmid, Philadelphia Fed chief Patrick Harker all speak. Bank of England policymaker Megan Greene speaks

* German Chancellor Friedrich Merz meets U.S. President Donald Trump in Washington

* U.S. corporate earnings: Broadcom, Lululemon, Brown-Forman

Russia will respond to Ukraine's latest attacks as and when its military sees fit, the Kremlin said on Thursday, accusing Kyiv of state terrorism and confirming that President Vladimir Putin had told Donald Trump that Moscow was obliged to retaliate.

Ukraine used drones to strike Russian heavy bomber planes at air bases in Siberia and the far north at the weekend, and Russia also accused it of blowing up rail bridges in the south of the country, killing seven people.

Kremlin spokesman Dmitry Peskov, at his daily briefing with reporters, highlighted comments made by Putin a day earlier about the railway attacks.

"The president described the Kyiv regime as a terrorist regime, because it was the regime's leadership that consciously gave the order, the command, the order to blow up a passenger train. This is nothing other than terrorism at the state level. This is an important statement by the president," said Peskov.

Russia has not yet provided evidence that Ukrainian leaders ordered the rail attacks, and Kyiv has not acknowledged responsibility.

Ukrainian attacks inside Russia and Russian air strikes and advances on the battlefield have escalated the war that began in February 2022, damaging prospects for peace talks that the two sides resumed in Turkey last month.

Peskov noted, however, that Putin had supported the view of Foreign Minister Sergei Lavrov at a meeting on Wednesday that working-level contacts with Ukraine should continue.

Peskov said Putin and Trump did not discuss holding a face-to-face meeting when they spoke on Wednesday. He said there was a general understanding that such a meeting was necessary, but it had to be properly prepared.

The two did not discuss the possible lifting of sanctions against Russia, Peskov said in reply to a question.

Ethereum (ETH) has recently completed four consecutive 2-week green candles—a bullish signal that’s catching the attention of seasoned crypto analysts. This pattern, last seen in Bitcoin’s (BTC) chart during the aftermath of the March 2020 crash, led to one of the most explosive bull runs in crypto history.

The similarity between Bitcoin’s 2020 performance and Ethereum’s current trajectory is striking. After BTC’s fourth green candle in 2020, the market momentum didn’t just continue—it accelerated into a full-blown bull cycle that pushed prices to all-time highs.

Now, ETH traders are drawing parallels and hoping history repeats itself in 2025.

In 2020, Bitcoin’s breakout following four green biweekly candles marked a shift in market sentiment—from fear to cautious optimism, and finally, to euphoria. Ethereum seems to be in a similar phase now. After months of consolidation and bearish sentiment, ETH has flipped the script and steadily moved upward over two months.

This pattern is more than just a coincidence. Market cycles tend to rhyme, and ETH could be mirroring Bitcoin’s early steps from the last major bull market. Analysts are particularly encouraged by Ethereum’s resilience and strength amid macro uncertainty, just as BTC showed in 2020.

While nothing is guaranteed in crypto, these patterns often guide trader psychology and market behavior.

$ETH has formed 4 consecutive 2W green candles since the bottom.In 2020, BTC did the same thing after the March crash.The similarities between BTC 2020 and ETH 2025 are just mind blowing.

For Ethereum to truly follow in Bitcoin’s footsteps, it will need to maintain this momentum. Key resistance zones lie ahead, and on-chain data, volume metrics, and macroeconomic signals will all play a role. However, four straight 2-week green candles offer a rare and powerful signal that many consider a strong foundation for a sustained uptrend.

If the current trend holds, ETH might just be at the start of a bullish chapter similar to what Bitcoin experienced from 2020 to 2021.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up